Decoding Money Flow within Markets to Anticipate Price DirectionI. Introduction

In the intricate world of financial markets, understanding the flow of capital between different assets is paramount for traders and investors aiming to anticipate price movements. Money doesn't move haphazardly; it often follows patterns and trends influenced by a myriad of factors, including economic indicators, geopolitical events, and inter-market relationships.

This article delves into the concept of money flow between markets, specifically analyzing how volume movements in one market can influence price directions in another. Our focus centers on two pivotal markets: the 10-Year T-Note Futures (ZN1!) and the Light Crude Oil Futures (CL1!). Additionally, we'll touch upon other significant markets such as ES1! (E-mini S&P 500 Futures), GC1! (Gold Futures), 6E1! (Euro FX Futures), BTC1! (Bitcoin Futures), and ZC1! (Corn Futures) to provide a comprehensive view.

By employing the Granger Causality test—a statistical method used to determine if one time series can predict another—we aim to unravel the nuanced relationships between these markets. Through this exploration, we aspire to equip readers with insights and methodologies that can enhance their trading strategies, particularly in anticipating price directions based on volume dynamics.

II. Understanding Granger Causality

Granger Causality is a powerful statistical tool used to determine whether one time series can predict another. While it doesn't establish a direct cause-and-effect relationship in the strictest sense, it helps identify if past values of one variable contain information that can predict future values of another. In the context of financial markets, this can be invaluable for traders seeking to understand how movements in one market might influence another.

Pros and Cons:

Predictive Power: It provides a systematic way to determine if one market’s past behavior can forecast another’s, helping traders anticipate potential market movements.

Quantitative Analysis: Offers a statistical basis for analyzing market relationships, reducing reliance on subjective judgment.

Lag Dependency: The test is dependent on the chosen lag length, which may not capture all relevant dynamics between the series.

Not True Causality: Granger Causality only suggests a predictive relationship, not a true cause-and-effect mechanism.

III. Understanding Money Flow via Granger Causality

The data used for this analysis consists of daily volume figures for each of the seven markets described above, spanning from January 1, 2018, to the present. While the below heatmap presents results for different lags, we will focus on a lag of 2 days as we aim to capture the short-term predictive relationships that exist between these markets.

Key Findings

The results of the Granger Causality test are presented in the form of a heatmap. This visual representation provides a clear, at-a-glance understanding of which markets have predictive power over others.

Each cell in the matrix represents the p-value of the Granger Causality test between a "Cause" market (row) and an "Effect" market (column). Lower p-values (darker cell) indicate a stronger statistical relationship, suggesting that the volume in the "Cause" market can predict movements in the "Effect" market.

Key Observations related to ZN1! (10-Year T-Note Futures):

The heatmap shows significant Granger-causal relationships between ZN1! volume and the volumes of several other markets, particularly CL1! (Light Crude Oil Futures), where the p-value is 0, indicating a very strong predictive relationship.

This suggests that an increase in volume in ZN1! can reliably predict subsequent volume changes in CL1!, which aligns with our goal of identifying capital flow from ZN1! to CL1! In this case.

IV. Trading Methodology

With the insights gained from the Granger Causality test, we can develop a trading methodology to anticipate price movements in CL1! based on volume patterns observed in ZN1!.

Further Volume Analysis with CCI and VWAP

1. Commodity Channel Index (CCI): CCI is a versatile technical indicator that when applied to volume, measures the volume deviation from its average over a specific period. In this methodology, we use the CCI to identify when ZN1! is experiencing excess volume.

Identifying Excess Volume:

The CCI value for ZN1! above +100 suggests there is an excess of buying volume.

Conversely, when CL1!’s CCI is below +100 while ZN1! is above +100, it implies that the volume from ZN1! has not yet transferred to CL1!, potentially signaling an upcoming volume influx into CL1!.

2. Volume Weighted Average Price (VWAP): The VWAP represents the average price a security has traded at throughout the day, based on both volume and price.

Predicting Price Direction:

If Today’s VWAP is Above Yesterday’s VWAP: This scenario indicates that the market's average trading price is increasing, suggesting bullish sentiment. In this case, if ZN1! shows excess volume (CCI above +100), we would expect CL1! to make a higher high tomorrow.

If Today’s VWAP is Below Yesterday’s VWAP: This scenario suggests bearish sentiment, with the average trading price declining.

Here, if ZN1! shows excess volume, we would expect CL1! to make a lower low tomorrow.

Application of the Methodology:

Step 1: Identify Excess Volume in ZN1!: Using the CCI, determine if ZN1! is above +100.

