Mastering Bullish & Bearish Crab Patterns - Entry, SL & TPs LevlHarmonic patterns are integral to technical analysis in financial markets, and the Crab pattern is one of the most distinct among them. Both bullish and bearish Crab patterns provide precise trading opportunities by indicating potential reversal points in the market. This article delves into the structure, identification, and trading strategies for both bearish and bullish Crab patterns.

____________________Bullish Crab Pattern_________________________

Structure and Identification:

A Bullish Crab pattern is a reversal pattern that signals a potential bullish reversal at the end of a bearish trend. It consists of five points labeled X, A, B, C, and D, forming distinct Fibonacci retracement and extension levels:

XA: The initial move from X to A.

AB: Retracement from XA, typically 38.2% to 61.8% of XA.

BC: Retracement from AB, typically 38.2% to 88.6% of AB.

CD: Extension of XA, typically reaching 161.8% to 224% of XA, and is the longest leg.

Entry, Stop Loss, and Take Profit Levels:

Entry: Place a buy order at point D, where the CD leg completes the 161.8% to 224% Fibonacci extension of XA.

Stop Loss: Set just below point D to safeguard against potential false breakouts.

Take Profit: Use multiple levels:

TP1: 38.2% retracement of the CD leg.

TP2: 61.8% retracement of the CD leg.

TP3: Point C level.

_____________________Bearish Crab Pattern_________________________

Structure and Identification:

A Bearish Crab pattern signals a potential bearish reversal at the end of a bullish trend. It mirrors the Bullish Crab pattern with the same Fibonacci retracement and extension levels but in reverse:

XA: The initial move from X to A.

AB: Retracement from XA, typically 38.2% to 61.8% of XA.

BC: Retracement from AB, typically 38.2% to 88.6% of AB.

CD: Extension of XA, typically reaching 161.8% to 224% of XA, and is the longest leg.

Entry, Stop Loss, and Take Profit Levels:

Entry: Place a sell order at point D, where the CD leg completes the 161.8% to 224% Fibonacci extension of XA.

Stop Loss: Set just above point D to protect against potential false breakouts.

Take Profit: Use multiple levels:

TP1: 38.2% retracement of the CD leg.

TP2: 61.8% retracement of the CD leg.

TP3: Point C level.

Conclusion:

Crab harmonic patterns, whether bearish or bullish, provide traders with high-probability reversal signals by leveraging precise Fibonacci retracement and extension levels. Correctly identifying these patterns and setting appropriate entry, stop loss, and take profit levels are crucial for capitalizing on their potential. As with all trading strategies, it's essential to complement harmonic pattern analysis with other technical indicators and sound risk management practices to enhance the chances of success.

Crab

Scott Carney's "Deep Crab" & the Fields Medal in MathematicsQ: What does the former have to do with the later?

A: The intuition in the former (S. Carney) is born out by the later (A. Avila; Fields Medal - 2014)

From Scott Carney's website;

---------------------------------------------------------------------------------------------------------

"Harmonic Trading: Volume One Page 136

The Deep Crab Pattern™, is a Harmonic pattern™ discovered by Scott Carney in 2001.

The critical aspect of this pattern is the tight Potential Reversal Zone created by the 1.618 of the XA leg and an extreme (2.24, 2.618, 3.14, 3.618) projection of the BC leg but employs an 0.886 retracement at the B point unlike the regular version that utilizes a 0.382-0.618 at the mid-point. The pattern requires a very small stop loss and usually volatile price action in the Potential Reversal Zone."

---------------------------------------------------------------------------------------------------------

From Artur Avila's Fields Medal Citation;

---------------------------------------------------------------------------------------------------------

"Artur Avila is awarded a Fields Medal for his profound contributions to dynamical systems theory, which have changed the face of the field, using the powerful idea of renormalization as a unifying principle.

Description in a few paragraphs:

Avila leads and shapes the field of dynamical systems. With his collaborators, he has made essential progress in many areas, including real and complex one-dimensional dynamics, spectral theory of the one-frequency Schrödinger operator, flat billiards and partially hyperbolic dynamics.

