GEVO. Manipulation Short squeeze. How short positions are reset.This example is on paper company Gevo inc - manufacturing. Chemical industry. Specialized chemicals.

I will say that I combined the training idea with the trading one , how the stocks will be relevant for trading now, the potential first profit with confirmation of support can be about + 90%.

Everything that happens now, goals, read below under the description of the manipulation of a short squeeze.

But let's plunge into the past and in order to examine this detective story in order to evaluate this masterpiece of trading art by applying the punishment of the zombie crowd of believers “it should be like that” and “put sure Stop-Loss like a smart uncle wrote to us in a book.”

It was like this ... It seems that the downtrend will last forever. After all, the price over the past 2 years has fallen by almost -99%! Dump from $ 245 to $ 3.30!

This is what happens with real companies, but what about non-existent crypto projects?

After all, almost all crypto projects are built on promises that this “nothing” will cost a lot. Buy and hold, and you and the plant employee will become a millionaire in a couple of months / years. The sweetest lie, the more willing poor John believes in it.

As you understand, in many cryptocurrency projects for lovers of “buy and hold”, to become a millionaire and stop going to the factory is still ahead.

It doesn’t matter whether these assets are pumped up yet or not, but their ultimate fate is the complete disappearance in the near future of the life of poor believing John.

The graph shows a strong downtrend , merciless to investors. But among investors, one must not forget that there are very rich uncles who can also make a mistake. But those who want to fix it. Well, it is clear that after such a fall from $ 240 to $ 3, no sane person believes in growth already, how silly it is. Most traders enter only a short position.

But there are more intelligent people who have thought and decided why we don’t make a lot of money on “100% faith” of people.

The strongest downtrend. Drop from $ 240 to $ 3.30. Minus 99% for 2 years.

As part of this trend, many sellers are going to expect a continued decline in the trend.

But after all, everyone was taught that it is necessary to put Stop-Loss, and if you do not, then you should always close somewhere.

Where will everyone have stops on this chart? Yes, everything of course depends on the point of opening positions, but the generally accepted approach - Stop-Loss who enters a short position will be put for the nearest resistance, that is, we will be interested in the zones above the selected levels on the chart.

If everything is clear and the main crowd has so much faith and become accustomed to the eternal fall, why not take advantage of this and start the domino effect? After all, money is burned only initially to start the process, then only fantastic earnings. How everyone will be "trapped" in a trap. Any inadequate Stop-Loss sizes will be reached. Buy or margin Call.

Gevo inc. Levels where the crowd of "shorts" puts Stop-Loss.

It is in these zones that Stop-Loss of most market participants are behind the resistance.

Large players understand this very well, it’s a sin not to use it if you have enough money on hand for this manipulation.

Perhaps the biggest player is the company itself, which is very interested in getting out of a loss-making situation and making big profits. After all, having for this a certain amount of money you can start an avalanche-like process and get the most unattainable Stop-Loss, thereby moving the market up against the current trend on Stop-Loss. This is an avalanche-like process.

You understand very well what will happen to those traders who have opened a short trend and the price will begin to rise against their position, and even grow rapidly impulse with no chance of pardon. Yes, everything is simple, when we reach a certain zone, the order is executed, that is, the position is closed by Stop-Loss. And we all know that a position is closed by opening a reverse position, which means that if we were on sale, then a purchase is opened to close, that is, we create additional demand for growth. And so on the chain.

And it’s not scary that then the price will return very quickly back to the previous values, because the manipulators will be in big profit, and the trader who caught the margin will no longer enter a short position on this asset. This is what came out of the chart below.

Gevo inc. Growth + 600% at closing short on Stop-Loss.

As we can see, the first strong resistance was + 100% of the minimum value before the short squeeze.

That's how you think who believed that the price will reach these values? It is clear that no one, well, especially since the price will reach the last Stop Loos zone.

For such an action, money was needed only until the first Stop-Loss zone, after which the price moves according to the domino effect. Growth fuel is the closing of short positions. Virtually no one believed in growth, which is why the impulse was + 600%, due to the closure of short positions of those who did not believe.

After a while, the price broke the line of the main downtrend. Price shifted to lateral movement. Wishing to enter the short was less and less, as everyone remembered the previous margin Call.

A year ago, there were two more attempts to punish those wishing to enter a short position in this trading instrument. It was not possible to repeat the short squeeze situation on such a scale. The first short squeeze is + 67% and immediately after it + 27%. It can be seen that there are no more willing traders to enter a short position on this trading instrument.

Gevo inc. The situation is now.

Please note that only on short-squeezes did a large volume go out at the auction. Traders with short positions were squeezed out of the market specifically.

In lateral movement, the price is now drawing a formation that could become a triple bottom. If support is confirmed , the growth potential to the previous local maximum and the first resistance is about + 90%.

___________________________________________

Manipulations.

Someone thinks that manipulations occur only in the crypto market, this is not so, they are everywhere, only in the crypto market they are open and arrogant, as there is no responsibility for this.

In other markets, there is price manipulation, but to a lesser extent, as if the relevant authorities prove guilty there will be huge fines, or the deprivation of a license for trading activities up to the prison.

___________________________________________

What is a squeeze on the exchange. Short squeeze. Long squeeze.

Squeeze (eng. Queeze - squeeze out) - a situation in the financial market when Stop Loss is sharply collected. As a result of the sharp increase, part of the Stop Loss is squeezed out, and part is closed at the “what is” price, this leads to an even greater increase / decrease in the price.

Since positions can be held both in purchase and in sale, both short-squeeze and long-squeeze are possible.

Short squeeze - it happens when sellers (shorts) are forced to close their open positions in order to avoid even greater losses, which only spurs the price even higher. On the graph, the hairpin (shadow) is up.

Long squeeze - exactly the opposite. A sharp decline in the price of assets, forcing buyers (longists) to close their positions. Here, the buyers are already the “victims”, who are forced to close open transactions at a loss in order to prevent even greater losses, which provokes a further drop in the price of the instrument. On the graph, the hairpin (shadow) is down.

________________________________________

Short squeeze on margin trading.

If it comes to margin trading, the strongest buyer today is yesterday's short. The vicious circle for bears is called "short squeeze" - short squeeze. In order not to be trapped, market participants must understand the principle of short positions, see the potential for a situation that could provoke a “short squeeze”. Experienced traders know how to make a profit with a short squeeze.

The strongest short-term growth waves often occur during periods when a large number of lower players find themselves locked in an unprofitable position due to an unexpected price increase for them. As a rule, these are mid-level traders and so-called “hamsters” market participants with a level of knowledge and experience that is close to zero and close to it. Unfortunately or vice versa, fortunately the bulk of the crowd of the crypto market is precisely this layer of society. In such a situation, in order to get out of the trap they have to actively buy this cryptocurrency in which they are locked at any price in order to save part of their capital and fix the loss. I will explain in more detail so that the mechanism of this phenomenon becomes more clear.

A short position or short-term transaction (from impudent short) is an operation when a trader sells a borrowed coin with the intention of buying it back later at a lower price. After the return of the borrowed coins, the difference between the sale price and the purchase price becomes profit.

You can borrow cryptocurrency from the exchange, which as a guarantee for such a loan requires an adequate amount of guarantee security in the account. As a guarantee, money, bitcoin or other cryptocurrencies, which are valued at a certain discount, can act.

