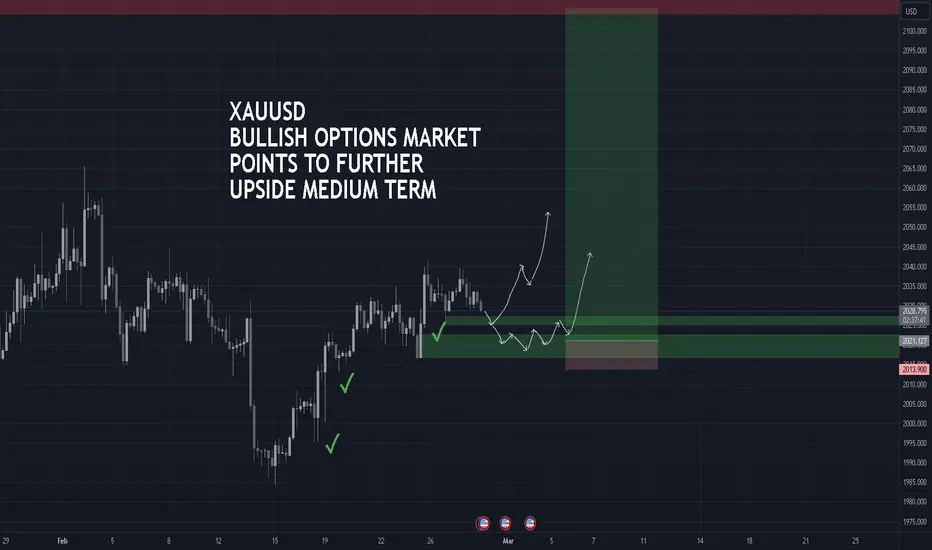

The options market has been a very accurate indicator for gold prices.

The 25 delta skew shows that big options market makers are positioning for volatility in the coming days/week. The volatility is likely to the upside given the Dec 24 futures are trading far above the current market.

Call/put ratio is above 1.2 indicating that both dealers and market makers will likely buy up gold in the medium term.

The 25 delta skew shows that big options market makers are positioning for volatility in the coming days/week. The volatility is likely to the upside given the Dec 24 futures are trading far above the current market.

Call/put ratio is above 1.2 indicating that both dealers and market makers will likely buy up gold in the medium term.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.