💥 XRP SHOULD I BUY OR SELL? IMPORTANT PSYCHOLOGICAL TRADING 💥 💥 Very important idea and question of the week here with our XRP should I buy or sell? Good question and let's see what we can figure, thanks for joining ladies and gentlemen.

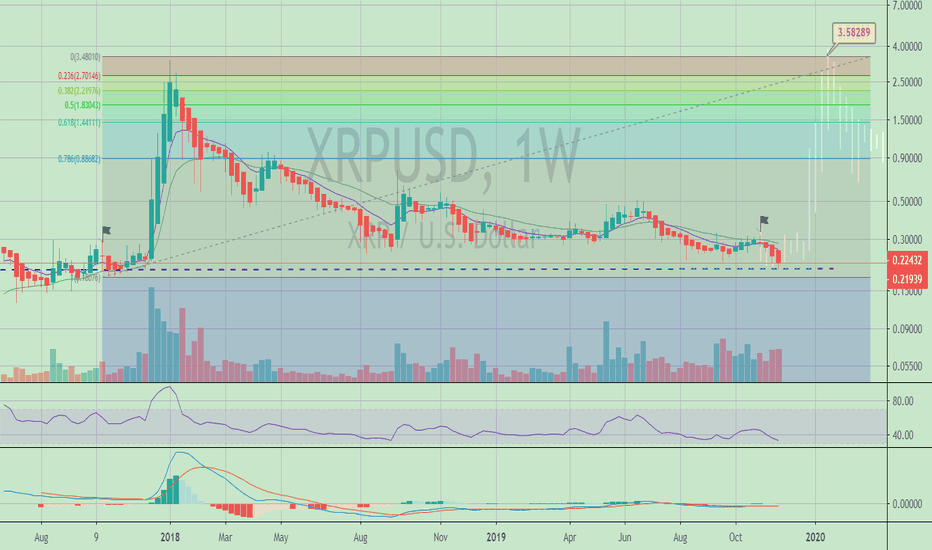

💥 XRP's been trending between 0.77 and 0.80 roughly displaying this horizontal channel which has basically displayed this sideways trend with us getting one breakout above for a relatively short period before reversing with the market now testing the waters and looking for a pivot in either way.

💥 Amongst this period of waves and sideways trading I've been getting asked by a few people whether or not they should or should not sell XRP. To start off on that, the question is what is your objective. Before you open a trade you should tell yourself at what price you are going to sell at. In this case the majority of that has been $1.

💥 We nearly hit $1 with XRP's first run up before failing because the traders that had already bought at $1 before decided to sell at $1 as they'd seen the price get lost before and wanted to sell at that price which is psychological for the most part.

💥 If we factor that in then we know now that should we approach that $1 mark again, we'll likely see more sales as the individuals that didn't sell at $1 will see the previous bounce up, reversal and think, if it did this at $1, why shouldn't I just sell at $1 in case it falls down again?

And thus they sell.

💥 What's important is that next time we approach $1, even with the selling we won't have nearly as much as we did the first time with much of the first wave of buyers having hopped out already thus it'll give us some leverage and potentially allow us to breakout/get a leg up above $1 which would be incredible. There's no guarantee that'll happen of course but that's something you guys can take note of, whether or not it does will be if the market has factored in the price of the news and what that news is, it's significance.

💥 Next important thing is why you exactly own XRP. Did you simply buy in to reap a specific percentage? If so then you're more than likely happy with 100% and doubling your money and should sell if that's what your content with/goal was.

💥 What if you bought in because of the utility use case and you believe XRP has an even brighter future? Well in that case you as well as that class of traders/investors will most likely be holding for the long term a couple of years believing that XRP's price has a lot more to rise in the coming years alongside it's utility and real world use/adoption.

💥 Still even with all of that there is another option, you can always sell your XRP for the high percent gain and convert that to another crypto you have faith in. Here's one example of what I'm talking about:

💥 You originally buy $50,000 worth of XRP at 40 cents. Now it's worth $100,000 at 80 cents with a 100% profit. If you believe it has more potential to the downside then the upside you could sell it all for $100,000, then convert that into Bitcoin to give you approximately 3.33 Bitcoin at current prices. Bitcoin has yet to make any major moves being stuck at that $29,000-$30,000 range still so it would make sense to do that if you believe Bitcoin will go back up and further within a year or more. Thus your $100,000 could become $198,000 if Bitcoin we're to hit $60,000 again.

💥 Above is the example of taking profits from one profitable trade and putting them to work in another which may be less risky buy still reap rewards and percentages, sure you're chances of seeing a crazy quick and high percentage rise will be way lower than with XRP, but you're money would also be safer and more than likely still reap profits, albeit in the longer term.

💥 This is all relative to the market cap of course and your risk tolerance. With XRP's market cap of roughly $41 billion right now it still allows a lot more room for growth, to get 100% you would need another $41 billion. Whereas with Bitcoin being at $578 billion, you'll need another $578 billion to hit $60,000 or so. It's a big difference but that's where the risk tolerance comes in. XRP offers a lot more profits but at a lot more risk, whereas Bitcoin may offer less profits but with a lot less risk. That's where it's up to you to think about your tolerance and what you're plan exactly is.

