PROTECTED SOURCE SCRIPT

VIDYA by Mehmet Yildizli

Updated

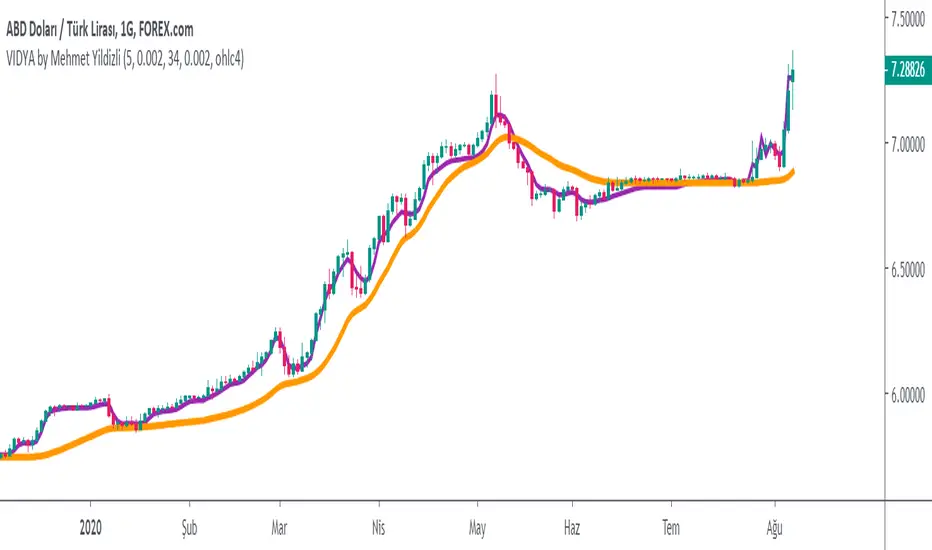

VIDYA by Mehmet Yildizli - Variable Index Dynamic Average

Our behaviours toward financial markets change every time of any date. On the other hand, we usually tend to analyze averages via constant period-of time. That is, our analyzing way is not consistant with a changing dynamics of financial markets.

Therefore, a new form of Moving Average comes trough into the scene: The Variables Index Dynamic Average-VIDYA.

VIDYA is a moving average that regulates itself according to the volatiliy of prices. When prices go up or fall down rapidly VIDYA approches to prices. When prices move less volatile, VIDYA tracks the prices from a distance.

We start calculating VIDYA with an approch of Exponential Moving Average. However, the difference between VIDYA and EMA(Exponential Moving Average) is the changes of constant coeffient of EMA, according to volatility. When new price comes, each time, the VIDYA calculates a new coefficient used to calculate the average. Then, each time a new price comes, a new period of time is calculated according to volatiliy.

In this moving average indicator, you can set two moving average period at the same time. Additionally, you can set two different step height for two moving averages. These step height coefficients is used to round the moving averages. Therefore, when prices cross up and down continously you can change these step heights in order to prevent unnecessary trades.

Our behaviours toward financial markets change every time of any date. On the other hand, we usually tend to analyze averages via constant period-of time. That is, our analyzing way is not consistant with a changing dynamics of financial markets.

Therefore, a new form of Moving Average comes trough into the scene: The Variables Index Dynamic Average-VIDYA.

VIDYA is a moving average that regulates itself according to the volatiliy of prices. When prices go up or fall down rapidly VIDYA approches to prices. When prices move less volatile, VIDYA tracks the prices from a distance.

We start calculating VIDYA with an approch of Exponential Moving Average. However, the difference between VIDYA and EMA(Exponential Moving Average) is the changes of constant coeffient of EMA, according to volatility. When new price comes, each time, the VIDYA calculates a new coefficient used to calculate the average. Then, each time a new price comes, a new period of time is calculated according to volatiliy.

In this moving average indicator, you can set two moving average period at the same time. Additionally, you can set two different step height for two moving averages. These step height coefficients is used to round the moving averages. Therefore, when prices cross up and down continously you can change these step heights in order to prevent unnecessary trades.

Release Notes

Version 2.0 Updates:- Default value of 'Step Height' for second average has been changed to 0.002

- Default color of the first average has been changed to purple.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.