NIFTY weekly view Jul 6 10

My last week’s view

I’ll do a detailed retrospective below. But quick summary - I was expecting consolidation with downward bias. Even a downward move. This did not happen. The move upward was strong as well. So I was wrong in my reading.

My observations for the current week

I define and follow the market trend on 4 time frames.

1. NIFTY closed at a new high 10600+. Consolidation last week resulted in an upward break.

2. BANK NIFTY is showing divergence to NIFTY. NIFTY made a new high, but BANKNIFTY did not. BANKNIFTY also closed negative for the last two days. This actually caused much confusion in my mind about the validity of this trend and breakout.

3. VIX dropped in the region below 30. Now at ~25. This has been a one way journey since spike to 80 at the peak of the fall in March. Typically, this is the region 20-25 where there can be a spike. Below 20, it is an indication that there is less uncertainty in the positions.

4. I am still following the bearish rising wedge pattern. But I increasingly feel that it will at least show a breakout from the pattern ~ it may turn out to be a false breakout.

So, NIFTY is showing an uptrend on the charts. Since it closed above 10600, key resistance level, the next resistance is 10989 and then 11000-11300 can offer strong resistance.

Possibilities next week

1) BANK NIFTY starts performing in coming two sessions very strongly and NIFTY rushes to 10800-10900 levels. VIX further drops around 22-23 levels.

2) NIFTY fizzles out the rally and drops back or consolidates.

Now for trading action, I do not think this is a good enough reading. Hence I wait. I wait patiently till I get some confirmation

1. If I see BANK NIFTY >> NIFTY and VIX dropping, I participate using intra day positions mostly buying options. I’ll avoid it if there are opening gaps.

2. I’ll try for reversal trades around 10989 - 11000 levels. Before that no reversal trades.

3. I’ll quickly shift to bearish - consolidation view only when NIFTY closes below 10390.

Typically, I have observed this kind of action happen when NIFTY changes it’s regime. The current regime is described as strong up move ~ retracement with volatile intraday swings. The new regime which can start

1. Slow moving market with lower daily ranges.

2. Change to the formation of lower highs and lower lows - essentially bearish trend.

These regimes typically last more than 2 months, sometimes longer.

Now review of my Last week's thinking

I had said

1. I am certainly not seeing a strong up move coming in this week. I think NIFTY will see down move or consolidation in tight range.

2. 10500 will be top end of the range for the week.

3. I'll create shorts below 10300 with stop loss of 10450.

Essentially, I was biased a down move, but breakout was on the upside. And it was strong enough to end at 10550. I did not create short positions, as convincing move below 10300 did not happen.