💥Important thing to note is what percent your gains will be taxed at if you do decide to close. Remember that you'll be facing long term or short term gains depending on how long you've held/had and you're income. If you sell for a short term gain there is no 20% like with long term gains, the tax percent can go as high as 37% for short term so it'll range in between 10% and 37% basically. For long term the range is 0 - 20% based off your total taxable income. Below is a link to the site I used which details a lot more on capital gains.

www.bankrate.com

💥 It's been a long enough idea I understand but I wanted to make some points clear, especially for those debating on whether or not to sell, so I hope that helps, because even if all of this were to help only one person, I would still be happy with that, anything for you guys. Thanks for tuning in and feel free to leave a like or follow, simply helps me, thanks.

~ Rock '

Ripple

Ninja Talks EP 11: BBQ TalkSince it's summer and the BBQS are out, it got me reminiscing about old times.

I used to tell people I was a trader, before I was even profitable.

Do I recommend this?

Nah not really no.

(1) It puts tremendous pressure on yourself to do what you say.

That pressure makes you rush, push and bully your risk into a brawl of epic proportions.

(2) Most people don't believe you and actual traders ALSO don't believe you.

However, if you're a super stubborn half autistic savant who dedicates their life to this and has no shame on the unlimited effort they're putting into this skill set, then we'll...shout it to the roof tops.

Muhammad Ali told people he was the greatest before everyone else even heard it - Floyd Mayweather - Conor McGregor etc the same thing.

Is it some spartan-esque teen thrown into the wild right of passage scenario?

Absolutely not.

But respect to those that choose that path.

Full transparency: I did.

That's all for today's ep!

P.S. As far as Ripples analysis, SEC will probably be positive news, thus making Bambi traders (both old and new) buy buy buy, which will be great for whales to exit their losing positions.

I know that will lose me followers, but the truth hurts and I don't need your money like other gurus.

Hope this helps Ninjas!

Keep your blades sharp.

Nick

The Howey Test: securities and cryptocurrencies / Ripple vs SECThe Howey Test

The Howey Test is a legal test to assess whether certain transactions are investment contracts. If a transaction is an investment contract, it can be considered a security by the SEC. It is subject to specific disclosure and registration obligations under federal securities laws.

The test got its name after the 1946 Supreme Court decision in SEC v. W. J. Howey Co., 328 U.S. 293 (1946). So, in this the Court defined an investment contract. Since then, courts throughout the United States have employed the Howey Test. This to evaluate whether a specific transaction qualifies as an investment contract. If so, it will then be handled as a security.

In fact, the Securities and Exchange Commission (SEC) has long used the Howey test. In its most basic form, the Howey test requires that a transaction involve the following:

(1) an investment of money

(2) in a common enterprise

(3) with an expectation of profits predominantly from the efforts of others.

Digital assets

Cryptocurrencies, digital or virtual tokens that use cryptography for security, have garnered much attention recently for their potential to take on fiat currencies. Their legal classification, however, has been unclear. For example, in the United States, the Securities and Exchange Commission (SEC) has been struggling to determine whether cryptocurrencies are securities. On June 14 in 2018, the SEC finally released its long-awaited report on The DAO, a decentralized autonomous organization that had raised over $150 million in a token sale. The SEC’s report stated that cryptocurrencies can be securities and that The DAO was an illegal security offering.

Actually, the digital asset space is emerging and constantly changing. A digital asset is a unit of value created and managed by its creators that may be exchanged on an online marketplace. As a result, they are subject to the same rules as conventional securities. However, in many places, the legitimacy of digital assets is still being contested. Digital assets are frequently regarded as securities. This is primarily due to the fact that digital assets are frequently used to raise finance for a company. According to the Securities and Exchange Commission (SEC), digital assets may constitute securities. As a result, digital assets could be subject to federal securities regulations.

Moreover, regulatory agencies are struggling to adapt to the rise in digital assets. These agencies must answer the question of whether digital assets should be seen as securities. Yet, the majority of digital assets are currently not registered with the SEC, which raises the question of whether the SEC has the authority to regulate digital assets.

Ripple

One company that the SEC has been investigating is Ripple, the company behind the cryptocurrency XRP. Ripple is facing a lawsuit from the SEC which alleges that it violated securities laws by selling $1.3 billion worth of XRP tokens. The SEC is seeking to determine whether Ripple’s XRP token is a security. So, the outcome of this case will likely have a significant impact on the cryptocurrency industry as a whole.

Furthermore, the SEC settles the majority of its lawsuits rather than going to trial. Individual cryptocurrency enterprises must comply with SEC orders and pay penalties in order to be released. Ripple, unlike many others, went all the way and participated in a legal brawl.

