Btc-e

Is Bitcoin Going For The Coffee?Hello dear crypto friends, grandpa BTC perfectly broke out yesterday as we had been analysing over the last couple of trades. Since I'm personally in a position, I wanna explain to you how you would've had to play this setup. Have fun watching! ;)

If you had some value from my analysis, give it a thumbs-up & comment it, because the mechanism shows my analysis to other people then. Make also sure to follow me so you get notified on my Crypto Analyses! I wish you a good trading! :)

Edgy is providing online mentorship & trading metrics only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

FIB, RSI, MACD, AND BREAKOUT PATTERNS ARE TRASH! (MUST WATCH!)I'm aware the title has offended you. Read through this post anyway, I'm sure I touch up on your complaints.

Stop forming your identity around your strategy. Even I am not immune to this. it’s all too common to form a personal relationship with the tools you’re using to trade. Whether that’s the indicators on your chart, your Gann shooting star wave pattern Fibonacci double top, or your boutique breakout patterns. It doesn’t matter how bland, innovative, common it is or if it’s the “golden standard” everyone worships and trusts. I’m happy that you like it and found something you identify with. It should be nice and comfy for you to settle into that confirmation bias, “Mm, yes it is indeed a double top” as you scroll through the fifth page of the Tradingview ideas section, pinpointing the chart that agrees with you.

There’s a better way to do things. I don’t care what you’re using, maybe, just maybe, there’s a way to improve your strategy. I can confirm this idea is seen as wildly offensive. Ask someone why their strategy works and they’ll cringe like you just asked them if their spouse is cheating. “How dare you question their effectiveness! I’ll let you know we have a long history together and I love them very much.” I’m sure you do, but have you noticed some of the warning signs? They’re all right there in front of you. It may not feel good when I ask, but if the signs are there and 3/4ths of marriages fail, it wouldn’t sit well with me if I didn’t speak up just to keep you comfy cozy.

Analogies aside, your “spouse” is your strategy. The warning sign is that you keep on losing trades, blaming your loses on “volatility” without wanting to admit what the real problem is. Perhaps you’re still green for now, just wait for a larger sample size of a trade history. Much like your imaginary marriage, the odds are wildly against you. Why do you think 95 plus percent of traders fail? You can massage data however you like, the problem is at some point you decided to stop improving because you got confident.

If you met a tribe in the wilderness who planted fish in their fields as “an offering to their gods” in order to grow bigger crops, what do you do? Do you keep quiet about their ways? Sure, their crops WILL grow larger because of this tradition, but not for the reasons they believe. Would providing them industrial fertilizer and a crop rotation plan improve their crop output? Absolutely, but that would require that they admit they’re wrong and would be contrary to their identity. You’d get the response “but it’s worked for us so far! What we’re using is a proven standard.” Their blind faith in their dogma would prevent them from seeing that maybe, just maybe their is a better way to do things. If you don’t know why something works, you need to be skeptical regardless of how effective it is. Don’t be satisfied with mediocrity, comfort and undeserved confidence will only get you so far. There will always be someone with more experience, money, knowledge, and connections than you. You’ve brought a knife to a gun fight and have decided not to pick up the gun because you got some lucky stabs in. What’s worse is this even isn’t a gunfight, it’s thermonuclear war between institutional investors.

If you're a middle school basketball star, do you cry when you skin your knees after getting fouled when you chose to play street ball in downtown Detroit? No, because you should have known what you were getting into, and if you do cry, all the street ballers will tear you to shreds. If you don't want to play street ball and learn to play like everyone else does, go back to your middle school basketball court. If you can't understand why you keep getting hurt trading crypto and are unwilling to adopt the winning fighting style, go back to trading securities. Winners don't need to play by the rules of "golden standard" of TA.

What if the "golden standard" is only so because they're tools that make you predictable for people who know better? If you have the masses all trading the same information, that makes for predictable moves.

Predictable traders make for a predictable market. A predictable market makes for a profitable market. The only reason you've been given the "golden standard" is to provide liquidity for those with more buying power, resources, knowledge, experience and connections than you.

