Bearish and Bullish Flag Chart PatternsFlag Pattern:

A flag is a chart pattern formed during a counter-trend move after a sharp price movement.

Why is it called Flag?

It is named because of the way it reminds the viewer of a flag on a flagpole.

What does the Flag Pattern represent?

It signifies trend reversals or breakouts after a period of consolidation.

The five main characteristics of a Flag Pattern are:

1. The preceding trend

2. The consolidation channel

3. The volume pattern

4. A breakout

5. A confirmation occurs when the price moves in the same direction as the breakout.

How to identify the Flag Pattern:

The most important part of the flag pattern is to identify a strong trend (in either direction, as the flag may be inverted, triggering a bearish move!). Take a look at the higher time frames when you find a flag pole to ensure the price is not simply ranging. It could be meeting a large area of resistance!

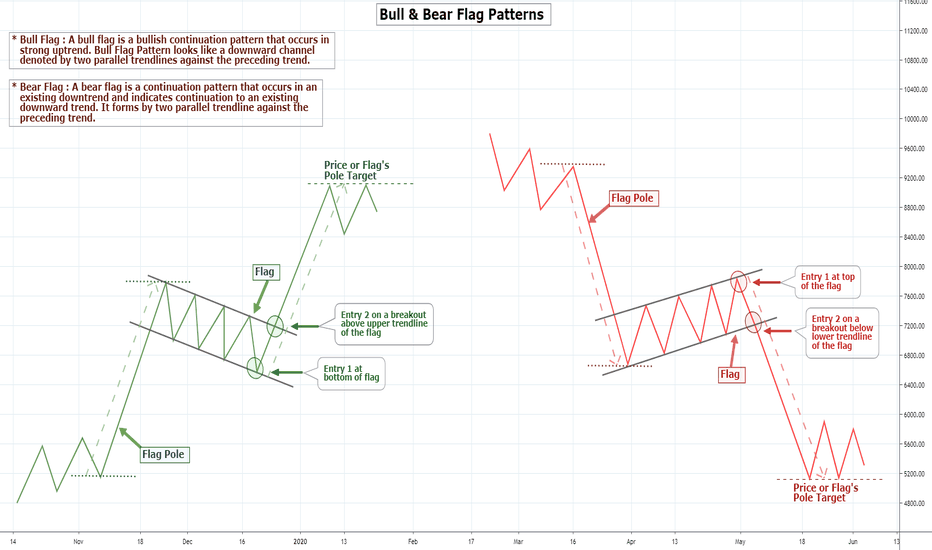

Bullish Flag Pattern:

When the prices are in an uptrend, a bullish flag pattern shows a slow consolidation lower after an aggressive uptrend. This indicates that there is more buying pressure moving the prices up than down and indicates that the momentum will continue in an uptrend.

Traders wait for the price to break above the resistance of the consolidation after this pattern is formed to enter a long position.

The breakout indicates that the prior uptrend will continue.

Example of a Bullish Flag Pattern:

Bearish Flag Pattern:

When the prices are in a downtrend, a bearish flag pattern shows a slow consolidation higher after an aggressive downtrend. This indicates that there is more selling pressure moving the prices down than up and indicates that the momentum will continue in a downtrend.

Traders wait for the price to break below the support of the consolidation after this pattern is formed to enter a short position.

Example of a Bearish Flag Pattern:

Conclusion:

A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. When the prices are in an uptrend, a bullish pattern shows a slow consolidation lower after an aggressive uptrend. When the prices are in a downtrend, a bearish pattern shows a slow consolidation higher after an aggressive downtrend. It is formed when there is an increase in demand or supply that causes the prices to move up or down.

May you all be PROFITABLE,

Flagpatterntrade

🚩 Bull Flags VS Bear Flags🚩What is a Flag Pattern?

A flag pattern is a commonly observed technical analysis pattern used to identify potential continuation of current market trends.

It is characterized by a period of consolidation, where the market experiences a relatively small range of movement, following a significant price movement.

This pattern is formed as the market returns to a state of equilibrium, following a large move. The flag pattern is considered a continuation pattern,

as it often indicates that the market will continue to move in the same direction as the preceding trend, once the flag breaks out.

