Build Confidence with Heikin-Ashi Candle Patternow to Trade Using Heikin Ashi Candles on the NDX Chart

Heikin Ashi candles are a powerful tool for filtering out market noise and identifying trends more clearly than traditional candlesticks. By smoothing out price action, they allow traders to focus on the overall direction of the market, helping you make more informed trading decisions. Here’s a breakdown of how to use Heikin Ashi candles effectively, specifically on the NDX chart.

1. How to Read Heikin Ashi Candles

The primary difference between Heikin Ashi and traditional candlesticks is in how they are calculated. Heikin Ashi uses a modified formula that incorporates the open, close, high, and low prices of the previous candle, which results in a smoother appearance. This smoothing effect allows traders to more easily spot trends:

Bullish Trends: A series of green candles with no lower wicks typically indicates a strong uptrend. These are the times to consider long trades.

Bearish Trends: A series of red candles with no upper wicks signals a strong downtrend. These are great opportunities for short positions.

Consolidation: Mixed green and red candles with wicks on both ends often indicate consolidation or indecision in the market.

The Heikin Ashi chart reduces the noise from minor price fluctuations, allowing you to focus on the trend itself rather than the short-term volatility.

2. Entry and Exit Points

The beauty of Heikin Ashi candles lies in their ability to simplify entries and exits. Here’s how to use them:

Entry Points: You want to enter a trade when a new trend is confirmed. For a long position, wait for the first few green Heikin Ashi candles after a period of red ones, signaling a reversal to the upside. For a short position, look for a sequence of red candles after a bullish period has ended.

Exit Points: Exit your trade when you start seeing signs of reversal. For long trades, this would be the appearance of the first red Heikin Ashi candle after a series of green ones. For short trades, exit when the first green candle appears after a bearish sequence.

Waiting for these clear signals helps avoid premature exits and ensures that you’re riding the trend for as long as possible.

3. Key Support and Resistance Levels

Heikin Ashi works even better when combined with key support and resistance levels. On the NDX chart, identifying these levels provides context for your trades:

Support Levels: If the price is approaching a key support level, and you start to see bullish Heikin Ashi candles, it’s a potential buy signal.

Resistance Levels: If the price is approaching resistance and bearish Heikin Ashi candles begin forming, that could signal a good time to sell or short.

Using Heikin Ashi in conjunction with these levels increases the probability of success by ensuring you are trading within important zones where price action tends to react.

By mastering the use of Heikin Ashi candles and combining them with support and resistance, you can significantly improve your ability to spot and act on high-probability trading opportunities, especially on volatile instruments like NDX.

SPX (S&P 500 Index)

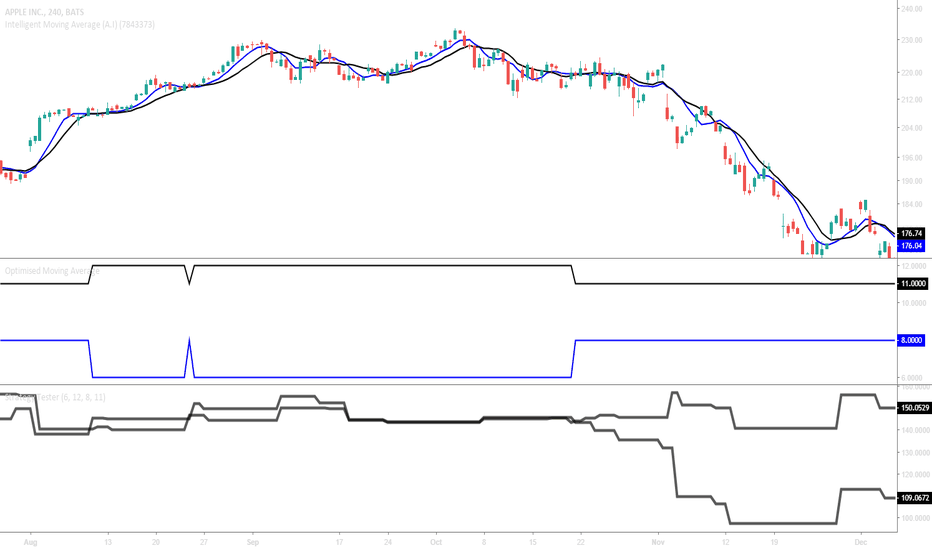

SPY/QQQ Plan Your Trade 7-20 - PineScript Project FeedbackI've been playing with this little project for about 7 hours now (off and on). Pinescript is fun once you get the hang of the syntax and how it expects objects/booleans for most of the conditionals.

Overall, I think this project is moving along nicely, but I wanted some feedback on the visuals.

I'm trying to create something that will help daytraders see and understand broad trends arising from shorter-term price swings.

I get a lot of questions related to how/when to identify key market price reversals - so I'm trying to develop a way to help traders understand and see where opportunities exist for better trades.

Watch this video and let me know if you see anything I can do to improve the visuals or color controls.

I want this to SHINE so people fall in love with it.

Thank you.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

New Volume Footprint option on TradingViewHi all,

This is the first (stream replacement) educational video with a very quick overview of volume. Tradingview just released the new Footprint Beta tool. It's something I asked them for a long time ago, so I am glad it's finally here!

In this video I cover the time-price-opportunity tool as well as visible and fixed range. Leading into footprint.

This is not a deep dive, it's more an intro to and how these things come together. If there is enough interest in this idea I will create a sequence based on trading volume in depth.

Thanks for watching! See you on the next stream/idea.

Why Price Matters - SPX to $4200The SPX reversal to $4,200 provides an opportunity to learn from the pros and get back to the basics of trading. This means understanding the numbers and being able to buy things wholesale and sell them at a retail price. With this knowledge, you can be a successful trader.