Step 2: Assess CL1! Volume: Check if CL1! is below +100 on the CCI.

Step 3: Use VWAP to Confirm Direction: Compare today’s VWAP to yesterday’s. If it’s higher, prepare for a higher high in CL1!; if it’s lower, prepare for a lower low.

This methodology combines statistical insights from the Granger Causality test with technical indicators to create a structured approach to trading.

V. Case Studies: Identifying Excess Volume and Anticipating Price Direction

Case Study 1: May 23, 2024

Scenario:

ZN1! exhibited a CCI value of +265.11

CL1!: CCI was at +12.84.

VWAP: Below the prior day’s VWAP.

Outcome:

A lower low was made.

Case Study 2: June 28, 2024

Charts for this case study are at the top of the article.

Scenario:

ZN1! exhibited a CCI value of +175.12

CL1!: CCI was at -90.23.

VWAP: Above the prior day’s VWAP.

Outcome:

A higher high was made.

Case Study 3: July 11, 2024

Scenario:

ZN1! exhibited a CCI value of +133.39

CL1!: CCI was at +0.23.

VWAP: Above the prior day’s VWAP.

Outcome:

A higher high was made.

These case studies underscore the practical application of the trading methodology in real market scenarios.

VI. Conclusion

The exploration of money flow between markets provides valuable insights into how capital shifts can influence price movements across different asset classes.

The trading methodology developed around this relationship, utilizing the Commodity Channel Index (CCI) to measure excess volume and the Volume Weighted Average Price (VWAP) to confirm price direction, offers a systematic approach to capitalizing on these inter-market dynamics. Through the case studies, we demonstrated the practical application of this methodology, showing how traders can anticipate higher highs or lower lows in CL1! based on volume conditions observed in ZN1!.

Key Takeaways:

Granger Causality: This test is an effective tool for uncovering predictive relationships between markets, allowing traders to identify where capital might flow next.

CCI and VWAP: These indicators, when used together, provide a robust framework for interpreting volume data and predicting subsequent price movements.

Limitations and Considerations:

While Granger Causality can reveal important inter-market relationships, it is not without its limitations. The test's accuracy depends on the chosen lag lengths and the stationarity of the data. Additionally, the CCI and VWAP indicators, while powerful, are not infallible and should be used in conjunction with other analysis tools.

Traders should remain mindful of the broader market context, including economic events and geopolitical factors, which can influence market behavior in ways that statistical models may not fully capture. Additionally, effective risk management practices are crucial, as they help mitigate potential losses that may arise from unexpected market movements or the limitations of any predictive models.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Commodity Channel Index (CCI)

Finding a section to start tradingHello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

The BW indicator included in the TS - BW indicator is an indicator expressed by synthesizing the MACD, StochRSI, CCI, PVT, and superTrend indicators.

When the BW indicator

- records a high point, it is time to sell, and

- When it records a low point, it is time to buy.

The BW indicator in the price candle section is the same as the BW indicator included in the TS - BW indicator, but it is an indicator that is expressed in the price candle when a horizontal line is formed at the highest or lowest point.

If you look at the position of the BW indicator expressed in the price candle section, you can know when to proceed with a trade.

I think you can be confident about starting a trade by referring to the status of the MS-Signal (M-Signal on 1D, 1W, 1M charts) indicator that can confirm the trend.

If you add the HA-Low, HA-High indicators here, you can create a more detailed trading strategy.

Have a good time.

Thank you.

--------------------------------------------------

- Big picture

It is expected that a full-scale uptrend will start when it rises above 29K.

The section that is expected to be touched in the next bull market is 81K-95K.

#BTCUSD 12M

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (overshooting)

4th: 13401.28

151166.97-157451.83 (overshooting)

5th: 178910.15

These are points where resistance is likely to occur in the future.

We need to check if these points can be broken upward.

We need to check the movement when this section is touched because I think a new trend can be created in the overshooting section.

#BTCUSD 1M

If the major uptrend continues until 2025, it is expected to start forming a pull back pattern after rising to around 57014.33.

1st: 43833.05

2nd: 32992.55

-----------------

Navigating Interest Rates with Micro Yield Futures Pair TradingIntroduction to Yield Futures

In the complex world of financial markets, Treasury Yield Futures offer investors a pathway to be exposed to changes in U.S. treasury yields. Among these instruments, the Micro 10-Year and Micro 2-Year Yield Futures stand out due to their granularity and accessibility. These futures contracts reflect the market's expectations for the yields of U.S. Treasury securities with corresponding maturities.

