CYPHER Harmonic Pattern - Made Easy For Everyone !The Cypher harmonic pattern is a technical analysis indicator used by traders to identify valuable support and resistance levels based on the Fibonacci sequence of numbers and detect trend reversals.

Here, in this article, we explain how the Cypher harmonic pattern works, identify it, and trade it.

What is the Cypher Harmonic Candlestick Pattern?

The Cypher harmonic pattern is a technical analysis formation indicating a price-action reversal.

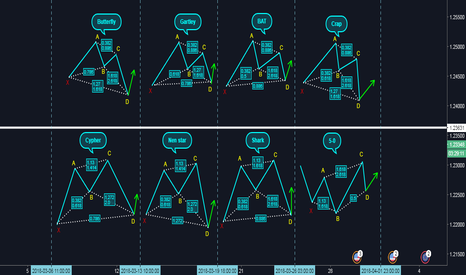

The pattern was discovered by D. Oglesbee and is known as a relatively advanced pattern formation. In structure, the Cypher pattern is similar to the butterfly harmonic pattern; however, the Cypher is not a very common chart pattern due to its unique Fibonacci ratios.

The Cypher pattern, which can be either bullish or bearish, has five points (X, A, B, C, and D) and four legs (XA, AB, BC, and CD). Like any other harmonic pattern, the theory behind the Cypher chart pattern is that there is a strong correlation between Fibonacci ratios and price movements.

Eventually, the market is expected to reverse from point D after the four market swing wave movements

How to Identify and Use the Cypher Harmonic Pattern in Forex Trading?

Much like any other harmonic chart pattern, several conditions must occur so you can identify the Cypher pattern:

B point retracement of the primary XA leg ranges between 38.2% to 61.8% Fibonacci levels

C point is an extension leg with a Fibonacci ratio that should be between 127.2% to 141.4% of the primary XA leg

D point should break the 78.6 retracement level of XC

Let’s see what the Cypher harmonic pattern looks like on a trading chart.

Cypher Pattern – Set a Stop Loss

A reasonable stop-loss level when trading the Cypher pattern is simple and does not necessarily require the combination of Fibonacci retracement.

All you need to do is to place the stop loss somewhere below the D level because if this level breaks, the entire Cypher pattern is invalidated. So, the stop would be placed at the next support or resistance level, which is the X-point

Cypher Pattern – Set a Take Profit Target

The simple Cypher pattern trading method is using its points as profit targets, meaning the A and C levels.

How accurate is the Cypher harmonic chart pattern?

The Cypher harmonic pattern has been historically proven to be a fairly reliable and accurate chart pattern. According to various studies, the pattern has an accuracy rate of around 70%.

Cypher

Cypher patternHow to trade when you see the Cypher pattern?

While trading the cypher pattern, you will apply a set of simple rules. They will try to minimize risk and maximize profits. Even though there is one more important step to learn before defining the cypher pattern trading strategy rules.

Step 1: Drawing Cypher patterns

Click on the harmonic pattern indicator located on the right-hand side toolbar of the TradingView platform.

Identify the starting point, X, on the chart, which can be any swing low or high point.

Once you’ve located your first swing high/low point, follow the market swing wave movements.

Every swing leg has to be validated and abide by the cypher pattern forex Fibonacci ratios.

Step 2: Trading process

Now that you know how to identify and qualify the harmonic cypher pattern, it’s time to trade the pattern. Standard methods of trading the cypher pattern include:

Entry point

The cypher pattern may be the most exciting harmonic pattern for risk management, because it has the highest winning rate. Backtesting results have continuously proven the cypher pattern forex is a very dependable harmonic pattern.

Next, buy with a market order at the first candle preceding the completion of the D point at 0.786 Fibonacci retracement of the XC leg. Once the market touches the 0.786 level, wave D is in place, because you can’t control how far the market will go.

When the CD leg gets to the 78.6 percent retracement level, the cypher pattern is complete and valid. However, the 78.6 percent Fibonacci retracement level of X to C also acts as the standard entry point for a valid cypher pattern trade.

Take profit

There are some ways to take profit with this pattern, but the standard method is to scale out of your position at the first take profit level and end the trade at the second take profit level. Take profit once you get to point A. To get to such levels, draw a Fibonacci retracement of the CD leg.

The cypher patterns trading method is a reversal method. Make sure you capture as much as possible from the new trend. If you’re not a fan of reversal strategy, and you prefer a trend following strategy, follow the MACD trend following strategy-simple to learn another strategy. The strategy has attracted a lot of interest from the Forex trading community.