When the value of the coin in which you are in a position increases, the size of the required guarantee for short positions also begins to grow rapidly. If the amount of funds in the account is insufficient to cover the required amount of security, the exchange may forcefully close the position.

Downgrade players usually try to prevent this situation and close the position before submitting a margin call request from the exchange. However, their tactics here are essentially the same - a quick purchase of a coin that has grown in price, and you are in a short unprofitable position on it. If the size of the positions of such participants is large enough, then this situation can lead to skyrocketing prices and the avalanche-like closure of other shorts.

Scalper traders and intraday traders who often open counter-trend trades in the hope of a pullback after active growth can aggravate the situation even more. If the rollback is not realized, then their purchases may become additional fuel for the upward movement.

________________________________

The immaturity of the cryptocurrency market provides opportunities for manipulation.

An important feature of the cryptocurrency market, which is often ignored, is its tendency to respond to the actions of individual bidders. By individual bidders, I mean large traders, the creators of individual cryptocurrencies on which manipulations occur, as well as exchanges, which naturally themselves are owners of large cryptocurrency assets. And also, if desired, can affect their price. Roughly speaking, these are market participants who are called “whales” in the slang of traders.

The cryptocurrency market is more affected by the influence of these particular market participants than other markets, due to the lack of maturity and insufficient control of the relevant state financial control bodies.

No fundamental does not work without money support, but money on the exchange without the influence of the fundamental works in such an uncontrolled market perfectly. For example, we are all familiar with such frequent phenomena in the crypto market as "pumps" (artificially pumping prices). Very often they occur even without the release of FUD news on a particular coin.

Also, the entire crypto market is very much tied to the dynamics of bitcoin, which can lead it in the opposite direction to fundamental factors.

In recent years, the market has become more “mature”: instead of the buy-and-hold trading strategy, many have begun to use more advanced methods. Futures contracts, trading with leverage, opening short positions are now available. The more powerful players appear in the industry, the more the community takes on them “tricks” from the field of trading.

More and more traders are using short positions in a falling market, allowing them to earn money in such conditions. And naturally, in such conditions, short squids and long squises often occur. Since the majority of traders take short positions in the bear market, many receive big losses, some especially greedy and not experienced margin calls.

Large investors can begin to behave dishonestly Short-squeeze can be carried out only by a large market participant, such manipulations are beyond the power of ordinary traders. How to do this you need a huge amount. As a rule, such manipulations are done by the exchanges themselves. This is illegal - but everything is legal on the cryptocurrency market!

There are conspiracy theories that such manipulations are carried out by exchanges, thus getting rid of customers who will definitely be in the black due to short positions and withdraw money from the exchange ecosystem.

Manipulation

Algorithm vs Liquidity In Determining PriceBased on my research into IPDA and algorithms, central banks, trading firms/hedge funds, and smaller banks use execution algos (EAs) for trading with different objectives. Small banks use EAs to split large parent orders into smaller child orders generally in one direction, buy or sell. These orders are executed separately over a period of time to either open or close positions.

Trading firms and hedge funds use opportunistic EAs to buy and sell to turn a profit.

Central banks use market making EAs to buy and sell in order to bring liquidity providers net positions back to or close as possible to neutral. (This sounds like equilibrium). Central banks use EAs cautiously and only during their main trading hours and always under the supervision of people.

A key reason for using EAs is to access multiple liquidity pools in order to reduce market impact or footprint.

This is similar to a parent child relationship between Central Bank algos and other smart money players, where smart money (including central banks) accumulate orders in consolidation before expanding price, then the central bank algo pulls them back to equilibrium like a parent calling their child that has strayed too far away. Then they rinse and repeat.

I am of the opinion that with the function of central bank algos to facilitate the provision of liquidity with minimal market impact, that liquidity itself is the determining factor in price delivery.

Algos used by smart money break up large orders in to smaller chunks and funnel them to multiple liquidity providers (market makers) for fulfillment since forex is decentralized. If there is enough liquidity (buyers and sellers) to open/close positions at a certain price then it is done at that price. When liquidity is low or there aren't enough buyers and sellers at the current price, the market maker's algo has to fill these received orders where there is enough liquidity based on available buyers and sellers. The algos move very quickly which can deplete available buy or sell orders rapidly leaving unfilled counter party orders in its wake which defines liquidity voids (imbalance).

Algo adjustments to meet buyers and sellers at their price is perceived as a stop hunt but it's just economics.

Example: If I must sell something and I want to sell it for $100 but no one is willing to pay $100, I would have to look for buyers willing to pay $95.

If I must buy something and I only want to pay $100 but the seller is charging HKEX:105 , then I have to pay $105.

Either the buyer crosses the spread to meet the seller or the seller crosses the spread to meet the buyer. When there are limit and stop orders the buyer or seller isn't moving so the liquidity provider has to move to meet these buyers/sellers at their limit or stop order prices (including orders left behind in liquidity voids).

When the orders trigger and price reverses it takes out both buyers and sellers so people call it a hunt, but I'm sure it is intended for actual institutional trading entities because retail traders such as ourselves can not provide the liquidity to be on the other side of every order placed by institutions.

We are simply collateral damage in the battle between financial titans seeking to provide and tap into liquidity.

Manipulation strategyWe all know that markets are highly manipulated and the traders have to look for a signs of manipulation.

There are a lot of types of manipulation - imbalance, candle without wick, liquidity grab and so on. On the chart I marked few areas, where price was manipulated and reversed.

The strategy shows you how to recognise the manipulation patterns. It is based on smart money concept, but it is more focused on the liquidity grab and the low liquidity moves.

So for example:

On this chart I marked areas, where price created low liquidity moves and the results are strong movements on the manipulated direction.

Why these examples are low liquidity moves?

Because price cleared a lot of stop losses and inject fresh money in the market. The banks do not invest into the markets, they generate money in order to profit.

In the first rectangle (lower one) - price created triple bottom - this is a major reversal retail pattern and created major liquidity pool, but look closer. Creating the pattern, price also took out lot of liquidity and moved away.

In the second rectangle (the wedge) - price also created low liquidity move, because every time it gave strong signs of reversal tricking the traders to sell or buy and then took them out.

Rule : In order price to move in one direction the institutions must buy or sell. To accumulate orders they should inject money in the market. The injections are liquidity grab in many ways and types.

The markets can not move always with low liquidity moves and always stay in efficiency. The liquidity must to be created first, so that traders can come into the market and later to be taken out.

As every strategy the "Manipulation strategy" sometimes give us false signals, but it is most accurate strategy.

For example in consolidation we may see many false signals, but this is not because the strategy failed, it is because price was manipulated constantly.

This is not smart money concept. The strategy is not focused on order blocks and breaker blocks, it is focused on low liquidity moves.

The manipulation areas are also the true support and resistance, because when the banks buy or sell from the specific level, they will protect this level, if it is not targeted.

Markets moves up and down, taking the buy side and sell side liquidity, this is the way that swings are formed. They are not forming based on retail support and resistance or Fibonacci numbers.

How to use:

1) Calculate the liquidity - look for retail pattern - double top/bottom, previous high or low, support or resistance or every other obvious buy/sell zone.

2) Wait price to clear the level - liquidity grab.

3) Wait until price form low liquidity move(pattern).

