SNT| There will be a continuation of the upward movement!Hello trader! Today I have a new idea for you. Like and subscribe to the channel, there is a lot of useful information there.✅

Previously, this coin had already given 1.5X, I think that after a short consolidation the coin will again continue its upward movement. Stop and take at your discretion, I showed clearly.

Deal plan:

Entry - 0.04471/0.04283$

Stop - $0.03988

Take - $0.05590

Guys, be aware of the risks, the coin may be too volatile at the moment.

SNT-BTC

SNT| Local downward channel, will there be growth here?Hello trader! Today I have a new idea for you. Like and subscribe to the channel, there is a lot of useful information there.✅

The SNT coin has formed a downward local channel at 2H, which in the future may work for potential growth; at the moment the price is almost at the upper limit and there is a possibility of a rebound to the 0.5 Fibonacci level.

Deal plan:

Entry - 0.02926/0.02815$

Stop - $0.02650

Take - $0.03323

Guys, the most important thing is to follow risk management, coins are too volatile to inflate risks, be careful!

Daily Bullish Signal $SNT #SNT #SNTBTC #BTC $BTC (23 April)RED ARROW indicates the EXPECTED Time and Targets

Level Stoploss point up to maximize profit and reduce risk

I'm working all the time, even in Bearish Market

======================

My path doesn't seem like anyone. I'm like a MONK, always studying to find the direction that prices will follow. I will feel very comfortable if the price goes exactly in the direction I drew. I will always try and practice until PERFECTION is MY OWN

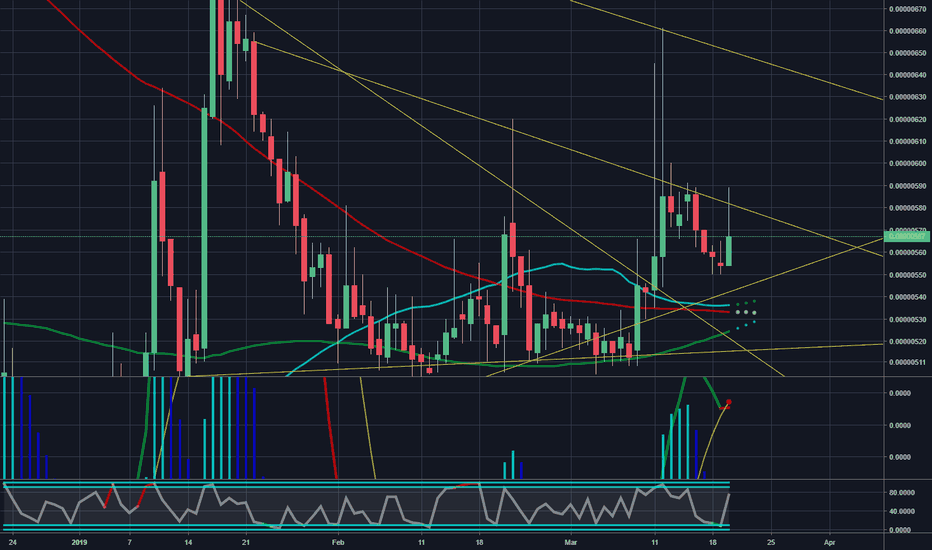

There is a possibility for the beginning of an uptrend in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 44.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000500 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000500)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001980

TP8= @ 0.00002928

TP9= Free

[SNT/BTC] STATUS NETWORK COULD BE BOTTOMING [ 25-300% PROFIT]#SNT / BTC ( Binance, Bittrex )

Buy Range : 570-600

Stop Loss : Not recommend

Target 1 : 860

Target 2 : 1346

Target 3 : 1815

WEEKLY CHART

- TD sequential setup suggest bottom could be near ( Positive )

- Trying to consolidate after 2 weeks ( Positive )

- CCI turning slowly from the lows and maybe in 2-3 weeks can turn into green ( Neutral )

- RSI touched 35 which is a good level to reverse ( positive )

DAILY CHART

- RSI is rising after touch oversold

- MACD is going up and showing positive strenght

- CCI shows some indecision due low volume on selling/buying ( neutral )

- SAR showing positive trend as price stays sideways and on accumulative phase

- Ichimoku cloud remains above candle ( Negative )

- Moving averages remains above candles ( Negative )

- Selloff candle ended at 516 sats where price started to reverse ( positive )

4H CHART

- Candles are "playing" with EMA20/50 But can't consolidate above it ( Neutral )

- MA200 remains above candle. However , it's going down soon and it could be touched if this coin get any poisitve impulse ( Neutral )

- Volume is not enough ( Negative )

- Downtrend has been stopped and SNT remains consolidate ( Positive )

- RSI is trending high ( Positive )

CONCLUSION

SNT has reached 4400sats/0.7$ around 9 months ago. Price has been dropped too much like other altcoins and is showing some potential signs of bottoming on the last weeks.