Specifically concerning the crypto market, there are additional flaws.

"There’s a general point here to make about standard oscillators like RSI: the numbers used for them basically assume conventional markets and typical oscillating ranges.

They were not designed to describe dramatically trending coins.

In such trends, they tend to go deep into “oversold”/“overbought” territory and persist. You may get several divergences before the one that actually reverses after exhaustion.

I wouldn’t call it useless so much as having far lower predictive power than advertised.

It’s also something so widely used that you can virtually guaranteed not to have an edge from that information." -acatwithcharts

If you ARE interested in a better way to do things, I am inclined to think my findings aren't half bad. Click through the links below and in my signature to learn more about how I do things differently.

Fake Volume, Bitmex and a possible Bitcoin ETFIn this video I explain why fake volume is irrelevant, my counter arguments against the SEC's stance regarding liquidity and manipulation, how I see Bitmex and the decentralization of exchanges, along with the real issues an ETF needs to solve before it gets approved.

Comparing the 2014-2015 with the 2018-2019 bear markets!Fundamental analysis only!

TLDW;

What makes the 2018-2019 bubble more bearish:

More scams (shitcoins - ponzis - cloud mining scam - giveaways)

Big shitcoin increase (too many shitcoins - all fighting each other for liquidity)

Shitcoin inflation (Too many premined shitcoins / ICOs - no fairness)

Easier to short (Way easier for people to short BTC etc, because they don't believe in them - sucking fiat value out)

Cash settled futures (Big players got in early and had this all planned - Also Cash settled futures suck liquidity from spot markets

Lots of new scam exchanges and fake volume (Some of these exchanges might be stealing coins from people or trick them to buy scam coins)

Bubble in a bubble in a bubble (BTC - ETH - ICOs all fueled each other. First Bitcoin created interest in Ethereum, which then created interest for ICOs, which held Ethereum, which went up and then people took profit into Bitcoin - Essentially a leveraged bubble!)

ETH. FIAT and Stablecoin pairs (Bitcoin's price is partially affected by people using it for speculation. Bitcoin also drives this market. So when it is used less / has lower price, shitcoins deflate too! Also arbitrage sucks money out, as there are too many pairs / exchanges, so liquidity is fractured)

Dummer money got in (Like Crypto Cobain said, the IQ of people getting in after each bubble is lower... Why? Because back then it was harder to get into Bitcoin. People had to be more technical and educated to understand it).

Mt. Gox coins being sold in the market (Mt. Gox 'locked' coins started hitting the market, something that didn't happen in 2014-2015)

Back then the market cap was much smaller and there way more lost coins as a percentage (also GBTC had just launched and its 'locked coins' were a big percentage of the total amount)

Stablecoin wars (fractured liquidity and people selling 1$ for less - Millions lost by retail that was gained by malicious players)

Hash wars (Bcash split - liquidity crunch as well as Bitcoin being dumped for hash power)

Finally in 2013 there was an 80% correction. So the 13 to 1200 rally wasn't done in one go. It took a big break before the last big rally.

What makes the 2018-2019 bubble more bullish:

No Mt. Gox collapse - No Willy (the rally was legit, I don't buy the : Bitfinex printed Tether out of thin air FUD). So the rally was organic and real, without having a big exchange collapse.

More Liquidity and on ramps (many good, regulated and unregulated exchanges, along with many other ways to buy Bitcoin like ATMs, vouchers, etc)

Improved custody and security (Hardware wallets, custodial solutions like Gemini, Coinbase, BitGo and Casa Hodl)

Many OTC desks and Indices (Easier to buy/sell big amounts of coins without affecting the spot market a lot)

Big boyz getting in (Bakkt, ErisX and even the probability of an ETF being approved)

Crypto funds (back then there weren't many, if any approved crypto funds. Most got approved in 2017-2018-2019)

