OPEN-SOURCE SCRIPT

Log Regression Channel [UAlgo]

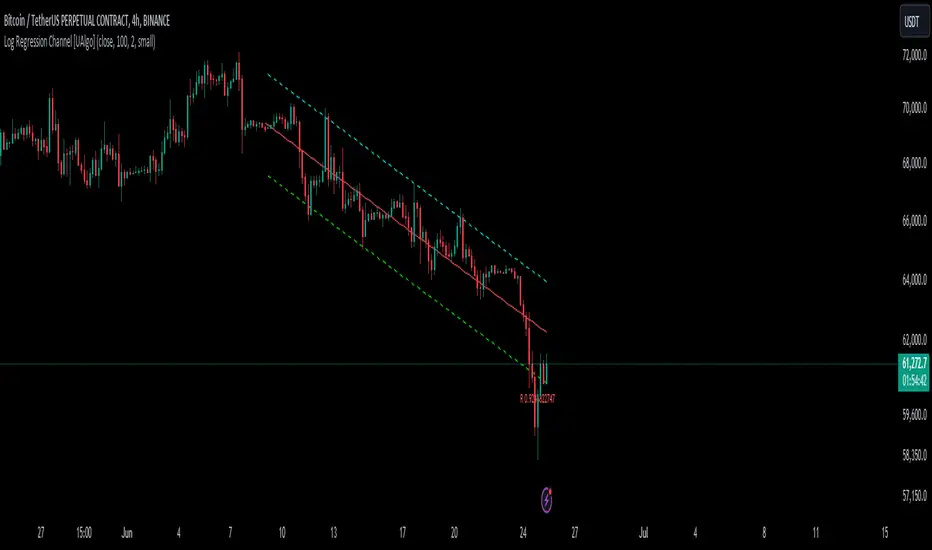

The "Log Regression Channel [UAlgo]" channel is useful for analyzing price trends and volatility in a financial instrument over a specified period. By using logarithmic scaling, this indicator can more effectively handle the wide range of price movements seen in many financial markets, making it particularly valuable for assets with exponential growth characteristics.

The indicator plots the central regression line along with upper and lower deviation bands, providing a visual representation of potential support and resistance levels.

🔶 Key Features

Logarithmic Regression Line: The central line represents the logarithmic regression, which fits the price data over the specified length using a logarithmic scale. This helps in identifying the overall trend direction.

Deviation Bands: The upper and lower bands are plotted at a specified multiple of the standard deviation from the regression line, highlighting areas of potential overbought and oversold conditions.

Customizable Parameters: Users can adjust the length of the regression, the deviation multiplier, the color of the labels, and the size of the text labels to suit their preferences.

R-Squared Display: The R-squared value, which measures the goodness of fit of the regression model, is displayed on the chart. This helps traders assess the reliability of the regression line.

🔶 Calculations

The indicator performs several key calculations to plot the logarithmic regression channel:

Logarithmic Transformation: The prices and time indices are transformed using the natural logarithm to handle exponential growth in price data.

Regression Coefficients: The slope and intercept of the regression line are calculated using the least squares method on the transformed data.

Predicted Values: The regression equation is used to calculate predicted values for each data point.

Standard Deviation: The standard deviation of the residuals (differences between actual and predicted values) is computed to determine the width of the deviation bands.

Deviation Bands: Upper and lower bands are plotted at a specified multiple of the standard deviation above and below the regression line.

R-Squared Value: The R-squared value is calculated to measure how well the regression line fits the data. This value is displayed on the chart to inform the user of the model's reliability.

🔶 Disclaimer

The "Log Regression Channel [UAlgo]" indicator is provided for educational and informational purposes only.

It is not intended as investment advice or a recommendation to buy or sell any financial instrument. Trading financial instruments involves substantial risk and may not be suitable for all investors.

Past performance is not indicative of future results. Users should conduct their own research.

The indicator plots the central regression line along with upper and lower deviation bands, providing a visual representation of potential support and resistance levels.

🔶 Key Features

Logarithmic Regression Line: The central line represents the logarithmic regression, which fits the price data over the specified length using a logarithmic scale. This helps in identifying the overall trend direction.

Deviation Bands: The upper and lower bands are plotted at a specified multiple of the standard deviation from the regression line, highlighting areas of potential overbought and oversold conditions.

Customizable Parameters: Users can adjust the length of the regression, the deviation multiplier, the color of the labels, and the size of the text labels to suit their preferences.

R-Squared Display: The R-squared value, which measures the goodness of fit of the regression model, is displayed on the chart. This helps traders assess the reliability of the regression line.

🔶 Calculations

The indicator performs several key calculations to plot the logarithmic regression channel:

Logarithmic Transformation: The prices and time indices are transformed using the natural logarithm to handle exponential growth in price data.

Regression Coefficients: The slope and intercept of the regression line are calculated using the least squares method on the transformed data.

Predicted Values: The regression equation is used to calculate predicted values for each data point.

Standard Deviation: The standard deviation of the residuals (differences between actual and predicted values) is computed to determine the width of the deviation bands.

Deviation Bands: Upper and lower bands are plotted at a specified multiple of the standard deviation above and below the regression line.

R-Squared Value: The R-squared value is calculated to measure how well the regression line fits the data. This value is displayed on the chart to inform the user of the model's reliability.

🔶 Disclaimer

The "Log Regression Channel [UAlgo]" indicator is provided for educational and informational purposes only.

It is not intended as investment advice or a recommendation to buy or sell any financial instrument. Trading financial instruments involves substantial risk and may not be suitable for all investors.

Past performance is not indicative of future results. Users should conduct their own research.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Get access to our exclusive tools: ualgo.trade

Join Our Discord For Updates: discord.com/invite/kyQkKxUQkW

All scripts & Content Provided by UAlgo Are For Informational & Educational Purposes Only.

Join Our Discord For Updates: discord.com/invite/kyQkKxUQkW

All scripts & Content Provided by UAlgo Are For Informational & Educational Purposes Only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.