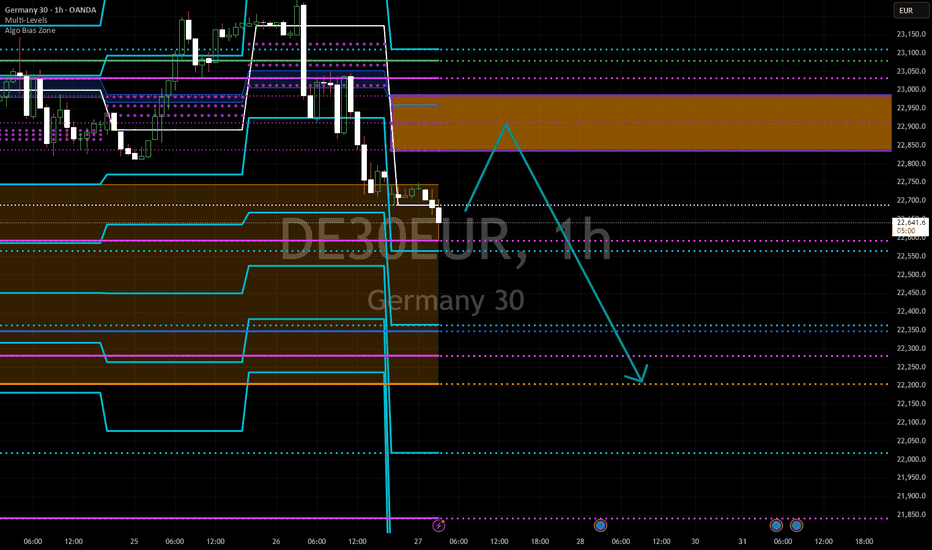

Quarter Ends, Setup Begins: Long from DAX Support ZoneDAX returned to its major support zone around 22,000 after an extended decline through March. I’ve been triggered into a long position as we step into a fresh month and quarter. We’re sitting at strong historical demand with multiple macro events lined up this week—I’ll take what the market gives and manage it accordingly. No ego here, just flow with the setup. Let’s see where this one heads as NFP and PMI data come in.

Technicals

• Timeframe: 1H

• Entry Zone: Strong support retest at 22,000

• Setup: Long triggered on reaction from major support

• Target: Zone around 22,950

• SL: Below the support zone (~21,800)

• Fibcloud: Still trending below, watching for reclaim

• End-of-month rebalancing and Quarter close may add volatility.

Fundamentals

• DAX dropped nearly 2% on Monday, hitting its lowest levels since Feb 10, in line with global market weakness.

• US trade tariff uncertainty under Trump’s “reciprocal” rhetoric weighs on sentiment.

• Germany’s CPI eased to 2.2%, the lowest since Nov 2024, aligning with market expectations.

• Q1 performance remains strong overall, up nearly 11%, supported by Germany’s spending plan.

• Eyes on this week’s NFP and PMI data which could drive further price action.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

D-DAX

DAX Bullish ReversalDAX Index (GER30) Trade Setup – 1H Chart Analysis

The DAX Index (GER30) is showing signs of a potential bullish reversal from a key support zone. The price has reacted at 21,975.87, indicating a possible upward move. A retracement to the **62% Fibonacci level (22,534.21) presents an optimal buy entry with a well-defined risk-to-reward ratio.

Trade Details:

- **Entry:** **22,534.21** (62% Fibonacci retracement)

- **Stop Loss (SL):** **21,975.87** (Below the recent swing low)

- **Take Profit Targets:**

- **TP1:** **23,476.14** (0% Fibonacci level)

- **TP2:** **24,056.53** (38.2% Fibonacci level)

- **TP3:** **24,995.45** (100% Fibonacci extension)

Analysis & Justification:

✔ Key Support Confirmation** – The price bounced off **21,975.87**, a significant support level.

✔ Fibonacci Confluence** – The 62% retracement level aligns with historical reaction zones.

✔ Moving Average Resistance** – A breakout above **22,600** could confirm bullish momentum.

✔ Risk-to-Reward Ratio** – The trade offers a **minimum 1.7:1 ratio**, improving with higher TP levels.