4) Buy/Sell to the opposite liquidity pool.

Trade With The Trend And Watch Out For Liquidity SweepsHello traders

In this example, we will explain how to trade with the trend and use liquidity as an additional confluence.

1) Price makes a new higher high, momentum is present.

2) After momentum, the price begins to create liquidity, as we talked about in one of the previous posts. Liquidity is a trap for retail and other traders.

3) We see that this is precisely why the manipulation took place, liquidity was picked up, and then the price moved impulsively towards the uptrend.

4) Price creates a new demand zone and impulsively continues bullish again. We see strong momentum.

5) In this situation, we see an excellent trend, we know that the price wants to continue bullish.

6) The price creates liquidity again and at one point, manipulation occurs again, we see a liquidity sweep, and the price from our zone impulsively continues to the uptrend.

- In the next post, we will show you this example on a chart so that you can better understand this concept.

- This is all about today's example, if you liked it, leave a like and write below in the comments if you have any questions.

Reminescence of a Scam Operator (ANTI SCAMMER GUIDE)Reminiscent of the roaring 1920s, the 2020 epidemic and the inability to work for many people brought an influx of new retail investors to the public market. Furthermore, the FED's decision to prop up the market by dropping interest rates combined with stimulus checks handed out by the U.S. government lured in even more investors who were hungry for profits. Although the market sensation also brought a rise of omnipresent scams across all trading platforms.

Lack of workforce, sophisticated methods, and automated bots often play into the hands of perpetrators who try to get ahead of the platform and its users. Therefore, we decided to write this concise article with the purpose of helping new investors to recognize good apples from bad ones.

The most common means of communication for criminals is to use private chat, public chat, comments, ideas, and headline references. Several examples of red flags are shown below.

RED FLAGS AND OTHER POINTS:

Asking for personal information and TradingView account information

One common tactic criminals use to exploit their victims is to ask for personal information or account information (login and password). This information should not be disclosed to anyone, including someone claiming to be a platform's employee/support (as these people tend to have access to this information).

Asking for trading account information

Another standard method bad actors use is asking for trading account information. On such occasions, a perpetrator asks for existing account information or requests a victim to create a new account; then, a perpetrator usually asks the victim to invest money into the account and let them use it in return for shared profits.

False promises

The third point probably accompanies every other point on our list. This point relates mainly to false promises about trading achievements, which often include statements about having a high win rate, high net worth, and an unbeatable trading system.

Financial gurus and lavish lifestyles

A high follower count and strong social media presence do not equal reliability. Perpetrators often portray lavish lifestyles across social media platforms to entice more people and trick them into buying a trading signal service or trading course (or any other service). The public image does not necessarily have to match a person's authentic lifestyle. Indeed, trading as a career is highly time-consuming and does not come with trading from a vicinity of a pool or ski resort; that is just public perception.

Trading signals and trading courses

Unfortunately, most of the time, trading signal services (for buy) lack performance and do not consider subscribers' risk tolerance and account sizes. In regard to trading courses, we hold a similarly low opinion of them as we think learning a skill to trade goes far beyond a few hours of any trading course.

Unrealistic win-rate claims

Most brokerages report that their retail clients lose about 50-90% of the initial capital, especially when trading CFDs. Therefore, we would like to put in perspective how realistic claims about a high win rate really are. Professional traders tend to peak at approximately a 50% win-rate over a consistent period. Thus, claims about a 90% or higher win rate are likely to be false.

Guaranteed moves and risk-free investments

Another tactic of scamming utilizes guaranteeing moves in the market. However, there is nothing like a guaranteed move since the market constantly changes and is influenced by complex factors.

These are just few points we included, however, we ask a public to share their own points in the comment section.

DISCLAIMER: This content serves solely educational purposes.

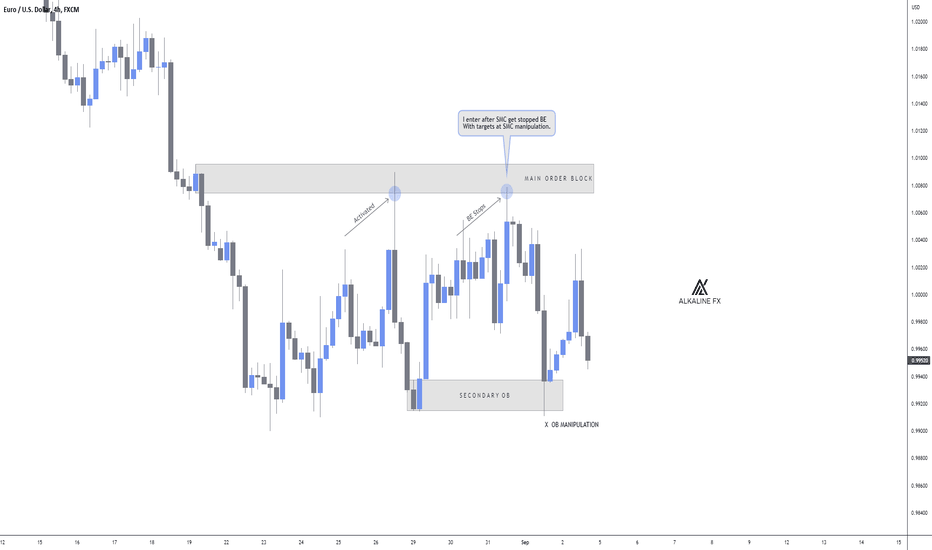

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋

How Market Manipulation WorksEver find yourself agreeing with someone who complains about rampant market manipulation, even though you don't really know how it happens or where it comes from? If so, do not feel embarrassed; the person complaining about it probably doesn't know either.

The truth is that the practice is so blatant and routine these days that it hides in plain sight. That, or it has simply become a modern taboo among those in power because widespread exposure of it could pose as a significant risk to said power.

Either way, it has gotten so ridiculous lately that it needs to stop before it potentially damages the all-important trust dynamic that maintains the "free" system's status quo.

Thus, let us begin this enlightening discussion with identifying who the direct culprits are.

These would be just about every financial institution that operates in some form as a Market Maker (MM) of weekly equity options. Yes - even your friendly mainstream broker that you had assumed was rooting for your financial success. Basically, if you can purchase weekly put options from them, they are part of the problem.

While this seems absurd, let's just discuss how markets get manipulated before you dismiss the idea entirely.

Markets can get manipulated through any number of sketchy practices. Just refer to the FINRA website and you will find terms for such practices, as well as laws governing their misuse. (Like when crude oil futures reach real negative levels, lol). But, the most tangibly-felt form of manipulation occurs in the way that is depicted in the chart above: by preventing markets from breaking out in either direction, particularly on days when options are set to expire. Quadruple Witching days, for example, are named as such because of how "supernatural" price movements tend to be throughout their sessions. This is complete nonsense, of course, since they move according to how the culprits want them to move - within a pre-defined range that is designed to suck traders into false-breakouts only to close very near the daily opening-cross.

The process of such a corrupt practice is known as price-pinning and it is at the core of every inexplicable market observation that seems uncannily perfect - like when markets only reveal their true direction during the last singular minute of trading. Note the extreme volume abnormality underlying the last-minute candle of today's E-mini session for a perfect example of this.

