NIFTY weekly view Jun 29 Jul 3

My monthly View

My last week's review

My reading last week was

I am sure about (~80%)

1. NIFTY to touch above 10300.

2. NIFTY is likely to face strong resistance in the 10300-10600 region.

3. The top end of the range I estimate is 10600-10700 for this week.

I somewhat assume (~60%)

4. Less and less volatile as the week progresses.

5. Another break below or touch of 10000 region possible.

6. Trapping both side traders, without clean swing. Example - gaping up but not sustaining gaps, gap down and recover fast etc. But this week I think it'll be less volatile.

Overall I was correct in assuming points 1,2,3,4,6. I was not correct on 5.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

For this week, I observe the following points about the market action.

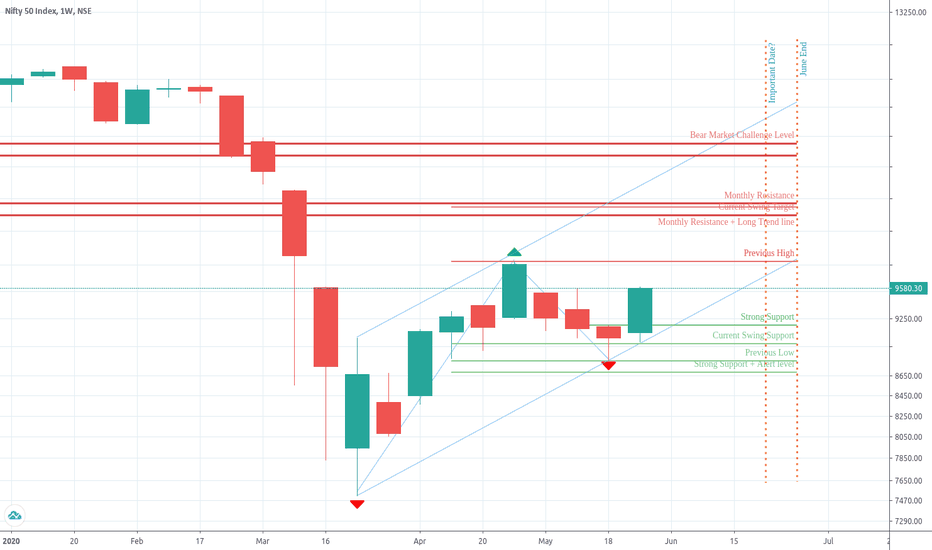

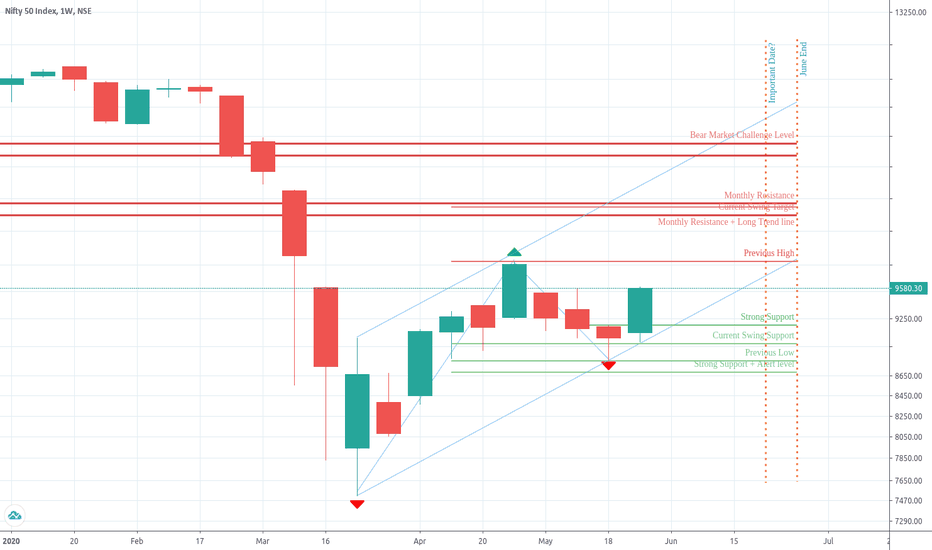

1. NIFTY formed bearish engulfing. This engulfing has no overlap region in recent couple of months. It also formed at a trend line connecting previous two tops.

