Power of compounding interest, but why do traders still fail ?

Hello everyone:

Welcome to this quick educational video on Compounding interest in trading.

Today I want to break down the benefits of compounding a trading account while keeping good risk management at bay.

The reason why compounding interest is so lucrative is due to investing interest on top of interest, and your trading account can grow much faster than traditional investment returns.

The important note is that, by having strict risk management rules, proper trading plan, the account can grow over time. But why do many traders fail to do so ?

Let's take a deeper look into this:

Many new/beginner traders often get involved in trading due to its profitable potential.

However, most of them do not learn about risk management, trading psychology on mindset and emotions.

They tend to over trade, over leverage their accounts in hope to double it in a short period of time.

This almost always leads to traders to blow their accounts, and re-deposit more money to “chase/revenge” their losses, and the cycle continues.

The truth is, growing the account by compounding can eventually double a trading account, but only in time and with strict risk management rules.

However, the greed, emotion and mindset often become the tread stone for the traders’ success.

It's important to understand that having a consistent, sustainable approach in trading can lead to profits and growth over time, but it's not something that is instantaneous, which is what most new/beginner traders often misunderstood.

This can be due to social media, and lots of typical trading “guru” out there promising guaranteed results and easy money.

Take a step back and think about compounding interest in time and scale. 5-7.5% return per month may not seem much for a small trading account, but it is sustainable and consistent by not over-risking and over-trading.

In time when the account is at a larger scale, a few % return with compound effect in a year can generate very sizable return and growth.

In today’s trading industry, there are many prop firms out there that allow you to trade their funds, if you can be consistent and sustainable.

Understand these firms are not looking for traders to double their larger capital, rather, to have consistent return and proper risk management.

When you can prove you can be consistent to compound a small account, then when you actually do trade a larger account, the % return would be the same.

Last Note:

Build up the right habits from the start. Your job in the beginning of trading is not to make massive returns, rather to focus on risk management, control emotion, and understand trading psychology.

Once all these are checked, then you will be miles ahead of other traders who are still struggling to understand the concept.

Any questions, comments or feedback welcome to let me know.

Thank you

Jojo

H-pattern

USD Pairs Bullish Outlook before NFP (GBP, EUR. CAD. AUD, NZD)

Hello everyone:

Since I couldn't do the mid-week market update live stream, I thought I would go over the USD pairs in more detail in this quick video.

My overall bias on the USD is strength in them, so I pointed out 5 USD pairs that could shape up for such opportunities.

Like always I need to wait for confirmation from them, so they are very close to shape up for the entries, and I would be watching them very closely.

Feel free to let me know if you have any questions, comments or feedback.

Thank you

Weekly Trading Recap: CADJPY, NZDJPY May 29 2021Hello everyone:

Welcome back to this week’s trading recap video.

Let's take a look at the trades entered/closed this week.

I will explain my approach on the entry, SL, TP and management.

Getting close to end of month, and overall pretty mellow. Quite normal coming from a bigger profitable month last month.

Still very please with the result, +3.36% per the month of May.

CADJPY: BE

Full analysis/forecast:

NZDJPY: -1%

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Detail USD Outlook in Price Action Analysis (GBP, EUR, CAD)

Hi everyone:

Today I want to dig deeper into a few USD pairs that may shape up for a very good bullish move in USD in the near future.

I narrow down the 3 best potential pairs, EURUSD, GBPUSD and USDCAD.

EURUSD

GBPUSD

USDCAD

Lets take a look at each of them, and see my analysis, forecast, and entry potential on all of them.

As always, understand that price needs to develop into the right price action before entering any live trades. If it does not, then no entry and move on to other opportunities.

Always have your own plan, management, entry, SL, TP that fits your trading perspective and expectations.

Feel free to ask me questions, or comment/feedback.

Thank you

Weekly Trading Recap: NZD/CADJPY, MATIC, CADCHF May 22 2021Hello everyone:

Welcome back to this week’s trading recap video.