S&P 500 A study of Market Cycles: Will History Repeat Itself?This video is a study of the history of The stock market when it comes to bull cycles and consolidation/ranging periods, which I think is a very educational thing to investigate in a period of market correction like the one we are currently living in. Please also refer to the Important Risk Notice.

Why the S&P500 Micro Futures is one of the best markets to trade Hey Traders so today I wanted to show you a great market to consider trading the S&P500 Micro Futures. I think it is one of the easiest markets to learn vs the Forex and others. It offers great leverage and really good risk vs reward. Of course futures are different from stocks, crypto and forex. The are considered high risk because of the volatility and leverage. But definitely I think they are a good asset class to consider adding to every traders portfolio with the right risk management. Plus this market is a great way to start capturing all the great gains that the stock market has had in the last 10 years. As long as the bull market continues I think this market will remain strong.

Enjoy!

Trade Well,

Clifford

A "Welcome to" Pinescript codingThis simple idea is an intro to @TradingView & @PineCoders

Nothing fancy or complex, if you are already coding - you can skip this.

simple MA build walk through & adding a second MA.

If you want to get into coding, then here's the basic introduction.

FYI - I am not a coder, 21 years trading experience and know a bit about the instruments - but new to actual coding, especially in Pine.

Hope it helps someone!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

The Importance of Correlating Assets Hello Traders,

In today's lecture I'm explaining the importance of monitoring correlating assets to help give us early clues about the major asset we're looking to trade.

When trading EURUSD, I like to look at 6 correlating assets. They are as follows:

GBPUSD

DXY

GOLD

SPX

DAX

I hope you find this video to be informative and educational to allow you to add correlating assets as a strategy approach when trade planning.

Always remember to trade safe - trade well.

~Michael Harding

Beginner TF Matching SystemA couple of people are trying this system I created, both have no previous knowledge of trading. This method is designed for people who are new to trading. This is system is suitable for strocks, forex, crypto, futures etc.They are also using it on an options demo account. Lets see how they go.

Made 45$/Hour With Scalping Indicator on SPY Live TradingIn this video, we went over the trades.

Thanks for watching.

Please support my work by sharing this video with other investors and traders.

Don't forget to smash that like button here and drop a follow.

See you guys tomorrow.

Take it easy.

~Bo

Learn These Strategies to Day Trade Against The Market!!!Key things to take away from this:

TD9 is still giving a bear market state.

Day traders can sell any selling opportunities if they think the bear is on.

Any selling opportunity will most likely to work out.

Trump's announcement called some people down. I am expecting the market to go up to set a good shorting opportunity.

Take it easy team.

See you on the next one.

~Bo Bugra

When the S&P500 catches the fluIn this screencast I look at the S&P500 on the 4H time frame only. I show how I estimate the probable direction (this does not mean prediction).

I give some information on why the markets are reacting to a low grade coronavirus called 2019-nCOV (same family as MERS and SARS).

Disclaimer: This is not trading advice. If you make decisions based on this screencast and lose your money, kindly sue yourself.

US Stock Markets: And what's Mueller got to do with you?!This screencast is speculative - and I invite the full brain power of Tradingview's community to consider the variables which might affect the US Stock Markets around this time. Let's do this together.

The stock market has retreated, probably due to nerves about the Mueller report - among several other things. If the report contains nothing on which Trump is impeachable then, I'm expecting a pump north.

Mueller's hit list so far has been :

1. PAUL MANAFORT

2. RICK GATES

3. MICHAEL COHEN

4. MICHAEL FLYNN

5. GEORGE PAPADOPOULOS

6. ALEX VAN DER ZWAAN

7. RICHARD PINEDO

(Names are in all caps only due to copy and pasting. Names and convictions are all in the public domain, so I'm not defaming anybody.)

Some may think that with so much dirt around it's unlikely that Trump will come out of this clean. Hey, this bull market is about Trump - let's not debate that. If Trump goes down the markets go down like lead balloons. Alternatively, if Trump comes out clean enough, expect bullish moves which may then be limited by other factors.

Separate to Mueller's investigation and report, there are 16 other investigations into Trump. If just one sticks, there could be catastrophic collapse of the American markets - with shock waves globally, hitting Forex as well.

We have other variables to consider :

1. The Fed 'money printing' press going to be turned up.

2. Bleaker than expected economic projections by the Fed and Draghi.

3. Expected weaker US Dollar - creating bullish pressure in the long term.

4. Flattening or inverted yield curves

5. Uncertainty's and delays on deals with China.

6. Potential Brexit shock waves.

7. Germany struggling against recession.

8. 'Housing' market bubbles in several countries including the US, in trouble.

9. US and Global debt totally out of control.

10 etc. .. and much more.

Sorry - I don't know what's gonna happen. I do not give tips on entry positions.

Stock buyback failures could herald a crashThe SPBUYUP index has not been shown in a published idea on Tradingview before now (I checked). It is the index which tells how much companies are buying back their own stock to keep the S&P500 afloat.

So if this fails, market 'manipulations' of the S&P500 could fail. Of course, this not the only thing that influences the S&P500 but it is a significant marker of influence or lack of it.

Today's Lesson (#5) : How trade possible market manipulations.Before playing that video, be aware that I'm a very agressive trader, which means high level of risk into trying to copy my trades. The quality in those videos comes out of their content, not just following blindly. I'll be trading this with low leverage as this is highly speculative. So please don't just follow blindly but just take the educational content out of this to learn how to trade manipulated market more "safely", still being aware that this remain high risky thing !