Bitcoin: No Action At Range Low Good For Longs?U.S holiday price action appears to be playing it's part in Bitcoin's slow price action, but this doesn't change anything. Bitcoin is in a consolidation within a broader BULLISH trend since April. Price continues to probe range lows which does NOT provide any evidence of progress or TREND on our time frame of interest. Keep in mind weak markets BREAK supports, they don't maintain them for long periods. The 8500 area is the key support that we are referencing in order to anticipate the herd mentality and gauge risk. In this video I will further explain the probability and potential of the current price location and why we continue to manage our swing trade LONG.

There is a lot of confusion around the concept of "trend". It is actually a very subjective idea which should be rooted by the TIME FRAME that your strategy utilizes. For example, if you are only interested in a higher frequency of trades, small targets and tighter stops, then a small time frame is appropriate. If you are trying to gauge risk and participate in broader market moves (as in 1000s of points) then small time frames (less than 8 Hrs) will only blind you. Many traders will argue that the "trend" is bearish because of some random structure on a 1 hour chart, but that information carries no weight within the scope of OUR long ONLY swing trade strategy.

Testing the 8800 and 8900 areas is not even close to compromising the 8500 support. The fact that buyers continue to step in (tails on recent candles), can be interpreted as strength. As long as this entire range (8500 to 10,400) stays intact, it is likely to act a continuation pattern and since the larger trend is bullish, probability still favors a bullish move (higher lows lead to higher highs). Until this structure changes (like a break of 8500), judging it any other way on this time frame is just asking for lower probabilities. Slow markets like these require a LOT of PATIENCE, and a strong understanding of how price structure shapes expectations. The evidence that carries the most weight continues to point to a bullish outcome, but there is no way to know when this will unfold. A few minor pullbacks into the low of the range is nothing more than NOISE and should not be confused with a trend on this time frame. A surprise catalyst can come out of no where, and next thing you know everyone is "predicting" 20K again. If you want to win, you must be positioned ahead of the herd, not react with it. We will continue to hold our long from 9225 and if it gets stopped out, we will wait for a new signal to go long again (unless price breaks 8500).

Bitcoin-consolidation

Everyone is so bullish on Bitcoin it hurtsBitcoin has had an incredible recovery from the liquidation cascade/fire-sale back on March 12 which drove the price from 9150 to 3850 in a matter of days. From the lows, we pumped over 160% - insane. But now that everyone is super bullish, a slow bleed downwards wouldn't surprise me, especially considering that the trend seems well and truly over-extended at this point.

However there is no denying that we are in a local uptrend, or that the bulls have reclaimed an important level. There is a very real bullish case to still be made so I can't count that out. In either case I expect that we deviate from this range quickly, otherwise we risk spending a long time grinding sideways + lower. Max pain is usually the way with these markets now that I think about it.

So what is the chart saying?

The MACD is showing a massive bearish divergence. It was already over-extended at 7400, and now seems ridiculous to me.

We are in a rising channel which seems likely to breakdown soon, though we may see a small bounce/scamwick upwards first. If we can break 10k convincingly on a bounce here I'll certainly be jumping in long but I'll be watching closely in case it is a trap and I need to pull out. Otherwise it looks like more pain on the downside will be in order.

Bulls have completely failed to regain any control after the dip on Thursday and have been showing increasing weakness since we rejected the highs at 9900. 9300 has held great as an overhead resistance over the past 2 days, and until that changes, my bias is on the downside and I am positioned accordingly.

Target of a swing long from 10,000 will be to close 50% at 11,600 and 50% at 13,000 and see what happens there (if we get there).

Target of short trade will be 6,900 - will be very flexible depending how price reacts at certain levels.

It's 1am I need to go to bed.

Never over-leverage if you want to stay in this game.

Stay wary.

Trader/Investors must understand this process.......!Kindly comment with " Yes " for agree and "No" for disagree with this post:

Before the break-out, I've informed that " Breakout will give truck of Money. ..!". Exactly, we seen this statement was TRUE, didn't it? (End of idea link is added about this idea)

Let's talk step by step was happened here.

The Width of congestion area was equal to height of the price surged.

From my personal experience and the survey/observation I'm talking about this is almost the same area as price congestion in size of width and height after the price break. Let's try to explain in another words:

Horizontal width of congestion size = Vertical price move after break-out. (Generally, i noted that price moved away so far after breakout whenever congestion area is much longer.)

--> Let's talk little more deeper about CONGESTION area:

In the congestion area, accumulation or distribution process process. We will talk about accumulation only because, this was happened here.

Accumulation : smart money, money makers, huge fund-management, landlord of global investors whatever you called them they grab/connecting instrument(stocks, currency,etc) from retail investors in very slow motion because, they can smell insider upcoming news. After the completing this accumulation, news clear and price start to go away from the breakout area.

later i will try to explain you more deeper about it practically. Yes, obviously we can smell the process accumulation/distribution.

