How To Have An Edge Over The Markets!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Today I want to share a basic trading plan that you can follow to quantify your trading edge.

📌Step 1:

First, start from the higher timeframes like Daily/Weekly to identify the current long-term trend. is it bullish, bearish or stuck inside a range?

If the price is sitting in the middle of nowhere, then it is a NO trade zone as price has 50% change to go either up or down. Thus no edge!

📚Wait for the price to approach the lower bound or upper bound. Then proceed to Step 2

📌Step 2:

No matter how strong a horizontal / non-horizontal support or resistance is, it can still be broken. Thus don't buy/sell blindly as price approaches a support/resistance.

Instead, zoom in to lower timeframes like H1 and M30 to look for setups.

🏹A basic approach would be to wait for a swing low to be broken downward around a resistance as a signal that the bears are taking over.

In parallel, wait for a swing high to be broken upward around a support for the bulls to take over.

This would be the confirmation to enter the trade.

⚙️Of course, your second edge would be through risk management by targeting at least double than your indented risk.

But that's a topic for another post 😉

Always follow your trading plan regarding entry, risk management, and trade management.

Hope you find the content of this post useful 🙏

All Strategies Are Good; If Managed Properly!

~Rich

EDGE

My Trading Strategy in 3 Steps 📊As per @TradingView 's previous post, in this article, I am going to share my trading strategy in three steps.

📌 Step 1:

First, start from the higher timeframes like Daily/Weekly to identify the current long-term trend. Is it bullish, bearish, or stuck inside a range?

If the price is sitting in the middle of nowhere, then it is a NO trade zone, as the price has a 50% chance to go either up or down. Thus, there's no edge!

Remember: No trade is also a trade.

📚Wait for the price to approach the lower bound or upper bound. Then proceed to Step 2.

📌Step 2:

Zoom in to lower timeframes like H1 and M30 to look for any reversal setups.

A basic approach would be to wait for a swing low to be broken downward around a resistance as a signal that the bears are taking over.

In parallel, wait for a swing high to be broken upward around a support for the bulls to take over.

This would be the confirmation to enter the trade.

Just like a sniper waiting for the perfect shot!

📌Step 3:

Target at least a 1/2 risk-to-reward ratio. This way, even with a 50% win rate, you can still be profitable.

Remember: We are risk managers, not traders. We can't control the market; the only thing we have control over is our risk.

📚Always follow your trading plan regarding entry, risk management, and trade management.

Hope you find the content of this post useful 🙏

All strategies are good; if managed properly!

~Richard Nasr

📕Low-Quality setups (UNCLEAR) VS High quality (CLEAR) setups📕High quality (Clear) vs Low Quality (Unclear, wicky, random, guessing)

Setups in Our Trading

High quality clear (HQC) setups are best representations of your EDGE, they allow you to feel confident in the MOMENT of placing a trade, and you can feel relatively good about it even if it’s a loser, because you know you traded in clear market environment and did your best

HQC setups bring you HEALTHY excitement and joy from the process of your trading, in case of a winner, usually not leading to overconfidence and doesn’t lead to attachment to random reward, and in case of a loser - you are not dragged into revenge or depression, because you know losers are also part of your strategy and your execution was good

When you enter HQC setups that speaks about you as about a trader you tested their strategy, who knows what they want to see in the market and applied effort to stay away from bad condition and wait for a better one. These skills alone are so much better than 1 random +3R or +5R winner

Low quality unclear (LQU) setups mean something is out of your mental game today, you feel not feel good in longterm perspective trading them, because you kind of KNOW you should trade them, but you still do. It all sucks you into an emotional circle.

LQU setups bring you UNHEALTHY , short term lived overexcitement in case of a winner, attaching you to random rewards, which is fatal for a trader. Every time entering a LQU setup you develop a habit or “teach” yourself that it is easy and fast way of earning money. Just see something distantly reminding about your setup and enter. Sometimes you’ll get away, but longterm you’ll lose more.

