Gold prices are likely to surge today for several reasons, but do not expect a long-term rally just yet.

Analysis by: Krisada Yoonaisil, Financial Markets Strategist at Exness

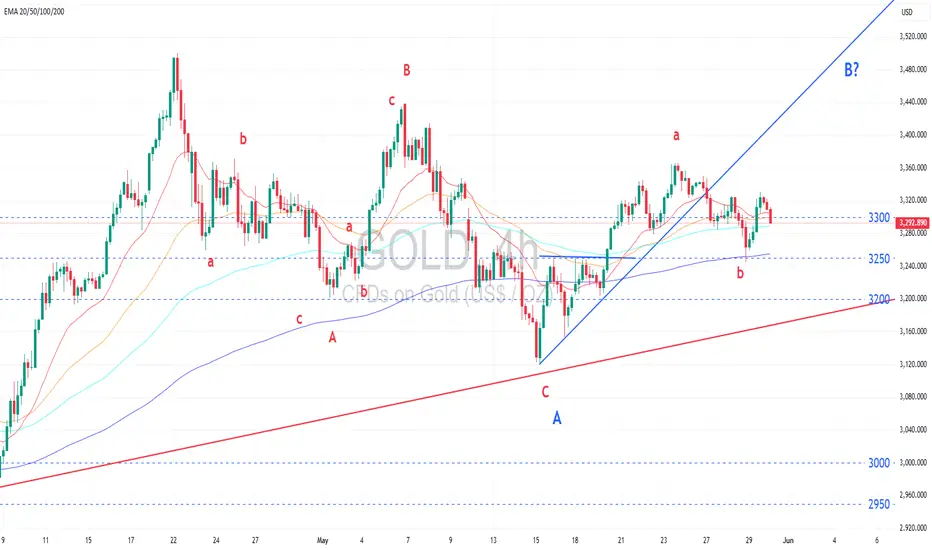

- Technically, the price has tested the former resistance-turned-support level at 3250, which aligns with the 50% Fibonacci Retracement, and has completed a 3-wave minor structure.

- After testing the 3250 level, the price rebounded significantly and broke the previous high, indicating a potential short-term uptrend in wave c of the broader wave B. This suggests that gold is currently forming a complex corrective wave, likely entering the final minor bullish wave before reversing downward once major wave B completes.

- Fundamentally, a federal appeals court has temporarily halted a Wednesday decision by the Court of International Trade that had blocked President Donald Trump’s tariffs.

The U.S. Court of Appeals for the Federal Circuit reinstated Trump’s power to enforce tariffs under emergency authority declared earlier this year.

This development deepens the uncertainty and confusion on US economic policies, which is putting pressure on the US dollar. This also reignites concerns over global trade and brings volatility to financial markets, prompting investors to return to safe-haven assets. - The PCE inflation data, the Fed’s preferred inflation gauge, will be released today. It will likely affect both the US dollar and gold prices.

The market expects the figure to ease to 2.2%, down from 2.3% previously. If the forecast is accurate, it would bring inflation closer to the Fed’s 2.0% target, increasing expectations of a potential rate cut. This would further weaken the dollar and could boost gold prices following the release. - * The current price retracement below 3300 following yesterday's surge is a "buy-on-dip opportunity," as bullish momentum remains intact.*

Analysis by: Krisada Yoonaisil, Financial Markets Strategist at Exness

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.