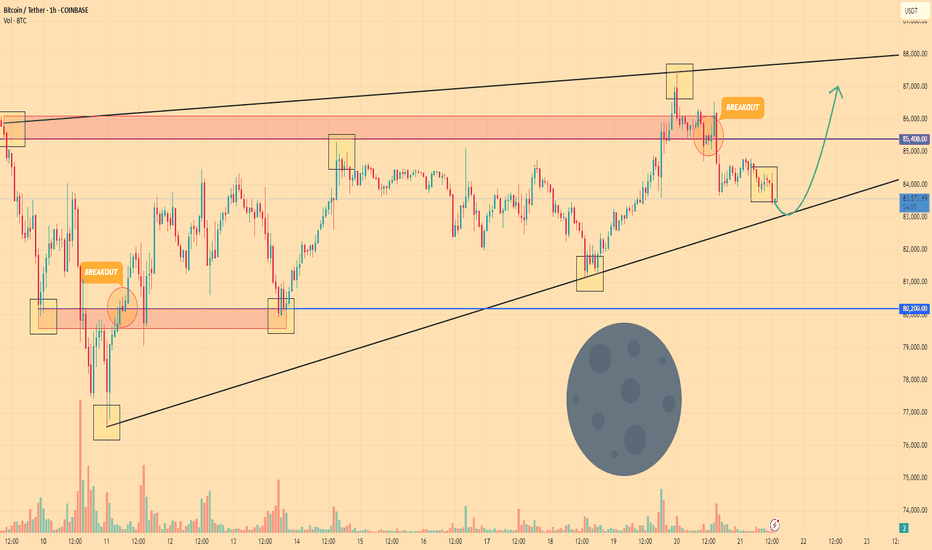

BITCOIN - Price can bounce up to $87K, breaking resistance levelHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Price entered to wedge and at once dropped to support line, breaking two levels, after which it bounced up.

Soon, it broke $80200 level and then tried to grow, but failed and made a correction to $80200 support level.

Later BTC rose to $85400 level and then some time traded near, after which it turned around and corrected to support line.

Then price in a short time rose to resistance line of wedge, breaking the resistance level, but a not long time ago fell back.

Bitcoin broke $85400 level and continued to decline, and in my mind, it can soon reach support line of wedge.

After this movement, I expect that BTC can bounce up to $87000, breaking resistance level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

USDT-M

bear market confirmationIf the chart will consolidates above 5.81%, i.e. above the sloping downtrend line, this would be an early indicator of the start of a bear market, because this line is global for the current bull market.

The second confirmation will be if dominance will bumped at 3.94 - 4.30% range as wave B and will update the end of wave A.

USDT.DOMINANCE WEEKLY CHART UPDATE. Current Market Structure:

Breakout Confirmation: USDT Dominance has broken out of its descending trendline and is now in a retest phase.

50MA as Support: The 50-week moving average now acts as dynamic support, reinforcing the bullish outlook.

Rejection or Breakout? The price is currently testing resistance. If it gets rejected, a temporary pullback is likely before further gains.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Bitcoin can rebound from triangle pattern to 90K pointsHello traders, I want share with you my opinion about Bitcoin. Not long ago, the price was trading within a range, where it quickly entered the seller zone and remained near this area for quite some time. BTC attempted to rise but failed, and after nearly reaching the upper boundary of the range, it dropped sharply. The price broke through the 94000 level, exiting the range as well, and then fell to the support level, which aligned with the buyer zone. Shortly after, the price made a strong upward impulse toward the resistance level before starting a decline within a downward triangle. Inside this pattern, BTC initially made a correction, climbed back to the resistance line of the triangle, and then resumed its decline. Eventually, the price dropped to the 78900 support level, where it touched the triangle’s support line and then began to rise. At the moment, BTC continues to climb near this level, and I expect it to rebound from the support line of the triangle and break above the resistance, signaling an exit from the pattern. If this happens, I anticipate further growth, so my target is set at 90000 points. Please share this idea with your friends and click Boost 🚀

GBPUSD 1HOUR CHART TECHNICAL ANALYSIS NEXT MOVE POSSIBLE This chart shows a technical analysis of GBP/USD on the 1-hour timeframe.