LQU setups means you are you fully confident in your core strategy, and so you may unconsciously search for random entries, because you entered like this before and it brought you reward. Trading LQU setups is destroying your mental game and account in the short, medium and longterm

Picture attribution Frame Border PNGs by Vecteezy

Understanding Your Statistical Edge STATISTICAL EDGE

A player's advantage in a game of chance that ensures favorable outcomes over the long run is referred to as a statistical edge. Think about a situation where a coin is rigged so that one side has a 51% chance of dropping heads while the other has a 49% chance. When a player wins, they are paid 1, and when they lose, their opponent is paid 1.

This establishes the rules of a game of chance, such as the likelihood of winning and losing, the reward for winning, and the penalty for losing. We may calculate the expectation using these parameters, which determines whether or not one has a statistical edge.

If the expectation is higher than 0, the player has a statistical advantage that could result in long-term financial success. The player who wins the coin game 51% of the time will make money in the long run because the expectation in this example is 0.02.

The metrics of a trading strategy are similar; the win rate, which measures the likelihood of winning, and the average Reward to Risk Ratio (RRR), which measures the average profit divided by the average loss of your trades, are both used. Consider a system that wins 40% of the time and has an RRR of 2, which means that winning is worth twice as much as losing. In this scenario, you risk 1R on each trade, and out of 100 trades, you win 40 and lose 60.

Your expectancy is then calculated by multiplying the number of winning trades by the reward (2R) and subtracting the number of losing trades by the risk (1R), resulting in a profit of 20R over 100 trades. Therefore, your expectancy is $0.2, meaning that for every 0.1 you risk on a trade, you earn $0.2 on average.

A successful approach, however, will fall short if proper risk management practices are not followed. A trading strategy is a tool, but risk management is what allows you to profit.

WINRATE & LOSES

The chart above displays your chances of having consecutive loses based win rate. As seen in chart above even if your trading method is 60% successful, there is still a 70% risk that you will suffer four consecutive losses. You have a greater than 50% risk of suffering eight consecutive losses if your strategy only succeeds 40% of the time. Knowing these numbers is very important as it helps with your psychology when you find yourself losing a lots of trades and you're questioning your strategy.

IMPROVING YOUR RISK TO REWARD

One way to improve your reward on trades is by using your MAE and MFE metrics to determine stops and take profit.

A trader's stop-loss and take-profit levels can be determined using the metrics MAE (Maximum Adverse Excursion) and MFE (Maximum Favorable Excursion).

No matter whether a trade is profitable or not, MAE calculates the maximum drawdown that can occur from the deal's highest point to its lowest position. However, regardless of whether a transaction is ultimately lucrative or not, MFE evaluates the highest profit a trade can achieve from its entry point.

In the above image we can see MAE calculations on trades. We can see that of all the trades taken the trades that have the best performance (above the blue line) are the trades with the least amount of drawdown. This information can help a trader determine at what point he/she should be closing trades if not running in their direction.

Trading professionals can better understand the behavior of the market and set more sensible stop-loss and take-profit levels by looking at the MAE and MFE of their transactions.

For instance, a trader may want to tighten their stop-loss level to reduce potential losses if they notice that their trades frequently encounter a significant MAE before eventually reaching their take-profit level. On the other hand, if a trader notices that their trades frequently encounter a significant MFE before being ultimately stopped out at a loss, they might want to think about establishing a broader stop-loss level to give their trades more breathing room. Overall, using MAE and MFE can assist traders in better understanding the advantages and disadvantages of their trading strategy and in adjusting their risk management plan accordingly.

How To Have An Edge Over The Markets 📚Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Today I want to share a basic trading plan that you can follow to quantify your trading edge.

📌 Step 1:

First, start from the higher timeframes like Daily/Weekly to identify the current long-term trend. is it bullish, bearish or stuck inside a range?

If the price is sitting in the middle of nowhere, then it is a NO trade zone as price has 50% change to go either up or down. Thus no edge!

📚 Wait for the price to approach the lower bound or upper bound. Then proceed to Step 2

📌 Step 2:

No matter how strong a horizontal / non-horizontal support or resistance is, it can still be broken. Thus don't buy/sell blindly as price approaches a support/resistance.

Instead, zoom in to lower timeframes like H1 and M30 to look for setups.

🏹A basic approach would be to wait for a swing low to be broken downward around a resistance as a signal that the bears are taking over.

In parallel, wait for a swing high to be broken upward around a suppor t for the bulls to take over.

