March and Bullish momentumThe month of March starts with the bullish momentum from the previous month Feb 2024.

February closed with strength while creating a new ATH which I expect March to breach with ease.

I will like to note: Monthly candle started on Friday March 1.2024

This is only of importance for the next sessions of intraday.

Weekly candle has not closed yet. I will add and update this idea once the weekly candle closes.

Still momentum should carry us above 18144.75

Lets take a look at our environment.

Dollar's( CAPITALCOM:DXY ) inverse correlation to equities has not been too evident the last Month.

Evident has been Dollars quick reprising after rebalancing lower levels.

The quick reprising in this case is the continued push higher by price. You can take this as an unwillingness by "price" to go lower.

Why is this important?

Dollar value affect purchasing power.

Futures Market:

ES ( CME_MINI:ES1! )

Looking Bullish as well

Expected to also take out 5123.50

YM ( CBOT_MINI:YM1! )

Also has a daily Bullish look

But will keep an eye out for the weekly close since it is the weakest of the weekly profiles.

ZB ( CBOT:ZB1! )

Looks like it is neutralizing the downward momentum and is attempting to roll.

All around there are no signs that the Bullish momentum is changing

-IT IS WHAT IT IS TILL IT'S NOT-

I will still recommend to check with the idea once Friday closes.

Once Weekly profile closes on Friday we will have more information about the possible time span of current movement.

Techindex

NASDAQ may be about to shoot up. But is the future bright?That's of course the million dollar question and on this post is based on a fractal analysis with the 1998 - 2000 sequence.

As you see today Nasdaq is currently trading within a Channel Up up and down the 1D MA50 (blue trend-line) similar to what it did in 1999. Both Channels formed after a very aggressive rise, which took place after a lengthy yearly period of extreme market volatility (1, 2, 3, 4) where the 1D MA200 (orange trend-line) got breached repeatedly. The 1W MA200 though (green dotted line) remained intact, which is what maintained the long-term bullish trend of the Bull Cycle. In late 1999 after the Channel Up broke upwards, an equally aggressive rise took place that formed the peak of the Bull Cycle and the historic pop of the Dotcom Bubble. The Bear Cycle started and in early 2001 the 1W MA200 broke.

It goes without saying that this is a very simplistic fractal comparison and can't be an investment strategy on its own, but is fundamental/ news framework that led to the 2000 Dotcom bubble much different from today's aggressive economic stimulus?

Let's make an interesting discussion down below!

Feel free to share your work and let me know in the comments section!

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> xBTala

--------------------------------------------------------------------------------------------------------

NAS100 Tech Index Short Term Bearish OutlookNAS100 bounced from the top resistance, signaling a downward movement for the coming days.

In my opinion the bearish reversal will not hold on for long, most likely we will reject the lower trend line and shoot for new ATH's after that.

The main support target for the current reversal are either the support at $12.200 or the lower pink trend line. Since the trend line is harder to predict, I'd go for the $12.200 support.

Facebook: Higher High on 1W. Potential pull back.Facebook has been trading within a 1W Channel Up (RSI = 69.832, MACD = 8.020, ADX = 41.061, Highs/Lows = 15.2786) since early February 2019. Right now the price is only a fraction below the pattern's Higher High trend line which is typically an early bearish signal.

On top of that both the MACD and RSI indicators on the 1D chart have reached their respective multi month Resistance Zones. This is an additional sell signal. As FB has been trading within a narrower 1D Channel Up since the October Low, our short term Sell Target can't be below the Higher Low trend line (dashed line). Since the former July ATH at 208.50 matches perfectly on the trend line, we will take that as TP (target/ take profit). Notice how well the 1D MA50 comes for support near that level.

It can be argued that the 1W Channel Up has a gap to fill much lower for a Higher Low, but it is too early to discuss that. If the MA50 breaks, then the MA200 may come for support and accumulate buyers without reaching the Higher Low trend line. And since Facebook is on a long term uptrend it is best to buy such pull backs (when/ if they come) and not sell.

~~~ Our previous long term call on Facebook issued last September with the 220 target hit:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

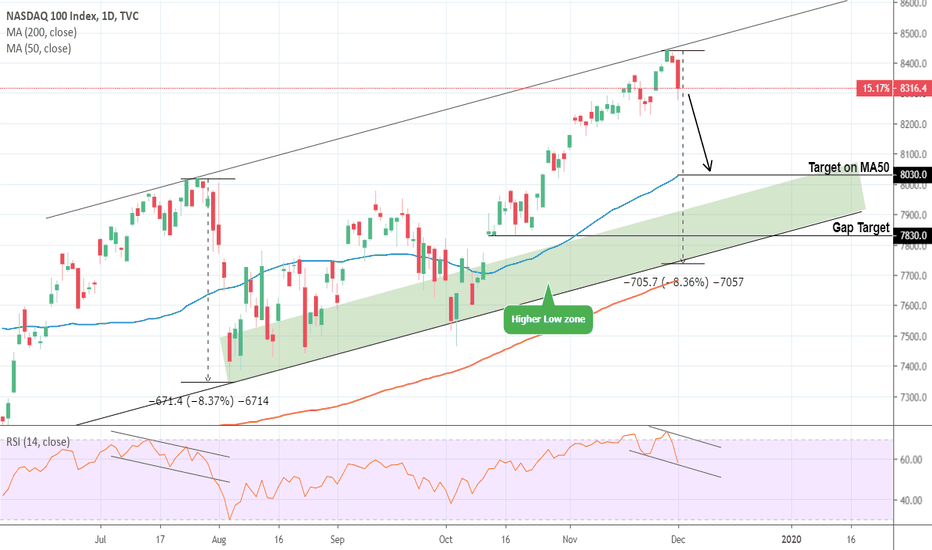

Nasdaq: Sell opportunity towards the 1D MA50.NDX has been trading within a Channel Up since July (1W RSi = 64.749, MACD = 236.300, Highs/Lows = 208.4773). Last week that pattern touched the Higher High trend line giving the first Sell Signal. The 1D RSI is on a bearish divergence similar to the late July Higher High.

Technically the index must touch at least the 1D MA50 before it resumes the bullish trend, so 8,030 is a moderate Target. Traders who can tolerate more risk may extend all the way to the Higher Low zone (green) and the 7,830 Gap Target.

See our recent successful trades on Nasdaq using this Channel:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.