Micro 10-Year Yield Futures allow traders to express views on the longer end of the yield curve, typically influenced by factors like economic growth expectations and inflation. Conversely, Micro 2-Year Yield Futures are more sensitive to changes in the federal funds rate, making them a ideal for short-term interest rate movements.

Why Pair Trading?

Pair trading is a market-neutral strategy that involves taking offsetting positions in two closely related securities. This approach aims to capitalize on the relative price movements between the two assets, focusing on their correlation and co-integration rather than their individual price paths. In the context of Micro Treasury Yield Futures, pair trading between the 10-Year and 2-Year contracts offers a strategic advantage by exploiting the yield curve dynamics.

By simultaneously going long on Micro 10-Year Yield Futures and short on Micro 2-Year Yield Futures (or vice versa), traders can hedge against general interest rate movements while potentially profiting from changes in the yield spread between these maturities.

Analyzing the Current Market Conditions

Understanding the current market conditions is pivotal for executing a successful pair trading strategy with Micro 10-Year and Micro 2-Year Yield Futures. Currently, the interest rate environment is influenced by a complex interplay of economic recovery signals, inflation expectations, and central bank policies.

Central Bank Policies: The Federal Reserve's stance on interest rates directly affects the yield of U.S. Treasury securities. For instance, a hawkish outlook, suggesting rate hikes, can cause short-term yields to increase rapidly. Long-term yields might also rise but could be tempered by long-term inflation control measures.

Strategic Approach to Pair Trading These Futures

Trade Execution and Monitoring

To effectively implement a pair trading strategy with Micro 10-Year and Micro 2-Year Yield Futures, traders must have a solid plan for identifying entry and exit points, managing the positions, and understanding the mechanics of yield spreads. Here’s a step-by-step approach:

1. Identifying the Trade Setup

Mean Reversion Concept: In this strategy, we utilize the concept of mean reversion, which suggests that the yield spread will revert to its historical average over time. To quantify the mean, we employ a 20-period Simple Moving Average (SMA) of the spread between the Micro 10-Year and Micro 2-Year Yield Futures. This moving average serves as a benchmark to determine when the spread is significantly deviating from its typical range.

Signal Identification using the Commodity Channel Index (CCI): To further refine our entry and exit signals, the Commodity Channel Index (CCI) is employed. The CCI helps in identifying cyclical turns in the spread. This indicator is particularly useful for determining when the spread has reached a condition that is statistically overbought or oversold.

2. Trade Execution:

Going Long on One and Short on the Other: Depending on your analysis, you might go long on the Micro 10-Year Yield Futures if you anticipate the long-term rates will increase more relative to the short-term rates, or vice versa.

Position Sizing: Determine the size of each position based on the volatility of the yield spreads and your risk tolerance. It's crucial to balance the positions to ensure that the trade remains market-neutral.

Regular Review and adjustments: Regularly review the economic indicators and Fed announcements that could affect interest rates. Keep an eye on the spread for any signs that it might be moving back towards its mean or breaking out in a new trend.

Contract Specifications

To further refine our strategy, understanding the specific contract details of Micro 10-Year and Micro 2-Year Yield Futures is crucial:

Micro 10-Year Yield Futures (Symbol: 10Y1!) and Micro 2-Year Yield Futures (Symbol: 2YY1!):

Tick Value: Each tick (0.001) of movement is worth $1 per contract.

Trading Hours: Sunday to Friday, 6:00 p.m. to 5:00 p.m. (New York time) with a 60-minute break each day beginning at 5:00 p.m.

Initial Margin: Approximately $350 per contract, subject to change based on market volatility.

Pair Margin Efficiency

When trading Micro 10-Year and Micro 2-Year Yield Futures as a pair, traders can leverage margin efficiencies from reduced portfolio risk. These efficiencies lower the required capital and mitigate volatility impacts.

The two charts below illustrate the volatility contrast: the Daily ATR of the yield spread is 0.033, significantly lower than the 0.082 ATR of the Micro 10-Year alone, nearly three times higher. This lower spread volatility underlines a core advantage of pair trading—reduced market exposure and potentially smoother, more predictable returns.

Risk Management in Pair Trading Micro Yield Futures

Effective risk management is the cornerstone of any successful trading strategy, especially in pair trading where the goal is to mitigate market risks through balancing positions. Here are key risk management techniques that should be considered when pair trading Micro 10-Year and Micro 2-Year Yield Futures:

1. Setting Stop-Loss Orders:

Pre-determined Levels: Establish stop-loss levels at the outset of the trade based on historical volatility, maximum acceptable loss, and the distance from your entry point. This helps in limiting potential losses if the market moves unfavorably.

