Commodity Futures Trading Commission (Commission or CFTC) publishes Commitments of Traders (COT) reports to help public understand market dynamics.

------------------- I used website called: Tradingster to get COT Report but you can see information directly from CFTC.gov too.

How To Find Official Information:

1) Google or DuckDuck go: cftc.gov 2) Left side under Market Data & Economic Analysis

3) Click On Commitments Of Traders 4) Scroll down to section called Current Legacy Reports

5) See 2nd one, which says Chicago Mercantile Exchange----> under Futures Only----> see Long Format or Short Format 6) Click on Short Format

7) You now see a lot of both commodity and/or Currency Futures (Forex) information---> scroll down to like Example Japanese Yen (chart example)

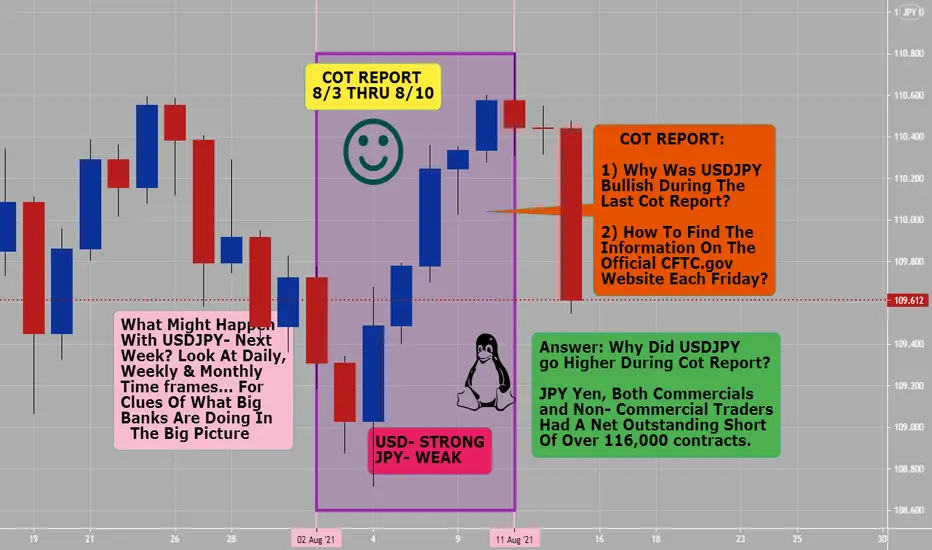

Why Was USDJPY Bullish During Last Cot Report Of Date 08/10/2021 (Tuesday)? (BELOW IS CUT/PASTE of Japanese Yen Information)

JAPANESE YEN - CHICAGO MERCANTILE EXCHANGE Code-097741

FUTURES ONLY POSITIONS AS OF 08/10/21 |

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL | COMMERCIAL | TOTAL | POSITIONS

--------------------------|-----------------|-----------------|-----------------

LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

--------------------------------------------------------------------------------

(CONTRACTS OF JPY 12,500,000) OPEN INTEREST: 206,131

COMMITMENTS

36,684 97,341 461 151,720 68,459 188,865 166,261 17,266 39,870<------ THIS IS INFORMATION YOU NEED TO KNOW!!!

FYI: From above information we can see total contracts of JPY of 12,500,000. Open Interest is 206,131. Non Commercial Traders have 33,000 more short contracts and Commercials have 83,000 more short contracts outstanding. What does that mean? JPY is Weak & USD is Strong- verified on chart.

------------------- I used website called: Tradingster to get COT Report but you can see information directly from CFTC.gov too.

How To Find Official Information:

1) Google or DuckDuck go: cftc.gov 2) Left side under Market Data & Economic Analysis

3) Click On Commitments Of Traders 4) Scroll down to section called Current Legacy Reports

5) See 2nd one, which says Chicago Mercantile Exchange----> under Futures Only----> see Long Format or Short Format 6) Click on Short Format

7) You now see a lot of both commodity and/or Currency Futures (Forex) information---> scroll down to like Example Japanese Yen (chart example)

Why Was USDJPY Bullish During Last Cot Report Of Date 08/10/2021 (Tuesday)? (BELOW IS CUT/PASTE of Japanese Yen Information)

JAPANESE YEN - CHICAGO MERCANTILE EXCHANGE Code-097741

FUTURES ONLY POSITIONS AS OF 08/10/21 |

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL | COMMERCIAL | TOTAL | POSITIONS

--------------------------|-----------------|-----------------|-----------------

LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

--------------------------------------------------------------------------------

(CONTRACTS OF JPY 12,500,000) OPEN INTEREST: 206,131

COMMITMENTS

36,684 97,341 461 151,720 68,459 188,865 166,261 17,266 39,870<------ THIS IS INFORMATION YOU NEED TO KNOW!!!

FYI: From above information we can see total contracts of JPY of 12,500,000. Open Interest is 206,131. Non Commercial Traders have 33,000 more short contracts and Commercials have 83,000 more short contracts outstanding. What does that mean? JPY is Weak & USD is Strong- verified on chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.