Ripple has particularly referenced some of the SEC members' connections to other crypto platforms, specifically Ethereum. While there is no proof of these connections at this time, the commission gave Ethereum a pass on securities legislation. They claim that it operates in a decentralized manner while using XRP. This seems very fishy.

As a result, Ripple perceived the SEC as prejudiced in its application of the security concept to virtual currencies such as XRP. However, Ripple's lawyers stated that the SEC never warned or notified the company. Also, Ripple wasn’t advised that XRP could be categorized as a security, according to the US regulator.

Conclusion

It is still unclear who will end up winning. For now, the assumption is that the final date will be somewhere in March 2023. The thing that matters is that the results will affect the crypto market in one way or the other. Therefore, for the benefit of the whole crypto industry, it is important for Ripple to get away with a win.

Explanation | the US Federal Reserve conference is of great impoAt the Jackson Hole conference, financial markets will keenly watch if US Fed chair Jerome Powell mentions the word taper in his speech and whether US Treasury Secretary Janet Yellen has anything to say on the interlinkages between fiscal and monetary policy

The financial media and markets will be buzzing for the next few weeks over the Jackson Hole conference. It is an important economics conference hosted by the Kansas City Fed, one of the 12 regional Federal Reserves created by the United States government. There is a history of important policy decisions unveiled at the Jackson Hole conference with implications for world markets. Here’s a lowdown.

What is the Jackson Hole?

In 1978, Kansas City Fed started organising an economics conference, and in 1982 moved the conference location to a valley named Jackson Hole (JH) in the Wyoming state. The annual conference has been held in the last days of August for quite some time now.

What is the history behind it?

Jackson Hole started as any other economics conference. The first four conferences were on agriculture, given the importance of the sector in this part of the US. In 1982, it organised the first conference on the monetary policy theme titled ‘Monetary Policy Issues in the 1980s’.

The 1982 conference was attended by then Federal Reserve Chair Paul Volcker, which set a precedent of sorts as most subsequent conferences were attended by the Fed chairpersons/senior officials. In 1982, the conference was attended by eminent macroeconomists and monetary policy scholars such as James Tobin (Nobel Prize in 1985), John Taylor (of Taylor Rule), William Poole (who became head of San Francisco Fed later), and so on.

In 1989, then Fed chair Alan Greenspan also made a speech at the conference. This added to its aura as now it was not just about the attendance of the US Fed chair but also about the remarks/speeches at the conference.

As linkages between monetary policy and financial markets deepened post-1990s, market participants started tracking the Fed chair’s remarks to figure the direction of the monetary policy.

Since 1982, the conference has been held 41 times including the 2021 edition. The theme has usually been around macroeconomics, monetary policy, long-term growth and policy, including the 2021 theme on ‘Macroeconomic Policy in an Uneven Economy’.

In 1990, the conference on ‘Monetary Policy Issues in the 1990's’ had representations from the erstwhile USSR, Czechoslovakia and Yugoslavia, and Bulgaria.

Gradually, the forum was attended by governors and central bankers from major advanced economies in Europe and Asia. This led to the financial markets in these respective economies tracking speeches and remarks from both global central bankers and representatives of their country’s central banks.

What makes Jackson Hole so special?

In many cases, it sets the agenda for monetary policy and shaped star economists.

The 1996 edition raised the importance of price stability. The 1999 edition highlighted the interaction of monetary policy with asset markets.

The 2005 edition was a swansong for Greenspan where his policies were praised only to be tarnished during the 2008 crisis.

The 2007 edition focused on housing and monetary policy where chair Ben Bernanke expressed confidence that the subprime housing markets are unlikely to lead to a crisis only to be proven wrong a year later.

The 2008 crisis led to increased attention on financial stability which was the theme in both the 2008 and 2009 editions.

In recent years as monetary policy has struggled to elevate inflation to the 2 percent target (for the US), there have been discussions on unconventional monetary policy (2013), designing resilient monetary policy frameworks (2016), monetary policy challenges in the next decade (both 2010 and 2020).

In 2020, Fed chair Jerome Powell released a new monetary policy framework named Average Inflation targeting which has become a major discussion point amidst the central banking research community.

The conference even catapulted the careers of economists. The name that comes to mind is that of Raghuram Rajan who had questioned the financial market developments in the Greenspan swansong edition in 2005. Rajan was dubbed a ‘luddite’ then but had the last laugh as the 2008 financial crisis engulfed the world economy.

What should we expect from the 2021 edition?

The theme of the 2021 conference is ‘Macroeconomic Policy in an Uneven Economy’. The global economy has been highly uneven due to the pandemic shock with rising inflation amidst stagnant growth prospects.

Conference watchers will keenly follow this edition as it is expected to be attended by US Treasury Secretary Janet Yellen, and Powell. This is rare as usually, the treasury secretaries do not attend the conference. Yellen is no stranger to Jackson Hole as she was the chairperson before Powell, and has been a chief speaker at the conference. If both attend and speak, it will be interesting as both the guardians of fiscal policy (Treasury) and monetary policy (Federal Reserve) will get together to provide solutions to the uneven economy.