Trailing Stops: Consider using trailing stop-loss orders that move with the market price. This method locks in profits while providing protection against reversal trends.

2. Position Sizing and Leverage Control:

Balanced Exposure: Ensure that the sizes of the long and short positions are balanced to maintain a market-neutral stance. This helps in minimizing the impact of broad market movements on the pair trade.

Leverage Management: Be cautious with the use of leverage. Excessive leverage can amplify losses, especially in volatile market conditions. Always align leverage with your risk tolerance and market assessment.

3. Regular Monitoring and Adjustments:

Adaptation to Market Changes: Be flexible to adjust or close the positions based on significant changes in market conditions or when the initial trading assumptions no longer hold true.

4. Utilizing Risk Management Tools:

Risk Management Software: Set alerts on TradingView to help track the performance and risk level of your pair trades effectively.

Backtesting: Regularly backtest the strategy against historical data to ensure it remains effective under various market conditions. This can also help refine the entry and exit criteria to better handle market volatility.

Effective risk management not only preserves capital but also enhances the potential for profitability by maintaining disciplined trading practices. These strategies ensure that traders can sustain their operations and capitalize on opportunities without facing disproportionate risks.

Conclusion

Pair trading Micro 10-Year and Micro 2-Year Yield Futures offers traders a sophisticated strategy to exploit inefficiencies within the yield curve while mitigating exposure to broader market movements. This approach leverages the distinct characteristics of these two futures contracts, aiming to profit from the relative movements between long-term and short-term interest rates.

Key Takeaways:

Market Neutral Strategy: Pair trading is fundamentally a market-neutral strategy that focuses on the relative performance of two assets rather than their individual price movements. This can provide insulation against market volatility and reduce directional risk.

Importance of Strategy and Discipline: Successful pair trading requires a disciplined approach to strategy implementation, from trade setup and execution to ongoing management and exit. Adhering to a predefined strategy helps maintain focus and objectivity in trading decisions.

Dynamic Market Adaptation: The financial markets are continuously evolving, influenced by economic data, policy changes, and global events. A successful pair trader must remain adaptable, continuously analyzing market conditions and adjusting strategies as needed to align with the current economic landscape.

Comprehensive Risk Management: Effective risk management is crucial in pair trading, involving careful consideration of position sizing, stop-loss settings, and regular strategy reviews. This ensures sustainability and longevity in trading by protecting against undue losses.

By maintaining a disciplined approach and adapting to market changes, traders can harness the potential of Micro Treasury Yield Futures for strategic pair trading, balancing risk and reward effectively.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Introducing another way to display volume profile sectionsHello traders!

If you "Follow" us, you can always get new information quickly.

Please also click “Boost”.

Have a good day.

-------------------------------------

The indicators activated in the settings are those created by trading volume.

Therefore, this indicator represents the volume profile section.

The indicator that the arrow points to is the indicator I mentioned earlier.

By looking at this indicator together with volume candles, you can more clearly identify the volume profile section and support and resistance sections.

In addition, you can verify the start of trading by checking the movement of the BW indicator, which consists of five indicators, namely MACD, StochRSI, CCI, PVT, and superTrend indicators.

BW-MACD, BW-StochRSI, BW-CCI, BW-PVT, and BW-superTrend indicators are displayed separately to help you understand the indicators.

Once your trading timing has been selected, you need to create a trading strategy that suits your investment style.

What is important in creating a trading strategy that suits your investment style is the investment period and investment size.

Once the investment period and investment size have been decided, you must create a trading method and profit realization method using the information obtained from chart analysis.

Trading methods include buying, selling, and stop loss methods.

The purchase method should focus on how to lower the average purchase price by purchasing in installments.

At that time, when the price falls below the stop loss point and shows resistance, you need to think about how to proceed with selling.

When taking a stop loss, you must proceed according to the investment period you have set.

For example, if you decide to trade within one wave as a short-term trade and proceed with the trade, but the price falls below the stop loss point, you should be able to sell 100% and then watch the situation.

If the price rises after purchasing, you must proceed with selling according to the selling method.

The selling method must also be carried out according to the investment period.

However, the method of increasing the number of coins (tokens) corresponding to profit by selling the amount equal to the purchase amount can be continued into mid- to long-term trading even if the transaction was done through day trading or short-term trading.

