Smartmoney

S2D FLIPHello traders

-In this example, we will explain how to trade the S2D pattern.

-S2D is a pattern in which the supply zone loses control, and the new demand zone takes control.

- In the next steps, we will break down the example we have here in detail.

1) The price is in a downtrend, and demand has full control.

2) Then we see a reaction from the demand zone to HTF, after the reaction, the price starts bullish.

3) The price breaks the supply zone and continues impulsively towards the uptrend. When the price breaks supply, we can expect a change in direction.

4) Momentum is present, and we clearly see that the price has broken the structure and wants to change direction.

5) We can see a new demand zone now taking complete control, and the price continues to be bullish.

Leave a like, and if you have additional questions, you can ask us in the comment below.

MONEY MANAGEMENT: The MOST Important Aspect of TradingIf you are a professional trader or plan to become one, Money Management is your #1 job. You could be the best chart reader or statement analyzer in the world but if you have poor money management you will still fail. In order to succeed you first have to last, and to last in the trading business you must be able to handle risk and manage it accordingly.

How you handle Money Management comes down to a few simple things:

Risk limits

- This consist of knowing your risk per trade, your max drawdown, and buying power limitations.

○ Risk per trade: This is the amount you are willing to lose if the trade goes against you and stops out (remember to always have a stop loss). Many traders refer to this as Risk Units or simply 'R'. This should be a defined amount that does not vary based on emotion. If you do use different risk for different trades you should have that clearly defined in your trading plan otherwise each trade should be the same. Risk per trade should be around 1% for experienced traders and $10 for new traders as they work towards slowly raising risk with consistency.

○ Max drawdown: This is the max amount you are able to lose per timeframe. For example, a day trader may have a max drawdown of 3R per day, 7R per week, and 13R per month. Max drawdown demands that if you lose that amount in that timeframe you are to be done trading until the next one. This helps traders from spiraling out of control and blowing up a trading account.

○ Buying Power Limitations: Knowing how many trades you are able to take at one time will help define your strategy.

Expectations

- This consist of knowing your expectancy and timeline

○ Expectancy: Your trade expectancy is the most important stat in all of trading. It tells you what you expect to make per trade. In order to properly manage risk you have to be sure that the strategy is worth it. The expectancy stat is how you do just that. For more info about expectancy check out my post on it here

○ Timeline: Everything takes time. Trading is no different. Having a realistic expectation about your timeline and how much you are going to make is a critical element in helping traders stay focused on their goals and not fall into a get rich quick scheme. If you expect your trading career will take 3-5 years to become profitable you will manage your money much better than someone who expects full time profits in under 1 year.

Yourself

- This consist of knowing your personality and trading plan

○ Personality: What is your personality like? Are you a jittery person or are you robotic. Knowing this will help build a management that you can trust and are able to follow.

○ Trading Plan: Make sure your trading plan fits your trading style. You have to take many things into consideration here such as time constraints, goals, and personality. It takes time to figure out what works for you.

If you can determine how to handle these three factors then you will be well positioned to not struggle with money management. After you have the fundamentals written in your trading plan all it comes down to is staying disciplined and following the rules set for yourself. Clearly define your limits, have an expectation, know thyself.

Thanks for reading, follow @Jlaing for more educational post about Money Management, Trading Stats, and more. I also stream a stock day trading chat room every morning at 9:15 EST right here on TradingView, come check it out and say what's up.

HTF direction LTF execution Hello traders

-In this example, we have explained the high probability setup after a reaction from a strong supply zone.

- Here, we have an entry after the reaction from the supply zone, which we will break down in detail in the following steps;

1) We can see that the price is in a downtrend, and supply has full control.

2) The price moves towards the supply zone, and make liquidity

3) In one move, the price picks up liquidity, and we see a good reaction from the supply zone.

4) An impulsive reaction from the supply zone tells us that we have a strong supply zone and we can expect a downtrend

5) After the reaction from the supply zone, we see a nice momentum, and then the price starts to pullback to our entry.

6) The price creates liquidity, that's another positive confirmation we see here.

7) We currently have everything we want to see, and the price from our entry is expected to continue impulsively towards the downtrend

- It is very important to read the PA in detail in order to understand the psychology behind the PA and to more easily recognize your high probability setup.

-Other people do not look at the market the way we do. They do not look at everything in detail. They don't know that this is necessary because if they do not understand the language of the market, they will have a lot of problems.

-It is hard, it requires time and hard work, and you need to be eager and well disciplined.

-Once we learn the language of the market and the way it communicates with us, we will always be able to understand what the market is saying to us.

- Don't forget to leave a like, if you have any questions, write us below in the comments.

EXPECTANCY: The Golden Key StatisticWhat is Expectancy?

