INVITE-ONLY SCRIPT

Alpha Trading - Absolute Mean Entropy with A2 EPP

Updated

Absolute Mean Entropy with Alpha Squared Entropy Price Percentile

Entropy

The history of the word ―entropy can be traced back to 1865 when the German physicist Rudolf Clausius tried to give a new name to irreversible heat loss, what he previously called ―equivalent-value.

The word ―entropy was chosen because in Greek, “en+tropein” means “content transformative” or “transformation content”

Since then, entropy has played an important role in thermodynamics and many other scientific fields. Being defined as the sum of “heat supplied” divided by “temperature” it is central to the Second Law of Thermodynamics. It also helps measure the amount of order and disorder and/or chaos.

The application of entropy in finance can be regarded as an extension of “Information Entropy” and “Probability Entropy”

Entropy in Finance can be used in many ways such as Asset Selection, Asset Diversification, Measure an Assets Risk, inputs into Options pricing. While Entropy started in the field of Thermodynamics as aforementioned it has also found a home in Finance. However, studies with entropy in the field of Finance are still in their infancy.

• Entropy is a measure of randomness. Entropy is used to help model and represent the degree of uncertainty of a random variable.

• Entropy is used by financial analysts and market technicians to determine the chances of a specific type of behavior by a security or market.

• Entropy has long been a source of study and debate by market analysts and traders. It is used in quantitative analysis and can help predict the probability that a security will move in a certain direction or according to a certain pattern.

The concept of Entropy is explored in the book "A Random Walk Down Wall Street."

Entropy is plotted below the axis with negative values. Entropy can also colorize the candle color if selected.

R-squared (The Coefficient of Determination)

R-squared is a statistical measurement that examines how differences in one variable can be explained by the difference in a second variable, when predicting the outcome of a given event.

In other words, this coefficient, which is more commonly known as R-squared (or R2), assesses how strong the linear relationship is between two variables, and is heavily relied on by researchers when conducting trend analysis.

To cite an example of its application, this coefficient may contemplate the following question: if an indicator becomes pregnant on a certain day, what is the likelihood that this indicator would deliver a new indicator on a particular date in the future? In this scenario, this metric aims to calculate the correlation between two related events: conception of the indicator and the birth of the indicator.

• The coefficient of determination is a complex idea centered on the statistical analysis of models for data.

• The coefficient of determination is used to explain how much variability of one factor can be caused by its relationship to another factor.

• This coefficient is commonly known as R-squared (or R2) and is sometimes referred to as the "goodness of fit."

• This measure is represented as a value between 0.0 and 1.0, where a value of 1.0 indicates a perfect fit, and is thus a highly reliable model for future forecasts, while a value of 0.0 would indicate that the model fails to accurately model the data at all.

R2 and Price

The hypothesis that R2 is related to investors’ biases in processing information.

This theory motivates an empirical hypothesis that stocks with lower R2 should exhibit more pronounced overreaction-driven price momentum.

Alpha Trading AME/A2 EPP Settings

Settings for AME (Absolute Mean Entropy)

Length: Sample size.

Use as Barcolor: AME color as Price Action Candle color.

Show Entropy Flashes: If absolute value of entropy is very low, it gives yellow color for AME and Price Action Candle color if selected.

Band StdDev: (2 times) AME StdDev bands.1st and 2nd default.

Exponential Weighted Entropy: Weights the AME exponentially, is more reactive, but more noise.

Settings for EPP (Entropy Price Percentile)

Percentile Period: lookback for percentile range(relevant for flashes)

Background flashes: if EPP is below threshold default is below 10%, Flashes green in the background.

Std.err bands period: default 3 and multiplier 1.

EPP Column Meanings

Bright Green: Returns above the mean and increasing.

Dark Green: Returns above the mean and decreasing.

Bright Red: Returns below the mean and increasing.

Dark Red: Returns below the mean and decreasing.

