Skyworks Solutions (SWKS) | Stormy Times-Technically In The ZoneHi,

Criteria:

1. The trendline

2. Strong multi-yearly resistance becomes support

3. Fibonaccy retracement 62%

4. Round number $100

5. 50% drop from ATH

6. Some EMA's from different TFs are in the zone

Do your own research and if it matches with my TA then you are ready to go.

Regards,

Vaido

Skyworks

skyworks option call for march 26th @185 strike why i just placed these calls??

first look at my other ost i posted about them and killed the game <3 now come back to this and see what im saying :)

chip shortage being a big thing now. it wont affect this company because..... they make these chips.

i see some gainz being had in my view. they could be underpriced but i dont really care about value NOW.

what i care about is what the future value will be so like my guy says buy something worth a dollar for .66cents babyyyyy

Skyworks Solutions Inc. Wednesday, 9 December 2020

22:18 PM (WIB)

Skyworks Solutions Inc. Is the global leader manufacture that produces semiconductor and others relates electronics for 5G LTE and its components. The clients are coming from top brands such as Apple, Samsung, Xiaomi, Realme, Oppo, etc. At this time surprisingly the price is not at the best performance yet, while the similar manufacture has reached the price momentum at $400. For consolidating into the highest price, it has to be forming the waves from resistance to support baseline. It is very clear support and resistance, that interesting to have this for many years to come.

Best regards,

RyodaBrainless

"Live to Ride and Ride to Live"

SkyWorks Solutions IncFriday, 27 November 2020

00:39 AM (WIB)

Skyworks Solutions Inc.

NASDAQ

OUR VISION

We are empowering the wireless networking revolution, connecting people, places, and things around the world. As the demand for ubiquitous, “always-on” connectivity increasingly expands, our innovative, high-performance analog semiconductors are enabling breakthrough communication platforms from global industry leaders – changing the way we live, work, play and learn. Through our broad technology expertise and one of the most extensive product portfolios in the industry, we are Connecting Everyone and Everything, All the Time.

QUALITY

We are passionately committed to providing our customers with the highest quality products, keeping their satisfaction and success at the core of our efforts. Our quality management emphasizes sustainable, continuous improvement.

SUSTAINABILITY

We are dedicated to minimizing our environmental footprint and cultivating safe and productive workplaces. Our policies and programs drive improvements affecting the environment, health, and safety, ethics, and labor practices.

CORPORATE SOCIAL RESPONSIBILITY

Skyworks wants to Make Every Connection Count – whether through our manufacturing operations or within the communities where we operate around the globe. Our CSR program spans environmental sustainability, supply chain responsibility, inclusion and diversity, and social impacts to ensure we are doing our part to make positive changes in the world, one connection at a time.

We Create Technologies That Make 5G Work

5G will transform our world, creating an ecosystem where everyone is connected to everything, all the time ─ and changing how we live, work, play, and learn.

Skyworks is at the forefront of this sea change. Leveraging our technology leadership, broad systems expertise, and operational scale, we are creating the solutions that will launch the true potential of 5G. A world of new and unimagined applications. From our breakthrough, SKY5® unifying platform to our 5G small cell and multiple-input, multiple-output (MIMO) technology, Skyworks' comprehensive approach across both infrastructure and user equipment facilitates powerful, high-speed end-to-end 5G connectivity.

www.skyworksinc.com

Best regards,

RyodaBrainless

"Live to Ride and Ride to Live"

SWKS loosing steam Skyworks is nearing a new high and running out of steam. Heres what the indicators say.

Sell/Buy indicators: SWKS has been marked a buy since 9/25. 4 trading days while our longest buy signal in the past 4 months has lasted 20 days. This is our only indicator not yet supporting a sell but can we spot it first? Lets check out the other indicators.

Moving Average: SWKS is slowly moving closer and closer to its moving average and if history repeats itself, once it falls below the MA we should see a sharp sell off.