Ensure you take profits once you reach point A of the pattern, because it has conservative take profit target.

So, why should you take profit so early?

For the most part of the harmonic patterns, it’s best to lock in profits as soon as possible. Since the cypher pattern is one of the most profitable harmonic patterns, you can give it more room for the price action to breath. You have the chance to at least see a retest of the wave A.

Stop-loss

Ensure you give your trade at least 10 pips space above X in the intraday charts. While trading a bullish cypher pattern, place the stop-loss at least 10 pips lower than the low of X. For a bearish pattern, place the stop-loss at least 10 pips higher than the high of X. That’s the only logical place to hide your stop-loss, because any break below will automatically invalidate the trade.

Bullish pattern cypherI'm new to this I like doing this while I trade is learn and do what's been selfthought, this to my knowing is a bullish pattern and we'd buy on the break of its trendline .. if not we sell the 1.24800 once broken from the 1.25000 that's fighting to keep price up

In wave's of intraday counting we in another correction before the last touch where I'd like to sell .. for I know the round figure can bring tough resistance.

TP 1.2558 if the top gets broken

And 1.2580

The Bullish Cypher Harmonics and sacred geometry are all around us. If we are perceptive enough, we are able to observe the laws of nature as it adheres to certain geometric and harmonic ratios while it performs it's beautiful expressions of matter and its interactions.

In trading too, price follows the most harmonious path possible. This is an example of one such tried and tested pattern which has led to success many times consistentl, the Bullish Cypher.

Ratios are simple,

AB movement should be 0.382 to 0.618 retracement of XA.

BC movement should be 1.272 to 1.414 extension of an XA.

Movement CD should be 0.786 retracement of XC.

The beautiful forms of life upon the earth combine and swirl and couple and embrace in

the most incredibly intricate, divinely magnificent spectacle conceivable.

Cypher pattern - Good Example #2DISCLAIMER - Your money is not in danger but guaranteed to disappear if you follow my trades. These ideas and trades are mostly for my personal use as a journal, but I try to provide as much value as possible to the community

Cypher patterns supposedly have 80% completion ratio. This one worked flawlessly

X - recent bottom

A - recent top

B - must touch 0.382 fib retracement and close BEFORE 0.618 of X-A. We have 0.455 - GOOD

C - must touch 1.272 fib extension and close BEFORE 1.414 of X-A. We have 1.244 - NOT QUITE. If you are really pedantic with it, you may choose to ignore this one. In my book so far, it worked !

D - nosedive required after C. Buy Entry - 0.786 retracement of X-C

Look at that bounce - pattern could not have worked better (as long as you don't need the 1.272 point to be hit and can settle for a 1.244) The extra volume and RSI cross-over are bonuses. No point to measure - both 382 and 618 targets hit.

Cypher Pattern - Good example #1DISCLAIMER - Your money is not in danger but guaranteed to disappear if you follow my trades. These ideas and trades are mostly for my personal use as a journal, but I try to provide as much value as possible to the community

Cypher patterns supposedly have 80% completion ratio. This one worked flawlessly

X - recent bottom

A - recent top

B - must touch 0.382 fib retracement and close BEFORE 0.618 of X-A. We have 0.463 - GOOD

C - must touch 1.272 fib extension and close BEFORE 1.414 of X-A. We have 1.265 - SORT OF. If you are really pedantic with it, you may choose to ignore this one. In my book, it counts.

D - nosedive required after C. Buy Entry - 0.786 retracement of X-C

The price bounced exactly on the 0.768 retracement level and easily hit the first target, which is 0.382 fib extension. It BARELY missed the 0.618 level depending on how pedantic you are with the charting tools. In fact it hit it but much later.

Cypher Pattern - Bad Example #1DISCLAIMER - Your money is not in danger but guaranteed to disappear if you follow my trades. These ideas and trades are mostly for my personal use as a journal, but I try to provide as much value as possible to the community

Cypher patterns supposedly have 80% completion ratio. This one failed

X - recent bottom

A - recent top

B - must touch 0.382 fib retracement and close BEFORE 0.618 of X-A. We have 0.463 - GOOD

C - must touch 1.272 fib extension and close BEFORE 1.414 of X-A. We have 1.367 - GOOD

D - nosedive required after C. Buy Entry - 0.786 retracement of X-C

We can see the price bounced in that area (the wick being much lower and touching X level. The pattern was close to being correct however the bears were too strong. If you were lucky - you could get a quick scalp.

