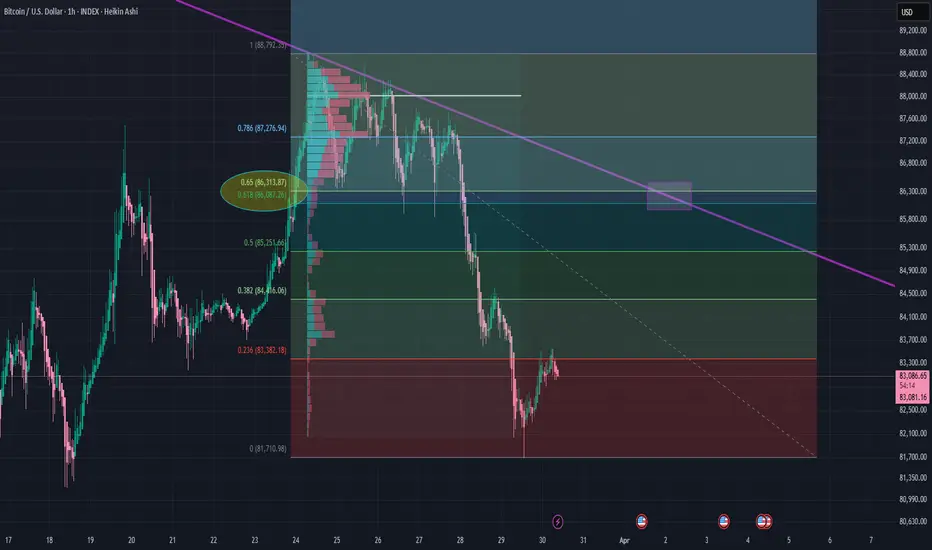

Several "if/when" scenario's in play.

If the Fib .236 level at $83.4K is broken (and held) to the upside it's realistic to expect continuation to the Fib Golden Pocket just over $86K near the end of April.

If $83.4k acts as resistance a retest of the recent low near $81.7 is likely. Support after that is $80K. If $80k breaks then $76.5k followed by 73K is in play.

73K is in play.

The short term fixed range volume profile shows little near term resistance until the 88K level.

88K level.

So it's just a matter of where the Market Makers want to push price in the immediate term. Liquidation levels are now reset to 50/50 on the daily time frame. Possible flush today (Sunday March 30th) followed by reversal Monday.

If the Fib .236 level at $83.4K is broken (and held) to the upside it's realistic to expect continuation to the Fib Golden Pocket just over $86K near the end of April.

If $83.4k acts as resistance a retest of the recent low near $81.7 is likely. Support after that is $80K. If $80k breaks then $76.5k followed by

The short term fixed range volume profile shows little near term resistance until the

So it's just a matter of where the Market Makers want to push price in the immediate term. Liquidation levels are now reset to 50/50 on the daily time frame. Possible flush today (Sunday March 30th) followed by reversal Monday.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.