PROTECTED SOURCE SCRIPT

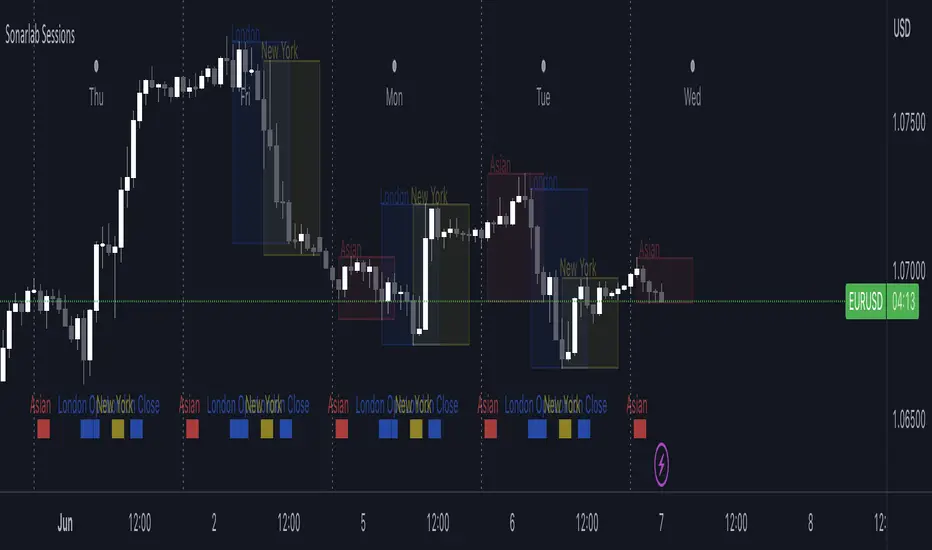

Trading Sessions - Sonarlab

Updated

The Trading Sessions indicator shows the most significant trading sessions for the Forex market, such as London, New York and Asian.

The sessions are presented as colored boxes on the chart, thereby clearly indicating open and close times of a particular session, as well as its trading range.

How is this Forex market session indicator used?

Traders normally use trading sessions to determine the volatile hours throughout the day, since the trading activities vary from one stock exchange to another.

London and New York market trading sessions are considered to be the most volatile, especially during the 4-hour overlap.

There are also strategies aiming only at the opening of the London session or those that allow trading only during the Asian session.

Backtesting

When testing out your strategy this Indicator can be handy to use while backtesting in Tradingviews replay mode. Only backtest the sessions you will normally trade.

Settings:

For each session:

The sessions are presented as colored boxes on the chart, thereby clearly indicating open and close times of a particular session, as well as its trading range.

How is this Forex market session indicator used?

Traders normally use trading sessions to determine the volatile hours throughout the day, since the trading activities vary from one stock exchange to another.

London and New York market trading sessions are considered to be the most volatile, especially during the 4-hour overlap.

There are also strategies aiming only at the opening of the London session or those that allow trading only during the Asian session.

Backtesting

When testing out your strategy this Indicator can be handy to use while backtesting in Tradingviews replay mode. Only backtest the sessions you will normally trade.

Settings:

For each session:

- Time beginning - end

- Show session range or only beginning

- Colors

- Overlay type: BOX/ Background/ High - Low

- Display settings statistics

- ADR

- Mid line (50%)

- Range

Release Notes

Added an option to show the session nameAdded different line styles for the High/Low lines and the Box Border

Minor bug fixes and changes

Release Notes

Trading Sessions by Sonarlab v1.3- Added Time zone option

- Fixed different session times bug

- Fixed High/Low display option bug

- Minor Changes

Release Notes

What is new?- Days of the week added. See mon, tue, wed, thur, fri on your chart.

- Asian extended levels which can be used for intraday targets

- Daily, weekly and monthly open level

- ICT Killzones

- COT label on chart.

- New alerts for Asian Liquidation, Asian extension targets and COT release

Release Notes

v1.4.1- Fixed "Extend Asian Levels" bug

Release Notes

Update- ICT killzones bug solved

- Alerts asian high and low bug solved

- Minor bugs

Release Notes

- Fixed Pine Compilation ErrorRelease Notes

Added an option to modify the KillZone timesDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.