This would be the confirmation to enter the trade.

Of course, your second edge would be through risk management by targeting at least double than your indented risk.

But that's a topic for another post 😉

Always follow your trading plan regarding entry, risk management, and trade management.

Hope you find the content of this post useful 🙏

All Strategies Are Good; If Managed Properly!

~Rich

🖐 5 Rules For Successful Trading!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Trading is simple, but not easy. Traders have difficulty succeeding simply because they are unable to follow clear rules over extended periods of time.

So what are the rules that every trader should follow?

💸 1- Only invest what you Can Afford to Lose.

Only invest money you can afford to lose, never ever borrow money or take a loan from the bank to invest. Because if you do, you will get emotional and make irrational mistakes.

⚔️ 2- 1% Risk per Trade.

We only risk a small portion of our account per trade. We enter with 1% risk per trade (2% max). We enter with a fixed risk per trade, not with a fixed stop loss in pips, nor with a fixed lot size.

Remember: All Trades Have To Have The Same Weight / Effect On Our Account!

📉 3- Three Confluences Trades. (Technical Edge)

Trading is nothing but a game probability. Moreover, we consider ourselves risk managers not only traders, as the only thing we have control over is "risk". The market can go anywhere.

To be on the winning side, we need to have an edge over the market.

One way to put the odds in our favor is by only entering trades when we have at least three confluences/clues, three things telling us to buy or sell lined-up together. One confluence may be random.

For example: Only enter when you have a pattern, support, and divergence. And your rules have to be objective following a well-defined / back-tested trading plan.

📕 4- Positive RRR - Risk Reward Ratio. (Risk Management Edge)

Our second edge is going to be through risk and money management by entering with a positive risk-reward ratio. That’s exactly why we enter with a ½ RRR (or higher), which means we always target at least double our stop loss. This way even with a 50% win rate, we are still profitable.

Remember: It is not about how many trades you win, what matters is how much you win when you are right, and how much you lose when you are wrong.

🧘♂️ 5- Emotional stability.

In the trading world, emotions are considered the enemy of traders. Knowing how to control emotions while trading can prove to be the difference between success and failure. When getting into a bad trade, the trader who can manage his psychology well will be able to minimize risk, while the trader who is emotional may make the situation worse.

Remember: You Are Getting Paid; To Wait!

Moreover, if you are not feeling well, don't trade.

Remember: You don't have to catch every trade, and you don't have to trade every week.

In fact, our 5 rules are all connected in a way or another.

If you invest money you can’t afford to lose or enter with 10% risk per trade, chances are that you will get emotional and not follow your trading plan objectively by closing your trades before reaching 2R or even entering trades that are not according to your strategy.

In parallel, even if you invest money you can afford to lose and risk 1% per trade, you won’t be consistently profitable if you don’t have a well-defined strategy that gives you an edge over the market technically or through risk management.

In brief, stay away from trading if you don’t have these 5 rules.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Correlation between FX and Equities! (Chicken or the Egg?)Which came first, the chicken or the egg?

Traders all over the globe are constantly looking for an edge, something that's going to give them an extra indication on market directional movements prior to them unfolding. I know from personal experiences and from chatting people at the firm that many traders lean towards finding correlation between the equities market and the FX market. There are a lot of analysts out there that say the equities market is what moves the FX market, and in return there are a lot of people that say the FX market is what moves the equities market.

So, which one is it?

Reality is will never know. There have been many of times where the FX market and shows clear indication of direction and then about a day later or a few hours later we have the equities follow suit. For example the RBA's recent decision to hike interest rates by .25% instead of 0.5% sent the Aussie dollar down, but when you move over to the AUS200 or look at General Equities in the ASX, you'll see that they had their biggest day in 2.5 years.

Then there are times, and this is more into day trading, where the indices in the equities movements tend to correlate well moving into the FX markets.

So there is evidence to support both sides. Not ideal.

It goes without saying that correlation between equities and FX is slowly starting to fade as volumes kick up since we are in the technologically advanced era. But, what is or was the correlation and how does it work?

The basic theory (aged) is that when equity markets rise, confidence in that specific country grows well, leading to an inflow of funds from foreign investors. Therefore, equities go up, FX value goes up. It's simple supply and demand when you look at it. If the equities are going up and you're a foreign investor and you want to buy into those equities, it creates demand for holding, let's say, the US dollar if I wanted to buy into the S&P 500.