Regulatory clarity (in 2014 there was a lot of fear Bitcoin could be banned etc. Now it is legal and clearly defined in many countries like the US, EU, Japan and South Korea)

Better mining (More efficient mining, along with liquid options to hedge, more decentralized and with bigger-long term players getting in)

Less inflation (Most big coins like Bitcoin, Litecoin and Ethereum have smaller inflation rates than they had back then)

Financial products (Bitmex, Cryptofacilities/Kraken, Huobi, Bitflyer, OKex, Deribit and LedgerX offer liquid futures and options products)

True believers own more (The hodlers, the hodlers of last resort, the ones that truly believe in this game, who are now more certain than they were back then - forks also helped true Bitcoiners to increase their Bitcoin holdings by holding Bitcoin!)

25-30B got into ICOs (Just the shitcoin market alone bottomed at 40B, out of which 2.5B was in stablecoins. Some of it has gotten back into Bitcoin or shitcoins)

More talent and money (People that work in this industry probably reinvest some of their gains back into the market)

Way more good educational material (Back then our understanding was not as great and good information wasn't easy to find)

Shitcoins provide a lot of free marketing and education to Bitcoin by proxy, as well as provide Bitcoin with a clear use case - Shitcoin speculation!

Crypto borrowing - Use Bitcoin/Shitcoins as collateral to get fiat, without having to sell your coins!

Crypto lending - Earn money by lending your coins/fiat for people to trade with it (Bitfinex, Poloniex, Liquid)

Bitcoin/Shitcoin Utility - Joinmarket, Lightning, Maker DAO, Masternodes, Staking (Holding crypto to make more... Crypto by providing specific services, essentially restricting the supply) - I truly believe that Staking (DPoS, PoS, Masternodes etc will drive the next bubble really high. Projects like Loom, Maker, Edgeless, Augur, Dash, Ren etc make me believe that there is a lot people that will get in because of this.

Decentralised trading tools for traders (Bisq, Liquid, Ren, DEXs, Stablecoins)

Even more lost coins, Bitmex insurance fund growing and ICOs still holding ETH (lol-lol-lol)

Central banks have take risk away from the markets, by lowering rates and printing a lot of money. But this has also lowered the returns investors expect... Which makes many investors turn into more risky investments. Why risk 100% of your capital for 5-10% returns on junk bonds, and not risk 100% for 1000-10000% by just doubling/tripling your risk? More QE is coming and the total money supply has significantly expanded since early 2015.

What I Think About TA, And Why I Love ItJust wanted to do a short video on the Bitcoin chart about how I feel about TA - what I think it is and also why I find it interesting. I hope someone finds this video interesting as well, and I'm curious to hear people's thoughts.

This is not financial advice. This is purely an educational video, and it's based on my own observations, assumptions, and opinions.

-Victor Cobra

Bitcoin: a gauge for asian risk toleranceSpread between Chinese and JGB's appears follow Bitcoin (usd) pretty well. As expected: bitcoin is the exact opposite of a portfolio hedge, and just a call option (like Tom Lee has made the case for) for growth. Interestingly enough, falling rates appear to stimulate selling and rising rates entice buying.

95% WINRATE STRATEGY? (MUST WATCH!) PART 3/3There’s a better way to do things. I don’t care what you’re using, maybe, just maybe, there’s a way to improve your strategy. I can confirm this idea is seen as wildly offensive. Ask someone why their strategy works and they’ll cringe like you just asked them if their spouse is cheating. “How dare you question their effectiveness! I’ll let you know we have a long history together and I love them very much.” I’m sure you do, but have you noticed some of the warning signs? They’re all right there in front of you. It may not feel good when I ask, but if the signs are there and 3/4ths of marriages fail, it wouldn’t sit well with me if I didn’t speak up just to keep you comfy cozy.

Analogies aside, your “spouse” is your strategy. The warning sign is that you keep on losing trades, blaming your loses on “volatility” without wanting to admit what the real problem is. Perhaps you’re still green for now, just wait for a larger sample size of a trade history. Much like your imaginary marriage, the odds are wildly against you. Why do you think 95 plus percent of traders fail? You can massage data however you like, the problem is at some point you decided to stop improving because you got confident.