Oversold RSI vs. bearish wave count The market shows strong bearish dominance with price (22,207.79) below all key moving averages (EMA200: 22,743.51).

3 Bearish Confirmations:

ADX 35.85 + -DI (36.59) > +DI (11.27) = strong downtrend

RSI 28.53 shows oversold but no reversal momentum

MACD (-139.49) remains below signal line (-116.26)

Price struggles below Camarilla pivot (22,680.36) with immediate resistance at 22,534.35 (R1)

Multiple POTENTIAL downward patterns identified (Flat/Downward Candidates & Diagonal Structures)

Recent wave structures suggest Wave 3 extension in progress below 22,207

Contradiction: Oversold RSI vs. bearish wave count suggests possible relief rally before continuation

Action: SELL LIMIT

Entry Zone: 22,680-22,800 (61.8% Fib of recent swing high)

TP1: 22,156 (S1) | TP2: 21,853 (S2 Classic)

Stop-Loss: 22,900 (above EMA200)

Risk/Reward: 1:3.5 to TP2

Position Size: Risk 1% capital (220 pips risk)

Investor Summary

High-risk buying opportunity only if:

Daily close > EMA200 (22,743)

MACD bullish crossover

RSI sustains > 45

Accumulation zone: 21,800-22,200 with tight stops

#202513 - priceactiontds - weekly update - dax futures

Good Evening and I hope you are well.

comment: First 3 trading days of the week bulls tried to break above and failed at every higher high, printing an expanding triangle, which broke to the downside on Thursday. Outlook is tough. I want to lean bearish but there is still bigger buying coming through at new lows and betting on the bear breakout is just not a good trade.

current market cycle: trading range - bull trend line is broken and market has failed to make new highs 2 times on the daily chart.

key levels: 22000 - 23746

bull case: Bulls see it as a trading range at the highs and want to continue sideways until the next impulse could bring them higher again. They prevented the market from making lower lows, which is the only objective now. Once market makes new lows below 22400, the bulls know that the next support is likely the trend line around 22000, which is also the open gap close. I don’t have much else for the bulls. Narrative wise it should have made higher highs already and technically this market has turned neutral again.

Invalidation is below 22400.

bear case: Bears have plenty of arguments now to make lower lows and test down to 22000. If they fail again at a lower low, bears have to give up and let bulls take control again. We have a big open bear gap between 22900 and 23078. Bears have to keep this open and stay below the 4h 20ema if they want lower lows. They can even argue an ugly head & shoulders top and the measured move down would bring us to exactly 21000. If bulls would have been stronger, we would have made higher highs by now. We have seen enough strong rejections above 23000, volume has picked up significantly and US markets are falling like dead fish. Now or never for bears or we go higher.

Invalidation is above 23000.

short term: Neutral but bear at heart. I just won’t bet on the breakout but rather want to see it happen and only join after a retest broke down again. Previous support is too big to ignore and bears have not done enough for me to be more confident about them. Below 22500 the odds go up significantly for the bears and bulls need to recover 22900+ for more upside or at least going sideways instead of down.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: Will join the bears below 22500 on good momentum for 22000 or lower.

chart update: Bull trend line is gone and added bear gap

#dax Forex Signal German index #dax says I am rising in the medium term in technical indicators. 30% increase is normal. It is necessary to take a position for a decrease when the blue line at the top, which is our technical resistance, turns.

If you want to be in action at the right place and at the right time, you can follow me.

I can draw it for you. Please write me privately.

NOTE: IT DOES NOT CONTAIN INVESTMENT ADVICE. EVERYONE IS FREE TO BUY AND SELL THE SHARES THEY WANT FROM THEIR PERSONAL ACCOUNT WITH THEIR OWN FREE WILL. NO ONE CAN GUIDE ANYONE OR PROVIDE SHARES THAT WILL PROVIDE 100% GUARANTEED PROFIT.

I can draw it for you. Please write me privately.