Avila’s work on real one-dimensional dynamics brought completion to the subject, with full understanding of the probabilistic point of view, accompanied by a complete renormalization theory. His work in complex dynamics led to a thorough understanding of the fractal geometry of Feigenbaum Julia sets.

In the spectral theory of one-frequency difference Schrödinger operators, Avila came up with a global description of the phase transitions between discrete and absolutely continuous spectra, establishing surprising stratified analyticity of the Lyapunov exponent."

---------------------------------------------------------------------------------------------------------

The connection here, as it is related to the specific "Deep Crab" harmonic pattern in trading, between intuition and general, analytical result, is illustrated somewhat simplified (but without distortion).

In essence, Avila has shown that in dynamical systems, in the neighborhood of phase-transitions in the case of one-dimensional (such as: Price) unimodal distributions, after the onset of chaos, there are islands of stability surrounded nearly entirely by parameters that give rise to stochastic behavior where transitions are Cantor Maps - i.e., fractal.

From that point it is an obvious next step to generalize to other self-affine fractal curves , such as the blancmange curve , which is a special case of w=1/2 of the general form: the Takagi–Landsberg curve. The "Hurst exponent"(H) = -log2(w) , which is the measure of the long-term-memory of a time series .

Putting it all together, it is not pure coincidence that a reliable pattern (representation) emerges from intuition (observation) which proves to be a highly stable (reliable) pattern that is most often the hallmark of a near-term, violent transition.

How to Use a Crab Pattern for TradingAre you looking to add harmonic patterns to your trading arsenal? You can try the Crab pattern. In this article, we’ll explore the basics of Crab patterns, the key rules and requirements you should be aware of, and learn how to use this versatile tool across all markets.

About the Crab Pattern

The Crab pattern is a harmonic pattern used in technical analysis to identify potential reversal points in financial assets. While harmonic patterns date back decades to H. M. Gartley’s 1935 book, Profits in the Stock Market, the Crab is a relatively new innovation developed by Scott M. Carney in 2000.

The Crab pattern is identified by specific Fibonacci ratios and consists of five distinct swings that are labelled as points X, A, B, C, and D. Point X is the starting position of the pattern, while point D is the potential reversal area. Notably, one of the hallmarks of the Crab is its long CD leg, as you’ll see shortly.

Despite being one of the rarer harmonic patterns, many traders successfully apply the Crab to markets, like stocks, commodities, forex, and crypto*, to create high-risk/reward setups. Traders typically use the pattern in combination with other forms of technical analysis, like trendlines, chart patterns, and indicators, to confirm potential reversal points.

How to Identify the Crab Pattern When Trading

Like other harmonic patterns, the Crab requires that a specific set of rules are met before being considered valid to trade. The essential Crab pattern rules are:

- X forms at a high or low.

- A is formed at an opposing high or low, i.e., if X is a high, then A is a low, and vice versa. This movement is known as the XA leg.

- The price retraces XA between 0.382 and 0.618 to produce B, creating the AB leg.

- C retraces 0.382 to 0.886 of the AB leg and generates a BC leg.

- D forms at a 1.618 extension of the XA leg, creating the final CD leg, and should ideally be a 2.24 to 3.618 extension of the BC leg.

- Traders enter at D.

Note that the ratios won’t always line up perfectly, so use your judgement to determine whether the pattern is valid. The ratios are simply guidelines to identify potential Crabs. It’s always best practice to use your discretion and consider other technical factors to decide whether you want to enter a trade based on your observations of the Crab formation.

As you dive deeper into the world of harmonic patterns, you might notice that the Crab and Butterfly look very similar. The difference is in their internal retracements and, most importantly, the depth of D. The Butterfly requires that D be a 127% to 161.8% extension of XA, while the Crab will always be a 161.8% extension of XA.

Trading the Crab Pattern

Now that we understand how to identify Crabs, it’s time to start looking at how traders typically employ the Crab to enter trades. We’ll be using the TickTrader platform to demonstrate how you can use this pattern, and if you’d like to follow along, feel free to use it as well. There’s no need to sign up to FXOpen , and you’ll be able to start honing your Crab identification skills within seconds. You can also open an FXOpen account if you want to practise the Crab in live markets.