SNT could be need some weeks/months of consolidation like other altcoins. It highly depends of major ones when this one start to rally.

However, we should be really near of bottoming according to the low prices and some other indicators. This point is a very interesant spot to buy and wait.

There is a trading opportunity to buy in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 42.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000510 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000510)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001672

TP8= @ 0.00001980

TP9= @ 0.00002390

TP10= @ 0.00002928

TP11= @ 0.00003740

TP12= Free

There is a possibility for the beginning of an uptrend in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 41.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000510 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000510)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001672

TP8= @ 0.00001980

TP9= @ 0.00002390

TP10= @ 0.00002928

TP11= @ 0.00003740

TP12= Free

There is a possibility for the beginning of an uptrend in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 49.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000530 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000530)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000646

TP2= @ 0.00000710

TP3= @ 0.00000880

TP4= @ 0.00001040

TP5= @ 0.00001400

TP6= @ 0.00001685

TP7= @ 0.00001980

TP8= @ 0.00002380

TP9= @ 0.00002900

TP10= @ 0.00003740

TP11= Free

A second chance to buy in SNTBTC..Status Network Token/Bitcoin

New trading suggestion:

*The price is in a range bound, but we forecast the uptrend would Resume.

*There is still possibility of temporary retracement to suggested support line(0.0000146), if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If the support line at (0.0000146) is broken, the forecast (Resumption of uptrend) will be invalid.

*We will close our open trades, if the Midterm level (0.0000146) is broken.

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 8 BUY trade(s) @ 0.00001140(day close price) based on the reversal candle (2-Day Hammer ) at 03.27.2018.

Total Profit: 3650

Closed trade(s): 1230 Profit

Open trade(s): 2420 Profit

Closed Profit:

TP1 @ 0.00001260 touched at 03.31.2018 with 120 Profit.

TP2 @ 0.00001600 touched at 04.03.2018 with 460 Profit.

TP3 @ 0.00001790 touched at 04.21.2018 with 650 Profit.

120 + 460 + 650 = 1230

Open Profit:

Profit for one trade is 0.00001624(current price) -0.00001140(open price) = 484

5 trade(s) still open, therefore total profit for open trade(s) is 484 x 5 = 2420

All SLs moved to Break-even point.

Take Profits:

TP4= @ 0.0000237

TP5= @ 0.0000319

TP6= @ 0.0000374

TP7= @ 0.0000480

TP8= Free

Technical analysis:

StatusNetworkToken/Bitcoin is in a range bound and resumption of up trend is expected.

The price is below the 21-Day WEMA which acts as a dynamic resistance.

The RSI is at 51.

A second chance to buy in SNTBTC..Status Network Token/Bitcoin

New trading suggestion:

*The price is in a range bound, but we forecast the uptrend would Resume.

*There is still possibility of temporary retracement to suggested support line(0.0000146), if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If the support line at (0.0000146) is broken, the forecast (Resumption of uptrend) will be invalid.

*We will close our open trades, if the Midterm level (0.0000146) is broken.

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 8 BUY trade(s) @ 0.00001140(day close price) based on the reversal candle (2-Day Hammer ) at 03.27.2018.

Total Profit: 3650

Closed trade(s): 1230 Profit

Open trade(s): 2420 Profit

Closed Profit:

TP1 @ 0.00001260 touched at 03.31.2018 with 120 Profit.

TP2 @ 0.00001600 touched at 04.03.2018 with 460 Profit.

TP3 @ 0.00001790 touched at 04.21.2018 with 650 Profit.

120 + 460 + 650 = 1230

Open Profit:

Profit for one trade is 0.00001624(current price) -0.00001140(open price) = 484

5 trade(s) still open, therefore total profit for open trade(s) is 484 x 5 = 2420

All SLs moved to Break-even point.

Take Profits:

TP4= @ 0.0000237

TP5= @ 0.0000319

TP6= @ 0.0000374

TP7= @ 0.0000480

TP8= Free

Technical analysis:

StatusNetworkToken/Bitcoin is in a range bound and resumption of up trend is expected.

The price is below the 21-Day WEMA which acts as a dynamic resistance.

The RSI is at 51.

Long-term buy opportunity for #SNTBTC, let's hunt it together !Technical analysis:

STATUS NETWORK TOKEN/BITCOIN is in a down trend and Beginning of up trend is expected.

The price is below the 21-Day WEMA which acts as a dynamic resistance.

The RSI is at 32.

Trading suggestion:

*The price is in a down trend, but we forecast the uptrend would begin.

*There is possibility of temporary retracement to suggested support zone (0.0000103 to 0.0000070), if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.0000103)

Ending of entry zone (0.0000070)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Hammer" or "Trough" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

(We have started to prepare these lessons in TradingView. If you want us to continue, give us feedbacks!)