Expectancy is the one of the most important statistics in trading. Expectancy is how much you expect to make per trade. If you have an expectancy of 0.3 that means you make 30% of your average risk per trade. If you risk $1000 per trade, then you would receive $300 on average for EVERY time you took a trade.

The baseline for a worthwhile & profitable strategy for most traders is an expectancy of 0.25 or higher. Anything more than 0.5 is outstanding.

How do you calculate expectancy?

A few different ways:

(gross profit/# of trades)/Avg. Risk

or

((Win%*Avg. Win)-(1-Win%*Avg. Loss))/Avg. Risk

The table on the chart breaks down the required Win% and Profit/Loss ratio needed for an expectancy greater than 0.25. As you can see there are multiple ways to build a profitable strategy.

What does Expectancy tell you?

Expectancy is a crucial stat for traders because it lets them know if their strategy is valuable. The only way to know your expectancy is to track your trades! Tracking your trades is an essential part of the job as a trader yet many fail to do so. It can be done for free with some simple spreadsheet formulas and a bit of time. Track your trades, review your stats, improves your trades. Rinse & repeat.

Thanks for reading, follow @Jlaing for more educational post about Money Management, Trading Stats, and more. I also stream a stock day trading chat room every morning at 9:15 EST right here on TradingView, come check it out and say what's up.

The true thinking process of the banks - Forex Master Pattern

Hello there traders, in this article I have compressed information which will be useful for every trader. There is this trading methodology which very little know of (Even though its public information) that revolves around a market cycle which consist of an contraction, expansion, and trend.

This article will just open the doors to your understanding of these principles, and will just go over the basics, to master it you must practice it a lot and identify many different zones in the markets.

Practice Makes Perfect

__________________________________________________________________________________________________________________________________________________________________

What will be gone over in this article?

This article will explain what exactly are contraction phases, expansions, and trends and how to identify these different market phases.

Get a basic understanding of what institutional traders look for and how they operate vs Retail.

What exactly is the value line and how it acts like the "center of gravity".

__________________________________________________________________________________________________________________________________________________________________

What is the Forex Master Pattern?

The “Forex Master Pattern”, is a alternative type of Technical Analysis which shows the true psychological patterns of the Financial Markets. This pattern has 3 Phases, which is known as the Contraction, Expansion, and the Trend Phase, which will complete one market cycle in this term.

This pattern also creates a concept known as the “value line,” which is the fair value zone or the neutral belief zone where buyers and sellers agree is the fair value. Consider it in terms of the center of gravity.

This pattern is present on every timeframe and in every market with enough liquidity and volume, and shows the behavior, psychology and activity of retail, professional traders, institutional traders and investors and market makers.

__________________________________________________________________________________________________________________________________________________________________

The Contraction Phase

The contraction phase is the setup and it indicates a period that the market is in consolidation, with a tight and narrow range. During the contraction phase there is going to be low institutional volume and they are avoiding positions and trades. It is best to avoid trade entries in this phase and wait for a clear trend after the expansion.

The Expansion Phase

The expansion phase is the play and its when the institutional traders begin to accumulate positions. There are many things that institutional traders would do in this phase. If the institutional trader or "market maker", main goal is to buy the asset, they will drive the price lower with their money to draw in retail traders to place shorts and sell their positions which will generate liquidity for "smart money" to buy cheaper. and vice versa.

If the institutional trader or "market maker", main goal is to sell then they will make the price go up a little with their own money to lure in traders who will buy their bags so that "smart money", can sell in a profit and overvalued.

The Trend Phase

The trend phase is the final phase that completes this market cycle. Once the institutional traders feel like it is time for them to start taking profits, will commence the distribution cycle which causes price to move down. All this profit taking from "smart money", will eventually lead retail traders to understanding that they were in the wrong side of the trade and the panic, liquidations, and stops start. Eventually they panic and start buying back in, and this generates liquidity for institutional investors and traders to take profits, leaving retail with overvalued bags, for the cycle to repeat itself again.

For the short scenario it'll be a vice versa too, they will move price up with their own money, cause retail to believe the price is going up so that they get into wrong trades (Retail buys, Smart Money Shorts), they start accumulating short positions or selling their bag and with the trend drive price back to value or even below, and at this point retail again begin the panic, liquidations, and get stopped, and ultimately sell their bags to institutional traders who buy at a discount.

This pattern is also similar to the accumulation and distribution cycle and are basically the same theories with different executions.

__________________________________________________________________________________________________________________________________________________________________

What is the value line?

Previously in this article I have explained how contraction zones create fair value lines. Value lines can be described as the average price and the neutral belief zone for price. It sorta acts like an center of gravity. Knowing the HTF value lines can be your key to success since you will understand the general direction of the market.

