Argentine Telecom deep discount breakout on falling wedgeTEO breaks out of deep falling wedge from half its value earlier in year.

* Paid a 17.45% dividend last year and known for double digit dividends

* Telecom 5G play for new subscribers in 2019, or watch until 2019 entry at higher price, likely near $30.

* Growing mid-cap telecom, cable, cellular provider

* Fell out of favor on negative earnings miss building infrastructure

* Revenue growth +35%, Revenue change +24%

* Currently only 20% large fund ownership, which will grow with 5G emergence

* Breaking out from bottom just above $15 and below $20 and going up.

Viewers come to own conclusions with charts and investing.

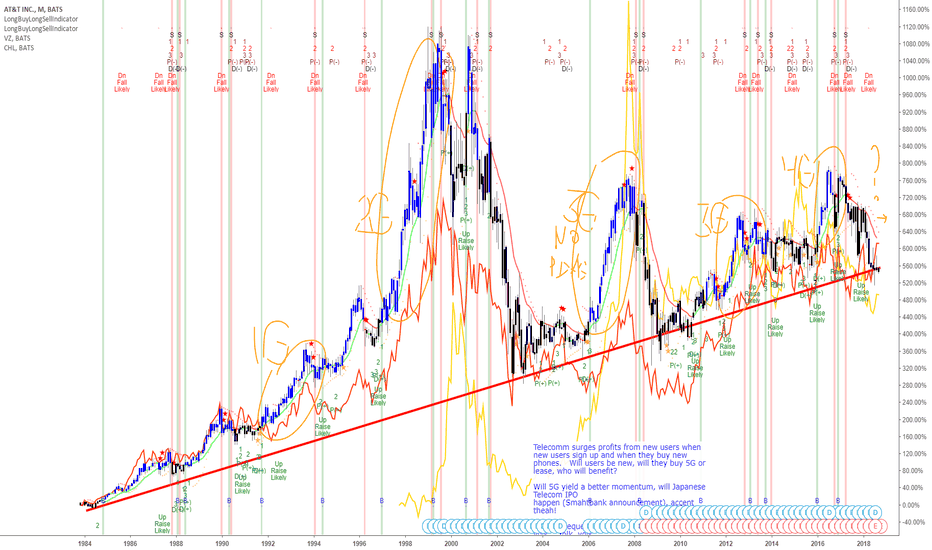

5g

ORCL - Oracle stock dominated by mobile architecture JavascriptORCL

Oracle (large cap.) offers a 1.59% dividend with current stock prices.

Dividend has not been raised since end early 2017 and overdue.

Top Oracle Software Exec. taking leave of absence per WSJ 9.7.18

Oracle 5G CUPS is new control and user plan software architecture partially introduced in 4G & to be fully integrated in 5G and help support cloud data integration & support SaaS.

* Dividend $0.19/Q, or 0.78/yr, which at $47.81 is a 1.59% yield.

* 5G will generate profits in late 2019 and slightly earlier for SaaS services

* Key markets healthcare, transportation, blazing internet, smart cities, energy security, aka billions of devices coming on-line

* In Aug. a pension fund started lawsuite with Oracle, accusing them of farbricating cloud sales and creating unstable sales model. In reviewing their chart, they are just like the spikes of major telecomm stocks associated with 1G-2G-PDA-3G-4G-4G LTE and soon 5G in 2019-2020.

* The past year was anything but stable for ORCL, which is more like telecomm stocks than IT/Software stocks.

* #needstodiversify

This posting is for own reference. Come to own conclusions. Comments welcomed.

QCOM, AAPL, OLED - Coincidence on new iphone plans?TELECOM Sector

Qualcomm snapdragon chips tend to go into cell phones #QCOM

Apple introducing new iphone as release X a fake release to 5G #AAPL

OLED displays are the best in the market #OLED

STM chips for ASIC might be made by someone else #whoknows

AXTI 3D sensors might have competition ?? #whoknows (not PM)

Yes, I left out AMD, which might be making the GPU, who knows ?? #toolate-shipsailing

Am I more interested in Softbank comment on new Japanese Telecom Carrier IP and needing big investments from banks.

Bought OLED in August. QCOM in Sept. Sold AXTI for now...3D sensor users needed. STM well holding on for no good reason.

These are all prognostications and viewers come to own sense of reality, investing, and humor.