Trade Idea: DAX 40 (15m Chart)Trade Idea: DAX 40 (15m Chart)

Price is currently retracing towards a higher timeframe Fair Value Gap (FVG) zone. This area aligns with previous supply and offers a high-probability short setup. Once price enters this FVG, watch for bearish confirmation such as a rejection candle or a shift in market structure on lower timeframes.

DAX H4 | Rising into resistanceDAX (GER30) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 23,093.36 which is a swing-high resistance that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 23,260.00 which is a level that sits above the 61.8% Fibonacci retracement and a pullback resistance.

Take profit is at 22,708.85 which is a swing-low support that aligns with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

DAX WILL GO UP|LONG|

✅DAX is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the index is about to retest the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 23,200

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX Index: Further Upside Ahead? On the DAX chart, we’re tracking a very large diagonal pattern to the upside, which is likely not yet complete. We are probably in the late stages of circle wave C, within a larger third wave in the yellow scenario.

Upside Targets

Next resistance levels: 24,205 and 25,715 EUR

Support Zone for Wave 4

Support area: 22,512 to 21,610 EUR

This zone would become more relevant if the current rally completes and Wave 4 begins.

On the very small time frame, it’s possible that the internal fourth-wave pullback within circle wave C has already started.

Micro support remains between 22,512 and 21,610 EUR

A break below 22,260 EUR would help confirm that wave 4 is underway

However, one more high is still possible before that pullback begins—this would align with the white scenario, where the current move finishes wave 3 before wave 4 kicks in.

DAX Growth Ahead! Buy!

Hello,Traders!

DAX is going down

And will soon retest the

Rising support and after

The retest we will be

Expecting a bullish rebound

Because we are bullish biased

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

German $DAX ($EWG) Topping Out?Originally posted on 3/12, but blocked b/c I referenced my X account. Looks like a bearish move could be materializing alongside broader risk asset weakness:

Is the XETR:DAX topping out? Monthly RSI @ 80+ w/ weekly nosing over and daily bearish divergences observable. Index high from 3/6 coincided with the 261.8% Fibonacci extension of the 11/2021-10/2022 uptrend correction.

Confirmation short setup could materialize $FDAX closes below pivot low of the 1D uptrend (22226), bounces off of short-term demand (ex: 22142-21691, and trades into supply ≥ 22226. This scenario is speculative - the market needs to show its hand.

Presently, DAX is up > 1.5% alongside US stocks, which dipped into intermediate-term demand and benefited from softer-than-expected CPI prints. However, DAX (and domestic) bulls haven't proven anything yet. Unless buyers manage to push the DAX higher - initially above 22900 and secondarily through 23000-23200 - on accelerating momentum, risk remains to the downside (IMO). German stocks have been global relative strength leaders as of late, so if they do correct, other equity indexes may retreat in tandem.

Long-term charts for US indices ( SP:SPX , NASDAQ:NDX , TVC:RUT ) look more bearish vs. bullish (I still have some shorts on), though a near-term recovery is plausible. If domestic equities do trade lower, selling could materialize in Asian and European markets. Use LTF charts to monitor price action/manage risk and splice into shorts if German stocks AMEX:EWG start to crack.

My $0.02. Feedback welcome.

Jon

DAX Trade Log DAX Buy Setup with Ichimoku Confluence

Geopolitical tensions—especially the ongoing conflict in Eastern Europe—continue to influence risk sentiment, while inflation and central bank policy remain in the spotlight. The European Central Bank’s more hawkish stance contrasts with fears of slowing growth in the Eurozone. Despite these headwinds, the DAX could see a near-term bounce, supported by technical signals:

1. Ichimoku Confluence : Price is testing the Kijun and the lower edge of the cloud, aligning with a daily pivot. A close back above the Kijun/cloud area suggests potential upside.

2. Volume Spike : Recent volume surge around this support zone may indicate bullish absorption—watch for follow-through.

3. Macro Backdrop : Although persistent inflation and geopolitical uncertainties loom large, short-term volatility can present trading opportunities. Keep an eye on ECB communications and any unexpected developments in global tensions.

4. Risk Management : A 120-point SL (around 2% account risk) below the key support could help protect against false breaks. Targets include the top of the cloud or previous swing highs.

