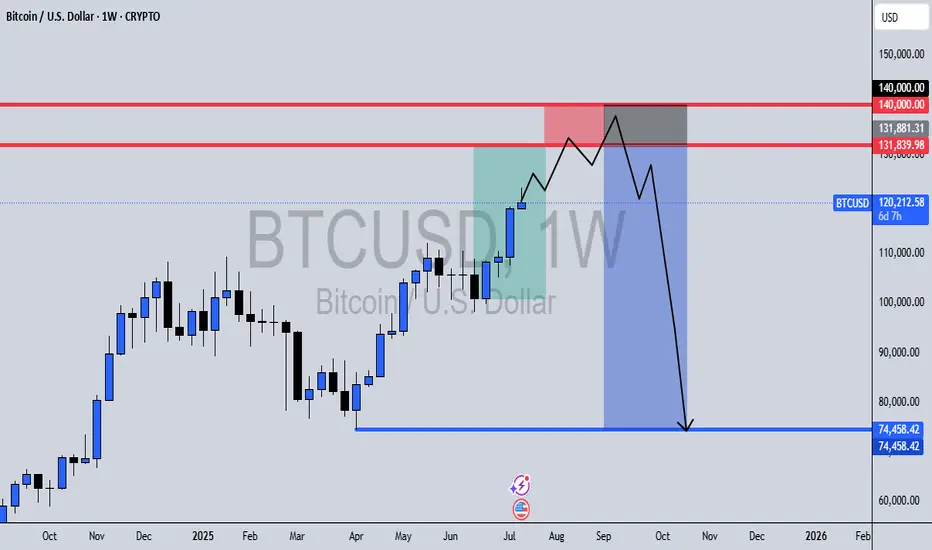

📅 Date: July 14, 2025

📍 Timeframe: 1W (Weekly)

🔍 Key Zones:

🔴 $131,839 – $140,000: Major liquidity pool & reversal zone

🔵 $74,458: External range liquidity target

Bitcoin has been pushing higher week after week, but this setup hints at a trap for late bulls.

Here’s what I’m watching:

Reversal Zone Between $131K – $140K

Price is approaching a critical area packed with buy-side liquidity, where I anticipate a liquidity sweep followed by a shift in market structure. This area also aligns with previous highs and psychological resistance.

Liquidity Sweep & Break of Structure

Once price sweeps the highs and takes out weak hands, I expect a bearish breaker block to form as the reversal confirms. This will be the key signal for a move down.

Targeting External Range Liquidity at $74K

The sharp decline afterward is expected to reach the external range liquidity around $74,458, taking out long-term resting liquidity. This aligns with clean inefficiencies and unmitigated imbalances on the chart.

🔔 Conclusion:

While the short-term bias may remain bullish into the red zone, I’m prepping for a high-probability swing short after signs of exhaustion and confirmation at the top. This is a classic smart money play—liquidity grab, breaker, and redistribution.

📌 Set alerts around $131K – $140K and monitor for structure breaks and bearish rejections.

📍 Timeframe: 1W (Weekly)

🔍 Key Zones:

🔴 $131,839 – $140,000: Major liquidity pool & reversal zone

🔵 $74,458: External range liquidity target

Bitcoin has been pushing higher week after week, but this setup hints at a trap for late bulls.

Here’s what I’m watching:

Reversal Zone Between $131K – $140K

Price is approaching a critical area packed with buy-side liquidity, where I anticipate a liquidity sweep followed by a shift in market structure. This area also aligns with previous highs and psychological resistance.

Liquidity Sweep & Break of Structure

Once price sweeps the highs and takes out weak hands, I expect a bearish breaker block to form as the reversal confirms. This will be the key signal for a move down.

Targeting External Range Liquidity at $74K

The sharp decline afterward is expected to reach the external range liquidity around $74,458, taking out long-term resting liquidity. This aligns with clean inefficiencies and unmitigated imbalances on the chart.

🔔 Conclusion:

While the short-term bias may remain bullish into the red zone, I’m prepping for a high-probability swing short after signs of exhaustion and confirmation at the top. This is a classic smart money play—liquidity grab, breaker, and redistribution.

📌 Set alerts around $131K – $140K and monitor for structure breaks and bearish rejections.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.