Weak Markets Don't Linger At Resistance. Bitcoin Is Not Weak.#Bitcoin continues to hold its higher prices which can be interpreted as BULLISH. All it needs is a catalyst to squeeze to the next major resistance in the 9K area. We continue to hold 1/3 of our original SWING TRADE position which triggered back in December, for its third target in the low 9Ks. The purpose of this evaluation is to share our insight and perspective as it relates to the actionable information derived from the ORDER FLOW of Bitcoin. Evaluating order flow offers practical clues about short term market intent which can be used to gauge general probabilities around specific market scenarios.

1. IF price decisively breaks 8325, and follows through beyond 8500, the low to mid 9Ks are likely to follow relatively quickly (short squeezes like this often unfold in a matter of hours thanks to short margin liquidations and new buyers).

2. As long as price can stay above the 7600 area, the minor consolidation breakout has a greater chance of occurring. A close below this higher low support can take price back to the 7K minor support zone. This is all about "IF" not WHEN.

3. There is a major resistance around the 9500 to 10,200 area. This zone is the HIGHEST risk, lowest probability location to take on new swing trade longs (but a great place to take profits). Usually AFTER the move takes place, people ask, "Is NOW a good time to buy?" which my response is, "Where were you at 7250?". There was a week and a half of noise and even cheaper prices following our long entry back in December. Think in probabilities, NOT LOGIC.

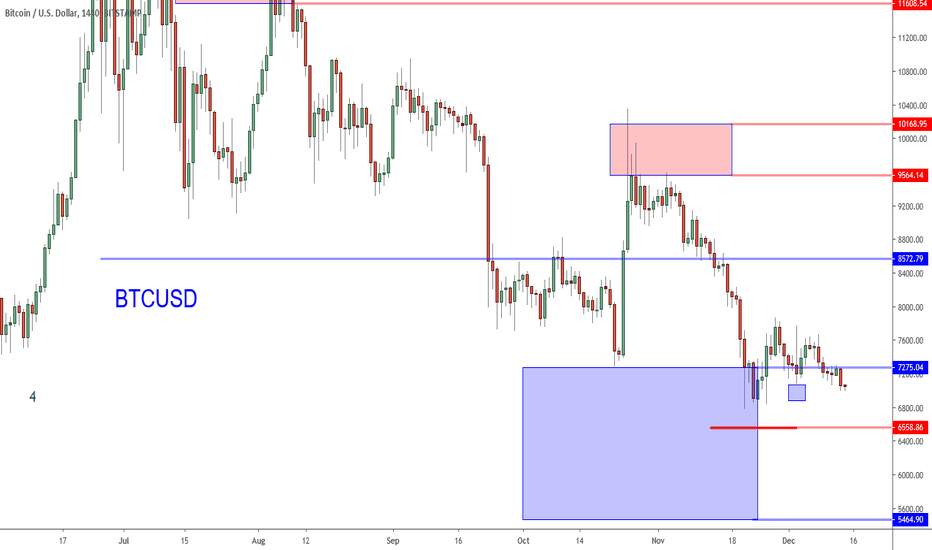

4. 7275 to 5464 still represents the HIGH probability location for bullish reversals. This means IF there is any revisit, (especially to the 6550 area), we will view this as another opportunity for swing trades and inventory accumulation. Price may not revisit this area again any time soon.

5. Although short term bullish momentum is now in play, we do not consider this market free of the corrective consolidation that is has been in since the June peak. Lack of follow through is still is still an equal possibility and our profit expectations will be adjusted in this way UNTIL Bitcoin proves otherwise. In other words, we will trade this like a Wave 2, until Wave 3 is in play (which requires a break of 10,300 AT LEAST).

6. The fact that price is lingering near the 8500 resistance area is a typical sign of strength (weak markets do not linger at resistance levels, they sell off). This minor consolidation break out can also prompt an alternate trade signal to go long upon the confirmation of a momentum continuation pattern like an inside bar.

Keep in mind these points represent part of the rationale that our decision making process is based upon. Timing markets over the short term requires knowing what information carries actionable value, and organizing it in a way that allows for a better sense of how ORDER FLOW is LIKELY to BEHAVE next. Order flow refers to price action based information that is either present or forward looking (trend lines, S&R lines, chart patterns, candlesticks, etc.). In isolation, this information carries little to no value and is why so many inexperienced traders dismiss it as "useless" and say things like "outside bars don't work".

Context and perspective come from knowing how these individual elements come together to define a range of REALISTIC outcomes. Overall, charts provide a record of human behavior and when part of a group, this behavior offers pockets of predictability, which can lead to opportunities for those who can identify the risk associated with these pockets.

Please Feed The Bears. Bitcoin Needs More Buying Pressure.Bitcoin price action has produced a clear bullish reversal pattern in a location where probability favors such a formation. The inverted head and shoulders, although not triggered yet, serves as a pretty good idea as to where this market is going over the next couple of weeks at least. A decisive close above the 7600 level, followed by 7950 should stimulate enough momentum to carry price to the next relevant resistance of 8500. I am sharing the following technical points to provide perspective, context and clarity for the community. This is also the information that we are using to guide our decisions for our recent swing trade long.

