Goldusdollar

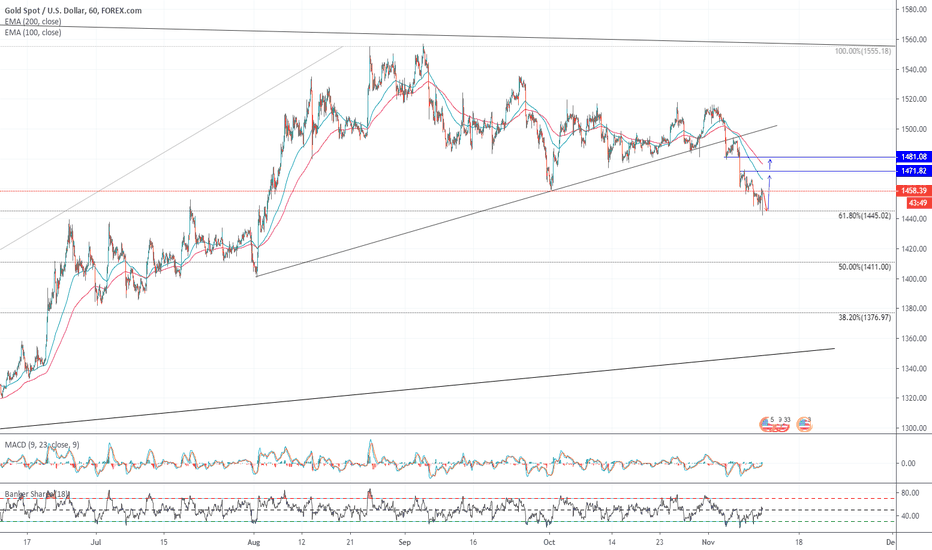

ANALYSIS ON XAUUSD (goldusd)ANALYSIS ON XAUUSD (goldusd)

Welcome to my analysis

-

30Min CHart

-

Interesting Point of interest In the XAUUSD pair.

- Price below 100/200 day EMA.

- Buy reversal.

- Expecting more Upward momentum.

- Watch 1471.82-1481.00 for take profit.

- MACD showing bullish divergence

Stay Tuned

Gold Bearish trend is comingHi Guy

At the moment gold on strong resistance area around 1530, will reject from this area??

gold already try 3 times to cross 1530 but rejected, now this time again testing but will reject it and dump soon.

also stochastic RSI are overbought area and also 30 MA cross to 100MA. So most probably chances that will dump and this time will break strong support.

Daily Gold price trend prediction !!30-Jun

Price forecast timing analysis based on pretiming algorithm of Supply-Demand(S&D) strength.

Investing position about Supply-Demand(S&D) strength: In Rising section of high profit & low risk

Supply-Demand(S&D) strength Trend Analysis: In the midst of an adjustment trend of downward direction box pattern price flow marked by limited rises and downward fluctuations.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.1% (HIGH) ~ -0.3% (LOW), -0.2% (CLOSE)

%AVG in case of rising: 0.8% (HIGH) ~ -0.1% (LOW), 0.6% (CLOSE)

%AVG in case of falling: 0.3% (HIGH) ~ -0.7% (LOW), -0.4% (CLOSE)

Don't miss the great sell opportunity in GoldTrading suggestion:

. There is a possibility of temporary retracement to resistance support line (1280.90). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XAUUSD is in a range bound and the beginning of downtrend is expected.

. Price is below WEMA21, if price rises more, this line can act as dynamic resistance against more gains.

. The RSI is at 29.

Take Profits:

TP1= @ 1272.90

TP2= @ 1260.60

TP3= @ 1240.55

SL= @ 1285.25

GOLD (XAUUSD) DROPPING - CATCH THE DROP GUYSSo happy new year people, hope you all had a peaceful and happy xmas and new year.

so Gold (xauusd) has hit some resistance now, th price being rejected. i am expecting furtherdrop, that will brek the trend line.

i am gunning for TP1, if it break that then TP2.

happy trading

See previous analysis

SUPPORT THE MOVEMENT WITH YOUR LIKES, COMMENTS AND FOLLOW FOR MORE

Gold depends on $ & supporting by Silver week aheadXAUUSD Technical Overview:

Week Pivot: 1191.82

Week Key Resistance: 1200.74 - 1206.16 -1215.16

Week Key Support: 1182.90 - 1177.4 - 1168.48

Technical Indicator:

Moving Average: SMA 200 (1196.65) & SMA 55 (1198.28) strong resistance for gold.