Despite what is commonly accepted, it is actually the case that MMs are essentially omnipotent, insofar as they can, and do, directly determine the opening and closing prices of individual issues - even on smaller timeframes such as the hourly or 15-minute scales. On most trading days, it is even possible for them to control outcomes on entire indices because of how influential options have become in today's market environment. The really serious problem with this is that it causes markets to crash wildly leading to widespread loss of wealth and subsequent economic severities.

How does too much power in free market system lead to the system crashing? It is because MMs are human beings and are therefore prone to making emotionally-charged mistakes; like getting cocky during times of persistently scarce volatility.

What ends up happening is that on very rare occasions, even bigger market players (like managers of huge pension funds that can affect markets absolutely) decide to unwind their long-held pure-equity positions accumulated over several years in a discreet manner. All the while, greedy/overconfident MMs continue to sell extreme quantities of put options to the public, thinking that there is no possible way that they'd ever need to pay for them at expiration. They'd be correct about this 99.99% of the time, and so they fail to realize how dangerous of a situation their in and how stupid it is to blindly sell such large quantities of out-the-money puts on the open market. The selling is so violent at the point of realization that MMs have no choice but to sell everything at once - even if everyone else suffers from the resultant market crash.

At this point, you might be wondering how this rare scenario has anything to do with the prevalent practice of price-pinning.

It relates because what normally happens when MMs get ahead of themselves in terms of how many puts they short on an expiration day is that they end up offsetting their risk via the mass purchasing of call options as the expiration nears. The calls become cheap enough that the entire cost of this process of risk hedging is pennies when considering the profits generated from selling the much more expensive time-heavy puts to the public. It is also a much more practical way to cover, which is why markets rarely make significant moves (especially downward) on Fridays. The process of MMs selling out-of-the-money puts, which they knowingly perceive as riskless for an exorbitant premium only to turn around and use call options to prevent prices from moving for the rest of the day IS THE MANIPULATION.

To reiterate, what I am saying is that the common form of market manipulation that most people arbitrarily place their blame on is the weekly Market Making process of covering themselves every Friday (and sometimes Wednesdays and Mondays as well) that is the de facto Manipulation that I am trying to convey in the chart above.

The reason why this process should be acknowledged as an illegal manipulative practice, rather than just some existential side-effect that comes with ever-evolving complex market systems is because:

1) It is enabling large institutions to sell grossly mispriced derivatives en masse with no intention of realizing the equivalent risk

2) It is a literal form of manipulation, as per the definition of the word "manipulation"

3) Once understood, it becomes blatantly obvious that markets lack the freedom that has always been pre-supposed, which will eventually change the nature of our

market to something non-sensical, like the concept of equal-outcome investments (you cannot grow your wealth in a market that grows everyone else's wealth at the

same pace, since that is just pure inflation).

To finish this lesson, I will use the chart of yesterday's price/volume action of the S&P futures as an example of how the manipulation of price-pinning can be applied practically:

1) Start with the obvious outlier that is the selling volume incurred at 3:59 p.m. yesterday

2) What this represents is the true bearish sentiment that should have resulted in a panic-sell to close the week

3) The reason why this panic sell never occurred is because MMs had bought very cheap call options starting around noon

4) Specifically, as soon as MMs feared that sentiment had turned bearish enough to threaten their short-put liability, they started covering with calls

5) This can be seen in the upper half of the chart, on the second breakdown, which notched the LOD

6) We can rule out the possibility of a major support bounce because the LOD is simply not a major point of support even if near the 4500 level.

7) This can be corroborated by the lack of historical price action around such high levels of the S&P. To naturally prevent a breakdown of this nature would require a more

historically tested level of support, in my opinion

8) Manipulation resulting from too much leverage and greedy MMs created a very tiny snapshot of the wrongdoing, which is captured full-circle in the volume reading of the last minute of the session.

I hope I was able to present this entire idea in a sensible way. Manipulative practices are very hard to pinpoint, prove and define, which is partially why they can persist for months on end. On a personal note, I really hate this type of market environment because it sucks to trade and limits the possibility of what makes markets fun in the first place. Ironically, I am sort of doing the very kind of complaining that I made fun of in the opening paragraph - the only difference is that I am certain about what is causing my frustration.

-Pig-Police

CME_MINI:ES1!

AMEX:SPY

SP:SPX

CURRENCYCOM:US500

DJ:DWCPF

MARKET MAKER MANIPULATIONHello everyone!

Today I want to discuss with you a very interesting topic - the traps of market makers.

Let's get started.

Traps…

How often did you encounter this - you opened a position, and why did the price go sharply against you, knocking out your stop loss, and as soon as your position was closed with a loss, the price turned around again and went where you expected?

You analyzed your trades and did not understand what you did wrong.

Actually, it's not your fault. You just fell into the trap of a market maker.

These traps are created by large players in order to collect the stops of small market participants, thereby creating liquidity for opening or closing their large positions.

What do traps look like?

As a rule, traps are false level breakouts.

It is in these places that small players place their stop orders and this will be the main goal of a large player.

The first trap pattern is the classic Double Top pattern.

Everyone knows from books that the second peak should be slightly lower than the first. So the market tells us that the price no longer has the strength to make new highs and it's time to fall.

In fact, above the first peak, most traders place their stop losses, and large players push the price to them in order to activate orders and gain liquidity, after which the market reverses.

The second trap situation is the trend.

The trend is our friend! Everyone remembers and knows this.

In addition, everyone remembers that the trend changes when the price, in a bear market, renews the previous high.

After the new high, we believe that the trend has changed, but the price suddenly falls even lower and the downtrend resumes again, what happened?

The big player knows that traders put their stop losses above the last high and that is why the price pushes higher, so liquidity gathers, after which the bear market continues.

How to trade?

We cannot find out the thoughts and desires of major players.

The average trader should analyze the chart and try to act in the direction the market maker is pushing the price.

Pay attention to false breakouts - these are strong signals.

Seeing that the price has updated the maximum, and then turned around sharply, go short, so you will trade in the same direction with a major player.

Also, remember that traps are usually characterized by candles with long tails.

A long shadow will be a false breakout.

Conclusions

Trading traps is very difficult and at the beginning of the path you will fail.

Study the market, try to understand how a big player thinks.

When you learn, this strategy will bring you big profits.

Good luck!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩

The Liquidity GrabI'm going to do my best here at explaining the basics around a liquidity grab (some times called a stop hunt), why it happens and how it works (ignore the chart I'm using, I'm not saying this is a manipulated move just showing you an example of how it works)

I often refer to this in my playbook as an STL "Sweep The Legs" coupled with a picture of Johnny Lawrence from the karate kid lol

First you need to understand that Big money plays a different game to retail.

When you want to place a buy order at a specific price point, lets say your buying a thousands dollars worth of BTC @ $30,000, you can put an order in and boom it gets hit your filled and your ready to go to the moon.

Now imagine some bigger traders who play with a lot more money than you, lets say there order is more like a billion dollars.

Well in order for them to fill there position, there needs to be a large amount of selling at that level other wise they may only get a small piece filled...... theeeeeen of course the price moves away and your priced out of the market (imagine putting your $1000 order in, only getting $10 of it filled and then having the price moon....yeah it would suck)

They do not want to chase candles or buy up the order book, thats just not good business, and if you have to do that in order to get your orders filled thats a good indication that there is already liquidity issues within this market and you may have a similar problem trying to cover of your position later on.