On the flip side, when the equity markets are falling. Then confidence falters, causing investors to convert their invested funds back to their own currencies outside of that country.

This is a general theory and I don't recommend basing any of your trading decisions on this, because if you actually have a look at the charts and the correlation, you'll notice that recently it's not been too hot. While you do get a general directional bias, one tends to move before the other and they tend to be quite random in which one goes first. If you have the ability or the skill to be able to work out when something is correlating and when something isn't, then for sure I think you'll be able to find an edge in the market trading some kind of correlation between equities and FX.

One correlation I have seen to be quiet useful in recent times is the S&P 500 And the Nikkei. Although in the Asian session the Nikkei is open in the S&P 500 isn't. Usually you see the S&P move and the Nikkei follow suit. Keep an eye on that correlation and tell me if you find any patterns.

As a whole, trading correlations can give you an edge in the market. It can provide you with valuable information when it comes to trading, whether you are trading FX or trading Equities. But it's not as simple as it seems. It will take more diving and understanding the markets on a deeper level to know when their correlating and to know when to ignore.

I hope you guys have enjoyed this article. If so, please give us a like leave and a comment. It does help the post a fair bit and I'll see you next week for some more content. Happy Trading!

-Jordon Mellor

📖 STEP 3 to MASTER TRADING: WHAT’S YOUR TRADING EDGE? 📖The topic of trading edge in the market is highly underrated, in my opinion. That’s why today I propose to discuss it, and I hope it can help you to shift your perspective on this matter. So let’s think about this together. What parts does your trading edge consist of?

🟩 THE BIG FILTER

For me, the first part of any trading edge is its filter. So your trading system tells you very clearly when you should NOT be in the market. It protects your capital - both $ capital and emotional capital - from poor market conditions, and low-quality and low-probability setups. And what it actually means when you execute your edge is that most of the time, you will stay out of the market.

🟩 YOU WILL “MISS” THE MOVES

That’s really tough topic for many of us, me included because very often you’re looking to enter the zone, but the price can either turn right before tapping into it or tap and doesn’t give any confirmation for entry. And that could be very emotional. However, the fact is simple - such “missed” moves are also part of our edge. Why? Because if you tested one set up, one pattern, and you know it’s profitable the way it is, then you need to execute it the way it is. Keep in mind, when I say profitable, I don’t mean crazy profitable. Today, with access to prop firms, we need a very low % of profitability to earn for living. We can scale the $ amount relatively easily if we are profitable consistently.

So again, we don’t need every move, and we don’t need the whole move. We just need some part of some moves - and a good edge will make consistent profits out of this.

And only then, if you want, you can tweak, refine and step by step make your system even more profitable.

🟩 THE PATTERN

This part is actually your entry pattern. Notice again, this is just a part of your system, not the whole system. If you really understand this, you’ll be much more relaxed in the market. This part should include a written checklist for your entry - just like a pilot has a checklist before his flight. A checklist, in its turn - is a part of your trading plan, it’s the essence of your trading plan. You will refer to it before every trade.

🟩 MANAGEMENT, LOSERS AND BREAKEVENS

When you executed your edge in the market, now you need to manage the trade accordingly, based on your checklist. So take partials, accept breakevens and losers. If you entered into a high-quality setup, which turned into a BE or a loser - it’s the part of your system, and usually, it doesn’t make sense to overthink it and try to find flaws in your system. But that’s flexible, and of course, you can analyze what happened, and maybe even find something to tweak, but very often a loser is just a normal loser, and breakeven is just a normal breakeven.

📖To recap, any edge will include:

🔹“missed” trades

🔹trades, where price didn’t tap into your entry order just a bit

🔹trades where you were stopped out for several pips and price then went to profit (if it repeats constantly, maybe consider having a bigger stop loss)

🔹full TP

🔹partials

🔹losers

🔹breakevens

🎁If you’re still here, here’s a BONUS trading hack for you. Ask yourself and try to answer honestly this question: “During all the time I’m trading, what is the maximum amount of days in a row, when I followed my rules to the T, honestly?” You will be surprised, but the usual answer is 3-10 days. Yes, people can trade for 2-3 years, but never manage to follow their rules (whatever they have at the moment) for at least a month in a row. It all leads to catastrophe, of course.

