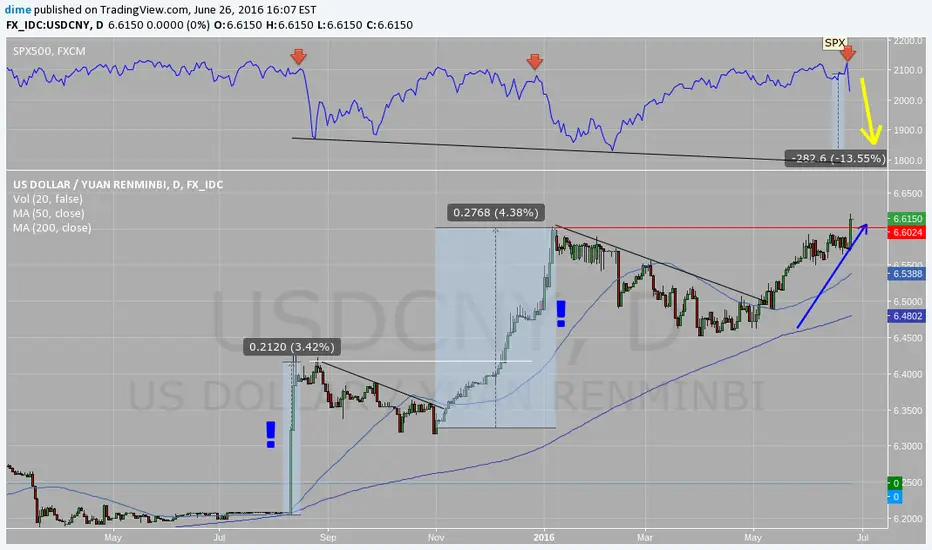

If this game was baseball, three strikes would mean you're out. Could this be the start of a third wave of devaluation in the Chinese Yuan?

Each time the Chinese Yuan devalues it just happens to coincide with a massive selloff in the SPX. 2015 was the first time that China reduced its stake in Treasuries on an annual basis in an attempt to support the yuan and stem capital outflows. Last year $225 billion in U.S. Treasury debt was sold, the most on record since 1978. The largest owner of U.S. debt, China dumped hundreds of billions in U.S. Treasuries in August and December.

Large devaluations of the Yuan occurred in August and Dec 2015. The PBOC shocked world markets last August with a surprise devaluation of the Yuan knocking over 3% off its value - the largest single drop in 20 years. China sold more than $100 billion of foreign-exchange reserves in August and again by January. Beijing announced in February the country’s foreign-exchange reserves fell to the lowest level in more than three years. The Chinese government continues to attempt try and stop the flow of money leaving the country for overseas investment.

Each time the Chinese Yuan devalues it just happens to coincide with a massive selloff in the SPX. 2015 was the first time that China reduced its stake in Treasuries on an annual basis in an attempt to support the yuan and stem capital outflows. Last year $225 billion in U.S. Treasury debt was sold, the most on record since 1978. The largest owner of U.S. debt, China dumped hundreds of billions in U.S. Treasuries in August and December.

Large devaluations of the Yuan occurred in August and Dec 2015. The PBOC shocked world markets last August with a surprise devaluation of the Yuan knocking over 3% off its value - the largest single drop in 20 years. China sold more than $100 billion of foreign-exchange reserves in August and again by January. Beijing announced in February the country’s foreign-exchange reserves fell to the lowest level in more than three years. The Chinese government continues to attempt try and stop the flow of money leaving the country for overseas investment.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.