WTI-Oil 2nd April Wti-Oil is another pretty simple setup with a continuous bullish movement up to the nearest supply, we may see a breakdown from that zone but of course if we don't see a breakdown we will look towards the new bullish range that would of been created to make another move higher...

from open iam looking for price to drop down giving us a reason for a shift higher after a small breakdown.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

WTI-OIL

WTI CRUDE OIL: One High left before new selling pressure.The WTI Crude Oil is being currently rejected on the 4H MA200 but with 4H technicals naturally bullish still (RSI = 61.154, MACD = 1.320, ADX = 61.771). This is due to the strong 9 day rally since the price made a bottom on the LL trendline of the Channel Down of December.

The 4H RSI also got rejected on the 70.000 overbought level and 5 times out of 6 within this Channel Down, this was an indication that we are either at the top or the last High before the top (LH trendline of the Channel Down). The last three tops were priced on the 1D MA100. We give slightly higher probabilities of this happening again. Sell this and TP = 67.00 (S1).

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

WTI H4 | Fibo confluence?Looking at the H4 chart, the price is currently at our sell entry of 72.56, which is an overlap resistance along with a 50% Fibonacci retracement and 127.20% Fibonacci extension. Our stop loss will be at 74.68, which is slightly above the swing high resistance. The take profit level will be at 71.46 along with a 23.6% Fibonacci retracement

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

USDCAD Outlook 28 March 2023The USDCAD traded strongly to the downside as the price failed to break beyond 1.3745 and fell beyond the support level of 1.3650.

This move lower was due to a combination of the renewed weakness of the DXY but more because of the surge in oil prices.

WTI traded up from the 69 price level, breaking beyond the near term high of 71.40 to reach the round number level of 73. This move is due to increasing supply concerns as Russia's sea-borne crude-oil flows have fallen to 3 million barrels a day and as European natural gas prices are higher due to strikes in France.

As WTI consolidates just below 73, if the upward move continues toward the next resistance are of 75, further downside could be anticipated for the USDCAD, with the next key support level at 1.3560.

However, watch out for a potential hesitation of the downside at the 1.36 price level.

WTI OIL Channel Up aiming at the 1D MA50.WTI Oil (USOIL) transitioned from the Inverse Head and Shoulders (IH&S) pattern we described last week to a Channel Up:

Our target remains 74.50 on the medium-term which makes both a Higher High on the Channel Up while filling a 2.0 Fibonacci extension, which is the technical target for the IH&S.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI H4 | Potential reversal from 38.2%?Looking at the H4 chart, price has reached our sell entry at 70.380 along with a 38.2% Fibonacci retracement. If the price were to reverse from here, it could potentially drop to our take profit level at 67.02, which is an overlap support. The stop loss will be at 72.80, which is just slightly above the swing high resistance.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

WTI OIL Inverse Head and Shoulders cementing the bottom.WTI Oil (USOIL) is forming an Inverse Head and Shoulders (IH&S) pattern on the 4H time-frame, which is a technical bottom and bullish reversal formation. The 4H RSI is on a Higher Lows trend-line, indicating an uptrend and already above the 50.00 neutral mark. One last pull-back to the 65.70 Symmetrical Support is possible, before a strong rally targeting the 1D MA50 (blue trend-line). Our target is 74.50.

This is an update to our last week analysis:

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI CRUDE OIL Bottom is near. Start buying.WTI Crude Oil is at the bottom of a Channel Down pattern.

Comparison with the November 22nd fractal shows there might be one last Low left but already the Risk/Reward is appealing going long.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 72.00 (on Fibonacci 0.5 and Pivot 2).

Tips:

1. RSI (4h) is forming similar bottom pattern as November's.

Please like, follow and comment!!

WTI BEARISH OUTLOOKWTI had fallen for 3 consecutive days in Wednesday. The bank crisis is calling banks to deleverage their positions, pulling back on their exposure on oil and causing the price to fall.

International Energy Agency (IEA) is also reporting that the current situation in the oil market is a situation of oversupply, while Russia is looking for buyers for its oil.

The price of WTI broke the support of the rising wedge pattern and continues to drop. Both MACD and RSI indicators are confirming the pattern as well.

If the current scenario continues, the price might reach levels of 62 or even 54.

In the opposite scenario the price might reach levels of 77.5 and pivot into an uptrend.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