Do Cyphers only work in sideways markets? Not in Bear/Bull markets?

I'll be following this up with some good Cyphers

Education Study: 5 good trades in nzdusdEducation Study:

How many good trading opportunity for NZD?

1. Bearish Cypher Pattern , short and capture a buyer failure

2. blue channel broken, retest and short

3. 0.7340 structure broken, retest and short

4. ab=cd plus structure retest

5. 1h inside bar break out and short

Learn the true rules of cypher.Cypher advanced formation is the most accurate formation among all advanced formations. It is about 70% accurate if identified correctly. The ONLY correct way of identification is as follows:

1. B-point must touch 0.382XA but should never close beyond 0.618XA

2. C-point must touch 1.272XA but should never close beyond 1.414XA

3. D-point is 0.786XC and it must be beyond B-point.

As you see frome the rules above the are no max limitations for B and C candle wicks. Whatever ratio will be correct if rule #3 isn't broken.

Do not trust these types of explanations: www.sr-analyst.com

Or this: forextraininggroup.com

Don't know why do people believe this kind of stuff and don't even make an effort to contact the creators of cypher - Tradeempowered guys.

//|+--------------------------------------------------------------------------------------------------------------+

//|This pattern was found with PatternSearch software

//| you can watch the sample video here: www.youtube.com

//|+--------------------------------------------------------------------------------------------------------------+

Best regards, Alexander Nikitin.

A professional trader, programmer and a trading coach.

CYPHER PATTERN EXPLAINED - USING TRADINGVIEW TO YOUR ADVANTAGE Hi All, I wanted to share this with you explaining Cypher Pattern.

On the left are steps required for valid Cypher, and the right Pane is the Stops and Targets

First I will explain the numbers I have noted on the charts, this is a standard procedure I follow

1. Recognized Structure - Potential X to A leg

2. A Leg is now formed

3. B Leg and lets see how far it retraces using the Fibonacci Retrace Tool - we have a potential Cypher is price falls

4. Now we have the criteria for the Cypher

5. At this point I have my 78.6% in place and I know my entry level - D completion - Price still has not hit the entry

so orders are resting at that level

6. Stops are immediately placed

7. After entry at 5 - I have my targets on screen ready to be adjusted at D completion - Target 1 Adjusted

8. Target 2 is adjusted when we have the reversal

9. Target 1 Has been hit so we want to move stops down

10. Second Stops is moved down

11. Stop is placed at break even which is our entry level 78.6% - we are now safe and covered

on our second target.

12. Second Target achieved

13. This is not on screen but I will also trail stops after we have a Target 1 hit, this will be determined on price action. If we hit the Target 1 level then we come back to retest our entry point. If second Target is not stopped for break even and price falls back towards Target 2, I will wait for a break below close below so LLLC or HHHC depending on bullish or bearish, my trail stop would be 5 pips above the last structure level set to trail.

Based on how price action works and structure levels which we know are key to trading, this action of price generally indicates a drop, and setting the trail to this level protects me with gaining the maximum profits if we just miss the Target 2 and if I am sleeping at the time. How many times would you see Target 1 hit then price falls to just past the 50% then back to stop out for break even.

Trading View has multiple tools to allow you to run very fast analysis and also publish your idea's. Learn to use them to your benefit

The XABCD and CYPHER makes it a lot faster to publish our idea's rather than drawing triangles, it also shows you

the ratios on screen so you dont need to draw Fib's - in saying this I always like to double check and its a habit to also have the Fib's on screen with a straight entry line.

Good luck traders and any questions or explanations you want me to publish, send request and I will do my best.

Dont shoot for the moon take profits and dont be greedy because it will turn into more loss than gain.

How To Trade The Cypher Pattern.Hi Traders,

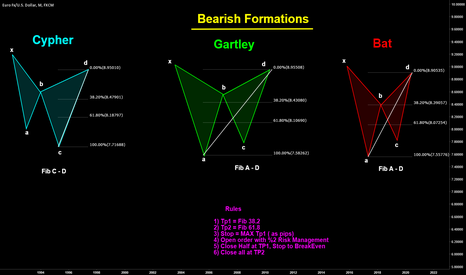

After more positive feedback received from the Gartley & Bat Pattern explanation, I have drawn the final illustration explaining my interpretation of the Cypher Pattern

For those who have not yet seen the explanation for the Gartley or Bat Pattern I have attach the link in the comment section below.