2. This action makes me revise the structure to 'rising wedge' pattern. It is a bearish pattern. But I see couple of problems.This pattern in general works well when prices are below 50% of retracement of the down swing. This is not the case. NIFTY is between 50% and 61.8%. Other thing I see is this pattern needs declining interest from market participants, which I don't see very clearly. The breakdown from this pattern can be sharp with targets of sub 9500 levels.

3. BANKNIFTY is also top of the range and has not clearly broken out.

4. Recent top is supported by VIX. VIX is around same level as earlier top of 10346.

5. Volatility is relatively reducing, It can go on before we see some strong move on either side.

6. Trend wise, monthly - Down , weekly - Up (indecisive) , daily - Sideways.

7. If it is really a bear market, which is my assumption from monthly time frame, then NIFTY is less likely to have positive July.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

My view for the week.

1. I am certainly not seeing a strong up move coming in this week. I think NIFTY will see down move or consolidation in tight range.

2. 10500 will be top end of the range for the week.

3. I'll create shorts below 10300 with stop loss of 10450.

The other view that NIFTY will form some trading range in this region 10500 - 9900 which likely to create a base for the next move. This I am not sure at this point. I need to see if NIFTY takes repeated supports or makes some kind of consolidation formation like a rectangle or traingle.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Some Trade Ideas

1. Sell CALL credit spread 10500/10600

2. Sell 10000/9900 + 10500 Strangle or condor.

3. Monthly 10200 PUT buy / Weekly lower prices PUT sell. (This I'll execute if NIFTY is below 10300.)

-----------------------------------------------------------------------------------------------------

Have a good trading week ahead.

My last week's review

My reading last week was

I am sure about (~80%)

1. NIFTY to touch above 10300.

2. NIFTY is likely to face strong resistance in the 10300-10600 region.

3. The top end of the range I estimate is 10600-10700 for this week.

I somewhat assume (~60%)

4. Less and less volatile as the week progresses.

5. Another break below or touch of 10000 region possible.

6. Trapping both side traders, without clean swing. Example - gaping up but not sustaining gaps, gap down and recover fast etc. But this week I think it'll be less volatile.

Overall I was correct in assuming points 1,2,3,4,6. I was not correct on 5.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

For this week, I observe the following points about the market action.

1. NIFTY formed bearish engulfing. This engulfing has no overlap region in recent couple of months. It also formed at a trend line connecting previous two tops.

2. This action makes me revise the structure to 'rising wedge' pattern. It is a bearish pattern. But I see couple of problems.This pattern in general works well when prices are below 50% of retracement of the down swing. This is not the case. NIFTY is between 50% and 61.8%. Other thing I see is this pattern needs declining interest from market participants, which I don't see very clearly. The breakdown from this pattern can be sharp with targets of sub 9500 levels.

3. BANKNIFTY is also top of the range and has not clearly broken out.

4. Recent top is supported by VIX. VIX is around same level as earlier top of 10346.

5. Volatility is relatively reducing, It can go on before we see some strong move on either side.

6. Trend wise, monthly - Down , weekly - Up (indecisive) , daily - Sideways.

7. If it is really a bear market, which is my assumption from monthly time frame, then NIFTY is less likely to have positive July.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

My view for the week.

1. I am certainly not seeing a strong up move coming in this week. I think NIFTY will see down move or consolidation in tight range.

2. 10500 will be top end of the range for the week.

3. I'll create shorts below 10300 with stop loss of 10450.

The other view that NIFTY will form some trading range in this region 10500 - 9900 which likely to create a base for the next move. This I am not sure at this point. I need to see if NIFTY takes repeated supports or makes some kind of consolidation formation like a rectangle or traingle.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Some Trade Ideas

1. Sell CALL credit spread 10500/10600

2. Sell 10000/9900 + 10500 Strangle or condor.

3. Monthly 10200 PUT buy / Weekly lower prices PUT sell. (This I'll execute if NIFTY is below 10300.)

-----------------------------------------------------------------------------------------------------

Have a good trading week ahead.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.