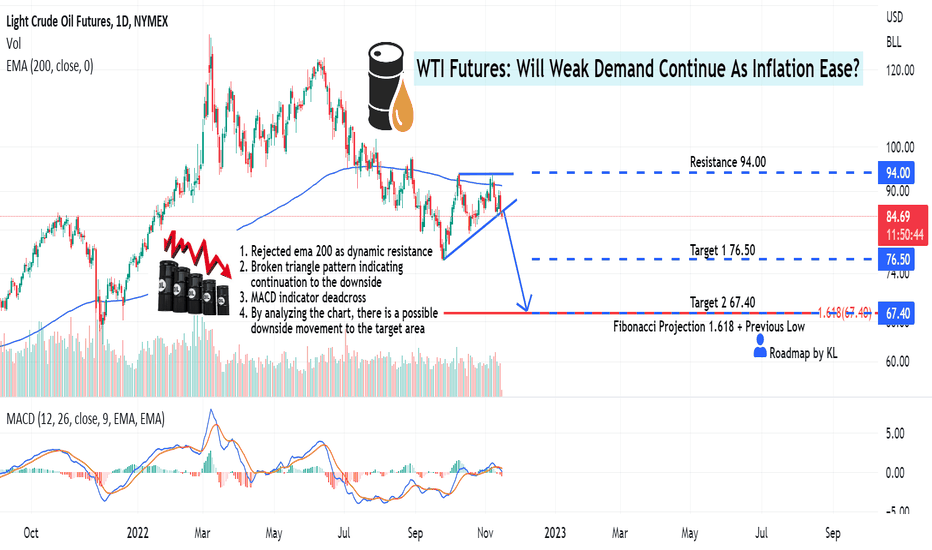

WTI Futures: Will Weak Demand Continue As Inflation Ease?Hello Fellow Oil Futures Trader, Here's a Technical outlook on WTI Futures!

Support the channel by giving us thumbs up and sharing your opinions in the comment section below!

Chart Perspective

WTI Futures is breaking out of the neckline of a triangle pattern. Breaking out of this pattern indicates a potential trend continuation from previous bearish bias. The MACD Indicator already made the death cross. The death cross signals a possibility of downside movement to the target area ahead.

Macroeconomic:

1. Rate Hikes across the globe slowed down the economy, weaken commodity demand

2. China manufacturing slowdown

All other explanations are presented on the chart.

The roadmap will be invalid after reaching the target/ resistance area .

"Disclaimer: The outlook is only for educational purposes, not a recommendation to put a long or short position on the WTI Futures"

The support is not broken:upYesterday's long positions in crude oil yielded good profits, and after taking profits, crude oil experienced a temporary decline. Currently, the medium to long-term strategy for crude oil is still biased towards long positions. The chart shows two support levels and two possible trends. Aggressive traders can go long now, but they should be mindful of their position sizes. Conservative traders can watch and wait for the next move.

From a technical analysis perspective, crude oil rose then fell yesterday, with the highest rebound reaching the 78.0 resistance level and then declining below the 4-hour midline. It fell again at the end of the day, and closed at a low point. The daily chart closed with a bearish K-line, forming a continuous downward trend. From the daily K-line structure, the continuous decline suggests a further decline. However, overall, it is still oscillating within a wide range of 72.0-82.0, and may return to the lower range, but breaking through will be difficult. It may also end up oscillating after a downward probe. The 4-hour chart continues to decline below the midline, and the step-by-step downward trend continues. Yesterday's high point of 78.0 is the critical point for short-term bears and also the short-term defense point for the midline Bollinger band. Below this point, traders can consider short positions. The overall break of the hourly chart support level of 76.0 has turned into short-term resistance. Taking into account yesterday's rebound and subsequent decline, today's trading may repeat this type of oscillating downward trend, with only the strength of the rebound determining the entry point for short positions.

In summary, for short-term trading in crude oil today, it is recommended to focus on the resistance level of 78.0-79.0 and the support level of 74.0-73.0.

Welcome to the discussion channel and express your thoughts

Crude long-term viewI count crude as wave circle C of a larger wave 4 that started in 2008. So far it looks like wave 1 of circle C is complete and crude is papering for a bounce in wave 2 (somewhere to 95-100 zone). Overall target for the larger wave 4 is in the 20-25 range. We then should expect a sharp rally to 200 level into 2027-28.

WTI CRUDE OIL can rise in the next 2 months back to $110 accordiWTI Crude Oil has been trading in the past two months on the Rising Support that emerged on the March 2021 Low. The longer it holds, the more likely a medium term (2 month) rebound is, back to the Resistance Zone and $110.

The reversal on the 1week MACD also supports that.

If the Rising Support breaks, the 1week MA200 will be the last level of Support before the Oil market collapses long term to the $35 Support Zone.

P.S. Short term still looks like the analysis below:

Follow us, like the idea and leave a comment below!!

WTI OIL Perfect shortCrude Oil crossed under Support A on Friday but today is rising and hit the 1day MA50 again. We followed a very successful model last time as indicated below for selling high and buying low:

Based on this, today's rise is the countertrend rebound that both of the previous short constructs followed. We believe it will be short lived and serves as a new sell point. We target 73.50.

Follow us, like the idea and leave a comment below!!

easyMarkets WTI Oil Daily - Quick Technical OverviewDisclaimer:

easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

WTI Potential for Bearish Drop | 1st February 2023Looking at the H4 chart, my overall bias for WTI is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market.

Looking for a pullback sell entry at 79.070, where the 38.2% Fibonacci line is. Stop loss will be at 82.525, where the recent high is. Take profit will be at 72.607, where the recent lowis

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

WTI Potential for Bearish Drop | 1st February 2023Looking at the H4 chart, my overall bias for WTI is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market.

Looking for a pullback sell entry at 79.070, where the 38.2% Fibonacci line is. Stop loss will be at 82.525, where the recent high is. Take profit will be at 72.607, where the recent lowis

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.