Accumulation and Shakeouts - How To Predict A Potential PumpMy First video idea. Just wanted to talk about something I've been observing in the market recently. This is how I was able to predict the recent ICX and ONT rises.

Hope you enjoy!

This video is not financial advice --- meant for educational purposes only!

-Victor Cobra

NIETZCHE AND TRADING PSYCHOLOGY, (MUST WATCH!)If you're a middle school basketball star, do you cry when you skin your knees after getting fouled when you chose to play street ball in downtown Detroit? No, because you should have known what you were getting into, and if you do cry, all the street ballers will tear you to shreds. If you don't want to play street ball and learn to play like everyone else does, go back to your middle school basketball court. If you can't understand why you keep getting hurt trading crypto and are unwilling to adopt the winning fighting style, go back to trading securities. Winners don't need to play by the rules of "golden standard" of TA.

What if the "golden standard" is only so because they're tools that make you predictable for people who know better? If you have the masses all trading the same information, that makes for predictable moves.

Predictable traders make for a predictable market. A predictable market makes for a profitable market. The only reason you've been given the "golden standard" is to provide liquidity for those with more buying power, resources, knowledge, experience and connections than you.

95% of retail traders lose money, so if you’re watching this, that probably includes you. What matters is that you take steps to learn rather than keep throwing money down the drain. Market manipulation in crypto exists, and with respect to trading, it’s not that it’s good or fair so much that it just is and you have to play the game as it is rather than what you may want it to be. There are ways to do that, and we’re confident we have one of them.

It’s worth noting for the record that other markets have manipulation too. Just less egregious amounts of the kinds you’ll find on the list on the Wikipedia article for market manipulation.

If you've found this info useful, dive into the links below.

BTC Bull Flag - What to look for nextA look at some recent BTC impulse moves higher and subsequent price movement. I prefer bull flags that drift lower on lighter volume and then push higher on increased volume. However, ultimately the breakout volume and follow-through move is what's important. Box A is yesterday's move showing an ideal pullback level. Box B is the Dec 17th move which turned into a good multi-day run. Notice the volume. Box C is the failed breakout attempt in early January. How will this latest one turn out is yet to be seen but so far the volume signature is positive. Sitting tight for a another day will help cool off the technicals and let the EMAs catch up. After that, we'll want to see some volume on a push above 3700 and see prices hold above that level.

If you put $1000 into Bitcoin last year, you would now have...Sorry for pooperino sounderino :(

If you put $1000 in Bit-con 1 year ago you would now have 170$ :)

Happy anniversary ATH Bitcoin ponzi.

How normal markets behave:

How a ponzi behaves:

So unlike normal markets here we have:

* Negative sum (FX null sum stocks positive sum)

* The whole system depends on miners which either: A) Get paid in crypto for running the system, that they sell and drop the price. B) Get paid in crypto for running the system, which they hold greedily until they have a fat stack that could single handedly crash the entire system.

* 99% of crypto existance is based on exchanges. Bitcoin was nothing before MtGox. People go to crypto exhanges to buy and sell. Unlike normal markets, these exchanges ar enot neutral. At all. Arthur Hayes is a crypto early investor and "believer" for crying out loud. They hold bags and have a 100% full clear conflict of interest. Also, if this ponzi collapses, their businesses likely die (unless theystart diversifying quick but all these names... like they can all make the transition to Forex or something else). The people running the show are dependent on it not crashing, or as slowly as possible. They are not regulated too. It is in their interest to keep this alive as long as possible.

WHAT COULD POSSIBLY GO WRONG? :D

Leprous - Contaminate me. Coldplay - Fix you.

