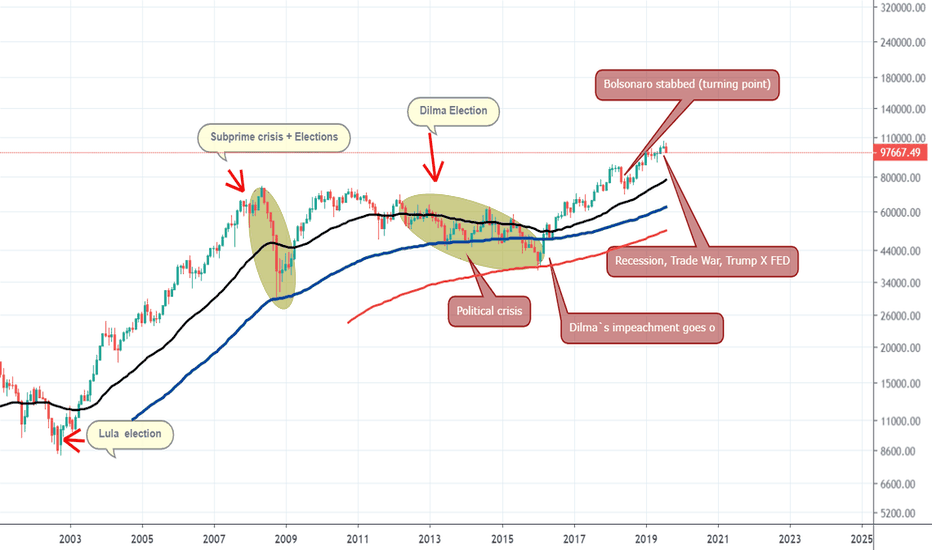

IBOVESPA Historical AnalysisThe following analysis is informative in a fundamentalist way.

I also highlight that in TA Bias, the best purchase occurred in the touch on EMA200 (perfect)

I highlight how political factors are clearly seen in the stock market.

Also note that EXPECTATION is the one that runs the stock market, so if you look at market expectations and how an exchange expectation will influence the market, you will make a lot more money than actually watching the news.

Remember that the Lula government begins with giving a favorable speech to businessmen, saying that Brazil needed them very much at this time (note that previously he had a hate speech against businessmen, which is why the market feared his candidacy).

We then highlight the Subprime Crisis that has affected the world globally, but while it has affected us here, it has not affected our tendency to improve internal conditions for investment and development.

Next, the highlight the change of government and as the political crisis in Dilma Government begins to precarize our national scenario, lack of confidence in the international scenario increases.

Here we clearly see the scenario of EXPECTATIONS, where the movement of Impeachment reflects in the stock market before it happens FACT, that is, the market already priced the fact before.

Note that there is political tension in the last elections, and the stock market falls as Haddad gained ground in election polls.

The market turns when the Bolsonaro takes the stab, at the same time the dollar reverses (uptrend) and falls sharply in the coming weeks.

The stock market has started to rise ever since, with Bolsonaro gaining ground in polls and winning the elections (priced earlier).

At the moment, the market suffers from risk aversion of the international investor.

Trade War has been intensified.

Trump X EDF in heavy clash.

But we have a very positive view for the Brazilian Stock Market and we may aim to 30% or more of upside momentum.