They have to answer some big questions facing the US economy which will also impact the world economy. The foremost question is whether the fiscal and monetary stimulus will continue to remain in the US economy, and for how long.

The financial markets in emerging markets will see if Powell mentions the word taper in his speech and whether Yellen has anything to say on the interlinkages between fiscal and monetary policy.

The ins and outs of trading psychologyThe ins and outs of trading psychology

For something that I believe makes up the bulk of trading itself, I believe it is also the most overlooked. Trading psychology is what I am talking about, and it is definitely the most important aspect of trading that every trader needs to develop and master in order to become successful.

In the most basic ways to put it, trading psychology is the term that defines all the feelings and emotions experienced day to day by traders. It is not something that can easily be controlled, however with time and experience it is definitely something that is needed to master in order to move forward in your trading journey.

The two emotions that drive the markets are fear and greed. Based on these two emotions, you can find all the negative effects of trading psychology.

Based on the emotion of fear, the following can occur:

• Fear of missing out (FOMO), leading to bad entries

• Exiting a trade too early

• Exiting a trade in a drawdown only to see it go in their original direction

• Adding to a losing position in hope of recovering the drawdown

• Constantly checking your trade

• Finding yourself glued to the charts

Based on the emotion of greed, the following can occur:

• Moving your original TP in order to gain more profits

• Adding large positions after seeing gains in a position

• Over trading and overleveraging to chase big returns

• Risking big on a single trade

Another important thing that needs to be understood is the difference between mistakes and losses. A lot of people think that trading mistakes and trading losses are the same thing. However, a trading loss is simply a trade that hit your stop loss and did not go your way. Until the day you learn to accept that losses are just as much a part of trading as winners, you will not become successful. A trading mistake on the other hand is you simply not following your own rules. You have to understand the importance of being disciplined and how it is possibly the single most important aspect of lasting in the markets. Never break your own rules just to be right, because as said earlier, you need to learn that losses are completely normal and expected.

Emotions are a normal part of everyday life, however it cannot be stressed enough how important it is to leave them completely out of your trading. Many others believe that negative emotions should be shut off, however positive emotions are great to have, however I think otherwise. Emotions should not be attached in any way to trades, whether positive or negative. If emotions are attached to every single trade then what can happen is that you could have a great week and make a certain amount of money that week. Now by attaching an emotion to that trade, you are programming your mind to believe that the following week even if half that amount was made, it is not good enough as you do not have the same intensity of positive emotions. In trading you have to be emotionless towards both wins and losses and strictly follow your rules.

Constantly working on your psychology and mindset is key to developing and succeeding as a trader. Something as simple as developing a daily morning routine, keeping a journal, meditation, exercise, and visiting a mindset coach, are great tools to constantly develop and keep your psychology and mindset at its best. Meditation alone has helped me to develop as a successful trader by improving my focus and attention, reducing stress, reduced panic, improved my information processing, increased mental strength and emotional intelligence, and increase in my focus.

If there is one thing that cannot be stressed enough, it is that the aim of forex is to gain pips and not money. Chasing money, especially fast money, is gambling and you will never have control as long as you remain with that attitude.

Ripple (XRP) Model PriceAn article titled Bitcoin Stock-to-Flow Model was published in March 2019 by "PlanB" with mathematical model used to calculate Bitcoin model price during the time. We know that Ripple has a strong correlation with Bitcoin. But does this correlation have a definite rule?

In this study, we examine the relationship between bitcoin's stock-to-flow ratio and the ripple(XRP) price.

The Halving and the stock-to-flow ratio

Stock-to-flow is defined as a relationship between production and current stock that is out there.

SF = stock / flow

The term "halving" as it relates to Bitcoin has to do with how many Bitcoin tokens are found in a newly created block. Back in 2009, when Bitcoin launched, each block contained 50 BTC, but this amount was set to be reduced by 50% every 210,000 blocks (about 4 years). Today, there have been three halving events, and a block now only contains 6.25 BTC. When the next halving occurs, a block will only contain 3.125 BTC. Halving events will continue until the reward for minors reaches 0 BTC.

With each halving, the stock-to-flow ratio increased and Bitcoin experienced a huge bull market that absolutely crushed its previous all-time high. But what exactly does this affect the price of Ripple?

Price Model

I have used Bitcoin's stock-to-flow ratio and Ripple's price data from April 1, 2014 to November 3, 2021 (Daily Close-Price) as the statistical population.

Then I used linear regression to determine the relationship between the natural logarithm of the Ripple price and the natural logarithm of the Bitcoin's stock-to-flow (BSF).

You can see the results in the image below:

Basic Equation : ln(Model Price) = 3.2977 * ln(BSF) - 12.13

The high R-Squared value (R2 = 0.83) indicates a large positive linear association.