The Bullish Crab Harmonic Pattern Strategy

Let’s briefly cover the exact rules for a bullish Crab pattern in the forex, stock, commodities, and currency markets. They are:

- XA Leg: The XA leg comprises a low X and a high A.

- AB Leg: B is a bearish move that retraces between 0.382 and 0.618 of XA.

- BC Leg: Another high, C, forms, which is a 0.382 to 0.886 retracement of AB.

- CD Leg: A sharp move down creates D, which is a 1.618 extension of XA and, ideally, a 2.24 to 3.618 extension of BC.

Traders will either set a limit order at a projected point D or wait for the price to show signs of reversal before entering with a market order. It can be tricky to know at which point the Crab becomes invalid if D continues past the 1.618 mark, so you may try setting a hard limit, like 1.7, at which point you consider it untradeable.

Stop losses are typically placed just below D. Traders often use a set number of pips or a volatility-based indicator, like Average True Range or Bollinger Bands, to find an appropriate point. Alternatively, you could try using a set limit that would invalidate the entire pattern for your stop loss.

Profit targets depend on how conservative your trading style is. Some traders prefer to begin banking profits once A is reached, while others start taking partials at B. For longer-term targets, a 1.618 extension of A and D is also commonly utilised.

The Bearish Crab Harmonic Pattern Strategy

The principles for a bearish Crab pattern are primarily the same, just flipped. As such:

- XA Leg: The XA leg features a high X and low A.

- AB Leg: A bullish move creates B, retracing 0.382 and 0.618 of XA.

- BC Leg: The price falls to produce C, a 0.382 to 0.886 retracement of AB.

- CD Leg: A spike upward generates D, which extends XA by 1.618 and should extend BC by 2.24 to 3.618.

Similarly, traders enter at D, either with a limit order prior to the point forming or with a market order once bearish price action confirms the formation.

Stop losses are usually placed just above D, although it’s up to you how you choose to determine the precise point. Just be wary of using a stop loss that’s too wide.

Likewise, traders often begin taking profits at A or B, with the 1.618 extension of A and D offering a suitable target beyond the range of the pattern.

What to Do Next

All that’s left to do is to keep practising and training your eyes to recognise potential Crab patterns. You can follow these steps if you want to improve your ability to spot Crab formations while forex trading, and start incorporating them into your strategy:

1. Practise identifying Crabs on historical charts.

2. Try using software that automatically identifies and labels Crab patterns for you, so you can focus on analysing their formation.

3. Open an FXOpen account and try trading the patterns as you see them occurring.

4. Experiment with indicators and other forms of technical analysis to create a viable strategy.

At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Harmonic Patterns Crab And Deep Crab my point of viewA proper Crab pattern needs to fulfill the following three Fibonacci rules: AB= retrace between 0.382 – 0.618 Fibonacci Retracement of XA leg; BC= minimum 38.2% and maximum 88.6% Fibonacci retracement of AB leg; CD= Poses a target between 2.24 – 3.618 Fibonacci extension of AB leg or an ideal target of 1.618 of XA leg.

Crab Pattern

The XA retracement levels are checked to validate the retracement (here, pivot B forms just near 61.8%, barely making it to qualify for the Crab pattern

At point C, we notice the retracement falling within AB’s 88.2% – 38.2% zone

Eventually, price surges higher to reach to 161.8% Fibonacci extension of XA and fits within the 222.4% – 361.8% extension of the CD leg

Following the high, a short position could be taken, with stops at the high of CD, which marks the price reversal zone

The Deep Crab pattern

The Deep Crab pattern on the price chart differs from the Crab pattern on one main aspect, which is the swing point B.

While in a regular Crab pattern, the B retracement fits within 38.2% – 61.8%% retracement of XA, with the Deep Crab pattern the swing point B sits at the 88.6% retracement level of XA.