The reason is that the average purchase price of coins (tokens) corresponding to profits is 0.

If you add other indicators to help you conduct split transactions based on price fluctuations, the chart will look like the one above.

If the chart is unfamiliar to your eyes,

It is recommended to view only the HA-Low, HA-High indicators and the M-Signal indicators of the 1D, 1W, and 1M charts.

Have a good time.

thank you

--------------------------------------------------

- The big picture

A full-fledged upward trend is expected to begin when the price rises above 29K.

This is the section expected to be touched in the next bull market, 81K-95K.

#BTCUSD 12M

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 13401.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

These are points that are likely to encounter resistance in the future.

We need to see if we can break through these points upward.

Since it is thought that a new trend can be created in the overshooting zone, you should check the movement when this zone is touched.

#BTCUSD 1M

If the general upward trend continues until 2025, it is expected to rise to around 57014.33 and then create a pull back pattern.

1st: 43833.05

2nd: 32992.55

-----------------

Key Interpretation Methods of CCI IndicatorsHello?

Traders, welcome.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a good day.

-------------------------------------

The CCI indicator, which is included in the 'Strength' indicator, now displays only the oversold or overbought zones.

Accordingly, it seems that there will be difficulties in understanding the indicators, so we took the time to give reinforcement explanations.

The CCI setting I use is 150.

Accordingly, it is utilized to see the flow of the mid-term and above.

The basic source value of CCI is (high + low + close) / 3.

Accordingly, we added the 150 SMA line and the CCI indicator as a secondary indicator.

If it rises a lot from the 150 SMA line, the CCI value rises above +100.

When it rises above +100, it is interpreted as entering the overbought zone.

Entering the overbought zone like this means that there is a possibility that it will exit the overbought zone in the near future.

However, while it is in the overbought zone, it also means that the force to rise is just as strong.

Accordingly, it is the basis for conducting transactions by identifying support and resistance points or sections.

Conversely, if the price drops a lot from the 150 SMA line, the CCI value will fall below -100.

Similarly at this time, when the CCI breaks out of the oversold zone, it enters the sideways zone, providing a basis for trading.

When the CCI is between -100 and +100, prices move sideways.

It is not easy to analyze with only the CCI indicator when it is in the sideways section with the CCI indicator.

Therefore, with the CCI indicator, it is recommended to find the basis for trading when entering and exiting the overbought section (CCI +100) and oversold section (CCI -100).

Since you can check the overbought and oversold sections of the Bollinger bands and CCI shown in this price chart, I think it is a good idea to use it together with the Bollinger bands.

It is quite difficult to create a trading strategy based solely on indicators like these.

Therefore, it is important to create a trading strategy by making sure to set support and resistance points on the price chart and see if the indicators are supported or resisted at those support and resistance points or intervals.

The setting value of Bollinger Bands used in this chart is 60.

-------------------------------------------------- -------------------------------------------

** All descriptions are for reference only and do not guarantee profit or loss in investment.

** Even if you know other people's know-how, it takes a considerable period of time to make it your own.

** This is a chart created with my know-how.

---------------------------------

Introducing the Trendicator (by Stock Justice)In this comprehensive tutorial, we dive deep into the world of the Trendicator, a powerful and innovative trading tool made by @StockJustice that enables traders to identify trends, spot reversals, detect bullish and bearish divergences, and perform multi-timeframe analysis. We delve into the inner workings of this never-before-seen indicator, demystifying its complex algorithms and showing you how to harness its full potential. From understanding the unique features of the Trendicator such as its compression stages, divergences, and MACD crossovers, to learning how to pair it with a Displaced Aggregated Moving Average (DACD) for enhanced precision, we cover it all in a fun and engaging manner.

The tutorial is not just about explaining the Trendicator's functionalities, but it also provides practical tips and strategies for using it in real-world trading scenarios. We discuss how the Trendicator can help traders spot the onset of a trend, gauge its strength, and pinpoint potential reversal points. Additionally, we explain how traders can utilize the bullish and bearish divergences identified by the Trendicator to anticipate market turns and make informed trading decisions.

Lastly, we emphasize the importance of multi-timeframe analysis in trading and demonstrate how the Trendicator can facilitate this process. By interpreting the Trendicator's signals across different timeframes, traders can gain a more comprehensive view of the market and make more accurate predictions. This tutorial is a must-watch for any trader aspiring to level up their technical analysis skills and trade more confidently and effectively. So, get ready to embark on an exciting journey of learning and discovery with the Trendicator!