Let's take a look at the trades entered/closed this week.

I will explain my approach on the entry, SL, TP and management.

NZDJPY - Running around BE

Full analysis/forecast:

CADJPY:

First Entry: BE

Second Entry: Running around BE

Full analysis/forecast:

MATICUSD: +0.53% profit

Full analysis/forecast:

CADCHF: -1% loss

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

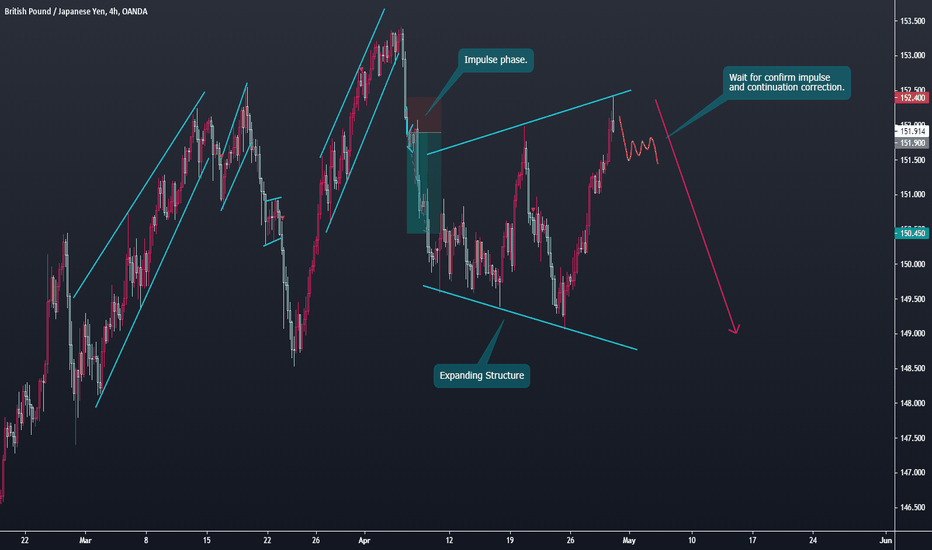

Detail Analysis and Forecast On the current JPY's Price Action

Hello everyone:

Many have asked me about what I think about the current JPY markets, so I figure a quick analysis and forecast on all of them would be the best way.

I did go over them in today’s midweek market updates, but let's take a look at them more closely here.

Remember, these JPY pairs need to develop the bearish continuation corrections on the lower time frames first before considering the entries.

In addition, it's best to choose and filter out the best pairs to get in, as entering all of them won't make sense from a risk management view.

Any questions, comments or feedback welcome to let me know :)

Thank you

Weekly Trading Recap: CADCHF, AUD/NZDJPY, EURCHF ADA May 15 2021Hello everyone:

Welcome back to this week’s trading recap video.

Let's take a look at the trades entered/closed this week.

I will explain my approach on the entry, SL, TP and management.

CADCHF: Running Position

Full analysis/forecast:

AUDJPY: - 1% loss

Full analysis/forecast:

NZDJPY: +0.5% profit

Full analysis/forecast:

EURCHF: - 1.16% loss from slippage

Full analysis/forecast:

ADAUSD: BE

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Detail Look into Parallel Channel In Price Action Analysis

Hello everyone:

Let's take another detailed look into some parallel channels structures/patterns in price action analysis.

Recall my previous educational video on Ascending/descending channel correction, they are higher probability reversal price action structures/patterns.

Today I want to go over the horizontal parallel channel structures/patterns as well where they are more neutral,

more advanced to analyze and forecast the potential direction of the impulse phase following after.

Let's take a look into some of these horizontal parallel channel corrections, and break them down more.

In my opinion, the longer, deeper these types of parallel channels go, the stronger the next impulsive phase will be.

Although they can be tricky depending on whether they are continuation or reversal correction.

I will go over for examples in different markets to pinpoint some of these price action structures/patterns.

