- Key Insights: Investors should remain cautious on Expedia due to ongoing

market volatility influenced by geopolitical tensions and tariff

implications. Although long-term growth prospects remain appealing in the

travel sector, immediate fluctuations may pose risks. Monitoring economic

indicators and corporate performance metrics will be essential to navigate

this landscape prudently.

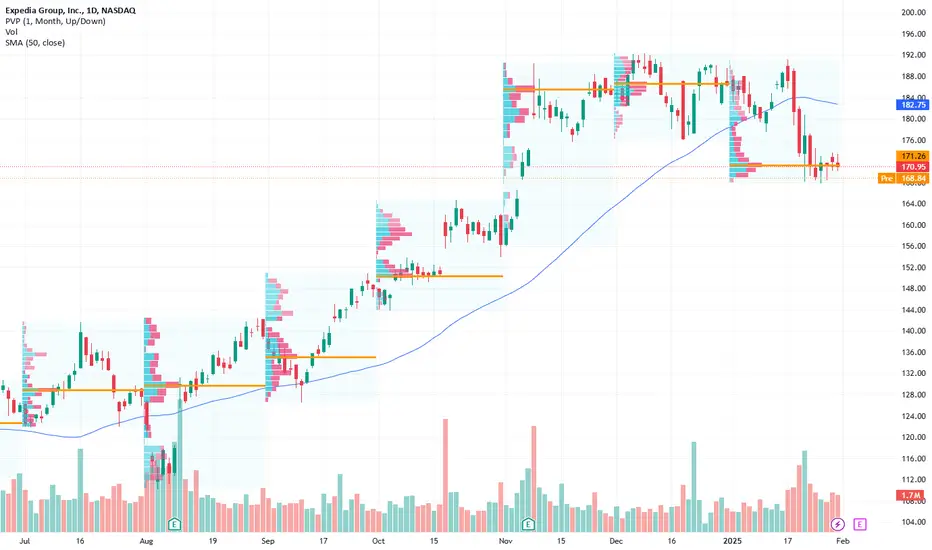

- Price Targets: Based on current analysis, the targets for next week are

outlined as follows:

- Next week targets: T1 at 186.05, T2 at 190.00

- Stop levels: S1 at 163.50, S2 at 160.00

This structure aligns with the current market price of 170.95 and preserves

appropriate safety margins for potential long positions.

- Recent Performance: Recently, Expedia's stock has navigated a volatile market

landscape, reflecting broader economic uncertainties and fluctuating market

sentiment. The price movement appears reactive, adjusting to both

macroeconomic news and sector-specific developments, which have strained

investor confidence.

- Expert Analysis: Analysts continue to emphasize a cautious outlook amidst

uncertainties in trade relations and inflation concerns. While a

stabilization trend in inflation has emerged, the prevailing sentiment

indicates apprehension about sustained growth. Experts advise investors to

monitor central bank communications carefully, as these will likely

influence market trends moving forward.

- News Impact: Notable recent developments regarding tariff announcements have

created additional layers of complexity for travel-related companies like

Expedia. Increased operational costs and potential barriers to international

travel are top concerns among investors, suggesting that without clarity on

trade negotiations, Expedia could experience continued pressure in its stock

performance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.