OPEN-SOURCE SCRIPT

US Treasury All Yield Curve IORB Weighted

Updated

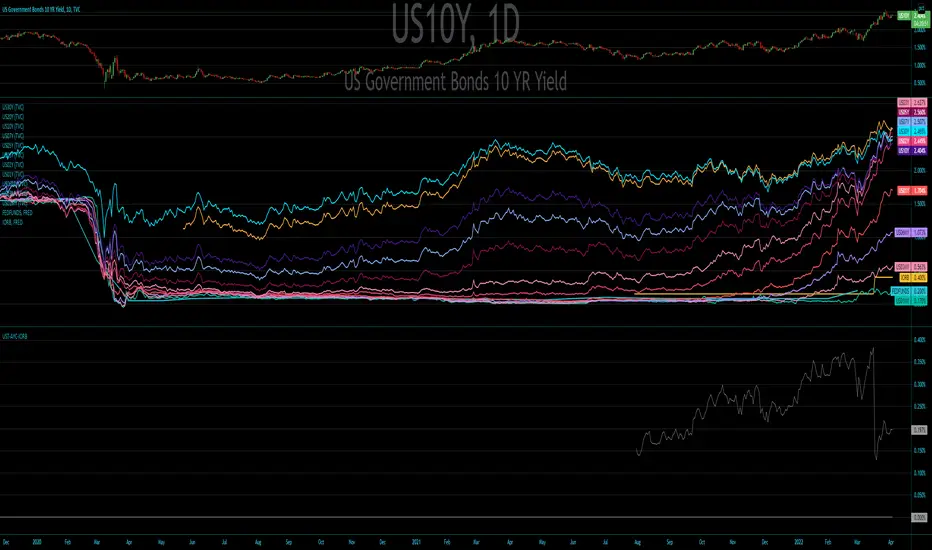

I've updated my US Treasury All Yield Curve indicator to use the new FRED:IORB (interest on reserve balances), instead of the FRED:FEDFUNDS which is only updated monthly.

The new IORB doesn't provide very long lookback for data, so I'm publishing this as a new version and not an update, making it possible for users to choose which version best suits their needs.

The new IORB doesn't provide very long lookback for data, so I'm publishing this as a new version and not an update, making it possible for users to choose which version best suits their needs.

Release Notes

Republishing with a cleaner chart and clearer description.This indicator weighs a basket of treasuries from 1month to 30Y against each other and then weighs that against the IORB rate. (Interest on Overnight Reserve Balance). The IORB is used in this case because it is more responsive to changes than the FEDFUNDS rate, which is only updated monthly.

A negative reading on this indicator means that the majority of the yield curve is inverted and/or pricing below the IORB rate. Both are indications of a dysfunctional bond market.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.