Dear Traders,

I hope this message finds you well in your trading endeavors and personal pursuits. I am excited to share a compelling opportunity with you through a new NIFTY analysis that sheds light on the continuation of the market shift.

Preliminary Analysis Overview:

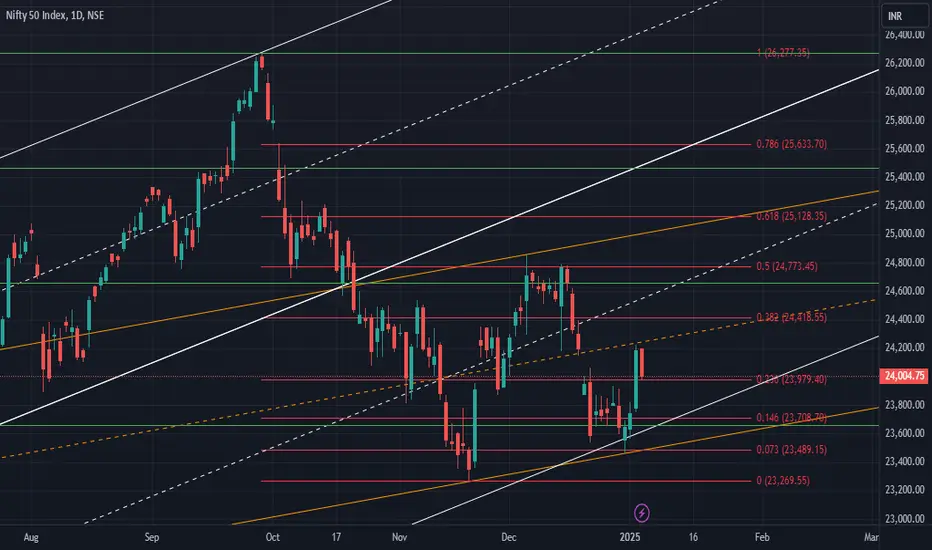

The correction initiated on September 27, 2024, is a correction for the move from June 17, 2022, to September 27, 2024 (15,183.40 to 26,277.35). This move has spanned over 120 weeks (834 days) in time and 11,093.95 points in price. This necessitates a long-term and deeper correction, which is currently underway. This can be visually represented by the trend lines:

The downward trend from the all-time high continues, which is currently experiencing a corrective phase within a larger correction.

There are two potential phases for the ongoing trend:

Phase I:

The initial phase of correction primarily tested the .236 R of the aforementioned motive wave (refer to the figure below):

Following the correction, there is a correction within the correction in a larger degree (although the primary downtrend remains intact).

This internal correction is anticipated to rise further to test 0.146 R and 0.073 R of the long-term bull market (serving as potential resistances).

RI – 24,254.10

RII – 24,600 ~24,657

RIII – 25,100 ~25,120

*These values are not actual but merely levels.

Reference:

Phase II:

Following the completion of the internal correction, the market is anticipated to resume its current downward trend in a more significant manner to test the 38.2 R (21,500 levels) + static support junction, which will be further discussed as the market evolves.

---

**Important Dates to Remember: **

Please note the following significant economic indicators and their release dates:

**January 8, 9, and 10: ** Federal Open Market Committee (FOMC) meeting and employment data release (NFP).

**January 13 and 14: ** Inflation data release.

**January 13-16: ** Sales and inflation data release.

---

---

**Strategy: **

Given the prevailing market conditions, adopting a bullish stance appears prudent. Key levels to monitor include 24,657 and 25,120, which are expected to be tested. It is imperative to remain vigilant and informed about potential opportunities that may arise.

------

Fellow Traders,

The creation of this valuable analytical resource has required countless hours of dedication and effort. If you find it useful, I humbly request your support by boosting the idea and following me (updates will be provided via this post, new posts, and through minds). Your comments and thoughts on this idea are highly valued, and I am committed to engaging with each one personally.

Disclaimer:

Before concluding, I must emphasize that the insights shared are based on my analysis. It is crucial for you to conduct your own research and, if necessary, consult with a financial advisor before making any trading decisions. The dynamic nature of financial markets necessitates that your strategies align with your financial objectives and risk tolerance.