Value lines help you visually understand what territory the market is in, like if its consolidating at value you should avoid entering any trade at all cost and wait for the expansion and perhaps the trend.

These value lines and contractions can also be used to find certain broadening wedge ranges and the longer price stays in a proper broadening wedge the more volatile it will get. The broadening wedge starting from the origin of the contraction is rare to find but can create some pretty good scalping environments and conditions.

Conclusion:

Well I hope this was educational, and it gives you another way of understanding the markets. This article was pretty basic in understanding this pattern and methodology but hopefully now you have more awareness. The best way to start understanding these principles is to practice in the charts and learn to identify the three phases.

This isn't a strategy but more like a theory or a concept which explains the behavior of the market. With proper understanding you can create many different strategies since this is extremely versatile and works on any market and timeframe if the liquidity is there.

So go on the charts and try to identify the three phases and see how you can improve your trading game!.

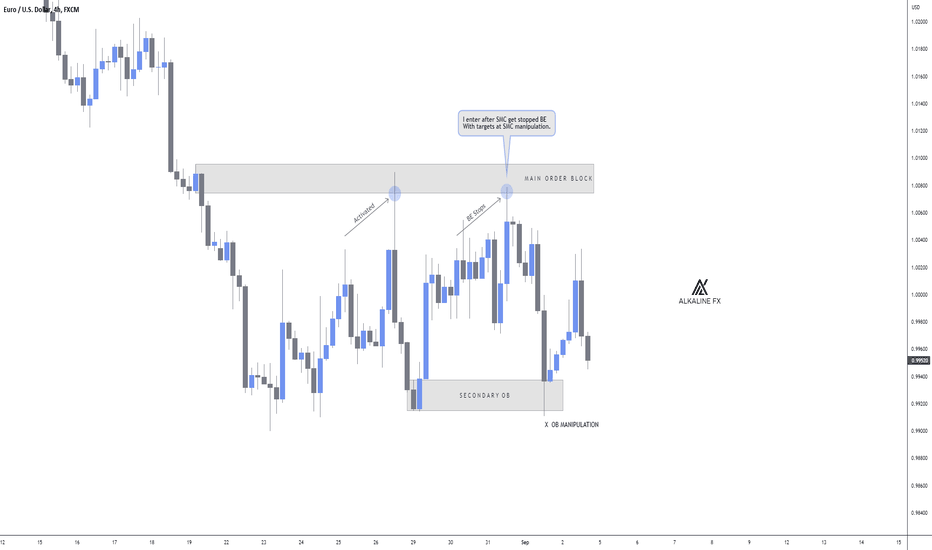

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋

What is IDO? Benefits and Risk WHAT IS IDO? SHOULD YOU BUY LAUNCHPAD TOKENS?

What is an IDO?

The initial decentralized offer is the process of selling tokens early on decentralized exchanges for new crypto projects (DEX). "IDO" - Initial Dex Offering. Decentralized intermediary exchanges help new blockchain companies sell their tokens. IDO is a common way to get people to invest in a crypto project. It works in a way that is similar to an IPO, which is when shares are sold on the stock market.

IDO takes place in two steps:

Tokens can only be used by a small group of people. On average, one participant gets a "allocation" of $100 to $1,000, but it depends on the project and could be more. Start of business. After being made, tokens are put in a pool where they can be sold. At this point, they can already be traded.

How IDO works?

With the help of decentralized exchanges (DEX), putting tokens into action is much easier. The project team issues its tokens on the chosen platform, and the exchange is already selling and transferring tokens. People buy them, which helps pay for the project. The main benefit of this method of promotion for the developer is that the process is automated. On DEX exchanges, everything is automated using smart contracts, so the developer doesn't have to deal with each sale and purchase.

Here are some basic rules about how IDO works:

From the start, the project is tested on the chosen DEX, and only after that can it be used for IDO. If the "exam" doesn't go well, they won't be able to enter IDO. Then, they sell a certain number of tokens for a set price. Buyers block their money, and the amount of assets they bought is given to them. After tokens are made, they are given to people (TGE). To buy, you have to be on the list of investors who have been checked out (White paper). For verification, you need either an address for a crypto wallet or the completion of tasks set by the project. The project team gets the money from the sale of digital assets, minus the money that goes into the liquidity pool. When the tokens are unlocked, they can be traded after the purchase. Coins can be locked for a few months or even a few years, depending on the project. During the attraction of investments in the project, the tokens are not liquid.

Participation in IDO

To join IDO, you'll need the following:

- Metamask or another active cryptocurrency wallet;

- Enough money in the right stablecoin to buy tokens and pay for exchange fees;

- Set up the connection to the DApps.

