OPEN-SOURCE SCRIPT

Z Score Enhanced Time Segmented Volume (Multi MA)

**THIS VERSION HAS BEEN STANDARDIZED WITH A Z SCORE CALCULATION AND ALLOWS THE USER TO SELECT WHICH MOVING AVERAGE THEY WOULD LIKE TO UTILIZE FOR THE SIGNAL LINE**

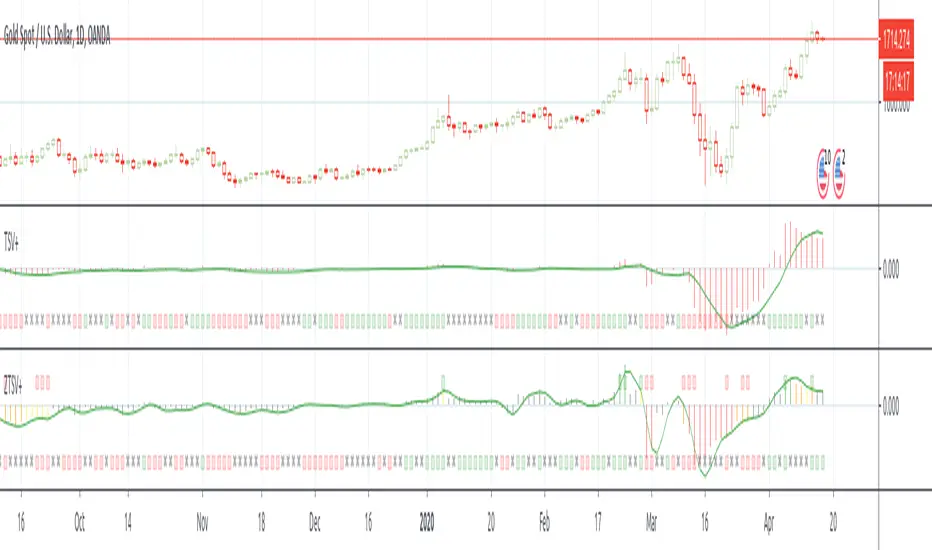

Chart shows the Non-Standardized Enhanced Time Segmented Volume (Multi MA) with default settings on top and the Standardized version with default settings on the bottom.

Time Segmented Volume was developed by Worden Brothers, Inc to be a leading indicator by comparing various time segments of both price and volume . Essentialy it is designed to measure the amount of money flowing in and out of an instrument.

Time Segmented Volume was originally ported to TradingView by user liw0 and later corrected by user @vitelot. I never quite understood how to read Time Segmented Volume until I ran across a version by user Storma where they indicated when price would be long or short, but that code also utilized the incorrect calculation from user @liw0.

In an effort to make Time Segmented Volume more accessible and easier to read, I have re-coded it here. The calculations are based on the code from vitelot and I have added direction indicators below the chart.

If the histogram (TSV) is greater than zero and greater than the moving average, price should be moving long and there will be a green box below the chart.

If TSV falls below the moving average while still being greater than zero, the trend may be exhausting and has been coded to read Price Action Long - FAILURE with a black x below the chart.

If the histogram (TSV) is less than zero and less than the moving average, price should be moving short and there will be a red box below the chart.

If TSV rises above the moving average while still being less than zero, the trend may be exhausting and has been coded to read Price Action Short - FAILURE with a black x below the chart.

At times, the moving average may be above zero while TSV is below zero or vice versa. In these situations the chart will indicate long or short based on whether or not TSV is greater or less than zero. It is possible a new trend may be forming as the moving average obviously lags, but also possible price is consolidating with little volume and causing TSV to oscillate close to zero.

**Z Score // Standardized Option **

Thist Standardized code implements all of the above but also allows the user to select a threshold level that should not need to be adjusted for each instrument (since the output is standardized).

If the TSV value meets the long and short signal requirements above and TSV is greater than the threshold values a green or red box will print ABOVE the oscillator. The histogram will also change color based on which threshold TSV has met.

This calculation allows us to compare current volatility to the mean (moving average) of the population (Z-Length). The closer the TSV Z-Score is to the mean, the closer it will be to the Zero Line and therefore price is likely consolidating and choppy. The farther TSV Z-Score is from the mean, the more likely price is trending.

The MA Mode determines the Moving Average used to calculate TSV itself. The Z-Score is ALWAYS calculated with a simple moving average (as that is the standard calculation for Z-Score).