I hope this message finds you well in your trading endeavors and personal pursuits. I am excited to share a compelling opportunity with you through a new NIFTY analysis that sheds light on the continuation of the market shift.

Preliminary Analysis Overview:

The correction initiated on September 27, 2024, is a correction for the move from June 17, 2022, to September 27, 2024 (15,183.40 to 26,277.35). This move has spanned over 120 weeks (834 days) in time and 11,093.95 points in price. This necessitates a long-term and deeper correction, which is currently underway. This can be visually represented by the trend lines:

The downward trend from the all-time high continues, which is currently experiencing a corrective phase within a larger correction.

There are two potential phases for the ongoing trend:

Phase I:

The initial phase of correction primarily tested the .236 R of the aforementioned motive wave (refer to the figure below):

Following the correction, there is a correction within the correction in a larger degree (although the primary downtrend remains intact).

This internal correction is anticipated to rise further to test 0.146 R and 0.073 R of the long-term bull market (serving as potential resistances).

RI – 24,254.10

RII – 24,600 ~24,657

RIII – 25,100 ~25,120

*These values are not actual but merely levels.

Time resistances are anticipated on January 9th and February 17th (of considerable strength).

Reference:

Phase II:

Following the completion of the internal correction, the market is anticipated to resume its current downward trend in a more significant manner to test the 38.2 R (21,500 levels) + static support junction, which will be further discussed as the market evolves.

---

**Important Dates to Remember: **

Please note the following significant economic indicators and their release dates:

**January 8, 9, and 10: ** Federal Open Market Committee (FOMC) meeting and employment data release (NFP).

**January 13 and 14: ** Inflation data release.

**January 13-16: ** Sales and inflation data release.

---

**Final Verdict: **

The current uptrend is considered interim. The primary trend remains downward and is anticipated to persist further and deeper. This trend is expected to test the 38.2% resistance level coinciding with the 21,360-support level.

---

**Strategy: **

Given the prevailing market conditions, adopting a bullish stance appears prudent. Key levels to monitor include 24,657 and 25,120, which are expected to be tested. It is imperative to remain vigilant and informed about potential opportunities that may arise.

------

Fellow Traders,

The creation of this valuable analytical resource has required countless hours of dedication and effort. If you find it useful, I humbly request your support by boosting the idea and following me (updates will be provided via this post, new posts, and through minds). Your comments and thoughts on this idea are highly valued, and I am committed to engaging with each one personally.

Thank you for investing your time in reading this article.

Wishing you profitable and fulfilling trading endeavors!

Disclaimer:

Before concluding, I must emphasize that the insights shared are based on my analysis. It is crucial for you to conduct your own research and, if necessary, consult with a financial advisor before making any trading decisions. The dynamic nature of financial markets necessitates that your strategies align with your financial objectives and risk tolerance.

Note

As mentioned in the previous idea, the correction has been marked in 3M chartNote

If 23,460 is taken out, then this strategy remains void. Please do not follow this after the said condition is met.Trade closed manually

The analysis was one step behind the actual market, A correction was expected before further weakness but market limited its correction & continued its way down.Today the 23,263 will be taken & this analysis will be void.

Therefore, closing any open buy positions seems prudent

Best Regards,

WDG_Dinesh_Gengarajan

Full-Time Analyst, Trader & Trainer

For learning, visit Wiz-Brains Online Trading Academy

Unlock free courses and face the markets with confidence! @ wiz.leadbrains.com

WDG_Dinesh_Gengarajan

Full-Time Analyst, Trader & Trainer

For learning, visit Wiz-Brains Online Trading Academy

Unlock free courses and face the markets with confidence! @ wiz.leadbrains.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Best Regards,

WDG_Dinesh_Gengarajan

Full-Time Analyst, Trader & Trainer

For learning, visit Wiz-Brains Online Trading Academy

Unlock free courses and face the markets with confidence! @ wiz.leadbrains.com

WDG_Dinesh_Gengarajan

Full-Time Analyst, Trader & Trainer

For learning, visit Wiz-Brains Online Trading Academy

Unlock free courses and face the markets with confidence! @ wiz.leadbrains.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.