1. The recent 6850 area swing low not only establishes a higher low formation (higher lows often lead to higher highs), but it also serves as the right shoulder of a broad inverted head and shoulders formation that began to develop in November. A break and close above the 7950 area and this bullish reversal pattern is confirmed and in play.

2. Yesterday's candle (inside bar) has triggered a new buy signal once price took out 7400. Follow through continues to be limited because of the tendencies of a range bound environment, but reward/risk on the bigger picture clearly FAVORS LONGS.

3. A close above 7600, followed by 7950 is likely to stimulate a flurry of margin liquidations (shorts following their small time frame charts who are now caught). This buying pressure, along with break out buyers can take price to 8500 or even the low 9Ks in a matter of hours.

4. Bitcoin has been in a corrective consolidation since June (this is NOT a trend environment). The price structure since then is now showing the potential completion of a broad Wave 2 (relative to the 3150 to 14K impulse wave). IF Bitcoin confirms this (by taking out 10,300) then a broad Wave 3 is likely in play. Such a wave can take price to 20K and higher in a matter of weeks or months. This scenario also aligns well with the May mining reward halving event.

5. IF the 6800 higher low support is compromised for whatever reason, it will negate the current bullish scenarios outlined here, and call for adjusting expectations for a RANGE BOUND market to continue further. It is important to keep time frames and magnitude of expectations in perspective. A break of 6800 will NOT change the bigger picture trend to bearish.

6. Our profit targets will continue to sit in the mid 7Ks, 8Ks and low 9Ks. 10K is the next MAJOR resistance level, and if Bitcoin is going to produce a large magnitude fake out, that is where it is most likely to unfold. Our goal is to take smart risks and reduce them as much as possible. Exiting 1/3 of our position at each predetermined target accomplishes this goal. (Small bites are what to lead to a positive return over the long run, NOT home runs).

For those that watched my recent video update and have been following this swing trade, we got long about two weeks ago on a break of an inside bar at 7250. There has been a lot of noise and sell signals since then that have gone NO WHERE. The point is this: the effectiveness of trend following strategies is going to be subpar on the larger time frames because the expectations that they produce are not aligned with the type of environment Bitcoin is in at the moment. This means sell signals carry no weight because they are appearing near the LOW of a broad consolidation. Selling near range lows is low probability herd behavior.

Overall, timing is all about letting the market act first, and then adjusting to the new probabilities as they develop. Just like in Texas Holdem, the players who act early in a hand give away important information to those to act after them (who can then make more informed decisions). Letting the market act first allows you to capitalize on the "reactive" order flow, or those who trade on emotion and impulse. This reactive liquidity is made up of the participants who are willing to take the other side of high probability setups. If everyone operated in a rational way, overbought and oversold conditions would never exist and neither would any opportunity. Want to improve your results? Learn psychology.

Bitcoin: Adjusting To Out Of Play But Bullish Location.Bitcoin is stuck, but before you get too bearish, it is worth noting WHERE it is stuck. The 7K level is a minor support, but it is within a very broad support zone of 7275 and 5464. In the middle of the zone is the 6558 reversal zone boundary. These levels and areas are not made up, or randomly selected. They are a result of previous price action and are proportional to relatively broad movements in Bitcoin. The purpose of this article is to point out how we are interpreting recent price action, and adjusting in terms of strategy.

1. 7275 to 5464 is relative to the .618 of the 3150 to 14K impulse structure. This is a typical retrace are for corrective waves to complete (particularly Wave 2). The movement from 14K to 6800 is a corrective consolidation that we interpret as a Wave 2.

2. Lower highs continue to be established, but lower lows are not. The 6750 (recent swing low) is NOT that much different from 7250 (previous swing low). A bearish trend is defined by a series of lower highs AND lower lows. Until a major new low is established, the risk of short squeeze is HIGH.

3. In order for bearish momentum to take hold, and FOLLOW THROUGH, a decisive close above 7875 would provide confirmation. UNTIL this occurs, buy signals carry less weight.

4. In range bound, lack of follow though environments, particularly at attractive accumulation levels (like 7275 to 5464), position trades are much more efficient compared to swing trades. As long as the sizing is carefully managed, it is less likely to get shaken out or stopped out as a result of random price noise. Also if a short squeeze develops out of no where, there is no missing out on the move.

5. Bearish momentum usually unfolds QUICKLY and makes progress. Bitcoin is struggling to go lower just as much as it is to go higher. This is NOT characteristic of a bearish trend. (Want to see a recent bearish trend? See stock ticker CGC).

6. Price can test 6550 or even the 5500 level and STILL establish a broad HIGHER LOW formation. 3150 is the reference point. As long as Bitcoin maintains some stability in this range, it is offering wholesale prices. Keep in mind, this perspective is NOT for small time frame strategies that utilize time frames less than 8 hours.

We recently entered a swing trade at 7550 and got stopped out at 7025. After taking a few stops in a row, it is easy to lose confidence in a strategy, but that is the common mistake that leads to strategy jumping and inconsistency over the long term. How come we don't change our swing trade strategy? Well, because it has proven itself across multiple markets like stocks and forex. When a market is out of play, no strategy will work, and that is precisely why we trade price MOMENTUM, no matter what market.

