INVITE-ONLY SCRIPT

Kenji Indicator Version 2.0

KenJi Indicator Version 2.0

Indicator Class: Average analysis/trend following

Trading type: Any

Time frame: Any

Purpose: Trend-based trading

Level of aggressiveness: Flexible

Introduction

The basic rule of trading is as follows: "trend is your friend." Means, it is extremely important to follow the current market sentiments rather than resisting them. Following this principle allows a trader to feel as comfortable as possible during the trading: positions typically are in a profit zone and there is no psychological pressure of a negative financial result that often leads to hasty position closures.

Despite the advantages of trend-following strategies, many traders struggle to accurately identify the prevailing trend and market sentiments, resulting in bad trading decisions and, consequently, unfavorable trading outcomes.

To address these challenges, streamline the analysis process, and enhance the overall quality of trading decisions, our team of analysts has developed The KenJi Indicator Version 2.0.

About the KenJi Indicator Version 2.0

The KenJi Indicator Version 2.0 offers a novel approach to traditional average-based analysis. Many conventional strategies relying on averages tend to generate numerous false signals, especially in “flat” markets where frequent crossovers and shifts in direction are common. This reduces the overall effectiveness of average analysis.

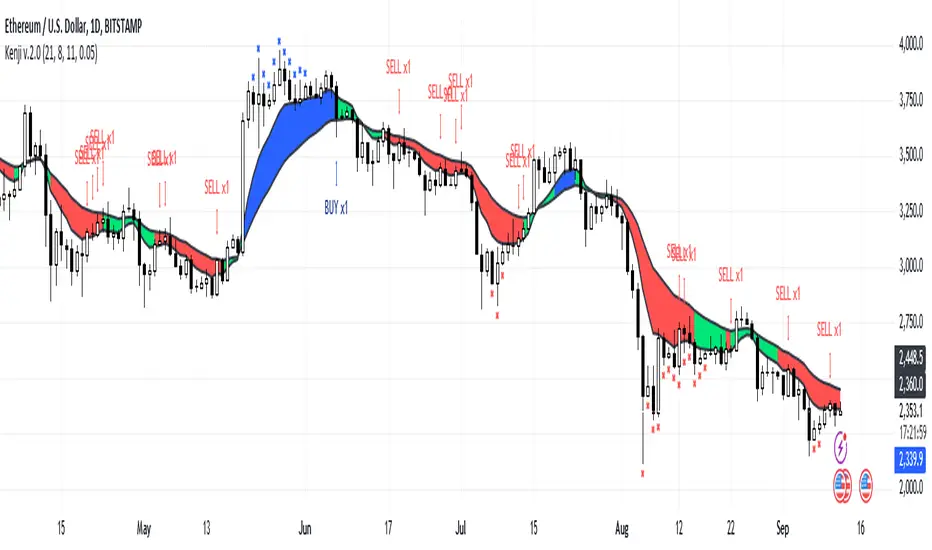

The KenJi Indicator Version 2.0 addresses these issues by incorporating a unique algorithm, which combines correlation and moving average analysis to avoid the pitfalls of traditional methods. It accurately identifies market conditions—indicated by colors: red for a downtrend, blue for an uptrend, and green for a “flat” market—thereby improving the quality of signals and helping traders manage trends more effectively.

The KenJi Indicator Version 2.0 indicator not only identifies optimal entry points but also assists in timing exits for profit-taking. Moreover, it assesses the aggressiveness of signals, making it suitable for both novice and experienced traders.

Trading Rules

Using the KenJi Indicator Version 2.0 is straightforward. When the price enters the buy or sell zone—represented by a blue or red area between the fast and slow averages—it generates a signal to enter a position. This position remains active until the market condition changes (such as a shift from a downtrend to “flat”) or until a close signal appears, indicated by a significant divergence shown by a blue or red cross.

Indicator Structure

The KenJi Indicator Version 2.0 consists of colored zones, level lines and stop crosses:

For ease of use, the indicator shows buy and sell signals directly on the chart.

Signal Types:

Profit zones are marked by blue/red x-crosses: red x-crosses indicate "sell" take-profit zones, while blue x-crosses indicate "buy" take-profit zones.

Alerts and Notifications

The indicator includes built-in alerts and notifications, ensuring traders don’t miss any "buy" or "sell" signals.