Thank you for your time! If you want to see more educational materials, please hit the BOOST button and leave your comments below.

Dima

STEP 1 to MASTER TRADING: Hindsight trading. Train your eyes.A common mistake that traders make after learning any kind of trading setup is jumping into backtesting using a replay tool, or even live trading.

However, if you think about it, trading is very much about pattern recognition. And when you force yourself into live trading without a proper understanding of what your patterns look like, most likely you’ll need much more time to succeed.

A different approach and much more effective would be using hindsight, that’s when you see what actually happened.

During this process, try to find at least 50 high-quality setups, that represent your trading system. So you actually see everything that happened and find situations, where your edge played out, document it in your journal. That’s great training for your eyes and brain.

You don’t need to guess, you will not feel anything, because you already see what happened, you’ll notice that sometimes your edge, your system doesn’t give you entries and price goes without you, sometimes, you’ll see a loser or a breakeven after your entry, start to get used to this, as it’s all part of your system.

After that, you'll have a much better understanding and vision for your setup - and that could be the time to try some backtesting and forwardtesting.

I’ll talk more about a different kind of backtesting in future posts. Meanwhile, take care, send your questions, and comments, will be glad to chat with you.

Dima

Education: Why your trading strategy win rate doesn't matter!What makes a profitable automated strategy?

Probably the biggest misconception for trading perpetuated in the mainstream is that you need to have a greater than 50% win rate to be profitable.

This is followed by a close second, of constantly assuming you need to have a risk-reward ratio of greater than 1:1 (e.g. 1:2, 1:3 etc). This one is perpetuated mostly by forex and stock market gurus.

By the end of this article, I hope to dispel these myths and aim to shed some truths on how to assess a profitable strategy.

Why your win rate doesn't matter:

Let's simplify this down using an example. Consider the following two strategies. Which one would you rather trade?

Strategy A: 50% win rate - When you win you make 2 dollars, but when you lose, you lose 1 dollar

Strategy B: 50% win rate - When you win you make 5 dollars, but when you lose, you lose 1 dollar

This one was a very obvious case of choosing Strategy B. In this case, both strategies have the same win rate, but Strategy B nets you 5 dollars per win, whereas Strategy A only makes you 2.

Let's take another example. A little less obvious this time. Which one would you rather trade here?

Strategy A: 90% win rate - When you win you make 1 dollar, but when you lose you lose 50 dollars

Strategy B: 10% win rate - When you win you make 200 dollars, but when you lose, you lose 1 dollar

Now the 90% win rate strategy may look attractive on the surface, but when you dig into it, you realise that you could get a massive 50 dollar loss in the 10% of times you do lose! For those of you who chose strategy B, this is the correct answer.

One way we can assess the above strategies is using Expectancy . The formula for Expectancy is as follows:

(Win % x Average Win Size) – (Loss % x Average Loss Size)

We can calculate the expectancies of the strategy below:

Strategy A:

(0.9 * 1) - (0.1 * 50) = -4.1

Meaning you are expected to lose an average of $4.10 per trade using strategy A. Not a good sign.

Strategy B:

(0.1 * 200) - (0.9*1) = 19.1

Meaning you are expected to win an average of $19.10 per trade using strategy B. This is a major winner here!

As you've probably realised. It is possible to have a profitable strategy using a low win rate. Many trend trading/breakout strategies tend to have lower win rates, but with larger rewards to risk, whilst mean-reversion strategies tend to have higher win rates with less frequent but larger drawdowns.