Just like markets, strategies also go in and out of favor. While there is not enough momentum for swing trades at the moment, position trading or inventory management is still attractive (high probability location + strategic sizing) because it does not require such precise timing, momentum or attention. Is it possible for Bitcoin to go back to 3K? Sure and that is the risk you MUST accept and adjust for when managing inventory. How do you think the institutional players do it? By obsessing over 1 hour charts?

Bitcoin: Short Squeeze Pattern, 8500 Next Resistance?Bitcoin has established a higher low off the 6800 level which we interpret as a sign of strength, especially within the context of the 7275 broader support level. As long as the 7K level holds, price is likely to break higher and into the low 9ks at minimum. Timing is less about "predicting" and more about about letting the market prove itself by demonstrating strength or weakness as an expression of order flow.

On Friday, our swing trade strategy generated a new buy signal and we are long from 7550. In this article, I will highlight the price action possibilities that will prompt us to take further action, or not.

1. A break and decisive close above 7900 can take price into the mid 8Ks or even 9Ks because of the amount of short covering or forced liquidations that follow. This is our ideal situation and requires no further action since both of our targets are within the 9 to 10K area (higher low often leads to higher high).

2. A decisive close below 6800 can lead price back to the 6550 reversal zone boundary (we will be stopped out by this point). The 6550 area is the next high probability location to look for long setups IF price gets there.

3. 8500 is the next minor resistance level. IF price action turns here (bearish pin bar) we will most likely close half of our swing trade in order to reduce risk and allow the market to breath.

4. 7275 and 5464 is still a high probability reversal zone for POSITION trades. IF price revisits this area, and shows patterns of stability again, we will add to our inventory (which is a separate strategy from our current swing trade).

5. We continue to categorize the structure between the 14K peak and 6800 low as a "corrective consolidation" or Wave 2. We will consider patterns and short term price action (candle sticks) within the context of a range bound market, NOT a trend.

6. If price takes out 10,500 and follows through (meaning no fake outs), then Wave 3 is likely in play which can lead price back to 20K. UNTIL this break out occurs, projecting outrageous price targets is unreasonable and unjustified. There is no way to tell from a chart WHEN such an event will take place.

Many get caught up in the fundamentals, hype, and drama that surrounds this market but none of it will help in terms of timing (especially over the short term). Sentiment drives price, NOT logic. Charts do provide actionable information because of 3 key ideas: markets trend, price is a discounting mechanism and history repeats itself. Learn what these actually mean and you will be less distracted by noise and more in tune with the probabilities of order flow.

Bitcoin: Continuation Long Setup Forming. Can You See It?Bitcoin is hesitating at a minor resistance zone which is a tough spot of both longs and shorts. Our recent series of trades have been mixed. A stop out, followed by targets reached, followed by a stop out again. At first glance this sounds like a negative outcome, but we actually came out ahead in terms of profit and that is because of our particular money management rules. In this article I aim to 1. provide perspective on the current Bitcoin price structure in terms of probability and 2. share some insight about how consistent money is made in this game.

First let's talk about the technical position of Bitcoin. You will notice my chart has almost NOTHING on it, only projected support and resistance levels. This is enough information to draw conclusions about where price is more likely to go next. All this complication I see on analyst charts is just so unnecessary and time consuming, and it all sums up to the same conclusion anyway. Learn to work with less and you will gain more.

Our swing trade strategy evaluates location, levels and price patterns. From that we can generate a sense of probability about how order flow is more likely to react in the near future. So lets consider each element:

Location: 9750 is a major support level (retracement of 3150 to 14K).

Levels: overlapping this level is the 9800 to 10,300 minor support zone which is proportional to the bullish swing from July to August. Proportional resistance area is 11,600 to the 12,300 region.

Price patterns: a potential higher low forming now following a failed low formation off of a range low support.

All these variables sum up to: we are looking for a swing trade long. Price is gyrating around a larger magnitude support area. This area is also part of a broader consolidation which we have been writing about since the 14K peak. Probability still favors buying, but the location poses more risk (compared to 9K support) and although we prefer to buy, that does NOT mean we jump in. We take it a step further and wait for candle stick confirmation and let the market tap us into a trade, we do NOT initiate the trade by pressing the button (which is how WE define reactive). So at this point we have an order in place to buy which we shared with our followers. And our targets are based on the projected resistance which means they are located somewhere in the mid 11Ks.

To satisfy the second goal of this article, I want to mention something about money management, win rate, and why most of you will not make money over time. We follow RULES (which we are going to talk about in our next podcast). The rules produce the results, NOT our opinions, or any other irrelevant factors. The market either cooperates, or it doesn't. We remove ourselves as much from the equation as possible, otherwise there is a greater tendency to react. And reactive decision making is where randomness, erratic and INCONSISTENT results culminate in an uncertain environment such as a financial market.