So these players some times need to hunt down and find or even artificially create liquidity pools for them to take a big bite at like pigs at the trough.

One of the easiest ways to do that is to look for the most obvious levels of support with in a trend of sideways channel and look at the buying thats happening on that level.

If we dont get an instant recovery or bounce at that level it can normally indicate price being trapped or held down in order to encourage more retail to "buy the dip" or buy on support as these are some of the most basic tools and strategies taught to retail traders.

Now one thing to remember when all of these traders/investors are in there positions from this level, there will be a large number of these traders protecting capital with stop losses, normally under the level they where buying at.

This now created a liquidity pool...... You see every stop loss on a BUY order, becomes a SELL order, and with so many BUY orders created and entered at a specific level that means the stop loss orders are stacking more and more on top.

Think about it like this, if we hit 30k and someone buys $1m worth, that means there is possibly a SELL order (via a stop loss) of roughly 1m under that level.... now we hit that 30k level again, and someone buys some more, maybe another $1m worth... well now there is roughly $2m worth of SELL orders in that stop loss zone. Hit that 30k super sweet safe support level 5 or 6 times and all the sudden you could have 8-10m worth of SELL orders at a single price point below support.

Now if I wanted to enter this market long and I had 10m order to fill, it would make sense for me to run the price down to clip these stop losses creating a large amount of selling straight into my pig of a buy order.

Once my orders filled I can stop holding the price down and let the price begin to organically rise again, this often creates fomo for all the retailers who just got knocked out of there trades from "tight stop losses" to chase the market back in only adding to the momentum and mark up of my position.

The same thing can happen in vice versa when they are covering or exiting a position as well, and its often followed by a square up to reduce or remove the risk taken on to manipulate the price during there accumulation or distribution of there order, more specially into a short position as they take on more exposure to the underlying asset to manipulate the price, in a long there exposure is fiat and there isnt any need to cover. (ill explain square up in detail next time)

This is often what is referred to as a liquidity grab and its how big players enter the market, they do not chuck a limit order in on Binance and hope for the best...

I hope that made sense and added some value, but if you have any questions please chuck them below

Psychology. Traps. The reason and the possibility of pump +8200%I made the trading idea about this coin about trading in the channel this afternoon, and I remembered the miracles on the roller coaster of 2.5 years ago on this coin. After all, such games rarely come across in the market to leave such a colorful mark in memories. You do not often see pumps at 19 and 82 x, after accumulating 88 and 100 days. The numbers are not random. Pumping was with an acceptable volume for such a coin.

In my opinion, the project is scam, well, like everything in the crypto world. I absolutely do not believe in anything. I have only cold calculation in trading. No sympathy for scam. In my opinion, all crypto projects including everyone’s favorite “anonymous”, “decentralized” “Beethoven” are frauds, making real money thanks to stupid bidders. But, in addition to “making money” for those who believe that without doing anything, you can become a millionaire. I think the naive point of view is that the "big brother" wants to make all the poor and lazy people millionaires. But they believe in it, because they themselves are such. This faith and inaction will lead to sad consequences. In addition to making money on fools, the crypto market carries more interesting tasks. Which, in case of success of the experiment, will become a reality and the poor will become even poorer, states will receive unlimited power and control.

But, let's get back to this coin. The legend of the project is Blockchain's solution for the global dental industry. The legend, unlike other promising projects, is supported by the principle: “Someday we will turn the mountains”, at least by their activity. Confuses a large number of blocked coins. Which at the time of "X" can bring down the price on all exchanges to zero. Therefore, this coin is not for holding, but for speculation from a good entry point to the planned exit or exit from certain situations in the market. By the way, not one "holder" could not sell not only on the 80X pump, but in general I doubt that 2-3X even on the accumulation price, although I can be mistaken, as after the pump I did not monitor the transaction. Why, I will describe below.

I started trading this coin in late October or early November 2017. Started by accident. On another exchange, I fell into the "trap" that was made on this coin. A book of orders, the entire history of purchases / sales and the trades themselves in the market with bait were also very cleverly made, but here one zero in the price was superfluous. So in a second I remember about $ 600-700 evaporated. I began to understand, I understood what was happening, well, what happened, what happened. By the way, this case in the future made a lot of money, as this action began to be used en masse at one time mainly on exchanges such as Binance and HitBtc when listing coins. Each manipulation against you, with the correct understanding of the essence of the work, can be turned into a weapon against the manipulator.

Everyone can be wrong, including you. Your mistakes are an invaluable experience.

So the initial acquaintance with this coin was not very pleasant for me, but very useful for work in the future. Then I found where this coin is being traded with great liquidity and without "surprises." It turned out the HitBtc exchange. It was evident from the work on the coin that someone on this exchange was gaining a position on this asset. I quietly started to do it too. Immediately in my work I had not a small amount, but when I understood everything what was being done and on what scale, I substantially added money. Every day +10 20% to part of the position. Not a coin, but a cash cow. Paradoxically, no one wrote about this coin anywhere in the chats, including the exchange’s trobox. It was a taboo.

I will say this, this pump at first at 1900% then at 8200% for the majority of those who stuck to this instrument of trading was a big disappointment. Before the growth, after 1.5-2 months of work in accumulation with strong volatility, I increased the initial amount of entry many times. Traded inside the day. At first I copied the actions of the “major player”, but when my position on the coin grew decently - teamwork through numbers. The work is clear, not complicated, without risk.

But the elephant climbed into the market and began to tear down the walls. Perhaps this "elephant" was this major player or the exchange itself. At first, we wanted to keep the price from rising in order to keep the price in the corridor. But nothing came of it. Money forces were not equal.

The biggest disappointment is when about 70% of the position was thwarted by + 300%. I didn’t think that it was possible, as the position was not small, that’s buying + 300% as an obvious not healthy thing. But what happened, it happened. but then the price was pumped up + 1900%

All further price movements I had to work with those coins that remained. It is good that the high price gave a larger spread, and therefore more freedom to manipulate work within the day. Played by what was left. Gradually increasing the number of coins on rising prices. At any moment I could leave the market, like any exit price - for me there was already a profit. Above + 1000% of the accumulation zone the game stopped, I already had enough. That and the liquidity to work a large amount was not there already, the games began for the schedule, but not for earnings. Then the green light is very greedy and stupid people.

Be less greedy than other people and as a result you will be richer than other people.

Let me remind you that the price soared by more than + 8000%. Why did this happen? Why did manage to raise the price? Why were there mostly inadequate buyers, but no sellers? There are several reasons, I will partially describe what happened so that you see similar manipulations in the future and know what to do and what not to do. By the way, similar manipulations are now happening on some coins, I won’t write the name, how it will look like an advertisement. I don’t need that. But, or will they be able to repeat this? More likely no than yes.

___________________________________________________________________

THE REASONS FOR THE HUGE PRICE GROWTH AND THE ABSENCE OF SELLERS.

1) "Killing faith" in a long downtrend. 88 days from the day of listing. The course is just down. (but only for the hamster).

The main thing is to "kill faith" below, "give faith above." In the market, as a rule, those who in the “non-faith” phase say that they do not believe in perspective, in the “faith” phase they will most likely acquire. The world is cyclical, events go in cycles, the flow of the crowd is cyclical, the thinking of the governed lends itself to cycles.