5. 8-Day Cycle : Day 2 in your cycle analysis suggests a potential upswing—confirmation will come if price holds above this confluence zone.

Stay vigilant, monitor news flow, and maintain discipline in your trading plan. This is not financial advice—always do your own due diligence.

2025-03-19 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: We oscillate around 23300 and not moving much. It’s a bull flag but one that has been going on for too long now. The longer we move sideways, the more neutral the market is. Clear invalidation prices for both sides. Breakout above the bull flag and 23400 could mean another try at 500 and if they crack that, 24k comes in play. Bears need strong closes below 23000 and then we could accelerate down again.

current market cycle: trading range

key levels: 23000 - 24000

bull case: Bulls have two big open gaps and if they defend them, they can continue to try and get a new ath above 23505 and maybe 24000 if momentum is there. On the daily chart this looks bullish and nothing else but on the 1h chart it get’s more neutral with every 1h bar. Not much else to write in favor of the bulls tbh. Either they break above the bull flag tomorrow or they better lock in those profits.

Invalidation is below 23000.

bear case: Bears have many arguments on their side but until we see prices below 23000, they are mostly hopes and dreams. Even the most bullish news one could make up about the big spending bill, could not get us a new ath, which means big bois are reducing their positions above 23300 (at least for now). Bears also see the big double top on the daily chart and if we break below 23000, it could accelerate down big time. Bulls have also tried 4 times on the 1h chart to get above 23300/23400 and failed each time. Market has turned mostly neutral and bears have a chance of closing the week below 23000.

Invalidation is above 23550.

short term: Neutral. 23300 is the fair price. Set alerts for the given invalidation prices and see if we can get a big trend before end of week. Chop is more likely though.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Buying below 23200, which was support yesterday and today it was good for 150+ again.

DAX strong bullish conditions. Targeting 24200.DAX is trading inside a Channel Up since the October 15th 2024 High.

Since March 11th 2025 it is on a MA200 (4h) rebound and the last time it did so was on January 13th 2025.

It then initiated a +9.12% rebound, which throughout the Channel Up pattern, has been a quite common bullish wave.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 24200 (+9.12% rise from the MA200 low).

Tips:

1. The RSI (4h) has print a Channel Up pattern that is seen on the last three major Lows of the pattern. Strong bullish signal.

Please like, follow and comment!!

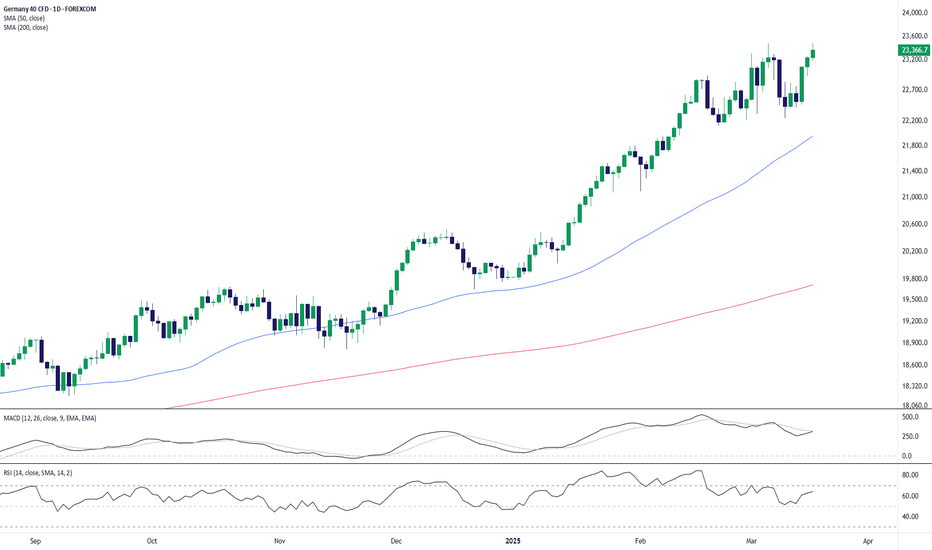

Germany's DAX Hits Fresh Highs as Uptrend StrengthensThe Germany 40 (DAX) continues its impressive rally, climbing to 23,378.7, up 0.60% on the session. The 50-day SMA (21,954.8) remains firmly below price action, signaling sustained bullish momentum, while the 200-day SMA (19,713.1) provides a solid long-term support base.

