H4 Analysis:

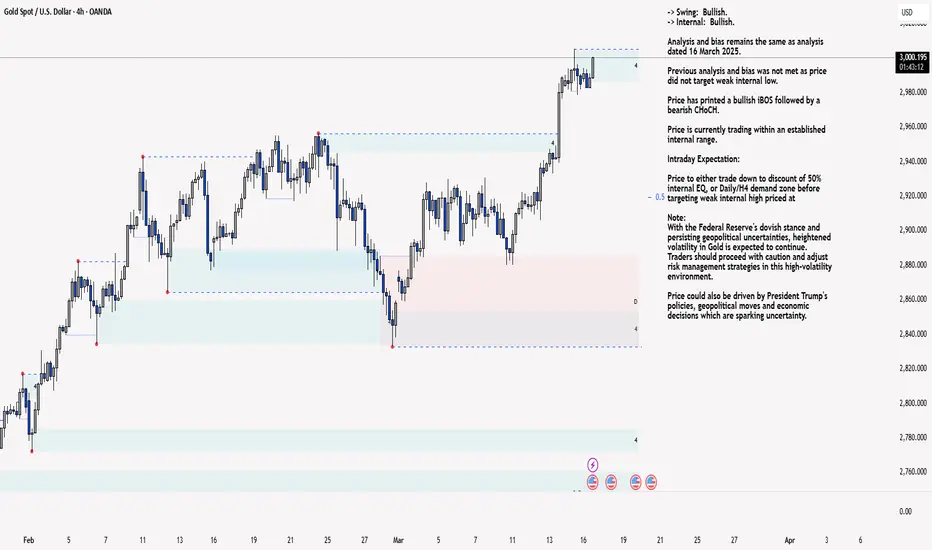

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 16 March 2025.

Previous analysis and bias was not met as price did not target weak internal low.

Price has printed a bullish iBOS followed by a bearish CHoCH.

Price is currently trading within an established internal range.

Intraday Expectation:

Price to either trade down to discount of 50% internal EQ, or Daily/H4 demand zone before targeting weak internal high priced at

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed a bearish CHoCH confirming internal range, however, price has not in any way pulled back significantly enough to classify current internal high as an iBOS, should price print higher than current internal high.

Remainder of analysis and bias remains the same as yesterday's analysis dated 13 March 2025

Analysis and bias has not been met, largely due macroeconomic events, particularly the Trump trade tariff war, which is causing uncertainty within the markets which is supporting Gold price.

Price has printed a bullish iBOS.

Within the structure following the iBOS, price has printed a several bearish CHoCH's with very minimal pullbacks before continuing bullish.

In order not to distort internal structure range I will apply discretion and not classify bearish CHoCH without considerable pullback.

Intraday Expectation:

Await for price to print Bearish CHoCH which is supported by a pullback relative to recent price action.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 16 March 2025.

Previous analysis and bias was not met as price did not target weak internal low.

Price has printed a bullish iBOS followed by a bearish CHoCH.

Price is currently trading within an established internal range.

Intraday Expectation:

Price to either trade down to discount of 50% internal EQ, or Daily/H4 demand zone before targeting weak internal high priced at

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed a bearish CHoCH confirming internal range, however, price has not in any way pulled back significantly enough to classify current internal high as an iBOS, should price print higher than current internal high.

Remainder of analysis and bias remains the same as yesterday's analysis dated 13 March 2025

Analysis and bias has not been met, largely due macroeconomic events, particularly the Trump trade tariff war, which is causing uncertainty within the markets which is supporting Gold price.

Price has printed a bullish iBOS.

Within the structure following the iBOS, price has printed a several bearish CHoCH's with very minimal pullbacks before continuing bullish.

In order not to distort internal structure range I will apply discretion and not classify bearish CHoCH without considerable pullback.

Intraday Expectation:

Await for price to print Bearish CHoCH which is supported by a pullback relative to recent price action.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.