2) Manipulation of the exchange with dcn / eth and dcn / btc pairs. This was the most important manipulation of the discharge of passengers. It was not possible to lower the price; nobody wanted to sell. They were not going to leave even at + 30% and above. In order to strengthen the dump, they announced a delist from the exchange of the dcn / btc pair.

It’s not the understanding of people that they really do not affect the price movement, but are just fuel in someone else’s game, which makes them this fuel for movement.

Whoever had a big position and the corresponding amount of BTC for the terrible visual presentation for hamsters put up walls pouring in them every time a huge sales volume with a gradual price rushing. At that time, the exchange blocked specifically on several days coins on the exchange’s account with many traders. But the panic sat on. Everyone wanted to leave the market, because it was very painful to watch how the price goes down. But they could not do anything, as for "technical reasons" the exchange blocked coins. But major market participants (perhaps the "exchange itself") held the idea of "killing the faith."

3) Bad news in front of the pump . There were a lot of big transfers to the exchange from wallets, many holders also surrendered ... Let me remind you the input / output was opened, but the trading account on this coin was blocked due to the fact that the dcn / btc pair will be delisting soon (those with orders were in this pair). Then, just before the delist of one of the DCN / BTC pairs, when the price dropped significantly by the game, all the accounts of the "traders" were unlocked. Naturally, everyone tried to sell on the market, because soon they would not sell where, as on the other pair there was no liquidity at all. Those who bought up naturally put up weak buy orders, so that hamsters had no hope of a price reversal.

A well-run crowd works like one very stupid person.

The interesting thing is the psychology of the crowd. I’m sure who sold “To get out at any price” after less than 3 weeks they bought from + 1000% and probably many people really got apathy for trading and a feeling of “lost profit” when the price during the pump reached + 8200% (82x) . It is probably painful to realize when you sell at a loss at the lowest price before the pump, and after such a short time you see such an increase.

4) Closed the input / output of coins before pumping coins naturally for "technical reasons". So no holder, with the exception of those who transferred coins to the exchange during the dump and did not have time to sell, could not use this pumped. Holders as always in flight ..

The more stupid a society is, the higher the percentage of earnings in it is for those who are smarter. Do not be one of many, be one among many.

5) After a while, the pair that was delisted from the exchange - DCN / BTC appeared again on the exchange.

6) Good news when pumping. On Twitter, the developers published the news in the manner: “DCN is the last hope of mankind” or “DCN will become the new Bitcoin” and similar nonsense in this spirit. In telegram chats, a similar FUD was also widely used. But the news has never moved or moved the price, they always move with money. News without money does not work. True, the crowd is convinced of the opposite.

6) The first pump at 1900% (19X). So called "Hamster Pump" , but my tongue does not turn + 1900% to call a hamster pump. But in this situation on this coin it was. I think any sane would go out without slowing down at such a price increase.

Then, after this pump, another pump happened, from the accumulation zone + 8200%. There were definitely no passengers on this pump anymore, therefore it was possible to raise the price in such a way by buying out own orders and making appearances of trade by luring hamsters.

Your first enemy is a lack of experience and knowledge. Your second enemy is greed and a sense of lost profits.

7) The presence of a lot of money from those who controlled the price. Without a good amount, this was not possible. You also need to consider that in addition to money (btc), it was necessary to have DCN coins "two or three bags" in order to direct the price. I think you understand who in this situation is the biggest player and initially has the most coins. Without an initially large position, it is very difficult for a trader to accumulate a large position in a short time, although in exceptional cases it is possible.

8) A clear, thoughtful, phased work plan for the manipulators in advance. Good knowledge of the psychology and thinking of the crowd.

This is an old thing, but it is possible for the conscious work and understanding of what is happening in reality in the bidding you will find this information useful. I think you understand that the exchange itself is partially involved in this manipulation. I do not think that exchanges will no longer sin by such manipulations. Be careful, be smart, don't be a herd.

If you understand what is happening in the trade - take part in the trade, if you do not understand - watch from the side.

I wish you all productive study and great profit in trade.

FOREX MARKET MANIPULATION - BIG BANKS🎡 FOREX MARKET MANIPULATION 👾

What is the first thing you learned when you started your journey in the forex market?

I will answer for the majority, Support/Resistance, trendlines, chart patterns and etc

Have you ever asked yourself why is it so common?

When we are introduced to the foreign exchange, we are thrown in a deep ocean with a lot of sharks.

Unfortunately for most of us, get eaten alive by these sharks.

We are thrown in the ocean without any clear context or a clear understanding of who is in charge behind the scene.

It is very easy to get lost in this deep ocean if you don't know where you are swimming to.

You may be diving right into a trap that the sharks intentionally made..

You won't even notice that you are lost.. the ocean is that deep.

Now ask yourself, do you think (you) as a (swimmer) in the ocean have more knowledge than the sharks that had been in the ocean before you came?

As crazy as it sounds, many traders believe they do and this confidence leads them to bad decisions.

New Trader Journey Timeline =

"Searches on the web" ---> "gets greeted with" ---> "learns a strategy" ---> "strategy fails"

---> ---> "looks around" ---> "learns a new strategy" ---> "strategy fails"

Sharks/Devils Timeline =

"Distribute false knowledge" ---> "give a false sense of hope" ---> "plant the trap"

---> "show the chart patterns" ---> "Trader left confused."

Retail Trader Development

(I want to trade) --->(Give me a strategy) ---> (It doesn't work)

Pro Trader Development

(I want to trade) --->(This is how the market behaves) ---> (This is how we will exploit it) ---> (I'm improving)

It's 90% mentality when it comes to trading the market.

You don't make the big moves, the banks do.

You have no control over any move, the banks do.

You are in no position to move the market by any means, banks do.

You are taught this basic information intentionally, by the devils.

You are falling into the traps of the sharks, they show you the patterns you are taught.

You are trading at any set time, you have no real strike time.

Once you understand that (You) are in no control of this market, you will start to think differently in many ways and build an anti-devil strategy.

As much as it is important finding the right entry, it is also crucial to find the right tike to strike.

Stop looking at other traders, because I guarantee you they are also a victim..

Focus on you.

Liquidity Traps, and hidden ordersTraps : When price is manipulated in order to capture liquidity, with misinformation, for instance in this case the buy orders @ 139.800 were completely hidden from the market, meaning information is not available at all for retail traders, why did they do this? In order to accumulate liquidity and give fake hopes to buyers, accumulating all positions with "Fake triangles" and fake breakouts. And then killing all...

What is what I noticed that gave up the trap?

1) The price entered a big resistance level with many open sale positions on the oder book, so it was extremely hard to break, however the price was still trying to go up

2) The price wouldn't go down, thing is different as why wouldn't it go up (of the huge resistance sellers had with open orders), there was no open buy orders @ 139.800, yet the price was not going down, this meant a huge hidden buy order was doing the dirty job...

