OPEN-SOURCE SCRIPT

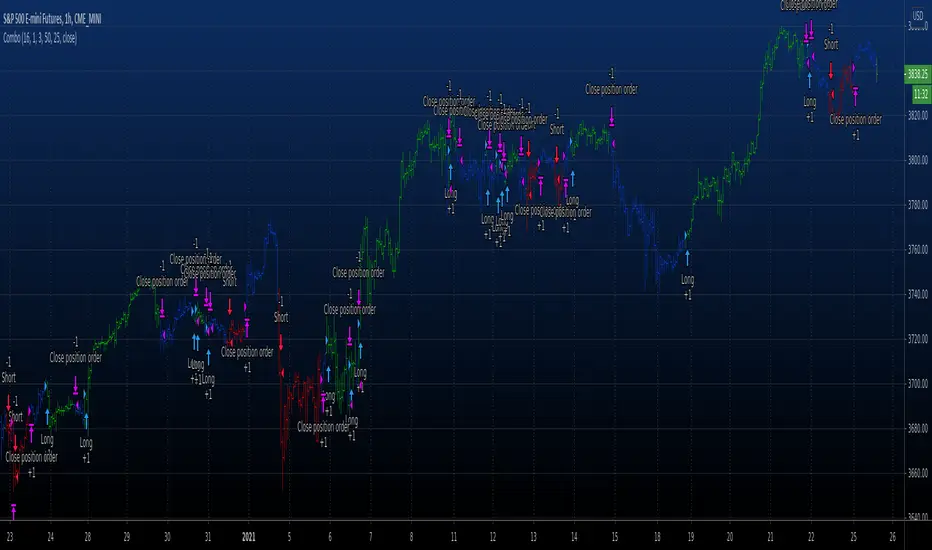

Combo Backtest 123 Reversal & Line Regression Intercept

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Linear Regression Intercept is one of the indicators calculated by using the

Linear Regression technique. Linear regression indicates the value of the Y

(generally the price) when the value of X (the time series) is 0. Linear

Regression Intercept is used along with the Linear Regression Slope to create

the Linear Regression Line. The Linear Regression Intercept along with the Slope

creates the Regression line.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Linear Regression Intercept is one of the indicators calculated by using the

Linear Regression technique. Linear regression indicates the value of the Y

(generally the price) when the value of X (the time series) is 0. Linear

Regression Intercept is used along with the Linear Regression Slope to create

the Linear Regression Line. The Linear Regression Intercept along with the Slope

creates the Regression line.

WARNING:

- For purpose educate only

- This script to change bars colors.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.