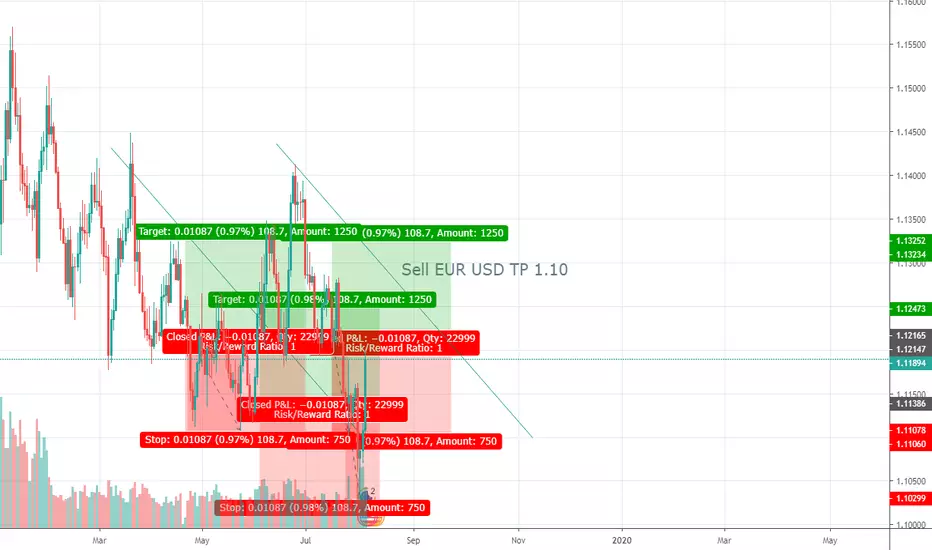

Currency: EUR USD

Target Date: (04-08-2019 to 09-08-2019)

Technical Analysis:

The EUR/USD pair has trimmed most of its weekly losses ahead of the close but ended in the red for a third consecutive week. In the daily chart, technical readings indicate that the bearish case remains firmly in place, as it is developing below a sharply bearish 20 DMA, which has crossed below the larger ones. Technical indicators have bounced modestly from oversold readings, but their strength upward is limited and fall short of suggesting an interim bottom in place.

Support levels: 1.1070 1.1030 1.0995 (1.107 already broken last week)

Resistance levels: 1.1115 1.1145 1.1180

Our Sentiment: Sell Till 1.107 (until the support is broken at 1.0995)

The Big Picture:

The EUR currency may suffer another downside drift with US GDP and will be affected with the below news:

News affecting USD:

Monday 05/08 – Services PMI (July) – Expected to be the same @52.2

Monday 05/08 – ISM Non-Manufacturing PMI (July) – Expected to be the increase @55.5

Tuesday 06/08 – JOLTs Job Openings– Expected to decrease (7.23M vs 7.32M)

Wednesday 07/08 - Crude Oil Inventories– Expected to increase (-6.29M)

Thursday 01/8 – Initial Jobless Claims– Expected to be the same @215k

Friday 02/08 – PPI (MoM) (Jul) – Expected to increase (0.2%)

News affecting EUR:

Monday 05/08 – Spanish Services PMI (Jul)– Expected to be the same @53.6

Monday 05/08 – German Services PMI (Jul)– Expected to be the same @55.4

Monday 05/08 – French Services PMI (Jul)– Expected to be the increase @52.2

Tuesday 06/08 – German Factory Orders (MoM) (Jun)– Expected to increase @0.5%

Wednesday 07/08 - German Industrial Production (MoM) (Jun)– Expected to decrease @-0.6%

Thursday 01/8 – ECB Economic Bulletin

Friday 02/08 – German Trade Balance (Jun)– Expected to decrease @18.4 Bn

Target Date: (04-08-2019 to 09-08-2019)

Technical Analysis:

The EUR/USD pair has trimmed most of its weekly losses ahead of the close but ended in the red for a third consecutive week. In the daily chart, technical readings indicate that the bearish case remains firmly in place, as it is developing below a sharply bearish 20 DMA, which has crossed below the larger ones. Technical indicators have bounced modestly from oversold readings, but their strength upward is limited and fall short of suggesting an interim bottom in place.

Support levels: 1.1070 1.1030 1.0995 (1.107 already broken last week)

Resistance levels: 1.1115 1.1145 1.1180

Our Sentiment: Sell Till 1.107 (until the support is broken at 1.0995)

The Big Picture:

The EUR currency may suffer another downside drift with US GDP and will be affected with the below news:

News affecting USD:

Monday 05/08 – Services PMI (July) – Expected to be the same @52.2

Monday 05/08 – ISM Non-Manufacturing PMI (July) – Expected to be the increase @55.5

Tuesday 06/08 – JOLTs Job Openings– Expected to decrease (7.23M vs 7.32M)

Wednesday 07/08 - Crude Oil Inventories– Expected to increase (-6.29M)

Thursday 01/8 – Initial Jobless Claims– Expected to be the same @215k

Friday 02/08 – PPI (MoM) (Jul) – Expected to increase (0.2%)

News affecting EUR:

Monday 05/08 – Spanish Services PMI (Jul)– Expected to be the same @53.6

Monday 05/08 – German Services PMI (Jul)– Expected to be the same @55.4

Monday 05/08 – French Services PMI (Jul)– Expected to be the increase @52.2

Tuesday 06/08 – German Factory Orders (MoM) (Jun)– Expected to increase @0.5%

Wednesday 07/08 - German Industrial Production (MoM) (Jun)– Expected to decrease @-0.6%

Thursday 01/8 – ECB Economic Bulletin

Friday 02/08 – German Trade Balance (Jun)– Expected to decrease @18.4 Bn

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.