Then I "winsorized" the statistical data to limit extreme values to reduce the effect of possibly spurious outliers (This process affected less than 4.5% of the total price data).

ln(Model Price) = 3.3297 * ln(BSF) - 12.214

If we raise the both sides of the equation to the power of e, we will have:

============================================

Final Equation:

■ Model Price = Exp(- 12.214) * BSF ^ 3.3297

Where BSF is Bitcoin's stock-to-flow

============================================

If we put current Bitcoin's stock-to-flow value (54.2) into this equation we get value of 2.95USD. This is the price which is indicated by the model.

There is a power law relationship between the market price and Bitcoin's stock-to-flow (BSF). Power laws are interesting because they reveal an underlying regularity in the properties of seemingly random complex systems.

I plotted XRP model price (black) over time on the chart.

Estimating the range of price movements

I also used several bands to estimate the range of price movements and used the residual standard deviation to determine the equation for those bands.

Residual STDEV = 0.82188

ln(First-Upper-Band) = 3.3297 * ln(BSF) - 12.214 + Residual STDEV =>

ln(First-Upper-Band) = 3.3297 * ln(BSF) – 11.392 =>

■ First-Upper-Band = Exp(-11.392) * BSF ^ 3.3297

In the same way:

■ First-Lower-Band = Exp(-13.036) * BSF ^ 3.3297

I also used twice the residual standard deviation to define two extra bands:

■ Second-Upper-Band = Exp(-10.570) * BSF ^ 3.3297

■ Second-Lower-Band = Exp(-13.858) * BSF ^ 3.3297

These bands can be used to determine overbought and oversold levels.

Estimating of the future price movements

Because we know that every four years the stock-to-flow ratio, or current circulation relative to new supply, doubles, this metric can be plotted into the future.

At the time of the next halving event, Bitcoins will be produced at a rate of 450 BTC / day. There will be around 19,900,000 coins in circulation by August 2025

It is estimated that during first year of Bitcoin (2009) Satoshi Nakamoto (Bitcoin creator) mined around 1 million Bitcoins and did not move them until today. It can be debated if those coins might be lost or Satoshi is just waiting still to sell them but the fact is that they are not moving at all ever since. We simply decrease stock amount for 1 million BTC so stock to flow value would be:

BSF = (19,900,000 – 1.000.000) / (450 * 365) =115.07

Thus, Bitcoin's stock-to-flow will increase to around 115 until AUG 2025. If we put this number in the equation:

Model Price = Exp(- 12.214) * 114 ^ 3.3297 = 36.06$

Ripple has a fixed supply rate. In AUG 2025, the total number of coins in circulation will be about 56,000,000,000. According to the equation, Ripple's market cap will reach $2 trillion.

Note that these studies have been conducted only to better understand price movements and are not a financial advice.

Related indicator:

Ripple's regulatory troubles |Why is XRP facing severe dumpingQuick glance: In this post, we attempt to decode the ongoing tussle between Ripple and the SEC. This episode was filed into a lawsuit on December 2020. But the events that led to this lawsuit date back 2 years.

Case Summary:

SEC filed a case against Ripple which is one of the largest crypto issuing companies.

The SEC filed a lawsuit against Ripple over its XRP cryptocurrency, alleging that the company held a $1.3 billion unregistered securities offering. The suit contends that Ripple should fall under SEC regulations because it is a security, not a currency.

The case was filed on 5 Dec 2020. The SEC had been investigating Ripple for almost 2 years prior to filing the case.

→The suit also alleges that Ripple was aware that it wasn’t likely XRP would qualify for status as a currency under the Exchange Act because it lacked the backing of a central government.

→In response to the SEC lawsuit, Ripple said that the U.S. regulator is incorrect — Ripple’s XRP cryptocurrency is not a security. The company said XRP is a virtual coin used as a medium of exchange for international and domestic transactions. Ripple further added that XRP is an asset that is perfect for payment processing because it’s quick and scalable.

→Ripple alleges that the SEC’s move “amounts to picking winners and losers” in the field, as fellow cryptocurrencies like bitcoin and Ether have not been subjected to such regulations.

→Coinbase stopped trading in XRP earlier this year after the SEC suit came down due to which we saw a major downtrend in the price of XRP.

→On 21/5/2021 Ripple filed the case to end with summary judgement after they filed a “lack of due process and fair notice” stating the fact that SEC had 2 years to prepare the evidence and along with the 6 months the case has been active.

→This month, Ripple sought the SEC’s “policies governing SEC employees’ trading in, or purchase or sale of, Digital Assets and/or Virtual Currencies, including all changes and updates to those policies.”

The SEC blatantly refuted this request with the SEC arguing that they were irrelevant to the litigation and would “not lead to the discovery of any relevant evidence.” But Ripple stated that the policies could reveal the SEC’s stance on digital assets — including any distinctions it draws between XRP and other cryptocurrencies, such as BTC and ETH.

→The presiding judge has ordered the SEC to submit these documents citing them as relevant.

