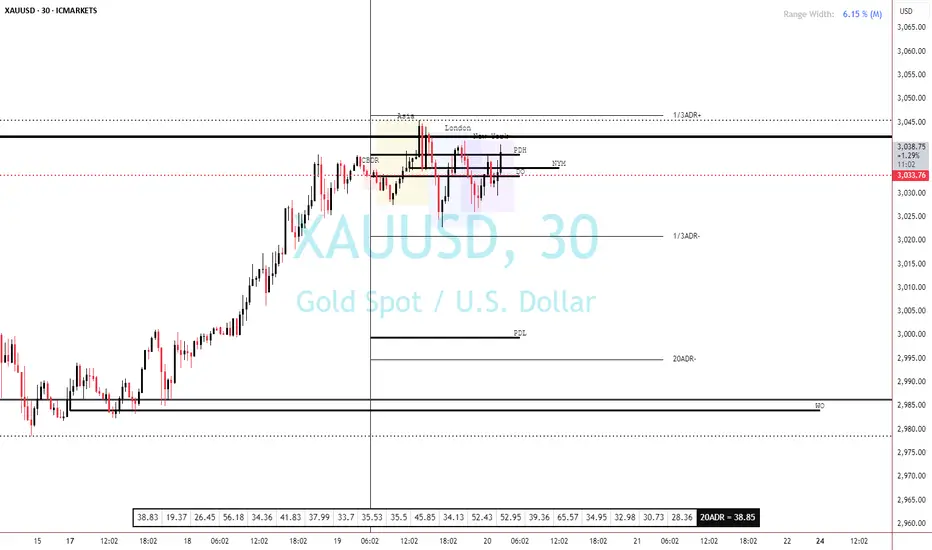

XAUUSD (30M) - Detailed Execution Zones Based on ICT & Price Action

🔹 Bias: Short-Term Bearish, Unless 3,045 Breaks with Strength

Market is in a range after a strong bullish move.

Liquidity traps are likely at both EPH (highs) & EPL (lows).

ADR (Average Daily Range) zones suggest price may push lower before another rally.

🟢 Bullish Execution Plan (If Smart Money Seeks Sell-Side Liquidity First)

🔹 Buy Entry 1: 2,995 - 3,000

Confluence: 20ADR Level + Fair Value Gap (FVG)

Trigger: Price sweeps below EPL & shows bullish reaction (engulfing, rejection wick).

Target: 3,025 (CBR Retest) → 3,040 (Final TP)

Stop Loss: Below 2,985 (Full ADR target)

Risk: Medium

🔹 Buy Entry 2: Break & Retest of 3,045

Confluence: Buy-side liquidity grab above EPH

Trigger: Strong close above 3,045 & retest of previous resistance

Target: 3,060 → 3,070

Stop Loss: Below 3,030

Risk: High (Since it’s above liquidity, fakeouts possible)

🔴 Bearish Execution Plan (Primary Plan, Based on ICT Concepts)

🔹 Sell Entry 1: 3,040 - 3,045 (Liquidity Grab & Rejection)

Confluence: EPH + Order Block (OB)

Trigger: Price sweeps above EPH, forms rejection candle (wick, bearish engulfing)

Target: 3,025 → 3,010 (ADR Target)

Stop Loss: Above 3,050 (If price closes strong above)

Risk: Low

🔹 Sell Entry 2: Break & Retest of 3,025 (CBR Breakdown)

Confluence: CBR level breakdown

Trigger: Candle close below 3,025 + retest as resistance

Target: 3,000 → 2,985 (Full ADR)

Stop Loss: Above 3,035

Risk: Medium

📌 Final Thoughts & Execution Summary

Main Idea: Watch for 3,040 liquidity sweep & rejection to enter shorts.

Alternative Buy Plan: If price drops to 3,000, look for bullish reactions.

Stay Cautious: Fakeouts are possible, always wait for confirmation before entering trades.

🔥 Most Probable Play:

→ Short 3,040-3,045 → TP1: 3,025 → TP2: 3,000 → TP3: 2,985 🚀

🔹 Bias: Short-Term Bearish, Unless 3,045 Breaks with Strength

Market is in a range after a strong bullish move.

Liquidity traps are likely at both EPH (highs) & EPL (lows).

ADR (Average Daily Range) zones suggest price may push lower before another rally.

🟢 Bullish Execution Plan (If Smart Money Seeks Sell-Side Liquidity First)

🔹 Buy Entry 1: 2,995 - 3,000

Confluence: 20ADR Level + Fair Value Gap (FVG)

Trigger: Price sweeps below EPL & shows bullish reaction (engulfing, rejection wick).

Target: 3,025 (CBR Retest) → 3,040 (Final TP)

Stop Loss: Below 2,985 (Full ADR target)

Risk: Medium

🔹 Buy Entry 2: Break & Retest of 3,045

Confluence: Buy-side liquidity grab above EPH

Trigger: Strong close above 3,045 & retest of previous resistance

Target: 3,060 → 3,070

Stop Loss: Below 3,030

Risk: High (Since it’s above liquidity, fakeouts possible)

🔴 Bearish Execution Plan (Primary Plan, Based on ICT Concepts)

🔹 Sell Entry 1: 3,040 - 3,045 (Liquidity Grab & Rejection)

Confluence: EPH + Order Block (OB)

Trigger: Price sweeps above EPH, forms rejection candle (wick, bearish engulfing)

Target: 3,025 → 3,010 (ADR Target)

Stop Loss: Above 3,050 (If price closes strong above)

Risk: Low

🔹 Sell Entry 2: Break & Retest of 3,025 (CBR Breakdown)

Confluence: CBR level breakdown

Trigger: Candle close below 3,025 + retest as resistance

Target: 3,000 → 2,985 (Full ADR)

Stop Loss: Above 3,035

Risk: Medium

📌 Final Thoughts & Execution Summary

Main Idea: Watch for 3,040 liquidity sweep & rejection to enter shorts.

Alternative Buy Plan: If price drops to 3,000, look for bullish reactions.

Stay Cautious: Fakeouts are possible, always wait for confirmation before entering trades.

🔥 Most Probable Play:

→ Short 3,040-3,045 → TP1: 3,025 → TP2: 3,000 → TP3: 2,985 🚀

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.