Basic Trade Signal

Long – Value of AME is low, as you see EPP increasing with a coloration of green consider taking a long if you have confluence with other Alpha Trading Indicators.

Short – Value of AME is low, as you see EPP increasing with a coloration of red consider taking a short if you have confluence with other Alpha Trading Indicators.

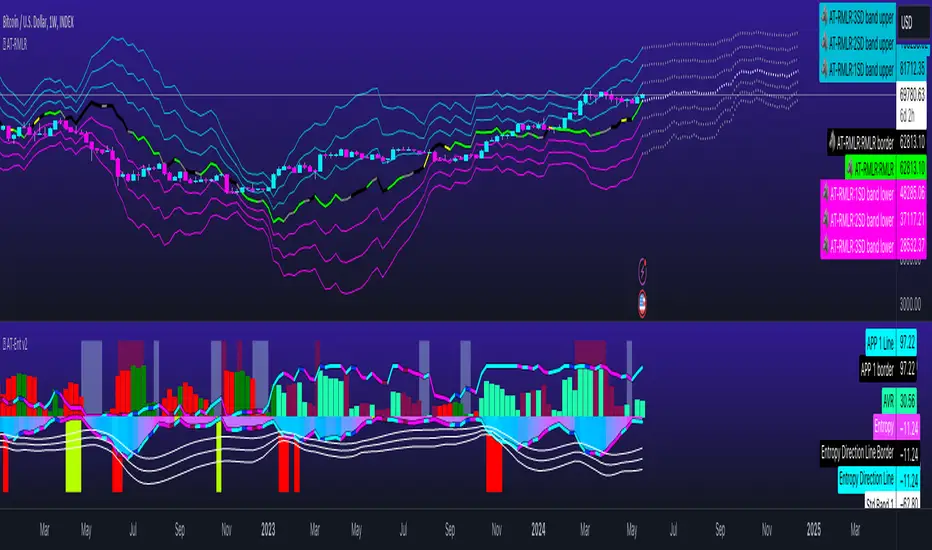

The Chart below is showing Entries, Exponential Weighting input turned on, Percentile Period set to 30 instead of default 100, everything else is Default....

When using other Alpha Trading indicators in confluence, there are other entries available when the indicator isn't flashing and the indicator still supports the move.

References

investopedia.com/terms/r/r-squared.asp

investopedia.com/terms/c/coefficient-of-determination.asp

wallstreetmojo.com/r-squared-formula/

byjus.com/r-squared-formula/

investopedia.com/terms/e/entropy.asp

en.wikipedia.org/wiki/A_Random_Walk_Down_Wall_Street

papers.ssrn.com/

Entropy

The history of the word ―entropy can be traced back to 1865 when the German physicist Rudolf Clausius tried to give a new name to irreversible heat loss, what he previously called ―equivalent-value.

The word ―entropy was chosen because in Greek, “en+tropein” means “content transformative” or “transformation content”

Since then, entropy has played an important role in thermodynamics and many other scientific fields. Being defined as the sum of “heat supplied” divided by “temperature” it is central to the Second Law of Thermodynamics. It also helps measure the amount of order and disorder and/or chaos.

The application of entropy in finance can be regarded as an extension of “Information Entropy” and “Probability Entropy”

Entropy in Finance can be used in many ways such as Asset Selection, Asset Diversification, Measure an Assets Risk, inputs into Options pricing. While Entropy started in the field of Thermodynamics as aforementioned it has also found a home in Finance. However, studies with entropy in the field of Finance are still in their infancy.

• Entropy is a measure of randomness. Entropy is used to help model and represent the degree of uncertainty of a random variable.

• Entropy is used by financial analysts and market technicians to determine the chances of a specific type of behavior by a security or market.

• Entropy has long been a source of study and debate by market analysts and traders. It is used in quantitative analysis and can help predict the probability that a security will move in a certain direction or according to a certain pattern.

