SMC TrapHello traders

- In this part, we will talk about the smart money trap.

- There are a lot of traps for traders left by big boys in the markets to take your money. That's why it's important to be careful, and don't swim with fish but swim with sharks if you don't want to be eaten.

- The move is designed to first take out early sellers, then take SMC traders.

-We'll explain this example in a few steps:

1) We see that the price is in a downtrend, reacting from OB, and supply has full control in this situation.

2) We can all assume that the price will continue to be bearish.

3) Now you can see that the price is coming aggressively to the last OB, and before that, we had WBOS, and there was a trap made for SMC traders.

4) This is inducement, and we talked about it in one of the previous posts, you can go back to it for a more detailed explanation.

5) This OB is not valid for us, because we have seen a lot of liquidity that the price needs to pick up and an aggressive retest.

6) We waited for the price to pick up all the SMC entries, and then the price came to our safe entry, which is marked on the chart as a valid OB.

If you liked this example, leave a like for more content like this.

Inducement

Inducement Hello traders

-In this example, we will explain what INDUCEMENT is.

-Inducement is a trap for traders left by big boys in the markets to take your money.

-The move is designed to first take out early sellers, then take retail pattern traders, then break out and break and retest traders together in one move.

-The beauty of it is that everybody thinks they win, but in reality, the big boys go home with your money.

-Look at this example carefully and next time you see it play out on the chart, look at how you can profit from it instead of getting your SL hit.

Example:

1) Here, we see that the price is in a downtrend

2) Then, at the last BOS, the price barely breaks through the low and makes a trap for retail traders, breakout and retest traders, etc.

3) As you can see, this was an obvious fakeout and trap for other traders

4) In the end, the price picked up all SL, and came to our entry, from where it starts to move in our direction.

-And remember, you want to swim with the whales and follow them, not go against them.

Don't forget to leave a like and follow us for more quality content.

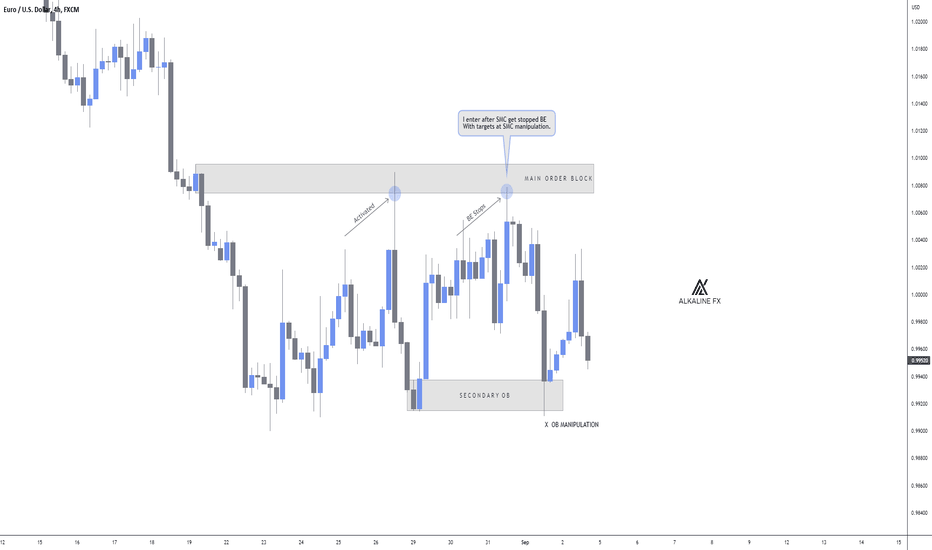

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋

📚 Inducement: What Is It ⁉️Inducement is a trap before an area of supply or demand.

Price will usually lure impatient buyers/sellers into the market before the zone is met to create liquidity.

Once the impatient traders get trap [ped and stopped out, the true move begins.

This just goes to show the importance of sitting on your hands!

Traders, if you have your own opinion about this idea, write in the comments section, I always reply. 💬

🚨 RISK DISCLAIMER:

Trading Crypto, Futures, Forex, CFDs, and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use a tight stop loss.

--------------------------------------------------------------------------------------------------------

Please like, subscribe, and share this idea with others! ⬇️

--------------------------------------------------------------------------------------------------------