3) The price entered a range, usually after finding such resistance, the price will fight a little and then fall straight down, well the price not only fought, but fought for 7+ hours, and accumulated around 4.7% in the range between 139.800 and 139.850 of all buyers in this zone. Not any sellers, why? Cause they are not going to kill sellers... The manipulator is a seller

4) Fake symmetrical triangle and resistance breakout, the price did go up, however for all the liquidity trapped in this zone the price should have exploded, not moved that little, overall even find some resistance like it did after breaking the symmetrical triangle

We are never shown the whole picture as retail traders

Fed Fund Rate ManipulationFirst of all, thank you to TradingView for allowing me to stream! In addition, hello and welcome to all the newest followers!

Here is a prime example of market manipulation that I explained the other day on my first TradingView Stream.

I look forward to showing you guys more examples in the future!

Have a blessed day,

Jon Fibonacci

I find it funny how big moves get always called manipulation 🤑Yesterday, there was a big dump 📉. Who would have expected that? Well --- you could say that after the battle, everyone is a general. But in this case, there were some decent clues which were, perhaps, ignored?

I looked at the situation retrospectively. After the rally, a small retracement hasn't managed to establish strong bottom support yet to bounce even further. Below was a long area of low volume - who would put buy orders there? Stop-loss squeeze enabled ✅✅✅. So it burst through some levels which were weak anyway and was put to an end near another.

I am strongly against excusing loses with "manipulation", evil 😈 Wall Street or whatever. It is always better to take responsibility for any loses you might have and ask yourself what you could have done better . Blaming events outside of your control won't make you a better trader. A retrospective analysis, on the other hand, does possess such a chance.

Good luck!

What Put:Call Ratio Tells Us About SPY QQQHere is a chart of the put to call ratio when compared with NASDAQ's ETF, QQQ. When the line is at the bottom of the PC chart, that means market participants are net short. When at the top, they are net long.

I'm sure we've all heard the saying that market makers usually take the other side of the trade. This chart shows that this is a true.

When stocks are going up, the majority of retail traders are shorting the market. When the market goes down, the majority of retail traders are longing the market.

Right now we're in an extreme situation where the majority of retail traders are shorting the market and institutions are doing what they do best, hitting their stop losses and squeezing them out, essentially taking the free money on the table. When this is no longer profitable, the trend usually changes with a few exceptions (see March 2020). To look at it another way, institutions make money on retail trader's emotions which is specifically disbelief.

They say 90% of retail traders lose money trading the stock market. I believe this chart is evidence of that.

TOTAL BULLSHIT!SOMEONE DOESN'T WANT YOU TO SEE HOW RIGGED SILVER WAS IN 1980!

CURRENCYCOM REMOVED ALMOST 40 YEARS OF PRICE ACTION!

SEE PREVIOUS POSTS! LOOKING INTO IT FOR YOU GUYS!

Psychology. Traps. The reason and the possibility of pump +8200%I made the trading idea about this coin about trading in the channel this afternoon, and I remembered the miracles on the roller coaster of 2.5 years ago on this coin. After all, such games rarely come across in the market to leave such a colorful mark in memories. You do not often see pumps at 19 and 82 x, after accumulating 88 and 100 days. The numbers are not random. Pumping was with an acceptable volume for such a coin.

In my opinion, the project is scam, well, like everything in the crypto world. I absolutely do not believe in anything. I have only cold calculation in trading. No sympathy for scam. In my opinion, all crypto projects including everyone’s favorite “anonymous”, “decentralized” “Beethoven” are frauds, making real money thanks to stupid bidders. But, in addition to “making money” for those who believe that without doing anything, you can become a millionaire. I think the naive point of view is that the "big brother" wants to make all the poor and lazy people millionaires. But they believe in it, because they themselves are such. This faith and inaction will lead to sad consequences. In addition to making money on fools, the crypto market carries more interesting tasks. Which, in case of success of the experiment, will become a reality and the poor will become even poorer, states will receive unlimited power and control.

But, let's get back to this coin. The legend of the project is Blockchain's solution for the global dental industry. The legend, unlike other promising projects, is supported by the principle: “Someday we will turn the mountains”, at least by their activity. Confuses a large number of blocked coins. Which at the time of "X" can bring down the price on all exchanges to zero. Therefore, this coin is not for holding, but for speculation from a good entry point to the planned exit or exit from certain situations in the market. By the way, not one "holder" could not sell not only on the 80X pump, but in general I doubt that 2-3X even on the accumulation price, although I can be mistaken, as after the pump I did not monitor the transaction. Why, I will describe below.

I started trading this coin in late October or early November 2017. Started by accident. On another exchange, I fell into the "trap" that was made on this coin. A book of orders, the entire history of purchases / sales and the trades themselves in the market with bait were also very cleverly made, but here one zero in the price was superfluous. So in a second I remember about $ 600-700 evaporated. I began to understand, I understood what was happening, well, what happened, what happened. By the way, this case in the future made a lot of money, as this action began to be used en masse at one time mainly on exchanges such as Binance and HitBtc when listing coins. Each manipulation against you, with the correct understanding of the essence of the work, can be turned into a weapon against the manipulator.

Everyone can be wrong, including you. Your mistakes are an invaluable experience.

So the initial acquaintance with this coin was not very pleasant for me, but very useful for work in the future. Then I found where this coin is being traded with great liquidity and without "surprises." It turned out the HitBtc exchange. It was evident from the work on the coin that someone on this exchange was gaining a position on this asset. I quietly started to do it too. Immediately in my work I had not a small amount, but when I understood everything what was being done and on what scale, I substantially added money. Every day +10 20% to part of the position. Not a coin, but a cash cow. Paradoxically, no one wrote about this coin anywhere in the chats, including the exchange’s trobox. It was a taboo.

I will say this, this pump at first at 1900% then at 8200% for the majority of those who stuck to this instrument of trading was a big disappointment. Before the growth, after 1.5-2 months of work in accumulation with strong volatility , I increased the initial amount of entry many times. Traded inside the day. At first I copied the actions of the “major player”, but when my position on the coin grew decently - teamwork through numbers. The work is clear, not complicated, without risk.

But the elephant climbed into the market and began to tear down the walls. Perhaps this "elephant" was this major player or the exchange itself. At first, we wanted to keep the price from rising in order to keep the price in the corridor. But nothing came of it. Money forces were not equal.

The biggest disappointment is when about 70% of the position was thwarted by + 300%. I didn’t think that it was possible, as the position was not small, that’s buying + 300% as an obvious not healthy thing. But what happened, it happened. but then the price was pumped up + 1900%

All further price movements I had to work with those coins that remained. It is good that the high price gave a larger spread, and therefore more freedom to manipulate work within the day. Played by what was left. Gradually increasing the number of coins on rising prices. At any moment I could leave the market, like any exit price - for me there was already a profit. Above + 1000% of the accumulation zone the game stopped, I already had enough. That and the liquidity to work a large amount was not there already, the games began for the schedule, but not for earnings . Then the green light is very greedy and stupid people.

Be less greedy than other people and as a result you will be richer than other people.

Let me remind you that the price soared by more than + 8000%. Why did this happen? Why did manage to raise the price? Why were there mostly inadequate buyers, but no sellers? There are several reasons, I will partially describe what happened so that you see similar manipulations in the future and know what to do and what not to do. By the way, similar manipulations are now happening on some coins, I won’t write the name, how it will look like an advertisement. I don’t need that. But, or will they be able to repeat this? More likely no than yes.

___________________________________________________________________

THE REASONS FOR THE HUGE PRICE GROWTH AND THE ABSENCE OF SELLERS.