Input Parameters

The KenJi Indicator Version 2.0 offers several input parameters for customization:

Access to the KenJi Indicator Version 2.0

For more information or to request access to the Kenji 2.0 Indicator, please send inquiries via private messages.

Indicator Class: Average analysis/trend following

Trading type: Any

Time frame: Any

Purpose: Trend-based trading

Level of aggressiveness: Flexible

Introduction

The basic rule of trading is as follows: "trend is your friend." Means, it is extremely important to follow the current market sentiments rather than resisting them. Following this principle allows a trader to feel as comfortable as possible during the trading: positions typically are in a profit zone and there is no psychological pressure of a negative financial result that often leads to hasty position closures.

Despite the advantages of trend-following strategies, many traders struggle to accurately identify the prevailing trend and market sentiments, resulting in bad trading decisions and, consequently, unfavorable trading outcomes.

To address these challenges, streamline the analysis process, and enhance the overall quality of trading decisions, our team of analysts has developed The KenJi Indicator Version 2.0.

About the KenJi Indicator Version 2.0

The KenJi Indicator Version 2.0 offers a novel approach to traditional average-based analysis. Many conventional strategies relying on averages tend to generate numerous false signals, especially in “flat” markets where frequent crossovers and shifts in direction are common. This reduces the overall effectiveness of average analysis.

The KenJi Indicator Version 2.0 addresses these issues by incorporating a unique algorithm, which combines correlation and moving average analysis to avoid the pitfalls of traditional methods. It accurately identifies market conditions—indicated by colors: red for a downtrend, blue for an uptrend, and green for a “flat” market—thereby improving the quality of signals and helping traders manage trends more effectively.

The KenJi Indicator Version 2.0 indicator not only identifies optimal entry points but also assists in timing exits for profit-taking. Moreover, it assesses the aggressiveness of signals, making it suitable for both novice and experienced traders.

Trading Rules

Using the KenJi Indicator Version 2.0 is straightforward. When the price enters the buy or sell zone—represented by a blue or red area between the fast and slow averages—it generates a signal to enter a position. This position remains active until the market condition changes (such as a shift from a downtrend to “flat”) or until a close signal appears, indicated by a significant divergence shown by a blue or red cross.

Indicator Structure

The KenJi Indicator Version 2.0 consists of colored zones, level lines and stop crosses:

- Trend Zones: These are color-coded (blue, red, or green) to highlight trend conditions and entry points.

- Level Lines: The lines indicate the nearest support/resistance lines (red for resistance, blue for support). Available for 4H time-frame and below

- Stop Crosses: Blue or Red crosses are displayed on the Chart to show the moments of extreme price divergence from the current trend. A good moment to fix profits.

For ease of use, the indicator shows buy and sell signals directly on the chart.

Signal Types:

- Standard: Uses the basic lot size for trades.

- Aggressive: Uses double the standard lot size for higher risk/reward trades.

Profit zones are marked by blue/red x-crosses: red x-crosses indicate "sell" take-profit zones, while blue x-crosses indicate "buy" take-profit zones.

Alerts and Notifications

The indicator includes built-in alerts and notifications, ensuring traders don’t miss any "buy" or "sell" signals.

Input Parameters

The KenJi Indicator Version 2.0 offers several input parameters for customization:

- Slow Average Period: Defines the period for the slow average. Longer periods provide a more stable, conservative response to price changes.

- Fast Average Period: Defines the period for the fast average. Similar to the slow average, a longer period provides more conservative signals.

- Correlation Period: Used to calculate the Pearson correlation coefficient and estimate the relationship between the fast and slow averages, improving trend identification.

- Divergence Sensitivity: Determines the placement of take-profit zones, with higher values increasing the distance of these zones.

Access to the KenJi Indicator Version 2.0

For more information or to request access to the Kenji 2.0 Indicator, please send inquiries via private messages.

Invite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact KenJi_Indicator_2 for more information, or follow the author's instructions below.

Please note that this is a private, invite-only script that was not analyzed by script moderators. Its compliance to House Rules is undetermined. TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Author's instructions

″For more information or to request access to the KenJi Indicator Version 2.0, please send inquiries via private messages.

Want to use this script on a chart?

Warning: please read before requesting access.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.