Volume: The volume indicator shows we are starting to loose bullish volume.

Relative Strength Indicator: Shows that SWKS is over bought, we should expect some heavy selling because of this.

Indicators are just collections of information that can help us analyze trends to make predictions about the future. SWKS price movement is not guaranteed. Even if it does receive a sell signal. Please trade at your own risk.

SWKS BUYBuy signal at 123.10 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

SWKS Bending TrendA commonly missed trendline pattern is the bending that occurs in a momentum trend as buyers begin to disappear. Profit-taking by professionals can create a sudden surge of selling, which can easily drive price into a retracement or correction. Speculative price action is riskier to enter at this level as the runs are shrinking. SWKS may have more speculation but this is an expert level for a trade, and is not suitable for a new or novice trader due to the risk factors.

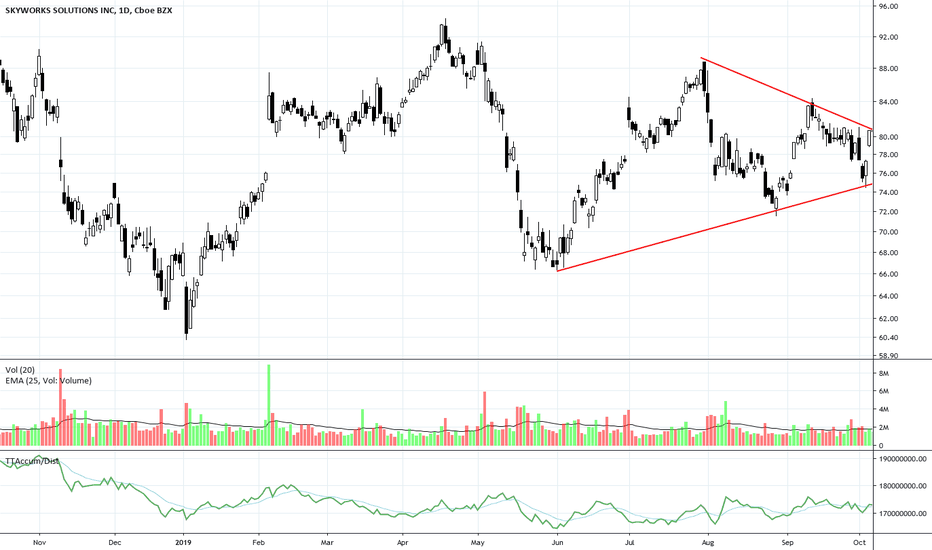

SWKS BUY 04.09.2019BUY signal at 74.17 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

ATTENTION this strategy may has downtrend about 10-15%, so you can split your buy order, that you have not big downtrend.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

The signals rare but useful.

*I've rewrite this idea because I wrote the same idea for English (IN).

SWKS Take-ProfitSell signal at 102.10 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

The signals rare but useful.

SKY Trading AdviceBuy Price: Yellow Line

TP: Green Lines

Moon: White Line

Support: Blue Line

SL: Red Line (I don't recommend to sell in loss.)

Invest Suggestion: 5-10 Percent

Profit Expectations: 5, 10 or >20 Percent

Just hold and watch. Sell when you get some profit. Good Luck!

Looks Good? Leave a like, share and tell me in comments if my trading advices are working for you.

Thanks for visiting.

SWKS - Possible Bearish Swing TradeI am considering taking this Bearish swing trade on SWKS. One thing I worry about is if I am triggered into the trade SWKS just recently bounced nicely off of the 20 EMA. If I get triggered in Monday or Tuesday, most likely the 20 EMA will be just below my entry. I sort of would rather have SWKS move sideways a few days allowing the 20 EMA to move above my trigger price. Obviously, I have no idea if the trade will work out in my favor or for that matter if I will even be triggered into it but I really like how the price action looks when I view the hourly chart. To me, it looks pretty weak.