A recent report in The Indian Express says, "While credit growth has been averaging 15-16%, deposits accretion has been averaging at 11-12% this fiscal".

The gist of this line is: Credit demand is rising while growth in deposits is slow. Due to which, banks are forced to raise the deposit interest rates to woo the customers. However, banks can not raise the credit interest rates further as they are already high, so net result would be lower margins/profits for the banks.

The trend was started by Bigger banks and now mid-level banks are also trying the same strategy.

As a trader, this means next quarter results will not look so good on paper and corrective market reaction will start much earlier. It could be as soon as next week.

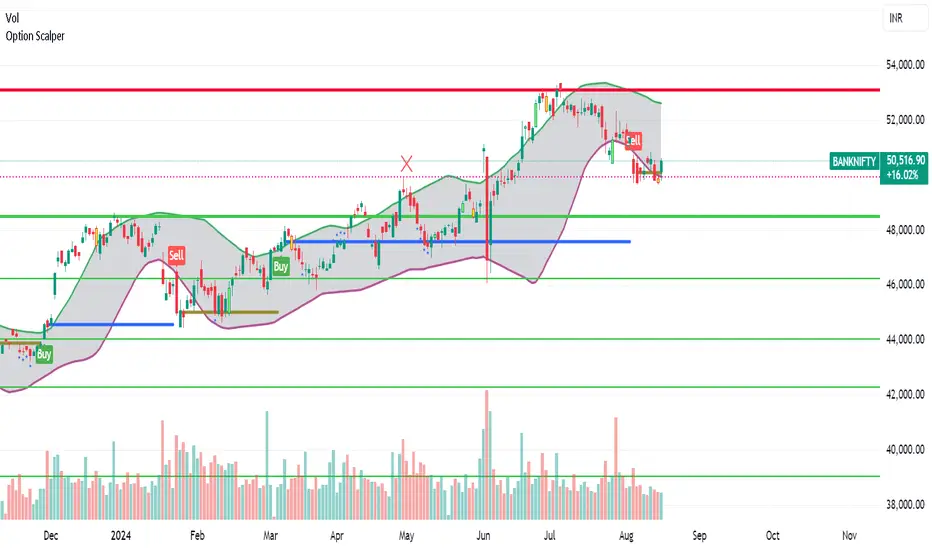

On daily candle, Sell Signal has already been given by Option Scalper but price is within the cloud now. As soon as price comes below the cloud, the Sell Signal will trigger.

Keep watching your chart to know when this happens, to get a windfall from this shorting opportunity.

The gist of this line is: Credit demand is rising while growth in deposits is slow. Due to which, banks are forced to raise the deposit interest rates to woo the customers. However, banks can not raise the credit interest rates further as they are already high, so net result would be lower margins/profits for the banks.

The trend was started by Bigger banks and now mid-level banks are also trying the same strategy.

As a trader, this means next quarter results will not look so good on paper and corrective market reaction will start much earlier. It could be as soon as next week.

On daily candle, Sell Signal has already been given by Option Scalper but price is within the cloud now. As soon as price comes below the cloud, the Sell Signal will trigger.

Keep watching your chart to know when this happens, to get a windfall from this shorting opportunity.

To avail FREE TRIAL for all our invite-only indicators, please contact us:

Telegram: @jellygill

Our Telegram Channel: @CheetaTrader

join to complete FREE TRAINING on how to use the indicators effectively and then request @jellygill for FREE TRIAL

Telegram: @jellygill

Our Telegram Channel: @CheetaTrader

join to complete FREE TRAINING on how to use the indicators effectively and then request @jellygill for FREE TRIAL

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

To avail FREE TRIAL for all our invite-only indicators, please contact us:

Telegram: @jellygill

Our Telegram Channel: @CheetaTrader

join to complete FREE TRAINING on how to use the indicators effectively and then request @jellygill for FREE TRIAL

Telegram: @jellygill

Our Telegram Channel: @CheetaTrader

join to complete FREE TRAINING on how to use the indicators effectively and then request @jellygill for FREE TRIAL

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.