Take Profits:

TP1= @ 0.0000126

TP2= @ 0.0000160

TP3= @ 0.0000179

TP4= @ 0.0000237

TP5= @ 0.0000319

TP6= @ 0.0000374

TP7= @ 0.0000480

TP8= Free

A New Trading Opportunity. TP3 hit with 3110 profit..!!Status Network Token/Bitcoin

New trading suggestion:

*The price is in a range bound, but we forecast the uptrend would Resume.

*There is still possibility of temporary retracement to suggested support line(0.0000126) , if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If the support line at (0.0000126) is broken, the forecast (Resumption of uptrend) will be invalid.

*We will close our open trades, if the Midterm level (0.0000126) is broken.

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 8 BUY trade(s) @ 0.00001140(day close price) based on the reversal candle (2-Day Hammer ) at 03.27.2018.

Total Profit: 3110

Closed trade(s): 1230 Profit

Open trade(s): 1880 Profit

Closed Profit:

TP1 @ 0.00001260 touched at 03.31.2018 with 120 Profit.

TP2 @ 0.00001600 touched at 04.03.2018 with 460 Profit.

TP3 @ 0.00001790 touched at 04.21.2018 with 650 Profit.

120 + 460 + 650 = 1230

Open Profit:

Profit for one trade is 0.00001516(current price) -0.00001140(open price) = 376

5 trade(s) still open, therefore total profit for open trade(s) is 376 x 5 = 1504

All SLs moved to Break-even point.

Take Profits:

TP4= @ 0.0000237

TP5= @ 0.0000319

TP6= @ 0.0000374

TP7= @ 0.0000480

TP8= Free

Technical analysis:

StatusNetworkToken/Bitcoin is in a range bound and resumptionof up trend is expected.

The price is above the 21-Day WEMA which acts as a dynamic support.

The RSI is at 51.

A New Trading Opportunity. TP3 hit with 3110 profit..!!Status Network Token/Bitcoin

New trading suggestion:

*The price is in a range bound, but we forecast the uptrend would Resume.

*There is still possibility of temporary retracement to suggested support line(0.0000126) , if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If the support line at (0.0000126) is broken, the forecast (Resumption of uptrend) will be invalid.

*We will close our open trades, if the Midterm level (0.0000126) is broken.

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 8 BUY trade(s) @ 0.00001140(day close price) based on the reversal candle (2-Day Hammer ) at 03.27.2018.

Total Profit: 3110

Closed trade(s): 1230 Profit

Open trade(s): 1880 Profit

Closed Profit:

TP1 @ 0.00001260 touched at 03.31.2018 with 120 Profit.

TP2 @ 0.00001600 touched at 04.03.2018 with 460 Profit.

TP3 @ 0.00001790 touched at 04.21.2018 with 650 Profit.

120 + 460 + 650 = 1230

Open Profit:

Profit for one trade is 0.00001516(current price) -0.00001140(open price) = 376

5 trade(s) still open, therefore total profit for open trade(s) is 376 x 5 = 1880

All SLs moved to Break-even point.

Take Profits:

TP4= @ 0.0000237

TP5= @ 0.0000319

TP6= @ 0.0000374

TP7= @ 0.0000480

TP8= Free

Technical analysis:

StatusNetworkToken/Bitcoin is in a range bound and resumptionof up trend is expected.

The price is above the 21-Day WEMA which acts as a dynamic support.

The RSI is at 51.

SNTBTC , weekly update:Total profit 2550 in 20 days.!STATUS NETWORK TOKEN/BITCOIN

New trading suggestion:

*The price is in a range bound, but we forecast the uptrend would begin.

*There is still possibility of temporary retracement to suggested support zone (0.0000103 to 0.0000070), if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.0000103)

Ending of entry zone (0.0000070)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Hammer" or "Trough" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 8 BUY trade(s) @ 0.00001140(day close price) based on the reversal candle (2-Day Hammer ) at 03.27.2018.

Total Profit: 2550

Closed trade(s): 600 Profit

Open trade(s): 1950 Profit

Closed Profit:

TP1 @ 0.0000126 touched at 03.31.2018 with 120 Profit.

TP2 @ 0.0000160 touched at 04.03.2018 with 460 Profit.

140 + 460 = 600

Open Profit:

Profit for one trade is 0.00001465(current price) -0.00001140(open price) = 325

6 trade(s) still open, therefore total profit for open trade(s) is 325 x 6 = 1950

All SLs moved to Break-even point.

Take Profits:

TP3= @ 0.0000179

TP4= @ 0.0000237

TP5= @ 0.0000319

TP6= @ 0.0000374

TP7= @ 0.0000480

TP8= Free

Technical analysis:

Status Network Token / Bitcoin is in a range bound and Beginning of up trend is expected.

The price is above the 21-Day WEMA which acts as a dynamic support.

The RSI is at 59.

SNT huge potentialSNT looks undervalued and getting ready to show a huge jump.

Yellow area means a buy-zone. It is already dipped and don't have much way to go down.

Expect a x10 like 0.20$ -> 2.00$ in a few months.

Please report if there are errors / mistakes i've made.