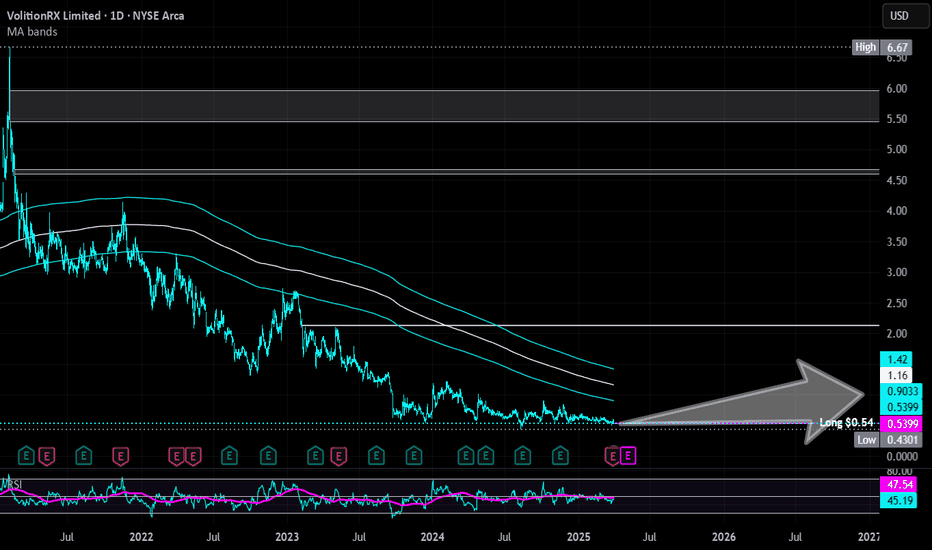

VolitionRX | VNRX | Long at $0.54***Stay away if you are risk averse (small cap with 300-400k daily volume and could go to $0).

VolitionRX AMEX:VNRX is a U.S.-based, multinational epigenetics company focused on developing blood tests for early disease detection, primarily targeting cancer and sepsis. Its Nu.Q blood tests are primarily for humans, focusing on early detection of diseases like cancer and sepsis. However, the company has also explored veterinary applications through its Nu.Q Vet product line, targeting cancer screening in animals, particularly dogs.

Recent insider purchases got my attention, with the CEO and Director each grabbing $100k worth at $0.55. Plus, many other insiders have recently been awarded options. The company is making progress in signing multiple licensing deals for their Nu.Q platform in the human market, with strong interest from large companies. Many development milestones have been made within their cancer testing program and more are likely to be announced. However, the company is unprofitable at this time, and this is a highly risky / speculative play. It may take years to unfold or be a total disaster and go to $0.00.

Rolling the dice at $0.54 with the goal to reach $0.75 and $1.00 in the coming 1-2 years. Analyst targets are in the $3.00-$3.50 range.

Screening

🟨 Weekly Charts for ScreeningWhy look at weekly charts?

We look at weekly charts because it reduces volatility when scanning for stocks. This is especially important during bear markets when the stocks are more volatile.

What do we want to see?

Base depth no more than 30%

Close on the weekly bars near the highs

Closes are tight (about 1-1.5% of each other)

Peak closes on weekly

Big Volume on the Up Weeks

Lower Volume on the Down Weeks (compared to the Up weeks)

RS Line near highs while stock is still in base

Here are some of the stronger names I see today:

$HALO, $PODD, $PI

TradingView's Missing FeatureTradingView is an great platform. I am especially a fan of PineScript, the programming language that allows you to build custom indicators. But while TradingView's current features are great, I think this is something very important that is missing. Something that, were the developers of TradingView to implement it, would change it from a great platform to an EXCELLENT platform...

And that feature is allowing users to screen stocks based on their scripts !

Why is this needed? There are many reasons:

1. Multi-timeframe analysis - The current TradingView screener has useful parameters, like finding stocks that are above their 20-day SMAs, but what if your strategy involves the values of indicators on a lower timeframe? For instance, what if you wanted to find stocks that are displaying a Golden Cross/Death Cross on the 1-hour chart? You can't do that currently, but it is easy in PineScript to tell if a stock has a Golden Cross or Death Cross simply by using the close series, or the security function to get the close from any timeframe. So if TradingView could implement a way to screen based on PineScript, this would make improved multi-timeframe analysis possible.

2. Published scripts - Perhaps you have read through some TradingView ideas and found an indicator you really like and want to use it as part of your trading strategy. But as we all know, not every stock -- or even every watchlist -- always provides an actionable signal all the time. So wouldn't it be great to be able to screen for stocks that are providing signals, even when those signals are based on indicators not included in TradingView's default list?

3. Personal scripts - Maybe you have developed a custom indicator of your own, and would like to find stocks that satisfy certain parameters based on it. Currently, you can't do that in TradingView. The closest solution is to build a 40-ticker watchlist, and then use the security function in a custom script to iteratively check each ticker against your condition. This is a decent workaround, but it still limits you to 40 tickers out of the hundreds of stocks on the market. So that leaves two other solutions - buy an API and make your own version of PineScript (not an easy, quick, convenient or affordable route, and one that requires a lot of programming skills) or... hope TradingView allows a new "screener" category for PineScript!

4. Greater flexibility - I have hinted at this in my other categories, but overall, screening based on PineScript would give the user far greater flexibility in his/her trading strategy. Maybe your strategy is complex, like "if condition A is met OR (condition B is met and condition C is met), go long," in which case, the existing TradingView screener would still require a lot of time-consuming and manual analysis to see if this either-or statement holds. But this is a few lines of code in PineScript!

Users:

So what do you think? Do you want to see the ability to include PineScript in TradingView screens? What sort of other powerful applications and strategies might you be able to implement if this feature were implemented? Let me know in the comments below and please give this post a "Like" if you want to encourage TradingView to implement PineScript-based screening!

Moderators:

If you could please pass this along to the developer team, it would be greatly appreciated! Thank you to the TradingView team for developing a great trading platform, and I look forward to continued development and additions!