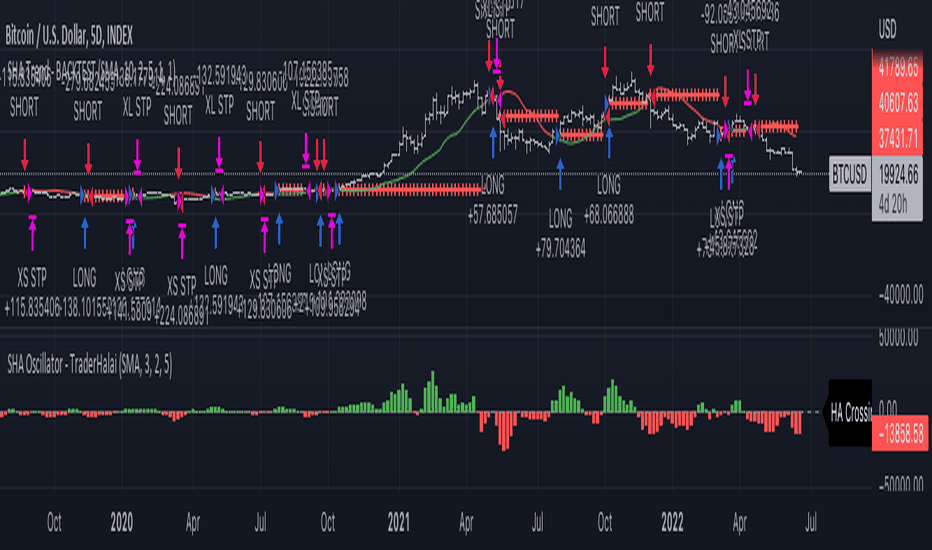

The backtest shown in this post shows an example of a low win rate, and high win amount strategy using the Smoothed Heikin Ashi Trend on Chart indicator which I have developed, with an overall positive expectancy, backtest (note, no strategy is perfect, should not just blindly trust backtest data).

Why you may still choose to define a risk/reward

Better consistency of your strategy

Psychological factor of knowing that you can be expected to lose only x amount (assuming no slippage etc)

As an aside, note that defining a fixed risk-reward may hurt your win rate (which could impact your expectancy) so it's important to backtest to see if you get better results with defined risk-reward parameters. This is beyond the scope of the current article, but an important consideration.

Why do traders gravitate toward a higher win rate?

The simple answer here is that everyone wants to be a winner! It's human nature to want to be right, whether this be about a market direction or when to open or close a trade. It's often easier to brag about how much you win whether that be on social media or just feeling good about yourself.

For algorithmic traders, having a higher win rate may also provide psychological benefits, as losing 20 times in a row can sometimes be very daunting for traders and can throw doubt into the efficacy of your system.

I hope that through this article, I have managed to convey that it may be prudent consider strategies with low win rates also, as these can be very profitable in their own right.

Digging further:

This article is only just scratching the surface of how to create and validate if a strategy is something that you should consider trading. There are many aspects of backtesting including Monte Carlo simulation, understanding standard deviation of returns and risk, Sharpe ratio, Sortino ratio, walk-forward analysis, and out-of-sample analysis to name a few that you should conduct before you evaluate a strategy as suitable for live trading.

If you've made it this far, thanks for reading. If you like the content, feel free to like and share, as well as check out some of the free scripts, strategies and indicators that I have published under the scripts tab.

Thank you!

Disclaimer: Not to be taken as financial advice, anything published by me is purely for education and entertainment purposes

Sunday afternoon backtesting sessionToday I am backtesting trades on EURUSD to further improve my strategy and my ability to apply my strategy. It is important to keep your tools, and mind, sharp so that you can execute your trades in a live market that has major market players, news events, volatility, liquidity with experienced traders with high end technology with a high end education trading these markets. This means you must find your edge and constantly practice it to refine it, improve it, and remember it anywhere, any place, any time.

CAD/JPY Short - 01 June 2021 | Hybrid Move Result: +3.00%Hey all,

Another quick breakdown of a Hybrid setup taken this month..

The trade initiated from a Sr. Daily Zone which was created all the way back in January 2018, where price showed a beautiful trendline break and a huge crash in price. Overall the monthly time-frame was sitting at major value as well together with the weekly chart being in need of a reversal after the strong 2020 and 2021 volatility in the markets.

The 4hour started to top out here after the daily showed a clearly over-extended run. When the double top formed at the 4hour chart, price confirmed the bearish bias with a clean 4hour star formation to the downside and a clean move later on. The orange candles at my chart are from our unique entry indicator developed to be optimal for our supply and demand zones.

If you have any questions, feel free to comment below!

