INVITE-ONLY SCRIPT

TWA - Surge

Updated

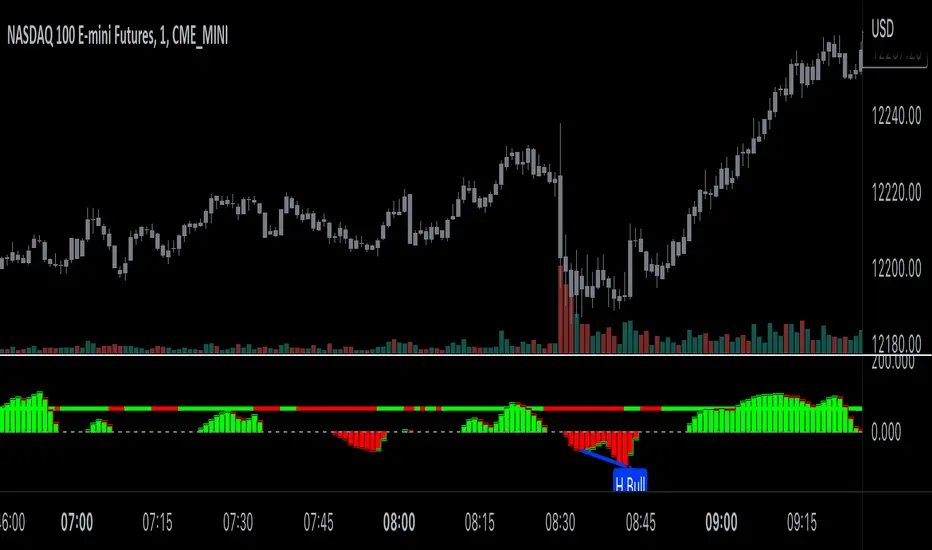

With the TWA Surge indicator we make price and volume impulses easy to read.

Ideally if you are looking to go long look for a red surge and if your looking to go short look for a green surge.

Volume traders out there always wonder if its a bull rush or a falling knife and not sure when that push of volume and momentum will slow down. That's where the borders of the surge come in when a green surge gets a red border forming or a red surge gets a green border forming that means it's show time.

Lastly the surge has exhausted volume built in as well so when you see a different color in your red or green surges you will be able to get further confirmation that the team you are trading against needs to take a break and your team is at full strength ready to take them down.

Under the hood the surge impulses are calculated using a proprietary algorithm involving the amount of standard deviations price deviates from an average, and accumulations of volume for both above and below average volume .

Similarly the exhausted volume looks for strong deviations from the average amount of volume . Standard deviations of price measure the amount of variation or dispersion among price values. Looking at price and volume through the lens of standard deviations it can be seen when price and/or volume are outside of their statistical norm, hence as outliers or extremes they become more likely to reverse and return to a statistical norm.

This increased tendency for a reversal makes the surges on the TWA Surge a useful tool for finding trade opportunities.

The indicator provides many elements to create confluence for trade set-ups. The border of the surge histogram changes color to visually signal when momentum is changing direction. A trade set-up of this would be seeing a red surge form followed by the border turning green. Other elements include horizontal line meters that change colors to show the story of price and momentum.

The uppermost horizontal line meter uses an algorithm to compare price to its recent ranges over multiple times to determine trend direction.

The 2nd horizontal line meter measures the directional efficiency of the movement of price to determine direction in the market.

The 3rd horizontal line meter calculates buying and selling pressure by separating volume that moves price up from volume that moves price down, and comparing that to the total volume .

The 4th horizontal line meter uses an algorithm combining the volatility of recent candles with the statistical likeliness of price to return to its mean in order to determine direction, and if that direction is strengthening or weakening.

Ideally if you are looking to go long look for a red surge and if your looking to go short look for a green surge.

Volume traders out there always wonder if its a bull rush or a falling knife and not sure when that push of volume and momentum will slow down. That's where the borders of the surge come in when a green surge gets a red border forming or a red surge gets a green border forming that means it's show time.

Lastly the surge has exhausted volume built in as well so when you see a different color in your red or green surges you will be able to get further confirmation that the team you are trading against needs to take a break and your team is at full strength ready to take them down.

Under the hood the surge impulses are calculated using a proprietary algorithm involving the amount of standard deviations price deviates from an average, and accumulations of volume for both above and below average volume .

Similarly the exhausted volume looks for strong deviations from the average amount of volume . Standard deviations of price measure the amount of variation or dispersion among price values. Looking at price and volume through the lens of standard deviations it can be seen when price and/or volume are outside of their statistical norm, hence as outliers or extremes they become more likely to reverse and return to a statistical norm.

This increased tendency for a reversal makes the surges on the TWA Surge a useful tool for finding trade opportunities.

The indicator provides many elements to create confluence for trade set-ups. The border of the surge histogram changes color to visually signal when momentum is changing direction. A trade set-up of this would be seeing a red surge form followed by the border turning green. Other elements include horizontal line meters that change colors to show the story of price and momentum.

The uppermost horizontal line meter uses an algorithm to compare price to its recent ranges over multiple times to determine trend direction.

The 2nd horizontal line meter measures the directional efficiency of the movement of price to determine direction in the market.

The 3rd horizontal line meter calculates buying and selling pressure by separating volume that moves price up from volume that moves price down, and comparing that to the total volume .

The 4th horizontal line meter uses an algorithm combining the volatility of recent candles with the statistical likeliness of price to return to its mean in order to determine direction, and if that direction is strengthening or weakening.

Release Notes

- updated made to the styling tabs to allow more versatile/color customizations

Release Notes

- updated the styling options of the exhausted volume

Release Notes

- Added preset alerts

Release Notes

- Improvement!! Style settings are now available for everything under the styles tab

Release Notes

- added the option to put strength bar coloring directly on the candles and evidence line coloring on the top bar.

Release Notes

- added inputs that allows the user to change the colors of all the informational tools the indicator offers to create a customized experience.

Invite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact TradingwithAdamT_W_A for more information, or follow the author's instructions below.

TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Want to use this script on a chart?

Warning: please read before requesting access.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.