OPEN-SOURCE SCRIPT

Supertrend & CCI Strategy Scalp

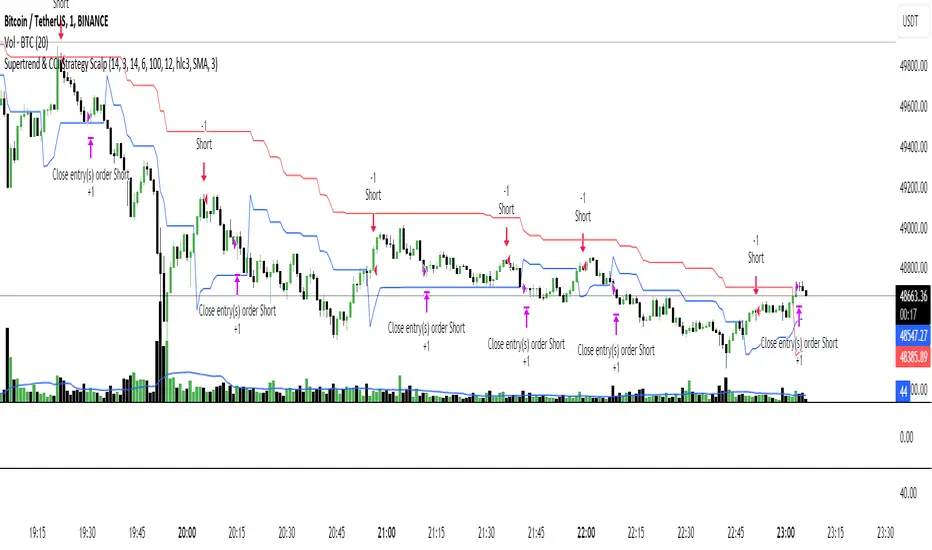

This strategy is based on 2 Super Trend Indicators along with CCI .

The longer factor length gives you the current trend and the deviation in the short factor length gives us the opportunity to enter in the trade .

CCI indicator is used to determine the overbought and oversold levels.

Setup :

Long : When atrLength1 > close and atrLength2 < close and CCI < -100 we look for long trades as the longer factor length will be bullish .

Short : When atrLength1 < close and atrLength2 > close and CCI > 100 we look for short trades as the longer factor length will be bearish .

Please tune the settings according to your use .

https://www.tradingview.com/x/dLke8G17/

https://www.tradingview.com/x/4DL8supS/

Trade what you see not what you feel .

Please consult with your financial advisor before you deploy any real money for trading .

The longer factor length gives you the current trend and the deviation in the short factor length gives us the opportunity to enter in the trade .

CCI indicator is used to determine the overbought and oversold levels.

Setup :

Long : When atrLength1 > close and atrLength2 < close and CCI < -100 we look for long trades as the longer factor length will be bullish .

Short : When atrLength1 < close and atrLength2 > close and CCI > 100 we look for short trades as the longer factor length will be bearish .

Please tune the settings according to your use .

https://www.tradingview.com/x/dLke8G17/

https://www.tradingview.com/x/4DL8supS/

Trade what you see not what you feel .

Please consult with your financial advisor before you deploy any real money for trading .

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.