The Threshold Levels are the levels at which TSV Z-Score will change from gray to yellow, orange, green ( bullish ), or red ( bearish ).

Statistically speaking, confidence levels in relation to Z-Score are noted below. The built in Threshold Levels are the positive and negative values for 90%, 95%, and 99%. This would indicate when volatility is greater than these values they are out of the ordinary from the standard range. You may wish to adjust these levels for TSV Z-Score to be more responsive to your trading needs

80% :: 1.28

85% :: 1.44

90% :: 1.64

95% :: 1.96

99% :: 2.58

The Z Length is the period for which the Z Score is calculated

More information regarding Time Segmented Volume can be found here: worden.com/TekeChartHelp/Cont...

Original code ported by liw0

Corrected by vitelot

Updated/Enhancements by @eylwithsteph with inspiration from Storma

Multiple MA Options Credits to Fractured and lejmer

Bits and Pieces from alexgrover, montyjus, and jiehonglim

As always, trade at your own risk.

Chart shows the Non-Standardized Enhanced Time Segmented Volume (Multi MA) with default settings on top and the Standardized version with default settings on the bottom.

Time Segmented Volume was developed by Worden Brothers, Inc to be a leading indicator by comparing various time segments of both price and volume . Essentialy it is designed to measure the amount of money flowing in and out of an instrument.

Time Segmented Volume was originally ported to TradingView by user liw0 and later corrected by user @vitelot. I never quite understood how to read Time Segmented Volume until I ran across a version by user Storma where they indicated when price would be long or short, but that code also utilized the incorrect calculation from user @liw0.

In an effort to make Time Segmented Volume more accessible and easier to read, I have re-coded it here. The calculations are based on the code from vitelot and I have added direction indicators below the chart.

If the histogram (TSV) is greater than zero and greater than the moving average, price should be moving long and there will be a green box below the chart.

If TSV falls below the moving average while still being greater than zero, the trend may be exhausting and has been coded to read Price Action Long - FAILURE with a black x below the chart.

If the histogram (TSV) is less than zero and less than the moving average, price should be moving short and there will be a red box below the chart.

If TSV rises above the moving average while still being less than zero, the trend may be exhausting and has been coded to read Price Action Short - FAILURE with a black x below the chart.

At times, the moving average may be above zero while TSV is below zero or vice versa. In these situations the chart will indicate long or short based on whether or not TSV is greater or less than zero. It is possible a new trend may be forming as the moving average obviously lags, but also possible price is consolidating with little volume and causing TSV to oscillate close to zero.

**Z Score // Standardized Option **

Thist Standardized code implements all of the above but also allows the user to select a threshold level that should not need to be adjusted for each instrument (since the output is standardized).

If the TSV value meets the long and short signal requirements above and TSV is greater than the threshold values a green or red box will print ABOVE the oscillator. The histogram will also change color based on which threshold TSV has met.

This calculation allows us to compare current volatility to the mean (moving average) of the population (Z-Length). The closer the TSV Z-Score is to the mean, the closer it will be to the Zero Line and therefore price is likely consolidating and choppy. The farther TSV Z-Score is from the mean, the more likely price is trending.

The MA Mode determines the Moving Average used to calculate TSV itself. The Z-Score is ALWAYS calculated with a simple moving average (as that is the standard calculation for Z-Score).

The Threshold Levels are the levels at which TSV Z-Score will change from gray to yellow, orange, green ( bullish ), or red ( bearish ).

Statistically speaking, confidence levels in relation to Z-Score are noted below. The built in Threshold Levels are the positive and negative values for 90%, 95%, and 99%. This would indicate when volatility is greater than these values they are out of the ordinary from the standard range. You may wish to adjust these levels for TSV Z-Score to be more responsive to your trading needs

80% :: 1.28

85% :: 1.44

90% :: 1.64

95% :: 1.96

99% :: 2.58

The Z Length is the period for which the Z Score is calculated

More information regarding Time Segmented Volume can be found here: worden.com/TekeChartHelp/Cont...

Original code ported by liw0

Corrected by vitelot

Updated/Enhancements by @eylwithsteph with inspiration from Storma

Multiple MA Options Credits to Fractured and lejmer

Bits and Pieces from alexgrover, montyjus, and jiehonglim

As always, trade at your own risk.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.