Everyone is in this to generate a profit, but are focused on "more is better". That is why all these polluted charts are so popular. Profitability does NOT come from lines on a chart. The chart is a reference point for order flow and sentiment that can be used to gain a sense of how the crowd will react next. A high win rate is another misleading variable. We produce profitable results with a process that is right just over 50% of the time (our non aggressive setup). What generates the positive outcome is the fact that when we win, we make more than what we lose.

To summarize: The current elements on the chart that we place the most weight on still favor longs. A broad support area, followed by a failed low and potential higher low formation are in line with our rules but it is up to the market to trigger the trade. Although the particular setup we are watching is bullish, the probability is not as attractive compared to when price is in the 9K location. For that reason, we categorize the idea as aggressive (for us that means smaller size).

Our rules prevent us from considering shorts and that actually minimizes fake outs and errors even further. Like we always remind our followers, you do NOT need to be in every move to make money in this game. Bitcoin has been frustrating to many because they are reacting to every movement within a NON trending environment, or following others who are. If you want better results, you first have to get to the root of the problem and it is usually found in your personal process. You owe it to yourself to learn how timing actually works IF you are in this to generate a positive return, otherwise consider this just another expensive hobby.

Will BTC break up or down from the triangle!?Even if it would breakdown, we have strong support at 9k to produce a fake breakdown.

Nonetheless, this scenario has a much lower probability due to other factors so sooner or later BTC most probably won't break down, but break up the triangle!

For now, we have strong support and reasons to believe that:

- MA100 as support line on daily (strong key level)

- triangle support holding for 4 days already (the more it stays there, more probably longer consolidation phase becomes)

- BTCUSD SHORTS are on one of the lowest levels and ready to make higher low (change of the pattern and great connection with the price movement!)

- MAC is in strong convergence (and crossing in oversold teritory)

- RSI has a triple bottom (with the direction to 50)

Based on all that and much more (check related ideas) it should not be so far away to see BTC rise again!

Before that, it should go into consolidation mode. During that phase, some interesting altcoins have great potential to rise.

Stay tuned and follow us and this idea so you can get automatic reminders.

THIS IS NOT FINANCIAL ADVICE.

Remember to trade safely!

If you just want to thank us you can hit like and leave a comment. Thank you for your support.

BTC dominance starts to fall, alts start to rise!As you can see from the graph it looks like BTC dominance has reached strong resistance points:

- local top resistance

- high volume resistance

- 5th Elliot wave with five inside waves

Additionally, oscillators are overbought:

- CCI is showing some divergence also

- RSI has a double top in the overbought area

- Stoch is also making lower lows in the overbought area

If we connect this to historical price movement in similar situations, the picture starts to unveil itself (check "Do you really think Bitcoin can dip up to $8000 or less!?").

We are most probably at the start of BTC consolidation before the next push. Many times alts followed BTC with delayed, but stronger growth.

If this happens now again, BTC would be losing dominance % as expected.

On the other hand, if BTC starts to fall to lower areas and breaks the resistances (check "Will BTC break up or down from the triangle!?") than it usually takes alts with him where alts fall even more.

So the last scenario is impossible if we want BTC dominance to fall and analysis shows it will. Thus BTC sideways (or growth) will help alts to grow also.

In the next posts, we will analyze some alts with good potential vs BTC.

Stay tuned and follow us and this idea so you can get automatic reminders.

THIS IS NOT FINANCIAL ADVICE.

Remember to trade safely!

If you just want to thank us you can hit like and leave a comment. Thank you for your support.

Consolidation around 8000There is a consolidation between the green and orange lines. Watch out for any breakout or breakdown. Price can move in any direction (sometime two-side shadow or long doji candlestick).

Also, we have published an impressive strategy that has a good capability to predict the exit direction of the consolidations, presented in the below link:

For example, dump from 6k channel consolidation in November of 2018

Or pump from 3k channel consolidation in March of 2019

Or some other lower time frame consolidations

For more information you can join us by telegram. Channel address: t.me

For getting access to the strategy you can contact us t.me is a telegram.

Bitcoin! Will it mimic 2015 in both time & price consolidation?!Hi folks,

Details in the chart.

If Bitcoin were to mimic the previous bear market consolidation phase, here's what we'll be expecting:

- 95% pump from Bear Market lows (target $6,100 levels), before significant retracement.

- 33 week consolidation phase , ending at end of July 2019, after which a roaring 2-3 year bull rally will start.

Hope you find this a helpful perspective... accumulating in these weeks is a great investment opportunity!

P.S. Keep a close eye on the weekly RSI . It's currently trying to surpass major resistance at 60. It could not do so in 2015. Iff it does and consolidates upon it, the bull run may have indeed started early! (which actually coincides perfectly with the idea that says Bitcoin begins its rally one year prior to its next halving event, happening almost one year from now in May 2020!)

Cheers,

Leb Crypto

Bitcoin still in a short term correction, no bull run just yet There's so much buzzz around the recent price action of bitcoin. A lot of media articles and we all know that that means. We have had a FOMO cycle again in the short term.

Elliott wave accounts for the psychological aspects of trading. The 5th wave of an Elliott wave is the FOMO wave. After a 5th wave follows a retracement and to me right now it's looking like a triangle with the constricting price range.