Possible conclusions and their respective impacts:

→ If Ripple wins: We can see XRP becoming another major crypto. If Ripple wins then coinbase could start trading XRP again and we can see a major bullish trend. This jump could also give the crypto industry a major boost and may stabilize the market. This could also give a chance to Dogecoin to follow similar footsteps and become a mainstream trading crypto currency. This win could bring some stabilization into the current volatile market and bring even more people into the crypto world.

→ If SEC wins: This might be bad news and may open flood gates for SEC to regulate the crypto market even more which could reduce the freedom that people associate with cryptocurrency. SEC has never regulated any other crypto before this and winning this motion could give them a green light to go after other currencies as well which is bad news especially considering the current volatility of the market and this major news can break the crypto world.

----------------------------------------------------------------------------------------

Any feedback and suggestions would help in further improving the analysis! If you find the analysis useful, please like and share our ideas with the community. Keep supporting :)

Elon candle| BTC massive trend reversal after Elon Musk's tweetIn this post, we are exploring the effect of "humorous tweets" by the Billionaire entrepreneur and CEO of Tesla, Elon Musk. In the recent past, his tweets had created quite a stir in the crypto universe. DOGEUSD had skyrocketed massively. Bitcoin tanked terribly after he tweeted that Tesla stopped accepting Bitcoin payments.

Just a few hours back, he has taken another humorous jab at BTC maxis by asking how many are needed to change a light bulb. Michael Saylor, Dan Held, Peter McChivo, and many more giants quickly joined the twitter frenzy to respond to Musk.

Many critics are calling out the SEC to take notice of his actions, terming them to be a clear case of market manipulation. The SEC is probing hard into the crypto realm, with the investigation with Ripple.

Elon had earlier stated that his company still holds $1.5 billion dollars worth of Bitcoins. It remains to be seen whether the tweets turn out to be the premise for a regulatory investigation.

As of now, BTC has already lost more than 4.2% of its market capitalisation post the tweet! And that does worry out the investors!

----------------------------------------------------------------------------------------

Any feedback and suggestions would help in further improving the analysis! If you find the analysis useful, please like and share our ideas with the community. Keep supporting :)

How to trade XRP. 3 Best and simpliest trading strategies. My Friend. Here will be the best patterns that work on Crypto and XRP:

1. False break out of key level

- U should wait for a pullback to a strong key level.

- Better when a false breakout happens after 100% of ATR drop.

example

2. Wage patten

This BNB trade is the best example.

We made 3% within 1 day))

3. Squezeeng to a key level

The best example will be on EUR/USD but it also works on Crypto and XRP.

I just showed you 3 best examples of how can buy XRP. Wait for one of these scenarios.

My Friends, if u want to learn how to trade crypto and make money on it write to us about education. Below this video will be a link which u can use for it. Because we closed the last 2 weeks with 80% of the profit. You also can learn how to do it.

XRP - How to trade extreme volatility😱❌✅✅👌🤠 Further to your comments, messages, questions: I have prepared this video to share some of my knowledge with you; especially the beginners.

In this video you will be shown how/why we have had success with taking PROFITS at the best rate and how we use our SUPPORT / RESISTANCE levels on the charts we share with you here to make the best with our trading.

We can not offer you investment advise but it's absolutely fine for you to hear more about what and how we trade so we have decided to allow you to receive our 'HOW TO TRADE EXTREME VOLATILITY' video with our personal ideas ( TC apply ).

More information here

Head and Shoulders - "Learn More Earn More" with usInverted Head and Shoulders Definition:

A head and shoulders pattern is also a trend reversal formation.

It is formed by a Valley (left shoulder), followed by a Lower Valley (head), and then another Higher Valley (right shoulder).

A “ Neckline ” is drawn by connecting the highest points of the two Peaks. Neckline resistance does not need to be strictly horizontal.

. This illustrates that the downward trend is coming to an end .

. When a Head and Shoulders formation is seen in an downtrend, it signifies a major reversal .

. The pattern is confirmed once the price breaches the neckline resistance .

In this example, we can easily see the head and shoulders pattern.

How to Trade the Head and Shoulders Pattern:

ENTRY:

we put an entry order below the neckline.

TARGET:

We can also calculate a target by measuring the high point of the head to the neckline.

This distance is approximately how far the price will move after it breaks the neckline.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader ?

Now, It's your turn !

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

Head and Shoulders - "Learn More Earn More" with usInverted Head and Shoulders Definition:

A head and shoulders pattern is also a trend reversal formation.

It is formed by a Valley (left shoulder), followed by a Lower Valley (head), and then another Higher Valley (right shoulder).

A “ Neckline ” is drawn by connecting the highest points of the two Peaks. Neckline resistance does not need to be strictly horizontal.

. This illustrates that the downward trend is coming to an end .

. When a Head and Shoulders formation is seen in an downtrend, it signifies a major reversal .

. The pattern is confirmed once the price breaches the neckline resistance .

In this example, we can easily see the head and shoulders pattern.

How to Trade the Head and Shoulders Pattern:

ENTRY:

we put an entry order below the neckline.