The concept of Entropy is explored in the book "A Random Walk Down Wall Street."

Entropy is plotted below the axis with negative values. Entropy can also colorize the candle color if selected.

R-squared (The Coefficient of Determination)

R-squared is a statistical measurement that examines how differences in one variable can be explained by the difference in a second variable, when predicting the outcome of a given event.

In other words, this coefficient, which is more commonly known as R-squared (or R2), assesses how strong the linear relationship is between two variables, and is heavily relied on by researchers when conducting trend analysis.

To cite an example of its application, this coefficient may contemplate the following question: if an indicator becomes pregnant on a certain day, what is the likelihood that this indicator would deliver a new indicator on a particular date in the future? In this scenario, this metric aims to calculate the correlation between two related events: conception of the indicator and the birth of the indicator.

• The coefficient of determination is a complex idea centered on the statistical analysis of models for data.

• The coefficient of determination is used to explain how much variability of one factor can be caused by its relationship to another factor.

• This coefficient is commonly known as R-squared (or R2) and is sometimes referred to as the "goodness of fit."

• This measure is represented as a value between 0.0 and 1.0, where a value of 1.0 indicates a perfect fit, and is thus a highly reliable model for future forecasts, while a value of 0.0 would indicate that the model fails to accurately model the data at all.

R2 and Price

The hypothesis that R2 is related to investors’ biases in processing information.

This theory motivates an empirical hypothesis that stocks with lower R2 should exhibit more pronounced overreaction-driven price momentum.

Alpha Trading AME/A2 EPP Settings

Settings for AME (Absolute Mean Entropy)

Length: Sample size.

Use as Barcolor: AME color as Price Action Candle color.

Show Entropy Flashes: If absolute value of entropy is very low, it gives yellow color for AME and Price Action Candle color if selected.

Band StdDev: (2 times) AME StdDev bands.1st and 2nd default.

Exponential Weighted Entropy: Weights the AME exponentially, is more reactive, but more noise.

Settings for EPP (Entropy Price Percentile)

Percentile Period: lookback for percentile range(relevant for flashes)

Background flashes: if EPP is below threshold default is below 10%, Flashes green in the background.

Std.err bands period: default 3 and multiplier 1.

EPP Column Meanings

Bright Green: Returns above the mean and increasing.

Dark Green: Returns above the mean and decreasing.

Bright Red: Returns below the mean and increasing.

Dark Red: Returns below the mean and decreasing.

Basic Trade Signal

Long – Value of AME is low, as you see EPP increasing with a coloration of green consider taking a long if you have confluence with other Alpha Trading Indicators.

Short – Value of AME is low, as you see EPP increasing with a coloration of red consider taking a short if you have confluence with other Alpha Trading Indicators.

The Chart below is showing Entries, Exponential Weighting input turned on, Percentile Period set to 30 instead of default 100, everything else is Default....

When using other Alpha Trading indicators in confluence, there are other entries available when the indicator isn't flashing and the indicator still supports the move.

References

investopedia.com/terms/r/r-squared.asp

investopedia.com/terms/c/coefficient-of-determination.asp

wallstreetmojo.com/r-squared-formula/

byjus.com/r-squared-formula/

investopedia.com/terms/e/entropy.asp

en.wikipedia.org/wiki/A_Random_Walk_Down_Wall_Street

papers.ssrn.com/

Release Notes

Predictor Coloring, AVR, SEP have been added. A2 is still an option as wellRelease Notes

Updated scaling so the user doesn't need to adjust, any indi options can be mixed and matchedRelease Notes

Code update to plot stylesInvite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact AlphaTrading-WolfPack for more information, or follow the author's instructions below.

TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Author's instructions

″To gain access to this script request support in the Alpha Trading Discord. https://discord.gg/kwBnS9Gu

Want to use this script on a chart?

Warning: please read before requesting access.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.