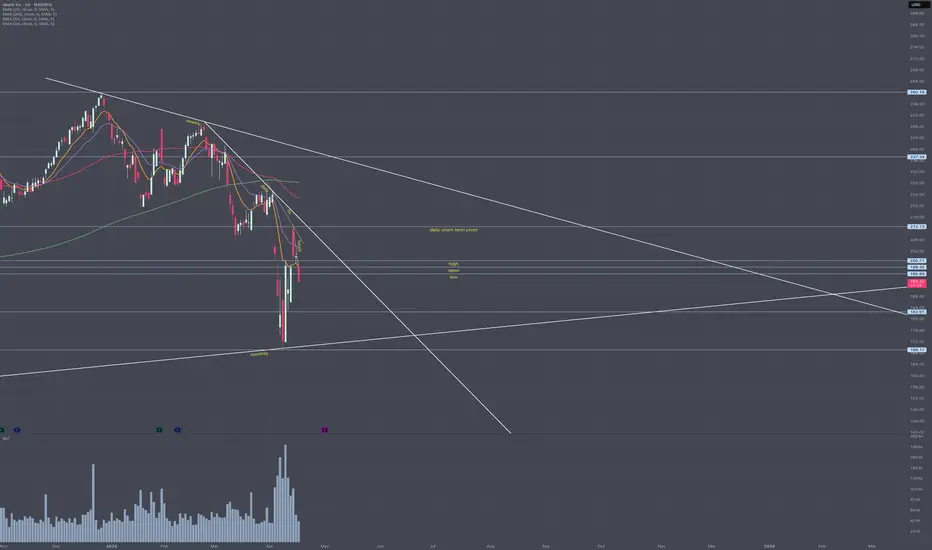

AAPL remains in a clear downtrend on the daily timeframe, with lower highs and lower lows intact. It gapped below yesterday’s low and is trading beneath all daily moving averages. The broader market (SPX) is also showing weakness, supporting the short thesis.

What I See:

Price has failed to reclaim the 10EMA and rejected at prior breakdown zones.

There’s room for a continuation move toward 182, which is a pivot point before it's decline in 2022 and aligns with last years gap up in May.

If momentum continues, AAPL may eventually test the broader uptrend line, which intersects with the area near 175–178, depending on timing. Or back to retest the pivot from earlier this month.

Key Profit Levels:

First target: 182

Remainder: Leave some on to see if it can break lower toward the monthly uptrend support zone

Contextual Note:

While the trend is currently down, this move could still be part of a higher low formation on the daily chart. Even a drop to 182 would be higher than the early April low, meaning buyers could still step in there. So while the trade favors continuation, I’m staying open to the idea that a base or reversal could form instead.

Invalidation:

A sustained move back above 198.70 (recent intraday high + above the open) would invalidate the current short thesis. If it continues down I'll update my stop.

What I See:

Price has failed to reclaim the 10EMA and rejected at prior breakdown zones.

There’s room for a continuation move toward 182, which is a pivot point before it's decline in 2022 and aligns with last years gap up in May.

If momentum continues, AAPL may eventually test the broader uptrend line, which intersects with the area near 175–178, depending on timing. Or back to retest the pivot from earlier this month.

Key Profit Levels:

First target: 182

Remainder: Leave some on to see if it can break lower toward the monthly uptrend support zone

Contextual Note:

While the trend is currently down, this move could still be part of a higher low formation on the daily chart. Even a drop to 182 would be higher than the early April low, meaning buyers could still step in there. So while the trade favors continuation, I’m staying open to the idea that a base or reversal could form instead.

Invalidation:

A sustained move back above 198.70 (recent intraday high + above the open) would invalidate the current short thesis. If it continues down I'll update my stop.

Trade active

I have yet to close my last positions out but I can tell this is not my best work. Not because I may not get a move in my direction, but because I went from a call, to a put, and back again. This happens when I'm not grounded in my plan. Will make final calls on Monday. Hope you are doing well and don't do like me this week, flip flop is no good for anyone, stay sharp and focused!! Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.