TARGET:

We can also calculate a target by measuring the high point of the head to the neckline.

This distance is approximately how far the price will move after it breaks the neckline.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader ?

Now, It's your turn !

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

Where fundamentals outshine TA, XRP and AlibabaIt is still the early days for many coins!

Over time we will see many coins die off as cryptocurrencies with stronger fundamentals and larger market caps live on. Comparable to the dotcom bubble in 2000.

I acknowledge there will be a period of time between this where it will be 'stormy' where the overall cryptocurrency market cap will increase. This is the best time to capitalize on projects that you dont see holding longevity.

I highly doubt this will be a completely alt coin friendly world.

XRP is an example of a coin with strong fundamentals (integration with banks, developed network) yet weak TA (not much to analyze)

Often you will see coins showing TA that promises huge potential (massive bull flags, huge falling wedges), yet will have weak fundamentals. This i see as bait.

Choose your cryptocurrencies wisely.

I am long XRP.

Bix

Ripple Prints High Volume, More To Come (Trade Inside 7X)Ripple used to get a lot of bad rep. from us cryptocurrency lovers... You know, the whole centralized stuff... Well, now the feeling is completely different, Ripple has become part of the market and we take it for what it is... Another altcoin that can be traded for profits for those who have the knowledge, patience, and experience to do so.

I also believe that the more choices we have the better it is for all of us...

Now, here is the full trade that you can use as an adjunct to your trades toolbox.

This is not financial advice, of course, all the information shared here is intended for educational and entertainment purposes only and can be used to help guide you find the important resistance levels and support on a chart... Everybody can use this information in whatever way they see fit, hopefully, to improve your trading skills and produce better results... See below!

After May, the altcoins market will start a process of sustained long-term growth.

Feel free to buy now and reload all your favorite altcoins... What is coming is a great opportunity if you prepare yourself before the action starts.

When everything starts moving, if you are not prepared, it is hard to make the right calls.

Always remember to take your time before taking any actions, buy/sell... Always wait/hold when in doubt... Build a plan/strategy before buying any coin.

This is Alan Masters.

Thanks a lot for your support.

Namaste.

XRPUSD 4H BUMP & RUN SHORT STRATEGYBump and Run Trading Strategy – Sell Rules

The Bump and Run trading strategy is one of the best reversal trading strategies that you’ll probably ever need to learn. The psychological reason why the Bump and Run reversal is such a powerful pattern is because it takes advantage of the result of excessive speculation. This propels the price too swiftly to the extreme which leads to a reversal.

Moving forward, we present the sell-side rules of the Bump and Run trading strategy:

Step #1: Wait until you can identify an uptrend (lead-in) and then an acceleration of that uptrend (Bump)

We’re breaking down the Bump and Run chart pattern into several steps. The first step is to identify an uptrend and then an acceleration of that uptrend. These two components of a trend constitute the first part of the Bump and Run Reversal.

*Note: A valid Bump and Run chart pattern has the first section of the trend drifting upwards very slowly and in the second part of the trend we need to see momentum picking up and the uptrend moving to the extreme.

Step #2: Draw the lead-in trendline that connects the lows during the first stage of the trend and draws a second trendline connecting the lows during the uptrend acceleration stage

The way you draw the trendline can be a subjective matter because there are several ways to do it and neither of them is better than the other. Ultimately, it all comes down to your experience and understanding of the price action.

Step #3: Sell Entry 1 at the break and close below the first Trendline , Sell Entry 2 at the break and close below Lead-in Trendline .

In order to maximize our potential profits we like to implement a two entries technique as follows:

Sell Entry 1 once the first trendline is broken. For confirmation of a valid breakout, we like to wait for the candle close below the trendline .

Sell Entry 2 once the Lead-in trendline is broken. Wait for confirmation of a valid breakout we like to wait for the candle close below the trendline .

During this stage, the market is in the process of reversal and the “Run” component of the Bump and Run chart pattern is formed.

The Run phase is identified when the price falls and breaks below the Lead-in trendline which also confirms that we’re in the process of reversing the previous trend.

The next logical thing we need to establish for the Bump and Run trading strategy is where to take profits.

Step #4: Take profit at the Lead-in trendline starting point

The ideal profit target for the Bump and Run trading strategy is at the Lead-in trendline starting point. In other words, take profits at the exact same level you use to draw your Lead-in trendline .

We encourage you to experiment different take profit strategies because the Bump and Run chart pattern can also lead to a severe reversal that can be the starting point of a big bearish trend .

Step #5: Place initial SL above the swing high created by the uptrend acceleration. Second SL placed above the Lead-in trendline breakout candle

Since we’re splitting our trade into two trades, we’re going to have two protective stop losses. The initial stop loss is placed just above the swing high created by the uptrend acceleration phase.

The second protective stop loss is placed above the candle that breaks the Lead-in trendline .

We’re adopting a very conservative approach here because if we truly have a reversal we consider that the market should not look back. In this regard, we keep our SL very tight.