Regarding the SR_R_C (Stoch RSI + RSI + CCI) indicator...Hello?

Welcome, traders.

By "following", you can always get new information quickly.

Please also click "Like".

Have a good day.

-------------------------------------

We use several methods to analyze charts.

When you start studying charts, you study a lot of things.

However, you should forget everything you have studied, trends, patterns, and indicators when conducting real trading.

Otherwise, it is because you are stuck in the studied frame and try to fit the chart into the studied frame without interpreting the chart movement as it is.

I think that this behavior makes you analyze charts with subjective thoughts, which increases the chances of creating a wrong trading strategy.

To prevent this, we will explain a new indicator.

The SR_R_C indicator is a combined indicator of the Stoch RSI, RSI, and CCI indicators.

- The set values of the Stoch RSI indicator are 14, 7, 3, 3.

It is displayed as one line by treating it as the middle value of the K and D lines.

- The setting value of the RSI indicator is 14.

Instead of the existing Close value, we tried to maintain the continuity between the oversold section and the overbought section by calculating the Heikin Ashi Close value.

RSI indicators are displayed in columns.

- The set value of the CCI indicator is 9.

When the CCI value rises above the +100 point, it is marked as overbought, and when it falls below the -100 point, it is marked as oversold.

CCI indicators are displayed in bgcolor.

There are a lot of information on how to interpret each indicator if you search.

However, you can read the searched content and forget it.

The detailed interpretation method can add subjective interpretation to the objective information that can be obtained through the index, so you can forget about the method of interpretation of the index itself.

The core interpretation method of the SR_R_C indicator can be interpreted that if two or more of the three indicators are defective, a reversal of the trend is highly likely.

For example, if two or more of the Stoch RSI, RSI, and CCI indicators are in the oversold zone, it can be interpreted that there is a high possibility of turning into an uptrend.

Conversely, if it enters the overbought zone, it can be interpreted that it is highly likely to turn into a downtrend.

Trend patterns such as Fibonacci, Harmonic, and Elliott waves will show the result of the discussion depending on the selected point.

Therefore, in order to use these patterns, indicators, and tools, the selection of a selection point is the most important.

However, I think that auxiliary indicators, such as MACD, RSI, Stoch RSI, CCI, etc., can help to obtain objective information because there is no point of choice.

In conclusion, the reason for analyzing the chart is to make a trading strategy based on the analyzed content to make a successful trade, so it is important to analyze the chart in the most objective and essential way.

Even with any of these indicators, patterns, and tools, critically choosing the wrong support and resistance points will lead to trouble crafting a trading strategy.

Therefore, solid learning of support and resistance points is required before studying or utilizing all indicators, patterns, and tools.

Thank you for reading this long article to the end.

For reference, all indicators included in this chart can be used normally if the chart is shared.

Also, you can copy and paste the indicators to other layouts to use them neatly.

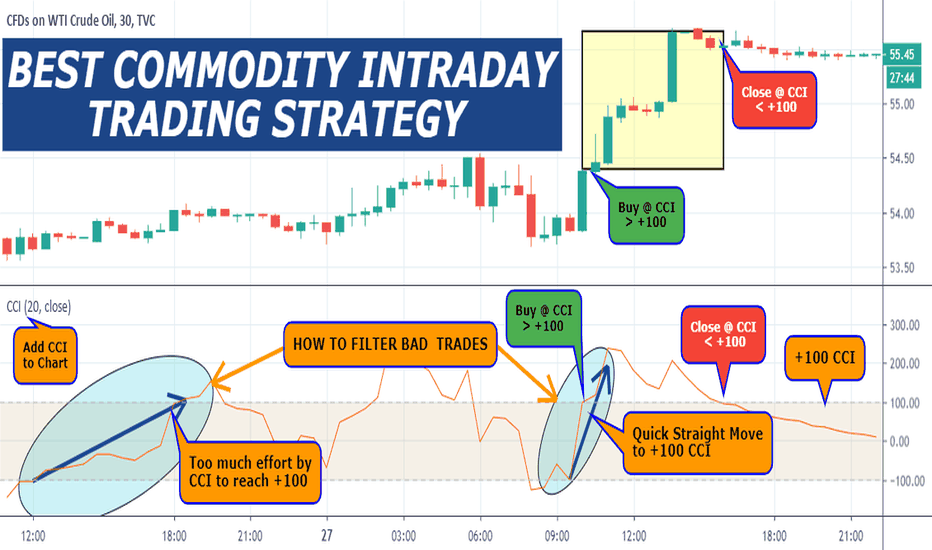

BEST COMMODITY INTRA-DAY WTI CRUDE OIL 30 M TRADING STRATEGY#1 Add CCI Indicator with default 20 setting.