1. Resistance Rejection – Price reached 1.30056 and faced rejection, indicating a possible reversal.

2. Bearish Scenario – The chart suggests a potential drop toward 1.29514 as the first support.

3. Breakdown Possibility – If 1.29514 fails, price could continue falling toward 1.29136, the next key support.

4. Price Action Structure – The drawn arrows indicate a possible retest of 1.29514 before a further decline.

Overall, this chart signals a potential bearish move if price fails to hold above key levels.

Why GBPJPY is Bullish?? Detailed technical and fundamentalsThe GBP/JPY pair has recently confirmed a bullish reversal by breaking out of a falling wedge pattern, aligning with our earlier analysis. Currently trading at 194.000, the pair is on track toward our target of 199.000.

Technically, the breakout from the falling wedge—a pattern typically indicative of bullish reversals—suggests increased buying momentum. This is further supported by the pair's ability to maintain levels above key resistance points, now acting as support. The next significant resistance is anticipated around the 195.000 level, a psychological barrier that, if surpassed, could pave the way toward our 199.000 target.

Fundamentally, the British pound has been bolstered by positive economic indicators, including robust GDP growth and a resilient labor market, enhancing investor confidence. Conversely, the Japanese yen has experienced depreciation due to the Bank of Japan's commitment to ultra-loose monetary policies, aiming to stimulate inflation and economic growth. This monetary policy divergence has contributed to the upward trajectory of GBP/JPY.

In conclusion, the confluence of technical and fundamental factors supports a bullish outlook for GBP/JPY. Traders should monitor upcoming economic releases and central bank communications, as these could impact market sentiment and price action. Maintaining a disciplined approach with appropriate risk management strategies is essential as the pair approaches the 199.000 target.

Ripple is Nearing Important SupportHey Traders, in today's trading session we are monitoring XRPUSDT for a buying opportunity around 2.35 zone, XRP is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 2.35 support and resistance area.

Trade safe, Joe.

USDT.D hinting of a massive cryto market reversal ↑. GET SEEDED!USDT.D an inverse confluence of the crypto market has predicted the major correction before it happened. It has gone parabolic for a few weeks tapping its favorite resistance roof line aT 5.50%.

Now, based on the last weekly close, USDT.D is hinting of a major market reversal to the upside. (USDT.D falling = crypto market rising). It means USDT.D in red means, more cash are being converted to crypto holdings.

The first descending shift line at the upper channel has been registered. First time since September 2024. This is already conveying of a major shift in trend and a weighty series of price growth from here is forthcoming in the next coming weeks.

Best season to get seeded again on the market -- moreso scale in on the bluechip ones, BTC ETH ADA XRP.

It's that season again. A very green one.

Spotted at 5.30%

Mid target at 3.50%.

TAYOR. Trade safely.

HelenP. I Bitcoin may grow little and then drop to support areaHi folks today I'm prepared for you Bitcoin analytics. Some time ago, the price rebounded from the resistance level, which aligned with the trend line and resistance zone, attempting to rise. However, it failed and started to decline. Later, BTC dropped to the same resistance level again, broke through it, and then fell to the trend line, which coincided with the support level and support zone. After that, the price made an upward impulse to the resistance zone, followed by a quick correction before reversing and climbing back to the 91300 resistance level. The price consolidated around this level for some time before declining to the 78350 support level. Recently, it turned around and started moving upward again. Given this structure, I expect BTCUSDT to rise slightly before dropping to the support zone and breaking the support level. With this in mind, my target is set in this area - 76500 points. If you like my analytics you may support me with your like/comment ❤️

Bitcoin can reach resistance line of wedge and then dropHello traders, I want share with you my opinion about Bitcoin. This chart illustrates how the price dropped into the buyer zone within an ascending wedge. After that, BTC reversed direction and began to rise, eventually reaching the wedge’s resistance line before making a correction to the support line. The price then made a strong upward impulse, breaking through the resistance level and exiting the ascending wedge. BTC surged to 94800 before reversing and dropping to 82600, breaking through the 87000 level. Following this decline, the price started to recover within a descending wedge and soon reached the resistance line, breaking through another resistance level. However, after this move, BTC reversed again and began to decline, eventually falling back to the 87,000 level, which coincided with the seller zone, where it traded for some time. It then broke through this level and continued declining toward the support level, even entering the buyer zone. BTC also dropped to the support line of the descending wedge before rebounding sharply, breaking above the 80000 support level once again. Currently, the price is continuing its upward movement. Given this setup, I anticipate that Bitcoin will reach the resistance line of the wedge before pulling back to the support level, potentially even lower. For this scenario, my TP is set at 78000. Please share this idea with your friends and click Boost 🚀

BTC/USDT Reversal scenariosThere is bear mood in market, its exactly what is needed for reversal, lets have a look closer. I see 3 options.