Below are some of the important topics that I mentioned in the video.

Reversal Ascending/Descending Channel

Risk Management: 3 different entries on how to enter the impulsive phrase of price action

Multi-time frame analysis

Identify a correction in price action analysis

Continuation and Reversal Correction

Any questions, comments, or feedback welcome to let me know thx :)

Jojo

5 Best Crypto to trade and/or to hold (BNB, ADA, XRP, DOT, LTC)

5 Best Cryptos to trade and/or to hold from a technical, price action point of view. (BNB, ADA, XRP, DOT, LTC)

Hello everyone:

The recent question I've been getting is what cryptos to trade or/and to hold.

Certainly trading and investing (holding) would be different,

so I thought I would outline some coins that have good price action and technical in my view at the current market condition.

Make sure to have your own plan on whether you are trading them or investing (holding),

as they can certainly have different outcomes and management needs to do so.

Remember please also take into consideration risk management and trading psychology as well.

Don't put all your eggs in one basket, spread out your $ to be stable and sustainable.

BNB

ADA

XRP

DOT

LTC

Any questions, comments or feedback welcome to let me know :)

Thank you

Jojo

Weekly Trading Recap: ADA, AUDCAD, GBPCHF, EURUSD May 08 2021

Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the trades entered/closed this week.

I will explain my approach on the entry, SL, TP and management.

CARDANO (ADAUSD) - Currently running at BE

Full analysis/forecast:

AUDCAD - Closed 2 trades for about 3.2% profit

Full analysis/forecast:

GBPCHF - Close down for about 1.87% profit

Full analysis/forecast:

NZDJPY - Closed 2 trades for about 0.74% profit

Full analysis/forecast:

EURUSD - Exit for about 0.85% profit

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

U.S. Indices Price Action Market Outlook (S&P500, NASDAQ, DOW)Hello everyone:

Many have asked me about my outlook and analysis on the US indices currently, so let's take a quick look at them.

My overall bias on the indices are bearish. There could be some lower time frames bearish price action to give us confirmation of the bigger sell setups.

All of them are pretty much sitting at the top of the overall higher time frame price action, so certainly has good probability that we can get some bearish reversals.

I will go over them from a mid-long term approach.

Once again patience is key, if the bearish price action does not develop or continue, then no trade and entry, move on to other opportunities and different scenarios.

SPX

NAS

DOW

Any questions, comments or feedback welcome to let me know.

Thank you

Jojo

Detail Breakdown on GOLD Mid-Long Term OutlookHello traders:

Today I breakdown GOLD's current price action, and I discuss the potential possibility on the mid to long term outlook.

There could be different possible scenarios from the price, so its a good practice to have a solid trading plan and management.

Mid term wise I prefer to see price makes one more move to the downside, breaking previous lows and hit the bottom for the HTF flag/channel structure before reversing.

Alternatively we can also expect price to consolidate here and form a LTF impulse to breakout of the LTF flag/channel as well.

In both cases, long term outlook is certainly bullish if we get a completion of the LTF flag/channel that will have high probability to lead into next bullish impulse run.

Any questions, comments or feedback welcome to let me know.

Thank you

Jojo

OIL higher time frame outlook (Multi-time frame analysis)

Hello everyone:

Doing a quick bearish outlook on oil.

I like the price had a strong reversal bearish price action from the top of the HTF double tops area, and could lead into further continuation on the LTF

I will be patiently waiting for price to develop into the price action I want to see before executing any trades.

Thank you

Jojo

AUDCAD Continuation Sell (Multi-Time Frame Analysis)

Hello everyone:

Looking at AUDCAD for continuation sell opportunities.

WE can see price had a bearish impulse phrase on the HTF, after breaking out from the rising wedge, and is now forming consolidation which can lead into the next down move.