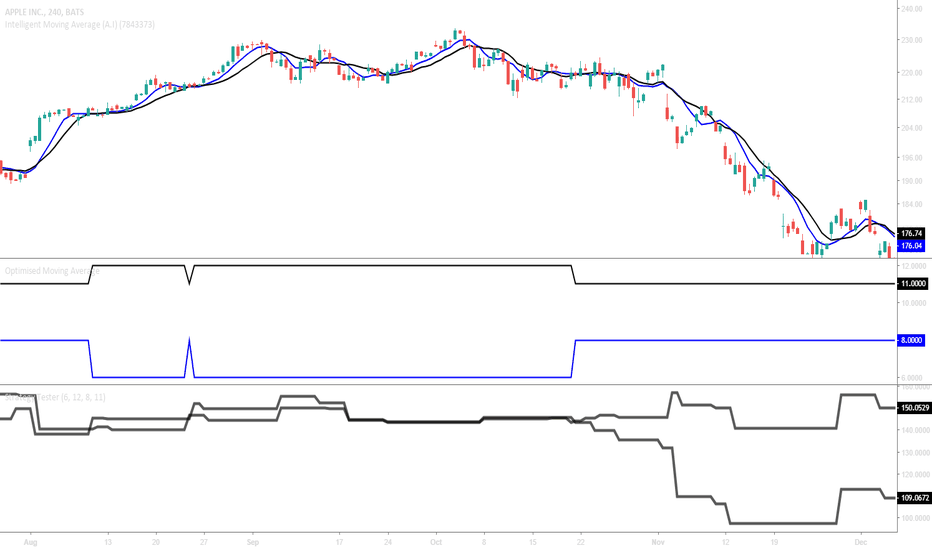

3 trading methods with my indicator. :)it's mainly for swing trading, i use the 3 day / 15 day / monthly charts with it and it works perfectly,

it works good for stocks and cryptocurrency.

you will use heiken ashi chart style and turn on the EMA DOTS indicator.

once the indicator is on you will hide the heiken ashi so you only see the dots.

when a green dot -0.57% -7.44% appears you buy, if a green dot -0.57% -7.44% appears after that green dot -0.57% -7.44% you hold your investment.

if a red dot appears you sell your position. easy as that.

the standard dots setting will be set to 10 - use this for any chart above 3 days

change the dots setting to 6 for 3day charts and below

shorter time frames will be choppy.

larger time frames will be smooth.

*Daytrading smaller timeframes is possible but not recommended.

Slow and Steady WINS the race.Buy Green

Sell Red

//

it's mainly for swing trading, i use the 3 day / 15 day / monthly charts with it and it works perfectly,

//

it works good for stocks and cryptocurrency.

//

you will use heiken ashi chart style and turn on the EMA DOTS indicator.

once the indicator is on you will hide the heiken ashi so you only see the dots.

//

when a green dot 0.35% -0.78% -0.78% -6.68% -7.44% -7.44% appears you buy, if a green dot 0.35% -0.78% -0.78% -6.68% -7.44% -7.44% appears after that green dot 0.35% -0.78% -0.78% -6.68% -7.44% -7.44% you hold your investment.

if a red dot appears you sell your position. easy as that.

//

the standard dots setting will be set to 10 - use this for any chart above 3 days

change the dots setting to 6 for 3day charts and below

//

shorter time frames will be choppy.

//

larger time frames will be smooth.

//

*Daytrading smaller timeframes is possible but not recommended.

FIB-Extensions and why you might use them wrong!#Cypher-Pattern!Hey guys,

here is my last video about FIBONACCI and its extensions. :-)

No offens to those you use it in a wrong way -I did the same mistake!

I just wanna show you how you should do it and wanna help you to improve your trading. :-)

If you don`t really understand why, just check the first Video of my Fibinacco-series.

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? Need more education or signals? PM mw. :-)

Tortuga V.3 update, 3hr timeframe with Mock Portfolio ShowcaseThis is the Tortuga V.3 update showcased with a Mock Portfolio against the 3hr Timeframe. The Tortuga V.3 indicator has been backtested to be 79% successful. This indicator is for sale, if you have any questions shoot me a direct message on tradingview.

As always, thanks for watching.

James