In order to validate this theory I'm looking for a C wave retracement soon down to the trend line.

It's invalidated by a close and retest of the resistance.

To trade this I'm not gonna be playing the swings cause lets tbh its too hard work with bitcoin. Instead I'musing this as a guide to anticipate a true breakout into what is hopefully the next impulse wave in a cylce that will take us back to the 6000 level.

Bitcoin: Bullish Pin Bar! Why Not Buy?Bitcoin update: Even in the face of a bullish pin bar, it is still reasonable to say that this market is going no where fast. Candle stick formations are random and what gives them any analytical value is WHERE they appear. Since our swing trade exit at 4125, we have been PATIENTLY WAITING for a setup that offers attractive reward/risk.

The typical trader craves action, but the market does not care what the typical trader wants. Good marketers know this and capitalize on this characteristic of human nature and they will write or say ANYTHING to capture attention (which is what they effectively monetize). The best information that you can get is on your chart, but it may not be as exciting as the marketer leads you to believe.

REALITY or the truth is often what the crowd does NOT want to hear because it is boring and uneventful. And the reality about Bitcoin is it goes into slow grind periods for weeks at a time, followed by some large movement which gets the herd all excited again. The key to navigating this type of environment is to pay the MOST attention when the market is not only quiet, but also in an attractive location.

Is Bitcoin in an attractive location to buy at the moment? In my opinion NO. The high 3800's to the 4100 area is a broader resistance zone. Sure, price may grind through it, BUT the risk is NOT worth the potential rewards at this point. Beyond the reward/risk we also consider the "personality" of this market in such a location. Fake outs and lack of follow through are more likely because Bitcoin is NOT in a strongly trending environment. Recent structure continues to offer plenty of clues that hint toward a range bound market. And in ranges, buying near highs (especially out of boredom) is not a productive behavior over the long run.

Overall, we want to see price test and develop a setup around the 3500 - 3600 area or the 3300 area. Those levels are at least closer to the range lows and are much more attractive in terms of risk compared to where price is now.

Keep in mind that there is also a potential bearish pennant developing. It is too early to make any judgements, but the appearance of the positive sloping converging trend lines serves as another reason to WAIT for a better situation when it comes to taking a swing trade long.

In summary, it is better to look for all the reasons to stay out of a trade than it is to find every reason to be in. Eventually you will run out of reasons to be out and that is usually when the rare and high quality opportunity surfaces. There is no reason to get excited over a couple of pin bars, especially when the location is NOT favorable.

Think less about profit and more about probability. That is how to effectively navigate an environment that is filled with constant uncertainty. We will continue to WAIT for a better price area before initiating another swing trade long. We don't hunger for action, instead we embrace reality and WAIT until the market meets our criteria. WAITING is what generates the profits over the long run, NOT chasing.

Bitcoin: 3450 Support And Consolidating The Bottom.Bitcoin update: Price has taken out the recent bullish trend line which points to a higher likelihood of retesting the 3450 area minor support. From a broader perspective, all this market is doing is establishing another consolidation which is a normal part of the bottoming process.

As we always remind our followers, tops and bottoms take time to develop. The key to managing risk effectively in these situations is to develop a number of scenarios and then constantly weigh the evidence as one begins to technically materialize. The easiest mistake you can make is to fixate on one single scenario.

The appearance of a large bearish candle points to further weakness in terms of momentum. This scenario can lead to the 3450 support test or even a revisit of the 3K psychological support. It is always about “Ifs” not absolutes. IF price tests 3450 and presents a bullish pin bar, then that would be a setup we would consider for a new swing trade long.

What if price breaks 3450 without any hesitation and closes the candle on its low? 3K becomes the greater possibility. What if price breaks 3K and closes weak? It can happen, and in such a series of events we have no problem stepping aside and waiting for a more supportive structure to return.

Do not lose sight of the bigger picture in the face of a large bearish candle. As long as the 3K area is maintained, that would serve as evidence of a broader consolidation. There are opportunities within sideways markets also, but they require the most patience since they are the most infrequent. The best thing we can see in such a situation is a failed low off the 3K bottom. This is usually when the reaction of the herd becomes extreme, which can be observed by dramatic spikes in short interest. During these periods you will also notice extreme emotional reactions in public forums like this one.

In summary, Bitcoin just like any other market is driven by the collective psychology of its most active participants. No one can accurately predict if this market is going much lower or not. Timing these markets effectively has little to do with prediction and everything to do with evaluating how new information is most likely to affect the perception of the herd in the near future. The highest probability setups are the ones where the crowd is faked out and caught on the wrong side. Your time is better spent learning to recognize the clues and then waiting for the evidence to appear, not chasing hype. Let Bitcoin find an appropriate level and then provide a solid reason to justify taking risk. The question is how well can you wait?

BTCUSD: New Range Or New Lows?Bitcoin update: Since the sharp sell off a few days ago, price seems to have found some stability. The appearance of two long wicks and inside bars certainly add up to signs of short term strength. It is a good location to cover shorts, or carefully add to long term inventory. The broader structure is now in a much less favorable position for a more significant price recovery any time soon.