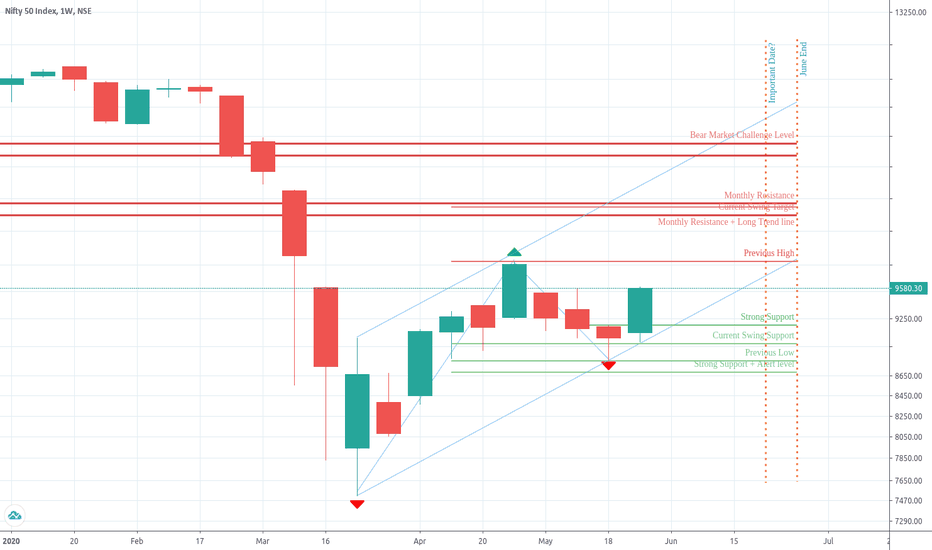

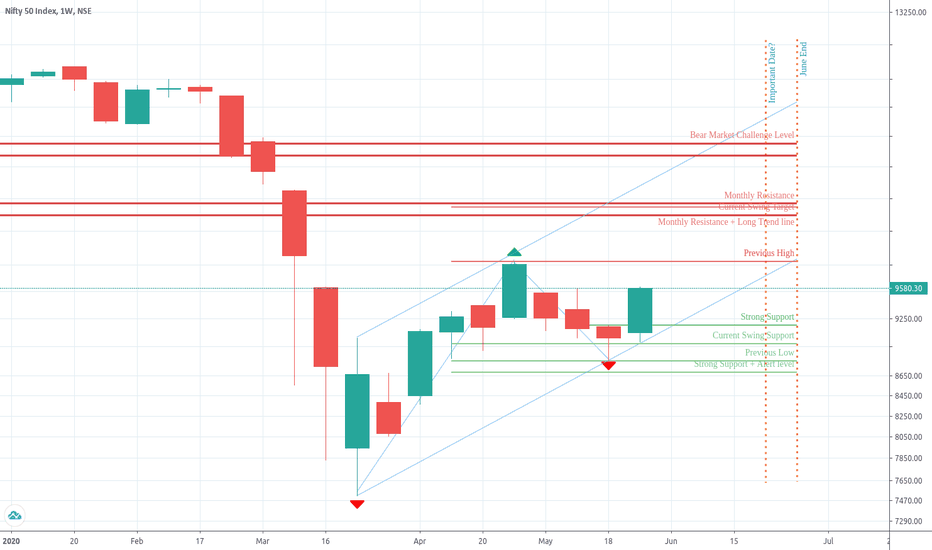

My monthly view is [Posted on start of June 2020]

I’ll do a detailed retrospective below. But quick summary - I was expecting consolidation with downward bias. Even a downward move. This did not happen. The move upward was strong as well. So I was wrong in my reading.

My observations for the current week

I define and follow the market trend on 4 time frames.

- Monthly - Down

- Weekly - Up

- Daily - Up

- Hourly - Up

1. NIFTY closed at a new high 10600+. Consolidation last week resulted in an upward break.

2. BANK NIFTY is showing divergence to NIFTY. NIFTY made a new high, but BANKNIFTY did not. BANKNIFTY also closed negative for the last two days. This actually caused much confusion in my mind about the validity of this trend and breakout.

3. VIX dropped in the region below 30. Now at ~25. This has been a one way journey since spike to 80 at the peak of the fall in March. Typically, this is the region 20-25 where there can be a spike. Below 20, it is an indication that there is less uncertainty in the positions.

4. I am still following the bearish rising wedge pattern. But I increasingly feel that it will at least show a breakout from the pattern ~ it may turn out to be a false breakout.

So, NIFTY is showing an uptrend on the charts. Since it closed above 10600, key resistance level, the next resistance is 10989 and then 11000-11300 can offer strong resistance.

Possibilities next week

1) BANK NIFTY starts performing in coming two sessions very strongly and NIFTY rushes to 10800-10900 levels. VIX further drops around 22-23 levels.

2) NIFTY fizzles out the rally and drops back or consolidates.

Now for trading action, I do not think this is a good enough reading. Hence I wait. I wait patiently till I get some confirmation

1. If I see BANK NIFTY >> NIFTY and VIX dropping, I participate using intra day positions mostly buying options. I’ll avoid it if there are opening gaps.

2. I’ll try for reversal trades around 10989 - 11000 levels. Before that no reversal trades.

3. I’ll quickly shift to bearish - consolidation view only when NIFTY closes below 10390.

Typically, I have observed this kind of action happen when NIFTY changes it’s regime. The current regime is described as strong up move ~ retracement with volatile intraday swings. The new regime which can start

1. Slow moving market with lower daily ranges.

2. Change to the formation of lower highs and lower lows - essentially bearish trend.

These regimes typically last more than 2 months, sometimes longer.

Now review of my Last week's thinking

I had said

1. I am certainly not seeing a strong up move coming in this week. I think NIFTY will see down move or consolidation in tight range.

2. 10500 will be top end of the range for the week.

3. I'll create shorts below 10300 with stop loss of 10450.

Essentially, I was biased a down move, but breakout was on the upside. And it was strong enough to end at 10550. I did not create short positions, as convincing move below 10300 did not happen.

My monthly view is [Posted on start of June 2020]

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.