Samsung / 5G-Apple here's a new product idea: I'd love to see a whole house smart phone system. Every phone has WIFI, display, GPU, etc. for under $1K or abouts.

AMAT Gap Down on Guidance - Right Down to Strong Support. . .Applied Materials fell hard on guidance today. Did AMAT stock get put on clearance sale with the drop?

Whether or not the stock deserved to fall almost double-digit percentages on the day is subject to debate, but the important thing is it fell to a very strong support level - and the tech story continues to look good.

Thank you for for lending me your attention!

AMAT provides equipment and support for chipmakers. There are several reasons why chipmakers are going to see robust business in the coming months and years - AI, automation, blockchain, I.o.T, data, etc. - meaning Applied Materials' customer base is ready and willing to do robust business with the company. As the automation and data gold rush continues, AMAT's customers will be buying more and more equipment and services.

There's also the 5G wildcard - while slow adoption of 5G technology doesn't necessarily hurt AMAT's business, a 5G tech connectivity boom would be a great boon to AMAT's prospects.

The technicals are as good a story as the fundamentals. Applied Materials fell from the low\mid $50's to close around $49.50 (down a little more than 8%) on 5/18. Looking back on the chart, we can see that the $48 area provides a strong support floor. AMAT approached that support zone intraday as selling momentum pushed price lower during the early trading hours - and selling pressure as well as lackadaisical summer trading may see price through to lower levels in the coming week or two - but Applied Mat'ls miss on expected guidance doesn't change the overall situation of the company or the tech sector.

Gaps like these tend to fill. Look for price to trend higher as tech remains strong and the chip manufacturers continue to buy products and services from AMAT, and as traders take advantage of the early Memorial Day sale price of Applied Materials' stock.

Please like, follow, and share, and maybe we can have fun and do great things together.

Thanks again!

See it on the site: holsturr.com/category/markets/charts/

** For speculative and research purposes only - good luck! **

2H Growth & Acquisition Friendly (PT: $9.00)Second half of the year has already been projected by various telecom companies and suppliers to be strong and accelerated compared to the first half. Seasonally weak Q1 numbers came in almost across the board. However, NPTN managed to not do as badly as most had anticipated, hence the growth in March fueled by positive sentiment that momentum was returning.

NPTN has repeatedly shown that it will dip under its overall trend lines (red+yellow) and return fiercely for some gains. It will take a stable, forward looking market with growth and momentum to get it back to $9. However, in the short term, I can easily see it retracing back up towards $7.50 before some profits are taken and the price drops back around $6.50. NPTN guided for a solid Q2, though the ZTE news may have a bit of a negative effect on it. However, that news has probably been baked into the current price, which is in part why it's dropped to where it is now. Ignore the Huawei noise, as China talks are at least still neutral, but moving forward again with additional talks and likely more extensions for negotiations.

Q3 guidance should remain the same, specifically focused on getting margins up with flat revenue compared to Q2. Anything above that, and we've got a rocket that will easily coast to $8 I think. Sales and growth into its strongest areas of 400G and 600G continue, with Verizon and others quickly deploying and growing 5G capabilities that NPTN participates in. Additionally, now that LITE has chosen to buy OCLR, the speculation that NPTN could be acquired escalated, so owning a piece of NPTN has additional leverage.

T-Mobile [1d chart] - Hangin' at Support, Upside in a Neat RangeThere's a lot going on with T-Mobile lately.

Despite the Great 5G Debate, regulatory concerns, and a third-times-the-charm merger attempt with Sprint, T-Mobile is trading in a somewhat predictable, relatively established range.

Thank you in advance for your attention!

The fundamentals of the stock put it in a precarious spot with outside uncontrollable governmental and economic forces dictating the speculative sentiment of its price, but from a technical standpoint, TMUS is offering buyers a cheap entry point at the bottom of a short-term trading range that nicely corresponds with some more established, longer-term historic support zones.

T-Mobile might be at the bottom of a nice, neat range, but the price activity of the last few trading days may indicate a bear flag situation tracing out, which could presumably send the stock price down into the ~$51.50 USD area - but, with price already at historic support and the support of the recent trading range, traders can make a case for a bear flag not playing out at all in the next few days, and T-Mobile returning to recent highs of $65.00-$66.00 in the next couple weeks - or higher in the next couple months.

Please like, follow, and share, and maybe we can have fun and do great things together.

Thanks again!

See it on the site: holsturr.com/category/markets/charts/

** For speculative and research purposes only - good luck! **