Above Is an illustration of a complete Cypher Pattern and the rules and ratios needed to trade this pattern.

First things first, grab your Fibonacci tool and draw from the X to A leg of the initial move or impulse leg.

The Fibonacci ratio's you are looking for are the 0.382%, 0.50% and the 0.618%, price MUST at least touch or spike through the 0.382% but not touch or exceed the 0.618%.

The price reversal zone is shown in the white box.

Now you have the B leg we are looking for the C leg which is an extension of the A to B move.

On this occasion grab your Fibonacci Extension tool and draw from the A to B and then back to A, you are looking for a minimum of the 1.272% extension.

On the C leg the price reversal zone is a little narrow on many occasion, price MUST hit the 1.272% but not exceed the 1.414%, which is once again shown in the illustration above.

Once you have the X A B and C legs you are looking for the final piece of the jigsaw which is the D leg completion and the area you are looking to buy.

There are a couple of different ways to get the D leg however they both end up at the same price, for me personally I use the Fibonacci retracement tool.

To get the D leg take your Fibonacci tool and draw from the X to C leg which will give you a 0.786%.

Once price falls to the 0.786% all criteria's are met, at which point you would buy in anticipation that price will rise.

TARGETS:

When looking to take targets on this pattern the first step is to once again use your Fibonacci tool.

Take your Fibonacci tool and draw from the C to D leg, you are looking for the 0.382% and 0.618%.

If this is the method you are looking to use for targets you would have your broker take off half of your position at the 0.382% and the other half at the 0.618%

To protect the profits you have accumulated it is advised to move stop loss to breakeven once the 0.382% target 1 has been attained, thus giving you a risk free trade and money in the bank.

STOP LOSS:

When looking to place your stops there are again many ways this can be done, but should always be placed below the X leg.

Your risk reward should be a minimum of 1:1 on every trade to the 0.382%, if this can not be achieved then I would not personally take the trade.

CURRENCY PAIR:

This pattern like any other and is more profitable with certain currency pairs, you should do your own back testing on this before trading the pattern.

I hope this is a more in-depth insight to advanced patterns in particular the Cypher Pattern .

I am available via private message for any questions you may have.

WEBSITE:

www.UKForexSignals.com

DISCLAIMER:

Please note I am only providing my own trading information for your benefit and insight to my trading techniques, you should do your own due diligence and not take this information as a trade signal.

USDJPY - the Cypher pattern explained.A bearish Cypher pattern is forming on this popular currency pair. It may look a bit weird, but it all points from X to C lign up nicely for a cypher pattern formation. Whether it will complete or not, I wanted to use this opportunity to give an explanation on this pattern.

How do you recognize a cypher pattern ?

The Cypher pattern was discovered by Darren Oglesbee from Trade Empowered and I have been told that at some point this was the only pattern he traded, and was very succesful at it as well as these patterns have a high success rate. This is a so-called "extension pattern", where the impulse leg (XA) is not the longest leg of the pattern but the C point extends beyond A.

What are the criteria ?

B-point : should see a minimum of 0.382 retracement of XA and cannot close beyond the 0.618 extension of that same leg.

C-point : should reach at minimum the 1.272 extension of the XA leg and cannot close beyond the 1.414 extension of that leg.

D-point : lies at the 0.776 of the complete XC move. Ideally you would look for some previous structure as well.

Where do stops go ?

As with any Harmonic pattern, stops exceed X with a certain number of pips (fixed number or defined by ATR)

Profit targets ?

Traditional targets apply :

Target 1 : 0.382 retracement of CD leg

Target 2 : 0.618 retracement of CD leg

You will notice that the Risk/Reward ratio is not ideal here and barely reaches a 1:1, however since this pattern is so successful, with Target 2 often reached as well, it's definitely worth it. This pattern occurs in the market quite often, so learning how to recognize it is definitely to your advantage.

Hope this was useful !!! Leave your comments below.

EJ SHORT + LESSON ON SHARK / CYPHERHow to determine the difference between a shark and a cypher as they are very similar. If I have time I'll try to catch the 5-0 trade on this one also. Extra addition: as you can see there were a lot of sellers in the 0.886 retracement too (as it is the first entry spot for a shark). You can determine if this is a false selling point by using the ABCD.

You sell at the 1.13 retracement from the XA leg, as Sharks tend to evolve into 5-0 patterns I trade this with only 1 profit target (near the 0.5 retracement of the CD leg) and then go long.