We also recommend that once your second entry gets triggered to move your initial stop loss in the exact location as the SL2. This will guarantee you that even if you get stopped out on your second entry you’ll still be left with some profits.

*Note: The above was an example of a SELL trade… Use the same rules – but in reverse – for a BUY trade, but this time we’re going to use the inverse Bump and Run reversal.

XRP/USD Swing StrategyHi guys, here is a simple Swing Trading strategy for Ripple BINANCE:XRPUSDT

To trade this strategy manually you will need the SuperTrend indicator, paired with a 25 bars EMA as trend filter.

Set the ATR multiplier to 2 and the lookback to 3 bars.

Filter trades whose ADX on the 1 Day timeframe is below 12.

Backtest results below.

Configuration:

To get the indicator and automate the strategy, use the link below, thanks.

My Trading StrategyFirst of all it is always best to have a trading strategy before entering a trade as I have made many mistakes in the past with margin trading and I found this way is the most effortless and least straining psychologically method. As I believe this is a huge growth industry, currently I use a Ledger, which are readily available and a great way to store your currency. Replacing the popular margin trading with the more stable 'growth over time method' is safer and won't have you checking your phone every two minutes, checking prices.. For reference currently I plan on holding my cryptocurrency for 20+ years, and passing the ledger onto my family or my kids, for their benefit at the time. I put the most emphasis on the psychological aspect as most trading does take a toll on your wellbeing and state of mind, while simply riding the ups and downs of the market is very satisfying. Constructive criticism / feedback encouraged! Buy and HODL!

Ripple | Holding the Bottom Support ..!!XRP/USD (Update)

Ripple price is still struggling to gain momentum and declining below $0.1920 against the US dollar.

In Bigger TF Chart, XRPUSD Is Forming Wedge Pattern & Holding Bottom Support As well.

Recently, Ripple (XRP) Hits 27-Month Low & Now holding the Bottom Support.!!

Ripple’s price action in 2020 will largely depend on the movement in Bitcoin’s market.

For instance, the 2020 Bitcoin halving event is expected to drive the price to highs above $20000. The correlation between the assets will impact XRPUSD into a bullish rally and could pull the price to levels above $1.0.

However, I still believe 0.9$ is a very conservative price for XRP.After Wedge Breakout.

Ripple Regulation..!!

Ripple has particularly struggled with regulation for its XRP cryptocurrency, especially in the United States.

The Securities and Exchange Commission (SEC) is torn between categorizing XRP as a security token or leave it to ride along as crypto.

However, XRP has gained traction in the United Kingdom, which recently referred to it as crypto, just like Ethereum.

Many experts and enthusiasts believe that unclear regulations for the industry are stifling innovation.

Ripple Future and Growth

Ripple is often regarded as the future of cryptocurrencies in terms of technology infrastructure as well as mainstream adoption.

Armed with its flagship products: RippleNet and xRapid the network is set to be the bridge between cryptocurrencies and the traditional banking system.

More importantly, Ripple believes that it will soon overtake SWIFT to become the preferred cross-border money transfer platform.

SWIFT has its own share of struggles that are dealing with including long processing time and unreliability.

On the other hand, Ripple as mentioned above already has signed partnerships with more than 200 banking institutions.

Besides, this number is expected to grow with the current expansion to the Middle East and the Asian regions.

Ripple’s XRP demand in the future will mainly come from banks as adoption increases supported by the need to send money across the border faster, reliably and a low cost.

Please like, subscribe and share your ideas and charts with the community!

XRP 11 11 windowIndiana had daylight savings time which means these charts can change on me by an hr forward. This being said the time is now gaged 10 - 12 am for me until I can see how it lines up. Overall we know we get a nice move usually 1hr or 12 hrs off the 11am / 11pm markers

I call this the window of structure formation when I trade XRP. Reversals tend to happen for accumulation or trend testing / continuation. Pivot points develop around this time. Catch the right pivot then ya might catch a leg C to D or D to E around this time. Use it to your advantage when you are counting up your signals for your bias. It will help. If we are on 11-2 of the 1333911-2 pattern we will repeat 1 impulse with a 3 to the third power move to follow after. Thus giving us 9 moves into the direction from the "1" impulse.

1 - look for the first impulse leg

333 - The onion layers kaleidoscope trade formula

9 - total moves 3 tests 3 rejects 3 patterns

11 - Window of opportunity time

2 - There is always 2 strong opportunities in a structure a buy or sell off the 11am and 11pm price action within 3hrs 9 - 12 am window for this to develop. It is best to trade this idea every other day and NOT on Mondays.

I don't expect a lot to understand this....but those with trading experience will see what kind of structure these could create and what follows. If we fall after Swell and cannot hold above .30 well we will see a discounted price for the rest of the year. If we hold above .30 then hell yes we can go to .50 cents

But we need to show that buyers have become so strong we change our level of support from .25 to .30

Makes sense right? Much love everyone. Trade safe as always.