#2 Add a CCI 0 level line.

How to Filter Bad Trades.

A - Bad: when price action makes CCI take a long time to go from -100 to + 100.

B - Good: when price action makes CCImake a quick straight move from - 100 to + 100.

#3 Buy when CCL breaks above +100 level.

#4 SL below CCI +100 breakout candle.

#5 Exit trade when CCI crosses below 0 level line.

EUDUSD 2 Hr Potential for Long with CCI diver, Fib. retr.The EURUSD upleg from May 25 to Jun 10 as retraced 38.2% of that price change, which is often a turning point for resumption of uptrend. During this price drop, 13 CCI has diverged, giving higher low, another checkpoint before price resumes any uptrend. If 100 CCI is > -100, that also allows upside to price. When the green trendline on 13 CCI is broken to the upside, That's the Long entry, whenever the other criteria have also been met. One more criterion, below, is necessary most of the time. (The exception is when a long explosive upmove happens, and takes 13 CCI above zeroline on the first move up)

After a CCI divergence forms higher low, the price generally then needs to drop back to retest the low or go even some lower, but then the door is open for price to resume uptrend if it wants. You can watch the retest of price low, then all the checkpoints are in to be ready to go Long if price moves up, and both CCI's move up

ETHUSD 30M CAMARILLA PIVOT TRADING STRATEGYDay Trading Camarilla Pivot Trading Strategy

Mean reversion day trading inherently has lower profit margins with Camarilla pivots. The reason behind this is very simple due to the proximity of the Camarilla points with the price action you’re left with lower profit margins.

So, from the start, you have a handicap that as a trade you need to overcome.

Trading is all about finding those situations where we maximize our profits and minimize the risk.

That’s the reason why we prefer trading breakouts of the Camarilla pivot points. The profit potential is far greater. However, in order to confirm our breakout trade, we’re going to throw in another indicator.

So, what’s the best combination with the Camarilla pivot points?

The CCI or Commodity Channel Index can be used in combination with Camarilla points to confirm breakouts.

Learn more about how the pro’s trade using the CCI trading system HERE.

So, what are the rules to confirm the Camarilla pivot point breakouts?

There are two rules:

For bullish breakout trades above the resistance R4, we need to see a CCI reading of +100 at the moment the breakout happens.

For bearish breakout trades below the support S3, we need to see a CCI reading of -100 to confirm the breakout.

Note* an effective way to hide your protective stop loss would be below (above) the resistance R3 (support S3).

You determine your own TP.

USDCAD 120min CCI turn signals diver retest hi TLBThis could have been posted 2-3 hr ago but trading comes first. There are still pips available, but more importantly the turn signals were so clear that the value is in the tutorial.

The first warning that uptrend was waning came with strong CCI divergence from price

Second, there was an abc down which corrected back up to retest the high (following divergence)

at the CCI high of the price hi retest, the CCI had a short signal with slanted rooftop. Together, those were a

first signal short.

Third, CCI crossed down thru an up-trendline giving a later signal short.

Reversal signal would be when CCI crosses back up thru a down-trendline on CCI (not shown)

BEST COMMODITY INTRADAY TRADING STRATEGY Before we outline the best commodity intraday trading strategy, it’s important to understand that trading commodities are different from trading Forex or stocks. Every financial asset has its own set of unique characteristics. The commodity market has its own behavior, that’s why some strategies are more suitable than others to generate profits from commodity trading.

We’re going to reveal some of the most well-kept commodity trading secrets only known by successful commodity traders.

Let’s now see what commodity trading strategy you can use to buy and sell products in the commodity market.

Here is the link to "Best Commodity Intraday Trading Strategy" pdf.

tradingstrategyguides.com

USDCAD 240 min Short. CCI lessons on end of continuationThe apex of triangle on CCI is below zero, favoring down. The move continues down from the previous CCI short signals. Because there is now a CCI divergence, two new things may be on the horizon.

1) at some time, the price is likely to be revisited where it was when the CCI low prior to the divergence occurred.

2) normally a CCI divergence occurs before trend can change direction. CCI now has a diver, but before the price turns up, usually price needs to retest the low or drop lower. The only exception to this is if CCI spurts north so fast that it crosses up thru the zeroline before pulling down a bit

Direction change to Long requires what is described in 2) above, and requires a CCI crossing up thru a down-trendline and moving above -100.