1) Manipulation is over, we reached the target of local FIBO 1.618 at 77055$

2) Level 73764$ - its the target of Double TOP , the edge/high of the last block and 0.618 level of grand FIBO

3) POC level of last accumulation block which lasted for 255d at 67436$ - we could reach this level only with fast squeeze and fast buy back, leaving long needle on higher timeframe

Bitcoin (BTCUSD) Rejection – Bearish Move Incoming?📉 Key Observations:

Resistance Zone (Purple Box): Price has tested this area and faced rejection.

Bearish Projection (Gray Box & Arrow): The chart anticipates a drop towards the $76,800 - $77,000 range.

Liquidity Grab? Price might consolidate before a sharp decline.

⚠️ Possible Scenarios:

Rejection Confirmation 🔻: If BTC fails to reclaim $84,470, selling pressure could increase.

Breakout Fakeout? 🤔: A deviation above resistance followed by a dump remains a risk.

🎯 Levels to Watch:

Resistance: $84,470 - $85,078

Support: $80,000 and $76,825

🔥 Final Take: If BTC struggles below resistance, a short setup could play out. Confirmation is key!

Breaking: $PIKACH Set for a Comeback Built on the Ethereum blockchain, while simply paying homage to an adorable creature we all love and parody- the Pokémon or its creation Pikachu, $PIKACH is set to soar amidst a bounced from the 38.2% Fibonacci retracement that is presently acting as a support point.

A breakout above the 1-month high could catalyse a bullish move with 30% gains in sight.

With the Relative Strength Index (RSI) at 56 this metric validates the bullish thesis on $PIKACH.

Pikaboss Price Live Data

The live Pikaboss price today is $5.40e-8 USD with a 24-hour trading volume of $24,671.20 USD. Pikaboss is down 2.77% in the last 24 hours, with a live market cap of $22,726,087 USD. It has a circulating supply of 420,690,000,000,000 PIKA coins and a max. supply of 420,690,000,000,000 PIKA coins.

Bitcoin Daily Bullish DivergenceAs the bitcoin price made a LL but the RSI on daily TF made a HL, which gives it a very bullish divergence, but as the price still is below the 200 daily MA , it can goes fall to about 76k but Im not expecting the RSI make a LL, which gives us another bullish divergence.

WHY GBPJPY BULLISH, DETAILED ANALYSIS GBPJPY is currently trading at 192.200 after successfully breaking out of a falling wedge pattern, a strong bullish reversal signal. This technical breakout suggests the pair is set for a significant upside move, with a potential target of 195.000 and beyond. The falling wedge is known for its bullish implications, indicating that sellers are losing control while buyers are stepping in with increased demand. If momentum continues, we could see a gain of over 500 pips in the coming sessions.

From a technical perspective, GBPJPY has cleared key resistance levels and is now forming a strong bullish structure. A retest of the breakout zone around 191.500-192.000 has already provided support, reinforcing the likelihood of further upward movement. The next major resistance lies at 194.000, followed by 195.000, which aligns with key Fibonacci retracement levels and previous price action zones. If buyers maintain control, a push towards 196.000 and beyond is also possible.

Fundamentally, GBPJPY remains bullish due to the policy divergence between the Bank of England (BoE) and the Bank of Japan (BoJ). The BoE's firm stance on interest rates, coupled with the BoJ’s continued ultra-loose monetary policy, favors a stronger GBP against the JPY. Additionally, risk sentiment plays a crucial role in GBPJPY's movements, and with equity markets showing strength, the yen's safe-haven appeal weakens, further boosting the bullish case for this pair.

With both technical and fundamental factors aligning, GBPJPY presents a strong buying opportunity. Traders should watch for a sustained move above 193.000 for confirmation of further gains, with the potential to reach 195.000 and beyond. A breakout continuation could trigger even stronger bullish momentum, making this a high-probability setup for traders looking to capitalize on the trend.