Bullish Crab patternOn AJ 1 hour chart, did you notice that the example bullish crab pattern ended on Friday? On the AJ 4 hour time frame (refer to another article done today by myself) it showed another harmonic bullish pattern- see two time frames show that this pair when they open up on Sunday/Monday will be bullish when it starts out trading. Just wait for an Engulfing, Harami and/or Pin bar candlestick set up on this 1 hour and/or 15 minute timeframe to do any buy trades with.

Different time frames give you another perception of candlesticks and shows you more probable's that you are trading in the right trend and with the current big banks, which you always need to be doing.

All harmonic patterns have a bearish and/or bullish one, which you can find on your charts, if you chose to trade them and make money off of them too.

Please do your own research of exact ranges of fib retracements and extensions which are needed for each individual harmonic patterns- Wish you best.

Crab and Deep Crab harmonic patternHow to trade when you see the pattern?

Trading a bearish Crab pattern

To trade a bearish crab pattern, put a short (sell) order at point D (the 161.8 percent Fibonacci extension of the XA leg).

Entry: Identify where the pattern will end at point D, and place your order

Stop-Loss: Put your stop-loss just below point D

Take Profit: The location of your profit target is highly subjective and depends on your objectives and market conditions. If you desire aggressive profit, place it at point A of the pattern. For a more conservative profit, place it at point B.

Trading a bullish Crab pattern

First of all, choose the crab pattern charting tool and follow all the above rules to identify the pattern. Remember that the Fibonacci ratios are very important to trade the crab pattern. If you notice the pattern on a price chart and if you find the ratios not matching with the pattern rules, it means that the pattern is not valid. So do not trade that pattern.

When the price action confirms the pattern, immediately enter for a buy. If you are a conservative trader, ensure you wait for a couple of bullish confirmation candles before entering the trade.

There are four targets (X, B, C, A) to place the take-profit order in the crab pattern. At the start, traders try to book full profit at point A, but when the price crosses point B, the market turns sideways. So book half of your profit at point B and then close your full positions at point A.

Most of the traders placing their stop-loss way below point D; however, that’s a wrong way to do it because they are risking more due to this simple logic. If the price action breaks point D, it automatically invalidates the pattern.

Bat Action Magnet MoveIn my previous idea i had posted about the bullish bat , which in due process got its PRZ violated and got morphed into a bat...

Herest is the current bullish crab in formation...https://www.tradingview.com/chart/BTCUSD/3Xk8coRL-Few-more-candles-to-Cavalry-Charge/

Here is the failed idea...

Disclaimer... For educational purpose onlyNot an investing/Trading recommendation

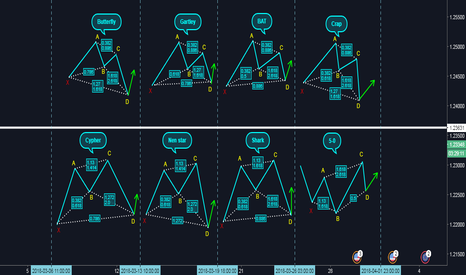

Advanced Patterns - Crab (by Scott Carney)"The Harmonic Pattern CRAB is yet another discovery by Scott Carney and is identified by its long stretching swing points. In the crab pattern the PRZ level at swing/pivot point D is overstretched and shoots beyond the initial swing/pivot point of X. This is the main key difference between other harmonic patterns. The crab pattern, while easy to identify requires a bit of skill in trading the patterns."

LESSON FOR CRABhi there

it is me chrystael again.

i made this out there for people to benefit and learn from. gotta say something about the CRAB. guess you like eating a crab, you can as well do it in the market. happy learning people.

Crab is one of the most successful harmonic patterns

it is rare to find and has a good completion and profitable rate

it is a trend reversal or a pull back before continuation of trend pattern, but mostly a trend reversal

it basically a failed gartley and bat patterns to an extension far longer that if it meets its termination just has no option but to start reversing.

it has its rules based with the critics of garltey and bat

i have traded crabs before and majority of it were so cute.

note: because you have found a crab and with all the likes about it does not mean it will trade, so be wise before taking a trade.

i made my EURUSD trade based on this.

hope this helps a lot

thanks