RSI: The indicator shows downward momentum & having strong resistance at 53.41 level (See in chart)

Technical Trade Idea for week:

Most Likely Scenario: Long above 1191.40 with target 1200 - 1205 in extension.

Alternative Scenario: Short below 1191.40 with target 1182 - 1176 in extension.

Fundamental:

Gold hit a fresh six-week low late in the week, but a strong performance in silver, coupled with profit-taking in the U.S. Dollar ahead of the week-end, helped the market recover nearly half of the week’s loss.

Although the direction of gold prices will be primarily influenced by the U.S. Dollar. Traders should also pay attention to the price action in the silver market.

Silver is being supported because it is relatively cheap. Additionally, it could be attracting buyers due to inflationary expectations and industrial demand during the current economic expansion. This makes it a more attractive asset relative to gold. This may be just enough to bring in the buyers. Now that the news is out there, look for heightened volatility.

Economic news that could influence the U.S. Dollar and gold prices next week are U.S. ISM Manufacturing PMI, ISM Non-Manufacturing PMI, and the Balance of Trade.

Additionally, investors will get the opportunity to react to the September Non-Farm Payrolls report. The headline number is expected to show the economy added 185K jobs last month. Average Hourly Earnings are expected to have risen 0.3% and the Unemployment Rate is expected to dip to 3.8%.

The dollar will continue to be influenced by Treasury yields and worries over Italy. We’re going to approach the market early in the week as if a stronger dollar will make gold weak. However, we’ll quickly shift to an upside bias if another rally in silver takes control of the gold market and drags prices higher.

Thanks

YoCryptoManic

European Session Gold keen observing "sensitive US dollar"XAUUSD Technical Overview:

Pivot: $1197.10

Day Trading Range: $1194 - $1214

Key Resistance: $1204.45 - $1207.29 - $1212.66 - $1218.89

Key Support: $1197.10 - $1194.22 - $1191.45 - $1189.56

Technical Indicator:

RSI: RSI lacks downside momentum, trading above 50 level.

Moving Average: SMA200($1198.94) & SMA100($1200.48) strong support for xauusd today.

Technical Trade Idea:

Most Likely Scenario: long positions above 1197.10 with targets at 1205.50 & 1207.56 in extension.

Alternative scenario: below 1197.10 look for further downside with 1194.50 & 1189.45 as targets.

Overall, Gold remains in a sideways consolidation between 1214 and 1182 but is making the case for a break higher according to the bullish symmetrical triangle. For bulls to get back control, whereby the market is heavily short of gold and to reconsider its positioning, (net speculative short positions, or bets an asset’s price will fall, in gold, are up 275% year to date), then they need to get and hold above the 50-D SMA at 1211 first, then 1214 which is resistance and then the 200-W SMA at 1233 will need to be challenged. A retry of the downside now should target 1146/20 monthly levels.

Fundamentally, the intensifying U.S.-China trade dispute is the driver ahead of next week's FOMC meeting. However, we have only seen modest moves in the greenback so far and markets, in fact, took the trade headlines in their stride. Even with President Donald Trump announcing $200 billion tariffs against China on Monday that provoked an expected and swift retaliation from the nation, fear has yet to really show up in the market and the US benchmarks were higher with the DJIA making another all-time record high.

Thanks

YoCryptoManic

European Seeion Yellow Metal Upside Bias XAUUSD Technical Overview:

Pivot: $1200.20

Day Trading Range: $1196 - $1214

Key Resistance: $1208.45 - $1212.89 - $1215.55

Key Support: $1204 - $1200.20 - $1196.28

Technical Indicator:

MACD: MacD is loosing bullish bias.

Moving Avg: SMA100 ($1201.03) & SMA200 ($1199.63) strong support for the day.

Technical Most Likely Scenario: long positions above 1200.00 with targets at 1208.25 & 1212.50 in extension.

Technical Alternative scenario: below 1200.00 look for further downside with 1196.00 & 1192.50 as targets.

Fundamental:

Gold markets have rallied significantly during the trading session on Thursday but hit a brick wall of resistance above the $1215 level, and I think that there are a couple of moving pieces right now that are throwing the markets around. The US economy printed a lower than anticipated CPI number, and that sent the greenback lower, and by extension sent the Gold markets higher. However, at the same time there is comments coming out of the European Union that further stimulus may be needed by the central bank, which is positive for the US dollar as the EUR/USD pair essentially drives the majority of US dollar flows.

Thanks

YoCryptoManic