Although this market is still range bound when viewed from the broader perspective, it still has some room to retest the recent low of 5188. A close below the 5430 area will trigger a momentum continuation pattern toward lower prices.

Before you get sucked into the hype and nonsense surrounding this market, keep in mind that the 4900 area is the lower boundary of the largest degree .618 support zone. This zone has been in play since June and still holds. This means, as ugly as the chart may look on smaller time frames, the market in general is still maintaining the price location where a broader reversal is a high probability.

On top of that, the most recent sell off was basically triggered by a tweet. A mining dispute that moved the price hundreds of points in about 15 minutes. This type of vulnerability is a risk that is very prevalent in these markets, particularly since there is no regulation. Insiders can use whatever means necessary to push the herd out of positions, or worse lure them into shorts. It is how large players accumulate positions at great prices. They don't buy highs.

Fundamentally not much has changed and we remain long term bullish. We have bought into the recent sell off to add to our inventory, but carefully. If price goes lower, we can handle it. We are a strong hand, and if it no longer meets our buying criteria, we will stop buying and just hold. For us, shorting at these levels (even if we could) makes no sense in terms of risk.

We keep our long term and short term strategies separate. Since we are playing a strong defense, we will not take just any swing trade long trigger that appears.

Short term structure now favors weakness so for us to take a swing trade long, we need to see a particular reversal structure in place. And since it requires the market to make an initial move higher, we will sit it out until it matures into the pattern that fits our more selective criteria. This helps to filter out the noise and fake outs that are highly probable at the current level.

In summary, timing markets is about knowing how to adjust more than anything else. We don't operate with an "absolutes" mindset, or the losing mentality which runs rampant in this space.

Our long term perspective still stands even in the face of the 6K break. We recognize the opportunity and risks and stick to our plan with our only adjustments being to increase our defensive measures. And for us that means being more selective on the short term, while consolidating our portfolio on the long term. Just like the insiders talked the price lower, they can talk it higher just as fast. You don't have to have a large account to think and maneuver like a large player.

BTCUSD: More No Go? Waiting For These Scenarios.BTCUSD update: The hard money continues. We got stopped out of another swing trade long recently which comes with the territory. And we were making every effort to be selective with our entry criteria. Our strategy is not flawed, it is just not the best one for this type of environment. So what is the more effective way to trade the hard money?

Before I answer that, there is one bad habit that develops in these environments that can ruin your account. And that is not respecting the stop. It begins with getting stopped out a few times in a row and then watching the market recover right after getting stopped out. The typical reaction is: remove the stops because they keep generating losses.

That's the wrong thing to do because at some point the market is going to break one way or the other. If you are on the wrong side, without a stop, that is where when a small loss becomes a huge loss. You may get away with it a few times, but all it takes is one time to get caught on the wrong side.

This bad habit is particular to short term trading strategies. This is why we keep our short term and long term strategies completely separate. We don't use stops for our inventory strategies, instead we depend on careful position sizing and other risk controls.

Stops are your best friend in this environment for short term strategies like swing trading. If you are getting stopped out often, it is a matter of questioning and adjusting to the environment. Not jumping to another strategy simply because what worked before is not working now. That is reactive and ineffective.

Hard money is another way of describing consolidating markets. Bitcoin is NOT going anywhere right now. These chart gurus who keep making outrageous calls are only looking for attention for marketing purposes and degrading the integrity of this community. Stop taking the bait.

Our plan is simple but unpopular: wait for Bitcoin to choose a direction. We are long term bullish so if price breaks below the 5800 area support, we will continue to be defensive and only consider long term inventory strategies. Those that have been following our trades and analysis know that we have always been very clear about not shorting these markets. (There are plenty of other instruments to short).

There are two bullish scenarios that we will consider. A clear reversal pattern and setup around the 6250 area (bullish trend line). Or bullish continuation patterns AFTER a decisive close above the 6550 resistance. Otherwise we stay flat in terms of swing trades.

The more effective way to trade the current conditions is to wait for longer term levels to be reached and look for inventory. For our inventory, one of the levels we are watching for is 6100. Any extreme range lows will also serve as areas that we will consider for careful accumulation. These types of trades are very infrequent, require tons of patience and a well thought out game plan as far as scenarios go. Consistent reward is the product of taking well thought out risks.

In summary, projecting where Bitcoin will be a year from now is nothing more than a call for attention. As the space evolves, the players and motivations change. The best thing you can do is let the market provide evidence.

This is a professional's market. The easy money has dried up because easy money comes from the ignorance of the herd, and the herd likes trends. When there is a break out, especially a bullish one, it will attract the less experienced participants and that is when trade setups and momentum are more likely to follow through.

Either wait for the most attractive levels (extremes at this point) or wait for the recovery to confirm. There is no missing out because when there is a broad move, attractive reward/risk opportunities are much more plentiful.

BTCUSD: When Will It Break? Know Your Environment.Bitcoin update: This market has been stuck around the 6400 level for about 10 days. We can sit here and go back and forth about what this means about the near future and why (along with 10 charts from gurus seeking attention). Or we can learn a very important lesson about market timing.