Momentum indicators support the uptrend:

✅ MACD remains in bullish territory, showing sustained strength.

✅ RSI at 64.04 suggests the index is trending strongly but isn’t overbought yet.

Key Levels to Watch:

📌 Support: 22,800 (recent pullback level), 21,950 (50-day SMA)

📌 Resistance: 23,600 (psychological level), 24,000 (round number target)

As long as 23,000 holds as support, bulls may push for 24,000+ in the near term. A drop below 22,800 could signal a deeper pullback.

-MW

2025-03-17 - priceactiontds - daily update - dax

Good Evening and I hope you are well.

comment: Weekly outlook gave clear invalidation points and bulls broke above. We have a clear measuring gap down to 22800 now and until that is closed, it’s bullish all the way to new ath and maybe 24k.

current market cycle: trading range but we could see the resumption of the bull trend tomorrow

key levels: 22260 - 24000

bull case: Bulls defended the breakout and had a perfect retest with last weeks close. Every pullback now should stay above 23000 and then we are free to test 23500 and maybe even 24000. Bulls are in full control again.

Invalidation is below 23000.

bear case: Bears failed in breaking below the breakout of 22800ish and they had to give up after we printed 4 consecutive 1h bars with big tails below. 1h 20ema is support and until bears get consecutive closes below it again, they don’t have much. I think most bears will wait how high this one goes and start looking for shorts above 23500.

Invalidation is above 23600.

short term: Bullish for 23500 and maybe 24000. Bearish only below 22900.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Bullish above invalidation point yesterday given. Hope you made some.

DAX Post Election Potential Bullish ContinuationDAX price still seems to exhibit signs of potential bullish continuation (during the current post election period) as the price action may form another credible Higher Low with multiple confluences from key Fibonacci and Support levels.

Trade Plan :

Entry @ 22653

Stop Loss @ 22014

TP 1 @ 23292 (Before All Time High)

TP 2 @ 23931 (After All Time High)

Move Stop Loss to Break Even if TP1 hits.

#202511 - priceactiontds - weekly update - dax futuresGood Evening and I hope you are well.

comment: Wild week where market reversed the huge selling on Friday and the daily bear bar looks more bullish than bearish. 23k is the battleground right now. If bears keep it a lower high, we could test further down but if they don’t, bulls could try and go for 24k. News certainly help in fueling this right now.

current market cycle: Bull trend until consecutive daily closes below 22000

key levels: 22000 - 24000

bull case: Above 23500 we could go for 24000 next week. This did not change since market went nowhere last week. Bulls defended the gap to 22000 and that is as bullish as it get’s. Plan for bulls is clear, keep market above the adjusted bull trend line around 22500 and make new ath above 23500, likely going for 24000. The channel looks still good, so trade it like it’s valid.

Invalidation is below 22400 because it would invalidate the channel but only a print below 22000 would change the character of this market.

bear case: Bears have shown decent selling pressure for 1200 points but that does not matter if they can not get below 22000 again. I do think it’s not unlikely that the bears have the argument for a head & shoulders, if 23000 proves to be bigger resistance now. I’d still favor the bulls for now but if we fail below 23200 for the next 3-6 days, the bull trend line would be broken and market could test lower, if overall sentiment shifts again after the expected short squeeze. Yes, I do keep in mind that German stocks are likely profiting big time from the spending spree Germany will likely go on but I am a price action daytrader. I read the chart and develop a thesis would could happen and if it does I put on risk. This front-running could very well reverse. Bears only have their confirmation below 22000 and for now market has tested 22147 - 22300 enough that bears gave up.

Invalidation is above 23500.

short term: Neutral around 22800/23200. Above 23200 we will retest 23500 and above that we likely try for 24000. 22400-22800 is the dead zone and only below 21900 bears have good reasons for lower prices. For now I can’t see any reason why this would fall below 22000 next week.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

chart update: Nothing