Make sure you have enough money in your account to cover the cost of transactions before you buy tokens. After connecting the DApp, you need to follow the instructions, which may be slightly different on each exchange. When a user buys tokens, he or she gets to keep them. When the generation period is over, the money is moved to the crypto wallet. Please keep in mind that the terms of the exchange say that assets may be locked for a while or used to stake. Before agreeing to the project's terms, you should carefully read the instructions.

IDO's Safety Measures

There are risks involved in any activity that has to do with buying assets. This is especially true when real money is used to buy virtual tokens in the crypto ecosystem. You have to do exactly what is said.

A few rules to follow in IDO to stay safe:

- Check out the link to sign up. Scammers can offer a fake link when they want to send money to a project. If you use it, the money will go to the attackers and not to the platform. This means you can forget about tokens. Look for strange redirects.

- Think about what you want to say. Project ideas are usually posted on well-known, popular exchanges, but not always there.

- Don't put money in until you've looked into the project. All of the information about the founder and his team needs to be carefully looked at. Most of the time, projects that make money are made by professionals who have done it before.

- Pay close attention to the terms. Based on the rules of the exchange, tokens could be blocked for a long time. You need to know what to expect ahead of time.

- Mentally say goodbye to the invested amount. The most important rule of investing is that you should only invest money that you don't mind losing if something goes wrong. IDO is not a way to make money where you have to put in money. Not because it was a scam, but because it took so long to pay back.

What will happen to IDO?

The rules for initial public offerings that are decentralized are always changing. There are new ways to trade coming up. The IDO (Initial Farm Offer) scheme is as popular as the IFO (Initial Farm Offer) scheme. The biggest problem with IDO is that assets have to be frozen before they can be released into the pool. So, you can only make money with tokens after a while. How many people take part in the trade determines how many digital coins the investor will get in the end. To attract big investors, basic and unlimited sale are added as new functions. IDO is one of the most popular ways to get money for a project right now, so they will become even more popular and better in the future.

IDO's +

- Using this method to get investments has a number of benefits:

- Investors and developers don't work directly with each other. Instead, they work through an exchange, so the investor doesn't have to trust the smart contracts of the project.

- Part of the money raised is put into the pools so that there will be a market for trading tokens after the sale.

- To make a transaction, you don't need to give any personal information; all you need is an active crypto wallet. The project can be used by anyone.

- At first, little-known tokens can attract investors, but it would be hard for them to do so through large, centralized exchanges.

- IDOs let you buy a limited number of tokens, so that more people can put money into the project. This cuts down on the risks.

IDO's -

- Among the things that are bad about the IDO scheme, the following stand out:

- Not enough good protection. The project is open to everyone. There is no guarantee that someone won't use IDO to launder money or do other illegal things.

- There is no proof. Through initial decentralized offerings, it is easier to spread tokens that don't have very high ratings.

Launchpads and IDO (launch pads). Should you buy launchpad tokens?

Launchpad is a place where people can invest in new crypto projects. Money can be raised so that tokens can be released, developed, and improved. The most important thing that platforms do is bring together investors and blockchain developers into one crypto community. When people invest in digital assets, they want to get virtual currency at a good price. Before the project is published, it must be checked out to protect investors from fraud. The more popular and larger the launchpad, the higher the requirements are for crypto projects. At the same time, most online IDOs are just scams, and the number of these projects is growing all the time. To pick a good IDO, you have to look at a lot of information. The best way to avoid a scam is to do your own research (DYOR). After careful analysis, the choice should be based on objective criteria. he launch of a project on two top platforms at the same time is a good sign. In this case, it doesn't matter which launchpad to use.

Investors. Be sure to research the investors and only trust those on the so-called "white list" if that is at all possible.

Terms. Paying enough attention to the project's tokenomics is important. For example, some proposals say that you can get assets in a few years. Long-term investments in small projects are risky in a world where things change quickly. You should always think about whether the game is worth your time.

If the project isn't shown on trusted platforms and investors from the Whitelist aren't involved, it's not a good idea for a beginner to take them on. You can try to learn about tokenomics by looking at the best projects. After you've mastered the details, you can try more risky launches, but only after you've done a thorough objective analysis.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

Volume profile confirmationsWatch this clip to learn how the volume profile can be used as an extra confirmation when looking for optimal entry criteria.

What to do when you do not have any good POIsWatch this video to learn how to adjust your thought process when the market does not give you any valid POIs to work with. I struggled with this for a long time.

ORDERFLOW & LIQUIDITYPlease like, share & comment on my educational post.

--------------

After a BOS we expect price to pullback and

mitigate a significant zone in the previous

range before continuing

to break structure again.

If we do not get this mitigation it is likely that the

high/low that failed to mitigate will become liquidity.