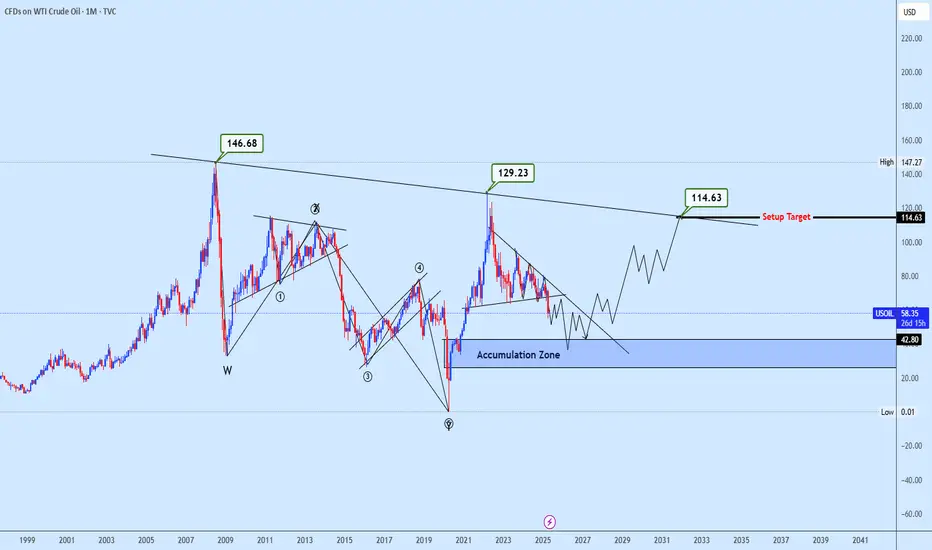

WTI Crude Oil has completed a prolonged complex correction from its historical high of $146.68, forming a structurally mature accumulation base between the $33.06–$42.80 demand zone. This zone aligns with multi-year support and marks the potential terminal point of a corrective macro structure positioning the asset for a major impulsive phase within either Wave 3 or Wave 5 of the broader cycle.

Recent price behavior near $33.06 reflects a critical inflection, signaling strong institutional absorption and suggesting exhaustion of the long-term bearish momentum. The projected bullish scenario envisions a reversal targeting $114.63 as the primary technical pivot, corresponding with significant resistance and the neckline of the long-term structural setup. A confirmed breakout above this level would unlock higher targets toward $129.23 and potentially a full retracement to the $146.68 high, contingent on macroeconomic alignment.

Fundamentally, this scenario is underpinned by key catalysts including OPEC+ production adjustments, U.S. inventory dynamics, geopolitical instability across major oil-exporting nations, and global macro data such as GDP trends, inflation prints, and energy demand forecasts. These elements are poised to fuel volatility but also support a sustained recovery phase, provided demand fundamentals remain intact.

Recent price behavior near $33.06 reflects a critical inflection, signaling strong institutional absorption and suggesting exhaustion of the long-term bearish momentum. The projected bullish scenario envisions a reversal targeting $114.63 as the primary technical pivot, corresponding with significant resistance and the neckline of the long-term structural setup. A confirmed breakout above this level would unlock higher targets toward $129.23 and potentially a full retracement to the $146.68 high, contingent on macroeconomic alignment.

Fundamentally, this scenario is underpinned by key catalysts including OPEC+ production adjustments, U.S. inventory dynamics, geopolitical instability across major oil-exporting nations, and global macro data such as GDP trends, inflation prints, and energy demand forecasts. These elements are poised to fuel volatility but also support a sustained recovery phase, provided demand fundamentals remain intact.

📢Follow the official links only! Trade smart, stay safe! 🎯

Telegram: t.me/+m0IACMn0ul03OTFk

Forex zone: t.me/+piiPgrNtrulkNDk0

💎 Premium details: t.me/wcsepayment

📩 Promotion/Partnership: t.me/WESLAD

Telegram: t.me/+m0IACMn0ul03OTFk

Forex zone: t.me/+piiPgrNtrulkNDk0

💎 Premium details: t.me/wcsepayment

📩 Promotion/Partnership: t.me/WESLAD

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📢Follow the official links only! Trade smart, stay safe! 🎯

Telegram: t.me/+m0IACMn0ul03OTFk

Forex zone: t.me/+piiPgrNtrulkNDk0

💎 Premium details: t.me/wcsepayment

📩 Promotion/Partnership: t.me/WESLAD

Telegram: t.me/+m0IACMn0ul03OTFk

Forex zone: t.me/+piiPgrNtrulkNDk0

💎 Premium details: t.me/wcsepayment

📩 Promotion/Partnership: t.me/WESLAD

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.