I would be waiting for a confirmed breakout from the continuation correction, and any LTF correction to get in on the sell

thank you

P.S. If you enjoy a video analysis breakdown moving forward, please let me know :) thx

Jojo

JPY Bearish Outlook (GJ, AJ, NJ, CJ)

Hello traders:

Similar like the USD outlook, I have made a quick video breaking down some of the JPY pairs I am looking at.

Same trading plan and risk management approach like the USDs, I would wait and see the bearish development first before enter any positions.

So watch out for some LTF development on some of these pairs in the up coming days.

Thank you

USD Outlook (GU, EU, AU. NU)Hello everyone:

Welcome back to a quick updates on the USD.

In this quick video I breakdown 4 USD pairs that are shaping up to for a good sell potential on them.

All of them will need a bit more development to give me the positive confluence to enter the trades, so patient is key here.

IF the price doesn't develop into what I like to see, then no entry for me. :)

EURUSD

s3.tradingview.com

GBPUSD

s3.tradingview.com

AUDUSD

s3.tradingview.com

NZDUSD

s3.tradingview.com

Any questions, comments or feedback welcome to let me know :)

Thank you

Weekly Trading Recap: GBPCHF, EURUSD Apr 24 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week.

I will explain my approach on the entry, SL, TP and management.

GBPCHF - Running 2% profit

Full analysis/forecast:

EURUSD 0 Closed for BE

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap: LTCUSD, XLMUSD, BNBUSD, GBPCHF Apr 17 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

Litecoin (LTCUSD) - Running about 2% profit

Full analysis/forecast:

Stellar (XLMUSD) - Running about 2.5% profit

Full analysis/forecast:

Binance Coin (BNBUSD) - closed down for +9.5% profit

Full analysis/forecast

GBPCHF - Closed down for +0.5% profit

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

How to identify a correction for the next impulse move ? How to identify if a correction is finished/completed and ready for the next impulse move ?

Hello everyone:

In this educational video I will go over how to properly identify a correction in price action analysis.

I recently made a price action workshop live stream video that went over everything on impulse - correction, structures/patterns, continuation and reversal corrections,

but I still get a lot of questions on identifying corrections itself.

How to draw, use the trendlines to identify a correction, and how to understand they are going to complete/finish.

In my opinion this is the most important part in technical analysis.

We need to understand that the market moves in phrases, it can only be in the impulsive phrase or corrective phrase.

The key to trading is to understand when a correction finishes, we are going to get the impulsive phrase which will give us traders a better edge in the market to enter, where the momentum is strong.

I have made many educational posts on price action analysis, specifically on continuation or reversal correction, which I will put the links below.

Any questions, comments, or feedback welcome to let me know.

Thank you

Jojo

Price Action Workshop

www.tradingview.com

Impulse VS Correction

Continuation and Reversal Correction

Multi-time frame analysis

Continuation Bull/Bear Flag

Reversal Ascending/Descending Channel

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Expanding Structure/Pattern

Basic understanding of Candlestick- and Chart-PatternsHello everyone, first of all - thank you for the positive respond to my previous video. Now that we know what a trend is made of, we want to point out the difference between Candle-Stick patterns and Chart-Patterns. Feel free to check out the previous episode below. In the next Video we are going to discuss the basic indicators you should look at for trading a trend.

Please give me some feedback on what i can improve.

Cheers,

Ares

Weekly Trading Recap: BNBUSD, GBPJPY, GBPUSD, XLMUSD, Apr10 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

Binance Coin (BNBUSD) - running about +8% profit, will exit at $500

Full analysis/forecast

GBPJPY - Exit for +3% profit first trade, and -1% loss on second scale in.

Full analysis/forecast

GBPUSD - Exit for +2% profit

Full analysis/forecast

Stellar (XLMUSD) - running about +1% profit, SL still at BE

Full analysis/forecast:

EURNZD - Exit for +0.5% profit

Full analysis/forecast

NZDCAD - exit for about -0.25% loss.

Full analysis/forecast

Any questions, comments or feedback please let me know. :)

Thank you

Jojo