Bloomberg-predictions

POTENTIAL SELLS FOR AUDJPYHello everyone ,happy new year and welcome to the new trading week , here is a great setup for audjpy sells ,before the festive period there was a news release which caused a great fall in price of all jpy pairs making audjpy reach a new low at price 87.06 ,after the low we noticed how price came to form a new lower high at price 91.2 , this week we expect price to hit back support area 87.06 , with that been said all we should look out for is sells at market opening is sells with take profit 1 @ 88.3 and Tp 2 @ 86 . like and follow me for more daily signals .Thank me later .Goodluck

ETHUSD POSSIBLE SELLS TILL 1100Hello everyone ethusd keeps breaking lows and there is possible sells expected till 1100 as price keeps breaking lows and failing to break highs . let see what 2023 got to offer ,looking at the chat a good sells is expected to happen till 1100 . Goodluck guys ,like and follow me for more daily signals .

NAS 100 SELLS FOR NEWYORK SESSION TILL 10500Hello every one merry xmas and newyear greetings in advace , we expect price to hit 10500 today as price keeps new lows till 10500 ,like and follow me for more daily signals

SELLS FOE CADJPY Hello everyone we noticed how price went to a all time low after news realest for last week, price then began to make a high and as we all know ,after a high we expect sell so at Asian session market opening we expect price to sell long term to around 97.1 area ,like and follow me for more daily callout .Shalom ...

BAT BTC Sun Rays Megastructure same as ETH at $220 in 2020 (22x)Background FA: BAT announced Fundamental Partnership with Solana and launched own DEX in Brave Browser (100m monthly users), making it a direct contender for Uniswap, $UNI (which has 3 million users and market cap 10x bigger than $BAT).

Background TA: BATBTC Pair broke out of Long-Term Downtrend with highest ever volumes, sending the BATUSD pair into ATH and Price Discovery .

Sun Rays Megastructure for BAT BTC is extremely similar to a similar megastructure that appeared with ETH USD pair in June 2020, when ETH was 220 USD. ETH went on to make a 22x run upwards after that.

Two interesting TP levels to watch marked.

Goldsworth. Org Technical Analysis ideas brought you $DOGE at 14 Sats , $LUNA at 10 cents, $SOL at 3 dollars.

Is Tether really stablecoin?Business media has raised its concerns regarding the stability of Tether USD. Personally, for me, it has been challenging to make an opinion is a Tether really going to continue its stability. What do you think, will Tether keep its status as the number one stable coin in the crypto market?

Bloomberg article: www.bloomberg.com

Bloomberg Bloomberg Commodity Index AWH CONTRACT UNIT $100 times the Bloomberg Commodity Index

PRICE QUOTATION Index points

TRADING HOURS CME Globex: MON-FRI 8:15am-1:30pm

CME ClearPort: Sunday - Friday 5:00 p.m. - 4:00 p.m. (6:00 p.m. - 5:00 p.m. ET) with a 60-minute break each day beginning at 4:00 p.m. (5:00 p.m. ET)

MINIMUM PRICE FLUCTUATION .10 Index point ($10.00 per contract)

BTIC: 0.01 index point ($1.00 per contract)

PRODUCT CODE CME Globex: AW

CME ClearPort: 70

Clearing: 70

BTIC: AWT

LISTED CONTRACTS Mar, Jun, Sep, Dec

SETTLEMENT METHOD Financially Settled

TERMINATION OF TRADING 3rd Wednesday of contract month/ 1:30pm

SETTLEMENT PROCEDURES Bloomberg CI Settlement Procedures

POSITION LIMITS CBOT Position Limits

EXCHANGE RULEBOOK CBOT 29

BLOCK MINIMUM Block Minimum Thresholds

PRICE LIMIT OR CIRCUIT None

VENDOR CODES Quote Vendor Symbols Listing

SPX Shorts History repeating itself from last weeks bounce History is repeating itself on both indexes. $SPX500 & $DOW seems to be rejecting today's earlier move up on vaccine news with #Covid-19 cases still on the rise we will be selling off on this news for the remainder of the week we already got a major buy move this morning which is more than enough to sell off until at least Wednesday and from Wednesday on we should be looking at some buys perhaps.

Dancing like its 1983.LETS "B" Real with B 52

www.youtube.com

I need a refueling

I need your kiss

Come on now and

Plant it on my lips

Whammy kiss me

Whammy hug

Revitalize me

Give me whammy love

Yeah!

On Planet X-oh it

Won't be long now

I got a light year to

Get to the phone now

I'm gonna contact you

When I get home

Give it all you got

Give it all to me

Come on mammy and

Throw me that whammy

I said give it all you got

Give it all to me

Come on mammy, throw

Me that whammy

And I know I need

That whammy kiss

Whatever you do

I'm just passing the

Time to get to you

To pass the time with you

He cannot stand to

Go into work when he

Needs some whammy love

Whammy

You gotta use it right

Use it right now

I ain't foolin'

Give me a refuelin'

Yeah, whammy kiss me

Whammy hug

Come on mammy throw

Me that whammy

;)

Watch me or learn from me. Either way you will learn something.

www.youtube.com

Important week on the Bloomberg Galaxy Crypto IndexI like to use the Bloomberg Galaxy Crypto Index (BGCI) to get an overall View on where the Crypto Market is heading in general. If you aren't familiar with this index, please visit:

data.bloomberglp.com

Please take the time to follow Cryptorae on Twitter if you like this chart :-)

TradingView chartsetup: Credit @Cryptorae on Twitter

This week is really important for the cryptomarket in general - Bitcoin volatility is down to a minimum and everybody is keeping their breath - hopefully we will get a major move upwards - but as always in Crypto: Be prepared for the worst!

EURUSD : November OutlookIn the previous post about EurUSd -0.23% , we were expecting EurUsd -0.23% to make a mid-term high in October and tread lower from there onwards to a short-term low in the first week of November, thats already in place and we are now expecting Euro -0.23% to keep trading lower against the Greenback till Feb 2018.The intermediate low has been marked on the chart @ 29 November - along with the price target of 1.1371-1.1471.

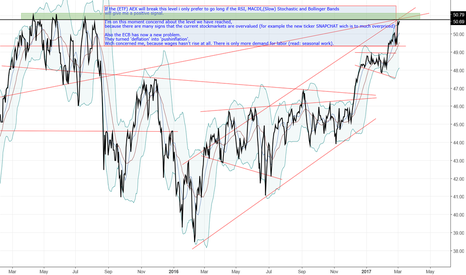

What will happen in the Netherlands and deflation or inflation?CHARTDESCRIPTION

If the (ETF) AEX will break this level i only prefer to go long if the RSI, MACDI,(Slow) Stochastic and Bollinger Bands

will give me a positive signal.

I'm on this moment concernd about the level we have reached,

because there are many signs that the current stockmarkets are overvalued (for example the new ticker SNAPCHAT wich is to much overpriced)

Also the ECB has now a new problem.

They turned 'deflation' into 'pushinflation'.

Wich concerned me, because wages hasn't rise at all. There is only more demand for labor (read: seasonal work).

GBP/USD Range OutlookWhile GBP/USD swiftly bounced from it’s brief foray below $1.20, price has once again been capped by the range that you can clearly see in the daily chart

The upper level of the range is definitely acting as resistance and the way it held again back in the first week of February puts Cable in play for shorts. Just keep in mind that it’s a 700 pip range and we’re already 250 pips off the highs. If that’s too close to the middle and not playing the edges for you, then fair enough. But as always, I would then look to zoom into an intraday chart and find an area of short term support turned resistance to manage risk around