Kind regards,

Max Nieveld

Meet Percy - 'YOUR' new Trading E-Mentor - he's cool......Percy is a great guy... he can be a girl too and you can call him or her whatever you wish. I just chose the name Percy, I think its quirky. :-)

BUT ....

Percy can help you like he helps me - Let me introduce you to him.

He tells me when to enter a trade, when to close a trade, what lot size to use - he helps me stay on track when I feel like closing early (Percy hasn't closed so I shouldn't) he helps me ignore them voices of increasing my risk.

Percy works incredibly hard, he has back tested over 4200 trades to help me identify my edge in the market.

Percy is simply a legend, I trust him, I have confidence in him and I follow his lead.

Get a Percy.

Regards

Darren

GBPUSD 1:2 RR - Whats your edge in the market?Hi,

I have just recorded this video to demonstrate the effectiveness and ease to find your edge with our strategy.

Any funded traders, attacking a challenge - you need to watch this too!

A 1:2 RR requires a 33% win rate and above, here you can see 100%+ gains YTD risking just 2% per trade on your account.

Simple trade with no bias and no emotion to any specific trade outcome - simply follow the strategy - trading can be mechanical, simple and emotionless.

I hope this video helps demonstrate how we trade and how we ensure we have an edge in the markets.

Drop us a DM, let us know what you think and if you have any questions.

Regards

Darren

Trading Psychology 5 Edge ExecutionEdge Execution

Trading is a numbers game, and markets are based on the mathematics of the traders equation. However, understanding this alone will not guarantee profits. The ability to apply and conform to the math of the current market context is what leads to consistent profits. Beginners often have a misconecption that they need to know what is going to happen over the period of the next X number of bars in order to make a profit. They believe they must enter at the exact right time and price in order to win on a trade. This could not be further from the truth, and anyone consistenly making money from the markets knows the reality. The reality is a trader does not need to know what is going to happen next in order to make a profit. In fact, a professional trader knows that any given trade is irrelevant to the bigger picture, and an income is generated over a series of trades; not any single trade. This menatlity is past the duality of winning and losing, which are simply accepted as part of the job. This can be called the "probability mindset."

Profits are generated over a series of trades, not any single trade. Therefore, it is not necessary to make money on every trade, every day, or even every month to be a succesful trader. It takes time to build confidence, believe this is true and fully understand this concept. Perhaps this is why most traders fail, by giving up before coming to this realization. It has been said that professional traders have "Won the game before they started playing." (Jack Swagger). This confidence can only come from the probability mindset, when a trader accepts he may lose on this trade, the day, or even this year. But he accepts his risk, and trusts the math that over time he will generate a profit. Even if he takes a large loss, or several, it does not matter; he knows he will make it back up. The overall point of this is that losses are part of the trading process. If a trade is a loser, it does not matter; move on to the next trade. Dwelling on losses or a drawdown does not bring the money back, but continuing to trade does. In this sense it can be said that a successful trader "trades his way out of a drawdown."

It is helpful to think of losses as the "cost of doing business" just like any other business would incur expenses while conducting its operations. There are very few (if any) businesses that do not require heavy start up costs, or capital to continue the business while generating profits. Ever heard the saying "It takes money to make money?" Trading is no different, although most traders fail to realize this, and focus solely on profits. In trading, our costs are commissions and losses, which are offset by gains, resulting in a net profit.

Employing your Edge

So what does this have to do with exeucting an edge? Well, it is necessary to understand not every trade is a guranteed success, and there is a random distribution between wins and losses, with any edge. Even the best setup or edge will result in a loss 30-40% of the time. It is virtually impossible to know in advance, which trade will win and which will lose. Therefore it is absolutely imperative to take every trade that meets a traders edge, regardless of how the trader feels, thinks, or any other variables unrelated to the edge. With this said, here are the basic steps to exeucting and employing an edge.

1). Identify edge. Pick a setup (second entry, wedge reversal, follow through bar, ect.) It is a good idea to start with one until familiar with reading prices.

2). Ask yourself at the close of every bar "Is my edge present?" If no, wait. If yes, enter the trade.

3). Execute the edge with a series of 10 or 20 trades, document every trade. At the end of the series analyze results and tweak.

Wishing you the best of luck on your trading journey

-Josh Ridenour