This breakout typically occurs when the price of the security breaches the upper or lower boundary of the flag, and it is usually accompanied by an increase in trading volume.

📈📉The difference between a Bull flag VS Bear flag

The difference between a bullish and a bearish flag is in the direction of the price movement. With the bullish flag, the idea is to participate in a strong uptrend. Meanwhile, with the bearish flag pattern, the idea is to trade short in the direction of the prevailing downtrend.

- Downtrend vs uptrend: Bull flag and bear flag are both continuation patterns that form when the price of a stock or asset pulls back from the predominant trend in a parallel channel.

- Bull flag: A bull flag is a sharp, strong volume rally of an asset or stock that portrays a positive development.

- Bear flag: A bear flag is a sharp volume decline on a negative development.

- Bull flag and bear flag share the same traits: Traits of Flag Patterns include support and resistant levels, flag, flag pole, breakout points and price projections.

📍Entry opportunities

The most important component of any flag pattern trade is the entry. It’s generally advisable to wait for a candle to close beyond the breakout point before creating any orders to avoid being burned by a false signal. In the example above, the entries are made on a High risk - High reward mindset with stop loss bellow the flag pattern. Most traders will enter a flag pattern trade on the day after the price has broken beyond the trend line. The length of the flag pole is typically used to calculate the profit target. Even when the formation of a flag pattern is obvious, there is no guarantee that the price will move in the expected direction. As with most technical analysis, you will get the best results from flag patterns by applying them to longer-term charts as you will have more time to consider your strategy and analyze the price action.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

FLAG = Impulse + Correction - "Learn More Earn More" with usWhat makes the chart interesting today is that:

. GBPAUD challenging the 1.8415 ~ 1.8450 resistance zone.

. Min 450 pips room to run. A break above 1.8450 could push the pair to its 1.8900 previous areas of interest.

. A rejection at the Flag range resistance, however, could lead to another retest of the Flag’s support.

Will the GBP see an upside breakout against the AUD ?

No one knows it! We have to wait and see!

FLAG = Impulse + Correction - "Learn More Earn More" with usWhat makes the chart interesting today is that:

. GBPAUD challenging the 1.8415 ~ 1.8450 resistance zone.

. Min 450 pips room to run. A break above 1.8450 could push the pair to its 1.8900 previous areas of interest.

. A rejection at the Flag range resistance, however, could lead to another retest of the Flag’s support.

Will the GBP see an upside breakout against the AUD ?

No one knows it! We have to wait and see!

How to Trade Bull & Bear Flag Pattern | Flag Pattern Tutorial !Bull & Bear Flag chart patterns Tutorial!

Bull Flag : A bull flag forms in bullish trending market, After a strong bullish movement when this pattern forms it signals the market is likely to move more higher. Bull flag pattern much similarly looks like a horizontal parallel channel or downward parallel channel along with a strong bullish vertical rally; when we draw the pattern it looks like flag on a pole, that's why they are called bull flags.

How to identify and Trade Bull Flags : - It is easy to identify a bull flag you just need to look for a Bullish Vertical Rally or Trend which is Pole of the Flag then identify the consolidation which will look like either horizontal channel or downward channel which will be the Flag. After identifying the pattern you can enter at the bottom of the flag or you can enter when price breaks the upper trendline of the flag which is more safe.

The breakout may also be a fakeout that's why we will take help of Volume and RSI Indicator to confirm the breakout. As shown on the below example you can see when price breaked the uppper trend of the flag the Trend drawn on the RSI was also broke and the Volume was high.

()

( *Key things to know : If the retracement measured from the vertical rally or Flag Pole retrace more than 50% the pattern becomes weak and it may not be a Flag Pattern but sometimes it stays valid if it breakouts above the uppertrend of the flag.)

Bear Flag : Bear Flag is just the opposite of the Bull Flag Pattern. A bear Flag forms in bearish trending market. Bear Flag pattern signals the market is likely to drop more lower. You need to identify Bear Flag in bearish trend when the price of a financial asset drops then if the price forms a horizontal channel or upward channel which will look like a inverted flag whose flag pole will be upside and the flag will be downside.

Stay Tuned; 👍

Like this tutorial & share your comment below and also

check other tutorials with example linked below;

Thank You-