Many years ago when I was a NASDAQ day trader, the experienced traders used to tell us: only trade what is in play. If the market is making new highs and your stock is going no where, find another stock. The same goes for timing Bitcoin.

The difference is the WHOLE space is out of play. Besides long term positioning, the only traders ignorant enough to force trades are those who made some money during the bull run. They haven't shaken off the bad habits that they acquired during the "easy money" from a year ago. They will either learn, wipe out their account, or both.

We have a swing trade long that we entered 9 days ago. Besides that we have been waiting for an outcome. I get criticized a lot for reiterating the importance of "waiting" which is to be expected from a market where the lack of emotional intelligence is the highest.

The other tactic that we are employing is the extreme buy. This is where we have an order way under the market, and IF there is another "massive sell off" we will buy into it. Carefully. The 6K area or slightly below is where we anticipate such a scenario to unfold.

The lesson here is less about patience and more about KNOWING YOUR ENVIRONMENT. Why would you go fishing in the middle of a desert? Have you seen the stock market? Tons of opportunities on all time frames. That is where the money is flowing at the moment.

We may not be actively trading Bitcoin, but we do expect it to return to the spot light. Consolidations break out and the longer it consolidates, the more dramatic the break out. That is the time to be more active and look for continuation patterns, not now.

The structure that continues to unfold is still bullish. And it is in line with our long term perspective. UNTIL that changes, we will look for longs, even if our current position is stopped out. A close above 6500 (Coinbase) is the confirmation we are waiting for. Will it happen this week? Ask one of the chart gurus in the comment section, maybe they know.

This price action has insitutional activity written all over it. This is the result of all the hedge fund money entering the market, NOT BTC 30K. Smart money doesn't buy high, they buy low and use what ever power they have to make that happen. They have the freedom to do or buy whoever they want in this space.

In summary, this is a professional's market and the only ones who are going to benefit are the ones who understand how this game is played. It has nothing to do with charts, the RSI or news drama. As a member of the herd, you help to provide liquidity for the long term positioning of the smart money.

The only way to avoid this is to take control OVER your own behavior, stop reacting and learn how to WAIT for the market to reveal its hand. It is unpopular and no fun, and certainly not the lottery ticket mindset, but that is the reality of best practices.

BTCUSD: Breakout? Waiting For High 6Ks.BTCUSD update: A breakout attempt to 6480 fizzles out. This is nothing unusual for a tight consolidation. There are major and minor support levels established through the 6300 to 6K price area. As long as these areas hold up, we will continue to anticipate strength and hold our long for the targets.

Even though price is not following through on the break out, it is still managing to hold the 6300 area. If you want to look at it from the Elliott Wave perspective, you can say it is a Wave 4, which often precedes one more attempt at the high (Wave 5).

For us, this is a waiting game. We have been managing a new swing trade long for almost a week. Being patient with a position is just as important as being patient on the side lines. As many of the top speculators and investors are often quoted, "Money is made in WAITING".

As long as the current structure stays intact, there is no reason to do anything else. The entire space depends on Bitcoin, and it is one of the only coins that still maintains a healthy long term structure.

Price structure develops as a result of the collective order flow. This is the natural trail of money and will often shed light on the short term strength or weakness of the market. And this is what shapes our decisions, NOT RANDOM LINES on a chart, or nonsensical rumors.

While we have always been long term bullish, our perspective shifts on the short term WITH THE MARKET. When both perspectives align on the long side, that is what allows us to justify risk on a swing trade. When they don't align we do something that the upsets the most ignorant of herd members, we stay on the side lines. We think like a casino, not a slot machine gambler.

Even if price closes below the 6300 support, we will continue to look for long setups. The major number for Bitcoin is 5750 and so far, we are no where near it. We are always open to anything and acknowledge that it can happen, but until price action shows clues or evidence, we will remain long or looking for longs.

In summary, for those new to this game, there is a different environment in play from a year ago. This is an institutional environment.

They have the resources to keep price more or less in line for them to accomplish whatever agenda is at hand. Bitcoin is unregulated and probably lacks the most emotional intelligence out of the entire universe of financial instruments (just read some of the troll comments).

This is the perfect space for institutions to exercise their power both on and off the exchanges. They are like the big stack at the Poker table, bullying the small stacks by going all in with then and eventually consuming their chips.

THEY can AFFORD to BUY control. We on the other hand cannot. The MOST we can control is our BEHAVIOR. We don't have to play when conditions are the most unfavorable. We don't have to take big risks, and we can WAIT until probability favors our idea the most.

Besides our behavior the ONLY other control we have is our RISK. This means having a strategy for POSITION SIZING, and knowing where to effectively place a stop.

A big risk is not necessarily about putting a lot of money on the line. A big risk is about taking a chance when the most likely outcome is unfavorable. Like betting on the horse that is least likely to win. It offers the highest payout, but chances are you will lose.

That is the lottery ticket mentality and does NOT produce consistency in any investment effort. It's fine for entertainment, BUT if you are looking to effectively grow capital, you must think more like the casino. High probability, but the payouts are small.