USDCHF Daily This is why we should waitThe price move in these situations is not convincing for a downmove , even if CCI crosses an uptrendline, until CCI gets below +100. This was described on previous chart. I pushed the short entry because I was sleepy, and stopped out. Actually I'm happy that happened, to show you why I need to wait for CCI to get inside +100 before I short.

I'll be ready to short again should CCI cross below 100 soon But no need to post it because you now now what to look for.

Correlation Coefficient + CCIPictured above is a graph of Royal Dutch Shell vs brent crude, the correlation coefficient between them, and the commodity channel index tracking the volume weighted moving average of Shell.

I tested this indicator on a few energy stocks: RDS, MRO, BP and XOM. Negative correlation between brent crude and an energy stock coupled with an overbought CCI seems to give an indication of price reversal. Here we see two overbought CCI readings coupled with negative correlation, both followed by massive drops in the price of BCO and RDS. Likewise we see negative correlation coupled with upward CCI readings pointing to massive price rises in RDS. Seems to work on daily time frame as well but indicator length will need to be tweaked accordingly.

Correlation coefficient going negative is an indication of pricing inefficiency and momentum potential, but does not give us an indication of price direction. The commodity channel index can give us a sense of where price momentum is pointed. Both put together give us a powerful indicator capable of foreshadowing both momentum and direction.

How To: Profit with CCI Colored Candles / Bars w/ Histogram You have SPY Trending down today CCI and Candles are red pink and purple buy the 1st or 2nd pullback where CCI goes near ZERO line on CCI

I use 5min charts minium Indicator link:

Color of your candles matches your CCI with Histogram indicator and trend line . CCI EMA or SMA based option, traditional or modern formula calculation options ect. Can change Length, source, Trigger Lines, colors of candles and histogram and more

The CCI compares the current price to an average price over a period of time. The indicator fluctuates above or below zero, moving into positive or negative territory. While most values, approximately 75%, will fall between -100 and +100, about 25% of the values will fall outside this range, indicating a lot of weakness or strength in the price movement.

A basic CCI strategy is used to track the CCI for movement above +100, which generates buy signals, and movements below -100, which generates sell or short trade signals. Investors may only wish to take the buy signals, exit when the sell signals occur, and then re-invest when the buy signal occurs again.

The CCI compares the current price to an average price over a period of time. The indicator fluctuates above or below zero, moving into positive or negative territory. While most values, approximately 75%, will fall between -100 and +100, about 25% of the values will fall outside this range, indicating a lot of weakness or strength in the price movement.

When the CCI is above +100, this means the price is well above the average price as measured by the indicator. When the indicator is below -100, the price is well below the average price.

1 CCI strategy is used to track the CCI for movement above +100, which generates buy signals, and movements below -100, which generates sell or short trade signals. Investors may only wish to take the buy signals, exit when the sell signals occur, and then re-invest when the buy signal occurs again.

Long-term chart is used to establish the dominant trend, short-term chart establishing pullbacks and entry points into that trend. A multiple timeframe strategy is commonly used by more active traders and can even be used for day trading, as the "long term" and "short term" is relative to how long a trader wants their positions to last.

When the CCI moves above +100 on your longer-term chart, this indicates an upward trend, and you only watch for buy signals on the shorter-term chart. The trend is considered up until the longer-term CCI dips below -100.

When using a daily chart as the shorter timeframe, traders often buy when the CCI dips below -100 and then rallies back above -100. It would then be prudent to exit the trade once the CCI moves above +100 and then drops back below +100. Alternatively, if the trend on the longer-term CCI turns down, that indicates a sell signal to exit all long positions.

When the CCI is below -100 on the longer-term chart, only take short sale signals on the shorter-term chart. The downtrend is in effect until the longer-term CCI rallies above +100. The chart indicates that you should take a short trade when the CCI rallies above +100 and then drops back below +100 on the shorter-term chart. Traders would then exit the short trade once the CCI moves below -100 and then rallies back above -100. Alternatively, if the trend on the longer-term CCI turns up, exit all short positions.

Make the strategy more stringent by only taking long positions on the shorter time frame when the longer-term CCI is above +100. This will reduce the number of signals, but will ensure the overall trend is very strong.

Entry and exit rules on the shorter timeframe can also be adjusted. if the longer-term trend is up, you may allow the CCI on the shorter-term chart to dip below -100 and then rally back above zero (instead of -100) before buying. This will likely result in a paying a higher price, but offers more assurance that th