1) "Killing faith" in a long downtrend. 88 days from the day of listing. The course is just down. (but only for the hamster).

The main thing is to "kill faith" below, "give faith above." In the market, as a rule, those who in the “non-faith” phase say that they do not believe in perspective, in the “faith” phase they will most likely acquire. The world is cyclical, events go in cycles, the flow of the crowd is cyclical, the thinking of the governed lends itself to cycles.

2) Manipulation of the exchange with dcn / eth and dcn / btc pairs . This was the most important manipulation of the discharge of passengers. It was not possible to lower the price; nobody wanted to sell. They were not going to leave even at + 30% and above. In order to strengthen the dump, they announced a delist from the exchange of the dcn / btc pair.

It’s not the understanding of people that they really do not affect the price movement, but are just fuel in someone else’s game, which makes them this fuel for movement.

Whoever had a big position and the corresponding amount of BTC for the terrible visual presentation for hamsters put up walls pouring in them every time a huge sales volume with a gradual price rushing. At that time, the exchange blocked specifically on several days coins on the exchange’s account with many traders. But the panic sat on. Everyone wanted to leave the market, because it was very painful to watch how the price goes down. But they could not do anything, as for "technical reasons" the exchange blocked coins. But major market participants (perhaps the "exchange itself") held the idea of "killing the faith."

3) Bad news in front of the pump. There were a lot of big transfers to the exchange from wallets, many holders also surrendered ... Let me remind you the input / output was opened, but the trading account on this coin was blocked due to the fact that the dcn / btc pair will be delisting soon (those with orders were in this pair). Then, just before the delist of one of the DCN / BTC pairs, when the price dropped significantly by the game, all the accounts of the "traders" were unlocked. Naturally, everyone tried to sell on the market, because soon they would not sell where, as on the other pair there was no liquidity at all. Those who bought up naturally put up weak buy orders, so that hamsters had no hope of a price reversal.

A well-run crowd works like one very stupid person.

The interesting thing is the psychology of the crowd. I’m sure who sold “To get out at any price” after less than 3 weeks they bought from + 1000% and probably many people really got apathy for trading and a feeling of “lost profit” when the price during the pump reached + 8200% (82x) . It is probably painful to realize when you sell at a loss at the lowest price before the pump, and after such a short time you see such an increase.

4) Closed the input / output of coins before pumping coins naturally for "technical reasons". So no holder, with the exception of those who transferred coins to the exchange during the dump and did not have time to sell, could not use this pumped. Holders as always in flight ..

The more stupid a society is, the higher the percentage of earnings in it is for those who are smarter. Do not be one of many, be one among many.

5) After a while, the pair that was delisted from the exchange - DCN / BTC appeared again on the exchange.

6) Good news when pumping. On Twitter , the developers published the news in the manner: “DCN is the last hope of mankind” or “DCN will become the new Bitcoin” and similar nonsense in this spirit. In telegram chats, a similar FUD was also widely used. But the news has never moved or moved the price, they always move with money. News without money does not work. True, the crowd is convinced of the opposite.

7) The first pump at 1900% (19X) . So called "Hamster Pump", but my tongue does not turn + 1900% to call a hamster pump. But in this situation on this coin it was. I think any sane would go out without slowing down at such a price increase.

Then, after this pump, another pump happened, from the accumulation zone + 8200%. There were definitely no passengers on this pump anymore, therefore it was possible to raise the price in such a way by buying out own orders and making appearances of trade by luring hamsters.

Your first enemy is a lack of experience and knowledge. Your second enemy is greed and a sense of lost profits.

8) The presence of a lot of money from those who controlled the price. Without a good amount, this was not possible. You also need to consider that in addition to money ( btc ), it was necessary to have DCN coins "two or three bags" in order to direct the price. I think you understand who in this situation is the biggest player and initially has the most coins. Without an initially large position, it is very difficult for a trader to accumulate a large position in a short time, although in exceptional cases it is possible.

9) A clear, thoughtful, phased work plan for the manipulators in advance. Good knowledge of the psychology and thinking of the crowd.

This is an old thing, but it is possible for the conscious work and understanding of what is happening in reality in the bidding you will find this information useful. I think you understand that the exchange itself is partially involved in this manipulation. I do not think that exchanges will no longer sin by such manipulations. Be careful, be smart, don't be a herd.

If you understand what is happening in the trade - take part in the trade, if you do not understand - watch from the side.

I wish you all productive study and great profit in trade.

Even Gold Is Subject To Manipulation and ControlAll the hu ha hu ha of the Gold Bugs calling that Gold is a sound money and nothing can manipulate the Gold price. Gold is subject to supply and demand.

The word manipulation has been abused by people so many times. They think that manipulation comes in the form that someone is trying to manipulate the price of an asset "SHORT TERM". Nope, short term manipulation can't work and will never be work.

Manipulation that I have been referring to including in all my past ideas are "LONG TERM MANIPULATION".

You need to understand that the dynamics of markets are moves by its participants. Therefore, the much easier way to manipulate a market is by doing that PSYCHOLOGICALLY.

That's why bubbles ALWAYS exist, because it is the job of the manipulator to push the price of an asset BEYOND people BELIEFS and IMAGINATION in order to LURE THEM into it.

If everyone is rational and behaves rationally, bubble WILL NOT EXIST.

That's the reasons why there are so many dumb people and the number of people who understand financial literacy are awful. Because the system is designed in that way. It always about the Elite making money and RIPPING OFF the dumb people.

So, the only way for you to win this battle is to THINK and BEHAVE like the Elite, NOT LIKE THE DUMB PEOPLE OR MONEY.

You need to bring you conscious and awareness AWAY FROM MAINSTREAM and from the CONVENTIONAL WISDOM.

Remember, the CROWD and MAJORITTY always wrong. That's who market works.

Gold is an interesting case study. Its an example of how assets work and how capital flow works.

Gold has never been going up forever. In fact, from 1980 to 2000, Gold SEVERELY underperformed the stock market.

Even now, Gold started to go back up and start to fight back with stocks market.

But can Gold outperform stocks? It depends, it depends on what the elites want to do.

The tricky part here is that most retailers are NOT in stocks. So, the Elites can't simply drop and crash the market, because everyone has sold out.

Its a tricky situation.

And that's why I like to think in terms of whales and all these market manipulators, because they do exist and they do have strategic and comprehensive plan.

As long as you keep thinking that you can beat the market, then you are doomed, You need to remove all the noises in your mind and start to think and behave like the elites/whales.

Daily "Manipulations"So here is a perfect example how the Institutions operate on a daily and weekly basis and how order flow works.

We got this gap because the institutions trapped traders into the believe that price would go higher and many orders were stuck there over the weekend.

Then we got a small gap signaling buying pressure while in reality the institutions sucked in orders to build their position (maybe only short term in a bigger cycle). The gap also faked some people out because they believed that this was a valid double Top there. They then just went 3.5 Pips higher to trick people into more buy orders so they could prepare for the final big move.

Just another day, same methods.

Trading is all about probabilities and order flow that creates those patterns.

On the lower timeframes those "patterns" are unreliable because all the pending orders and such create heavy noise at important levels and those patterns are more a result of that noise and HFT firms than a planned move within itself. So we should stick to higher timeframe confluences.

But anyways, this is how it works.

Cheers